Asset based lending outsourcing (ABL) offers businesses capital which is rather like a credit line only on the security of their receivables, inventories, and equipment. As the industry evolves, thus, outsourcing different aspects of ABL has taken the forefront in assisting lenders to digitize processes and reduce operational costs.

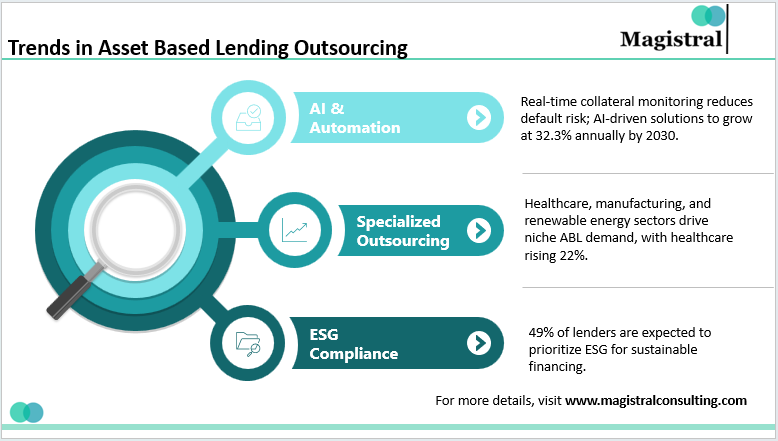

Trends in Asset Based Lending Outsourcing

Asset based Lending outsourcing is evolving with tech, ESG focus, and niche industry demands reshaping its landscape. The following are some of the trends:

Trends in Asset Based Lending Outsourcing

Use of AI and Automation for Real-Time Collateral Monitoring

The ability to monitor collateral in real-time, encompassing supply chain management and accounts receivable, is changing the face of ABL outsourcing. Automated tools can analyze inventory positions, accounts receivable turnover, and the valuations of equipment in real-time and accomplish this with consistency and speed, thus reducing default risk. The annual growth rate of lending solutions enabled with AI is expected to reach 32.3%, by the year 2030, persistently pointing at the ever-increasing consumption of technology in outsourcing.

Increasing Focus on ESG Compliance in Asset Based Loans

Environmental social and governance (ESG) factors are obtaining critical importance when making lending decisions based on assets. Lenders are outsourcing ESG audits and compliance checks to many firms, which specialize in that area. According to a survey, 49% of global lending institutions are expected to give priority to ESG compliance in managing their portfolios, indicating a heightened desire for sustainable financing solutions in asset based lending outsourcing.

Shift Toward Specialized Outsourcing Providers for Niche Industries

Lenders recognize the demand for a more selective focus on lenders that primarily cater to certain industries through asset based lending outsourcing. Such sectors as healthcare, manufacturing, and renewable energy will frequently leverage the expertise of asset valuation and compliance that specialists provide most effectively. Healthcare asset based lending outsourcing has seen a 22% rise in demand over the past three years, relatively driven by multiple factors associated with valuing medical receivables and equipment.

Technology Integration in ABL Outsourcing

Technology is transforming ABL outsourcing with more efficient tools like blockchain, cloud platforms, and loan management systems that will enhance efficiency, security, and scalability.

Role of Software and Tools for Loan Management, Reporting, and Risk Analytics

Advanced technological facilities are provided to ABL outsourcing companies for its loan management system and reporting system. Origination of loans, swift process, and various risk analyses on lending can be done by those software. According to statistics from the research, the worldwide loan management software market would reach $8.9 billion by 2028, which indicates technology is being increasingly integrated within asset based lending outsourcing.

Benefits of Blockchain for Secure Data Management in ABL

Secure and transparent, blockchain technology handles data management with decentralization so as to mitigate fraud risks and preserve data integrity. Studies described reductions of 30% in operational costs due to its adoption, making it a very attractive option for asset based lending outsourcing.

Cloud-Based Solutions for Scalability and Real-Time Access

Cloud platforms provide lenders with scalability in customer communications and real-time access to their data from anywhere. Outsourcing providers run powerful cloud solutions as a result of their use of platforms like AWS and Microsoft Azure, thus reducing infrastructure costs by 40%. Real-time access to borrower data can improve decision-making processes and compliance monitoring across the client in the asset based lending outsourcing sector.

Operational Challenges

ABL outsourcing overcomes challenges such as decreasing loan approval time, handling large volumes of transactions, and proper valuation of collateral by the expertise and advanced tools.

Reducing Turnaround Time for Loan Approvals

Outsourcing the loan approval function can lessen the time involved in documentation and collateral assessment. One may reasonably expect that following a received pattern and allocating sufficient resources can yield a processing time reduction of anywhere from 30%-50%. Such a fast turnaround makes for a pleasant client experience, hence giving lenders leverage in the competitive ABL outsourcing market.

Managing High-Volume Transactions Efficiently

Performance of high-volume asset based lending transactions requires precision and scalability. Outsourcing partners are used for implementation of expert workflows and infrastructure for the sake of an effective outcome while maintaining commitment to accurate result processing and compliance. For some functions, one mid-sized bank claims to have had ABL operations that earned a good 35% efficiency within a year of outsourcing.

Accuracy in Collateral Valuation and Monitoring

Collateral valuation and monitoring are critical for the risk minimization of lending. Outsourcing firms using ABL value using sophisticated tools and specialist expertise provide accurate and reliable valuations. According to a study, this method decreases valuation error by 25%, and hence it increases the decisions made by lenders.

Risk Factors and Considerations in Asset Based Lending Outsourcing

Major risks in ABL outsourcing include data security, compliance with regulations, and maintaining quality standards, necessitating robust safeguards and well-defined SLAs.

Ensuring Data Confidentiality and Security

Data breaches continue to be a major area of concern in outsourcing, especially where it comes to finance. Lenders must make sure that their outsourcing partners are meeting rigorous data security requirements. The average breach in financial services is expected to cost institutions $5.97 million—a sobering reality check regarding the stakes of it all.

Compliance with Local and International Lending Regulations

Secured transactions sometimes cross multiple national jurisdictions; hence, providers need to cater to regulatory compliance. Asset based lending outsourcing companies with expertise in global compliance can reduce risks, with cross-border transactions implicitly involving non-negotiable compliance with GDPR in the EU and CCPA in the U.S.

Monitoring Quality and Accuracy of Outsourced Deliverables

While ABL outsourcing provides an opportunity for increasing efficiency, a constant check on the quality of all stuff is pertinent. Establishing the Service Levels Agreements (SLAs) and periodic audits can maintain standards.

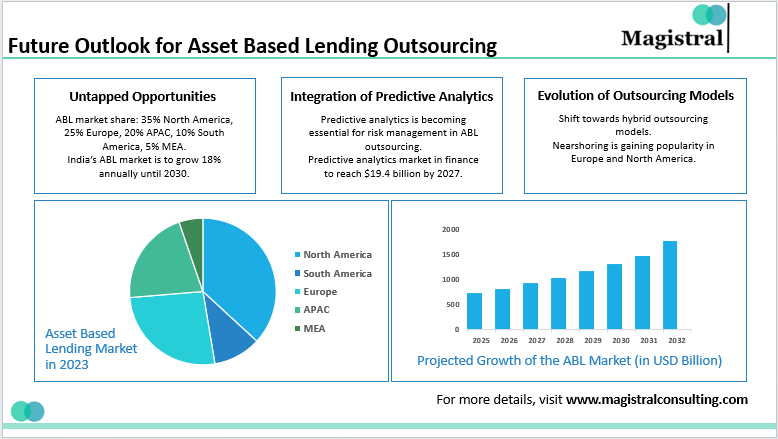

Future Outlook for Asset Based Lending Outsourcing

ABL outsourcing addresses bottlenecks such as the reduction of processing times for loans, handling significant volumes of transactions, and accurate valuation of collateral through specialisation and state-of-the-art tools.

Future Outlook for Asset Based Lending Outsourcing

Untapped Opportunities in Emerging Economies

The ABL market share is 35% North America, 25% Europe, 20% APAC 10% South America and 5% MEA. Activities are increasing in emerging markets, such as India, Southeast Asia, and Africa. Companies looking to expand to these areas may have vast opportunities for outsourcing providers focusing on those regions. For instance, the India ABL market is expected to grow 18% annually up to 2030. And the ABL market is projected to increase from 567.17 USD Billion in 2023 to 1773.41 USD Billion by 2032.

Integration of Predictive Analytics for Risk Mitigation

Predictive analytics is likely to be the backbone for ABL outsourcing. Through historic data and market trends analysis, the asset based lending outsourcing firms can realize the risk areas in advance. A study projects that the predictive analytics market in finance will reach $19.4 billion by 2027.

Evolution of Outsourcing Models (Hybrid, Nearshoring, etc.)

The outsourcing landscape is shifting toward hybrid models, integrating onshore and offshore resources for the best results. Nearshoring, or outsourcing to nearby countries, is gaining attention, especially in Europe and North America, with a balance of cost-effectiveness and operational control.

Magistral’s services for Asset Based Lending Outsourcing

Magistral Consulting offers asset-based lending outsourcing solutions that are wholesome and aimed at optimizing lenders and the improvement of efficiency while their operation is on; this ensures that every step in the lending process can be dealt with precisely to gain accurate results.

Borrower Due Diligence

Through our borrower due diligence services, lenders are able to acquire loan information with assurance. We assess the worth and quality of the collateralized assets-whether receivables, inventory, or equipment-with respect to the minimum standards. Moreover, we assess the borrowers’ financial health and repayment ability. Through in-depth industry and market research, we assist lenders in identifying risks and aligning strategies with business goals.

Loan Underwriting Support

The firm supports lenders in the underwriting process by preparing financial models and conducting scenario analyses to determine the feasibility of the loan. It identifies all potential risks and offers actionable solutions to mitigate them. Extensive review of loan documents ensures compliance with regulations, reduces errors, and therefore allows lenders to advance the deal with confidence.

Portfolio Monitoring

Our portfolio monitoring services keep the lenders up to date on the value of collaterals and asset quality throughout the entire loan period. Periodic checks are carried out to ensure that the borrower is in compliance with the loan agreement, thus facilitating early identification of risks. We provide detailed performance reports to help lenders take the right measures to safeguard their portfolios and maximize profitability.

Loan Servicing Support

We reduce the intricacies of servicing loans through timely management of the payments by the borrowers, reconciliation of accounts, and responding to late or defaulted payments. The restructuring, renewal, or modification of loan agreements with the borrowers can also be supported by our team, thus reducing the administrative workload and improving the overall experience of lending to the borrower.

Operational Support

For Magistral to administer everyday working of loan and borrower details easily in digitized form for better retrieval, we make optimum use of technology to shorten time cycles and improve efficiencies to help lenders achieve quick approval decisions with support through customized reports and dashboards that directly reflect portfolio performance and enhance proactive and informed lender decision-making.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does Magistral Consulting help with borrower due diligence?

Magistral evaluates the quality and liquidity of assets used as collateral, analyzes borrowers’ financial health and repayment capacity, and conducts market and industry research. This ensures lenders receive accurate insights to make confident lending decisions.

How does Magistral support loan underwriting?

Magistral provides detailed financial modeling, risk assessment, and sensitivity analyses to evaluate loan feasibility. Additionally, we review loan documents to ensure compliance with regulatory requirements and minimize errors, helping lenders close deals efficiently.

How does outsourcing improve portfolio monitoring in ABL?

Outsourcing enables lenders to maintain oversight of collateral values and borrower performance through regular compliance checks and detailed performance reports. This reduces risks, ensures adherence to loan covenants, and helps lenders optimize portfolio profitability.