Certified Public Accountants are major stakeholders in terms of the financial integrity of most organizations. Their credibility is founded on adhesion to the subject laws and regulations; it is the very basis of their practice. To understand the intricacies involved, this article reviews CPA compliance—its importance, key elements, and strategies for implementation.

Understanding CPA Compliance

Compliance to this respect serves to portray adherence to the laws, regulations, and standards of ethics that guide accountancy. Compliance enables the business to maintain the virtues of integrity, transparency, and accountability. It is a multidimensional expression with several main important aspects.

Importance of CPA Compliance

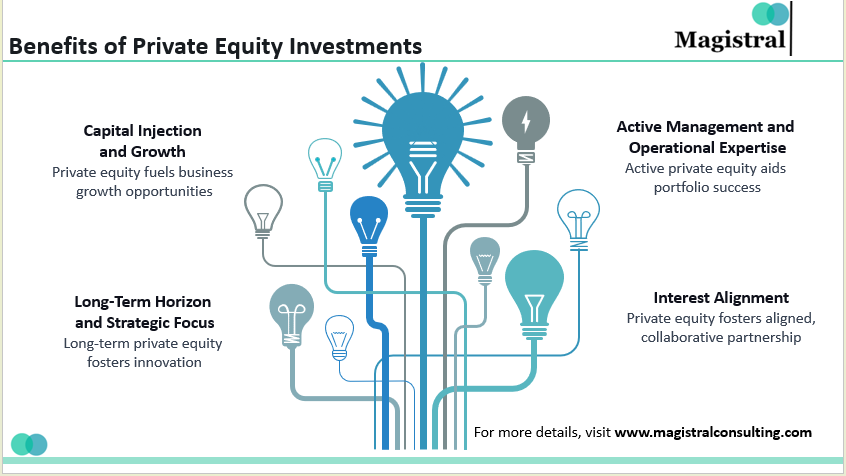

Proper financial reporting is reliable and accurate for the interest of the public; CPA compliance protects stakeholders such as investors, creditors, and any member of the general public. Compliance protects the integrity of the profession maintaining the reputation that should be expected of an accountant, a stakeholder protector and a performer of duties in a reliable manner. Compliance standards protect CPAs from legal consequences since non-compliance brings penalties, fines, and other litigation against persons and organizations that may hurt their financial health and reputation.

Regulatory Bodies and Standards

It also involves a number of regulatory bodies and standards for compliance by CPAs. AICPA sets the ethical standards and auditing guidelines so CPAs are able to maintain their integrity and objectivity. PCAOB oversees audits pertaining to public companies and seeks to protect investors, ensuring accurate and independent audit reports. The Securities and Exchange Commission regulates the financial disclosures of publicly traded companies and requires full and accurate information about their financial status.

Key Compliance Requirements

The compliance requirements for CPAs include ethical standards, continuing professional education, and audit standards. Ethical standards are sourced from the AICPA Code of Professional Conduct, which requires CPAs to conduct themselves with integrity, objectivity, and professional behavior. Continuing professional education is mandated so that CPAs remain current with changing industries and maintain professional competence. Conformity with GAAS and PCAOB criteria ensures that audit reports are comprehensive, accurate, and independent.

Key Components of CPA Compliance Programs

Effective compliance programs will embody some critical components that help in ensuring standards and regulations are adhered to. All of these elements work together to put in place a solid framework through which any organization can ensure it is compliant.

Key Components of CPA Compliance Programs

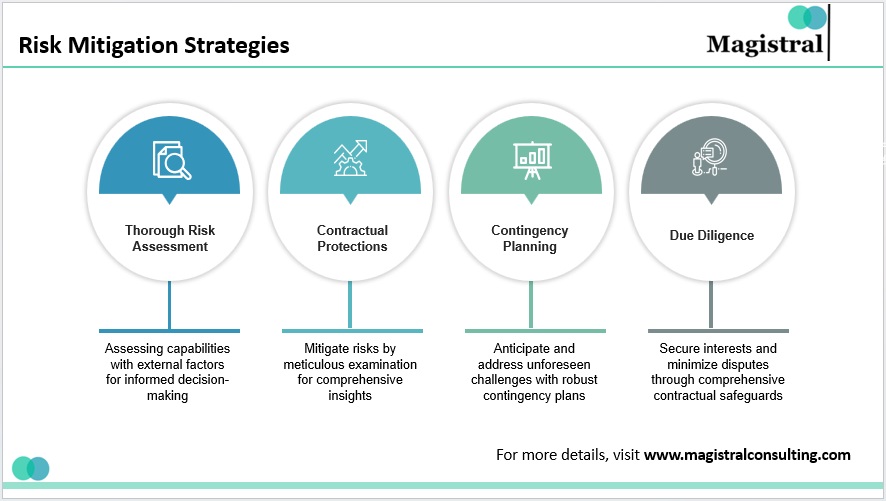

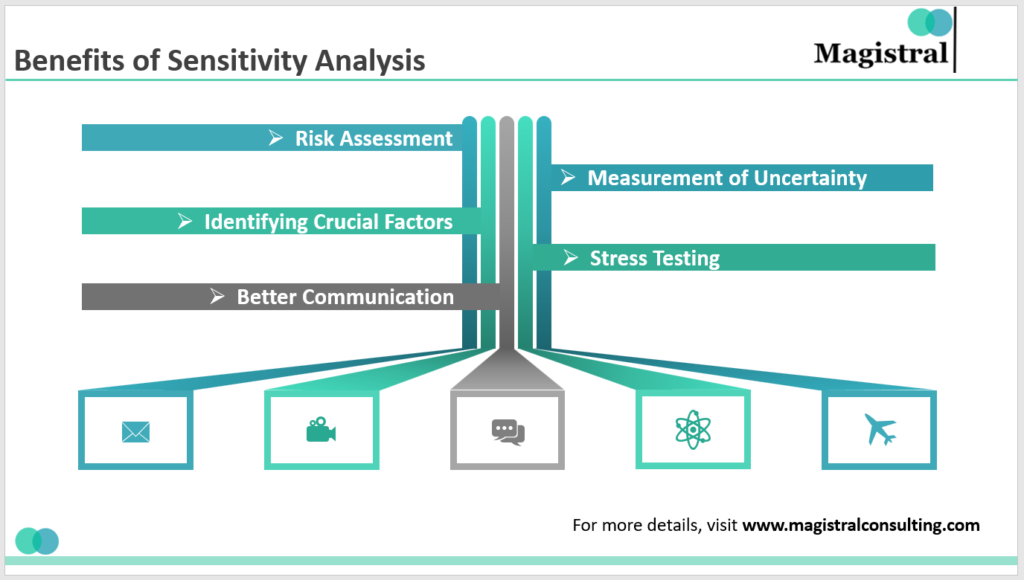

Risk Assessment

An essential component of any CPA compliance program is risk assessment. It is a process aimed at identifying potential compliance risks related to financial reporting, audits, and ethical conduct. Through proper risk assessments, companies could establish areas where they are more likely to have problems of non-compliance and measure strategies that mitigate them. Such mitigating programs may include enhanced internal controls, better training programs, and enhanced monitoring in high-risk problem areas to be well geared for dealing with any rising compliance issues.

Policies and Procedures

Policies and procedures are at the heart of any compliance regime. The publicized policies and procedures align every person to a single version of truth regarding the compliance requirements. They clearly document desired actions and behaviors from employees to attain and retain compliance. Policies will have to be applied across an organization in a uniform manner; likewise, periodic review and updating of these documents maintains their currency for regulatory changes and best practices.

Training and Education

Integrating a routine for training and education is essential to maintaining a compliant office. Compliance requirement and update training ensures workers are conversant with changes in laws, regulations, and standards. Such can be delivered in the form of workshops, seminars, online programs, or courses. CPAs are required to complete CPE hours to maintain state licensure and demonstrate professional competence. Effective training and education will keep workers included and competent, which greatly reduces the risk of non-compliance.

Monitoring and Auditing

Any organization aiming for CPA compliance needs to have monitoring and auditing. Internal audits are conducted periodically, which assess the compliance of the organization in the light of the policies and procedures set up by it and point out any omissions or other anomalies. The organization can be prepared for the official inspection through the eyes of an independent auditor. Effective monitoring and audit procedures will let an organization conform to the laws with limited disruptions to its operations.

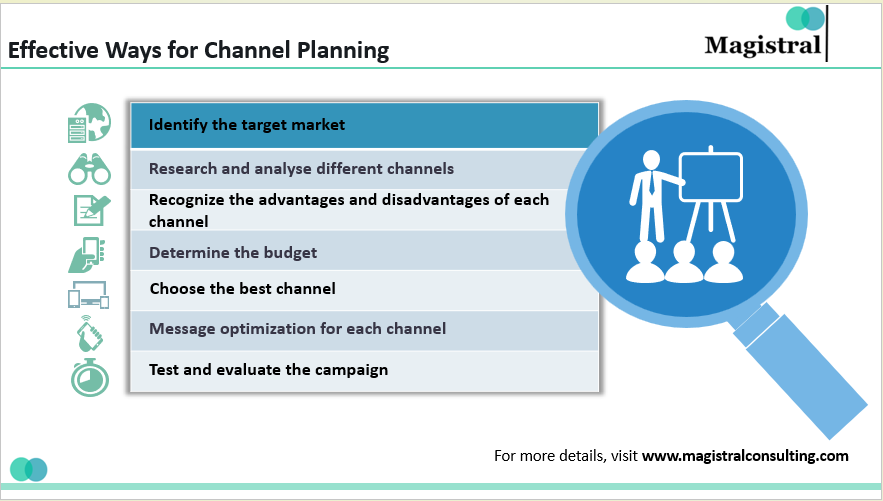

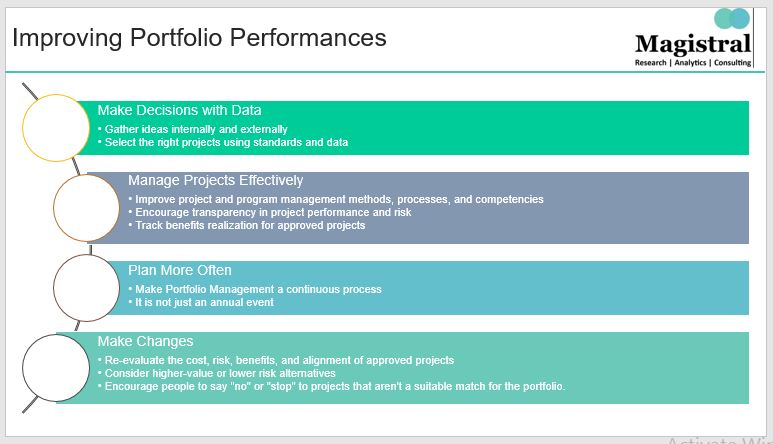

Strategies for Effective CPA Compliance

These strategies, when put in place, can ensure that a CPA compliance program is at its best in delivering on all it is built to achieve. They are meant to instill a culture of compliance within the organization and ensure that regulations and standards are followed without a hitch.

Strategies for Effective CPA Compliance

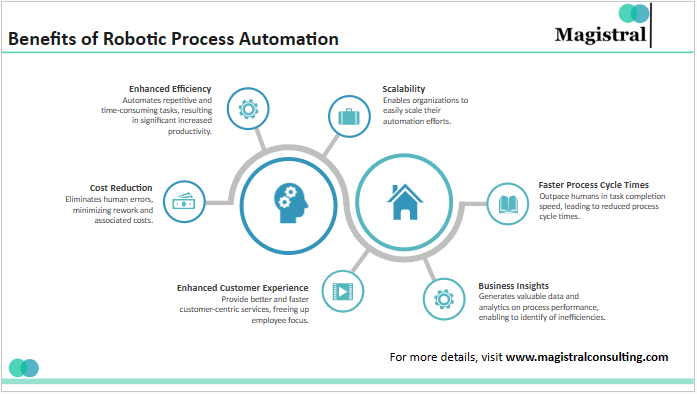

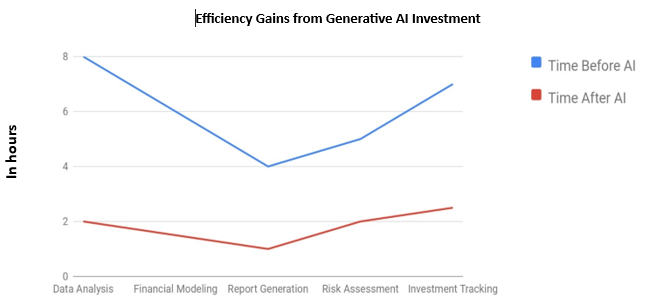

Leveraging Technology

Technology is an essential constituent of most modern CPA compliance programs. Compliance software can automate the management and monitoring of policies and procedures for consistency, minimizing human error. Analytics performed on the data may highlight compliance problems or trends, pinpointing anomalies that indicate possible non-compliance. In these ways, technology helps make compliance programs much more efficient and effective while easing their maintenance in dynamic regulatory environments.

Enhancing Communication

Effective compliance for CPAs emanates from clear and open communication. It is very important to ensure that all employees clearly understand the compliance policies and expectations. Regular communication on any compliance update keeps them updated. The need for an anonymous reporting mechanism through which employees may report compliance violations with impunity—oftentimes a whistleblower program—is necessary. These mechanisms encourage employees to come forward to point out problems so the organization can address the issues in a timely fashion and maintain compliance.

Building a Compliance Culture

Building a strong compliance culture is fundamental to the success of any program. Securing commitment from top management to prioritize compliance sets the tone for the entire organization. When leaders demonstrate a commitment to compliance, it encourages employees to follow suit. Fostering an organizational culture that values ethical behavior and compliance creates an environment where adherence to regulations and standards is the norm. This culture helps prevent compliance issues and promotes a proactive approach to maintaining compliance.

Continuous Improvement

Continuous improvement enables an organization to ensure that it remains compliant under the CPA. To this end, mechanisms should be established through which appliances of compliance processes are able to give their input for improvement. Compliance programs need regular updating with regard to content and current best practice so they remain up-to-date with changes in regulations.

Magistral Consulting’s Services

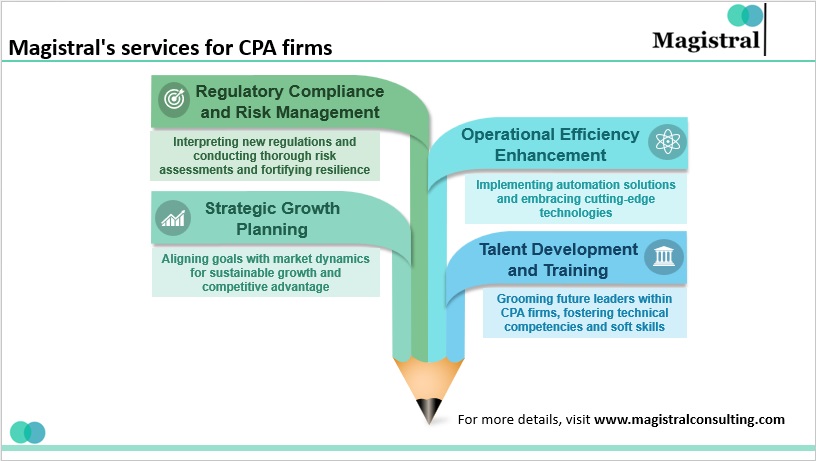

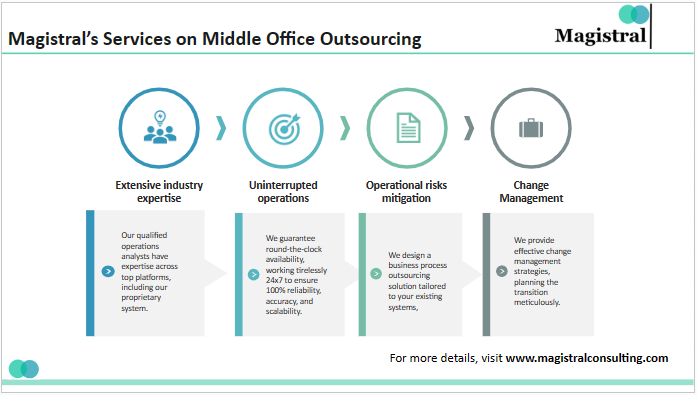

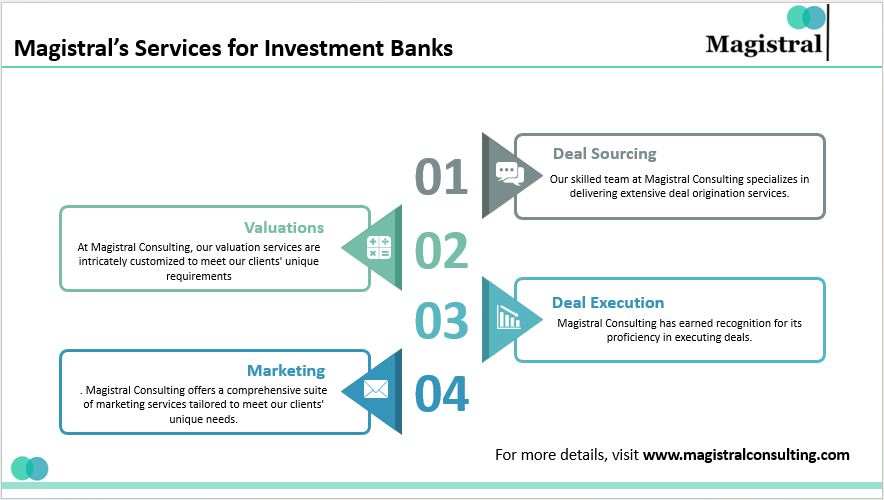

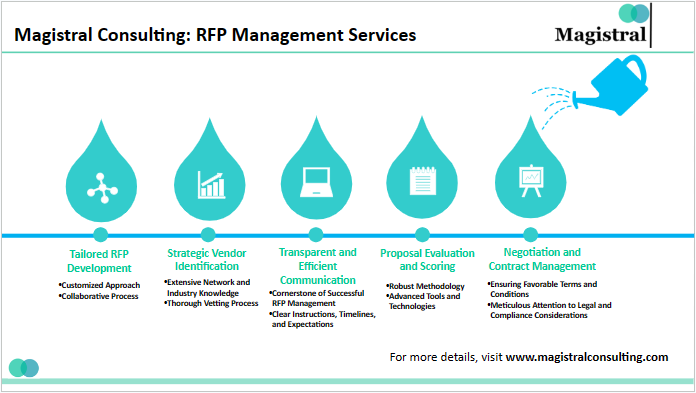

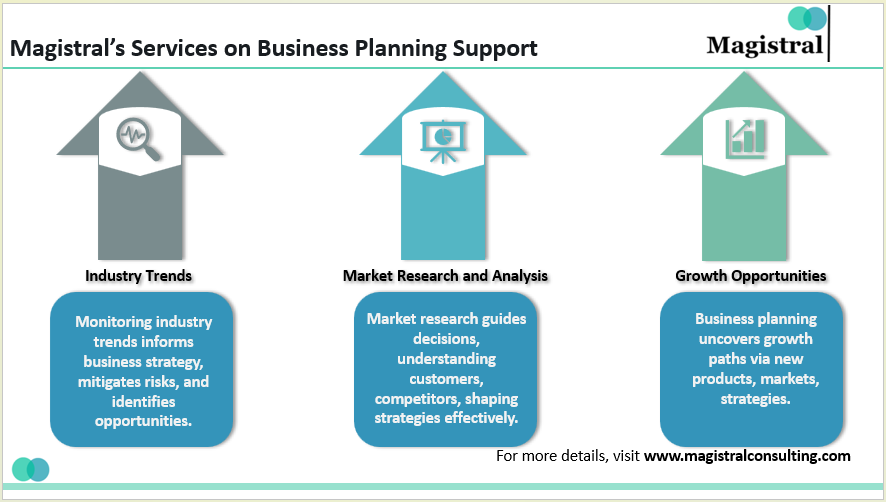

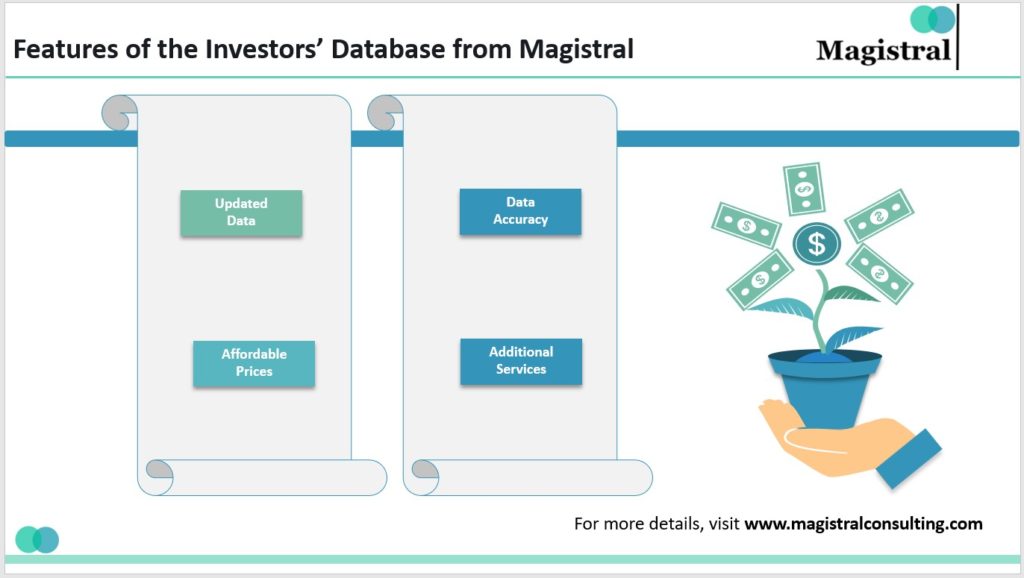

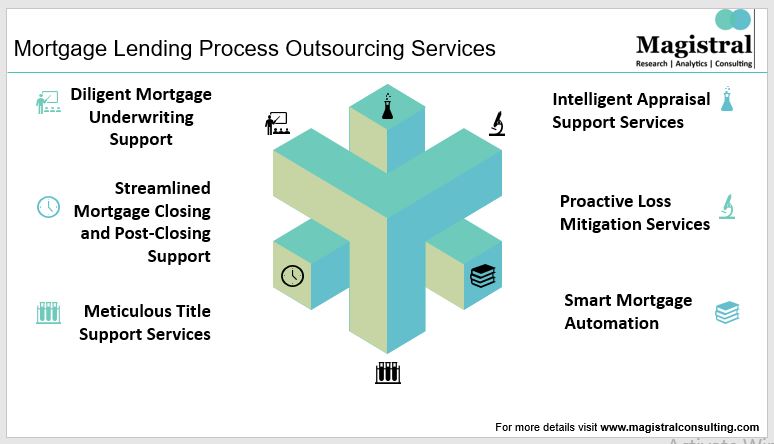

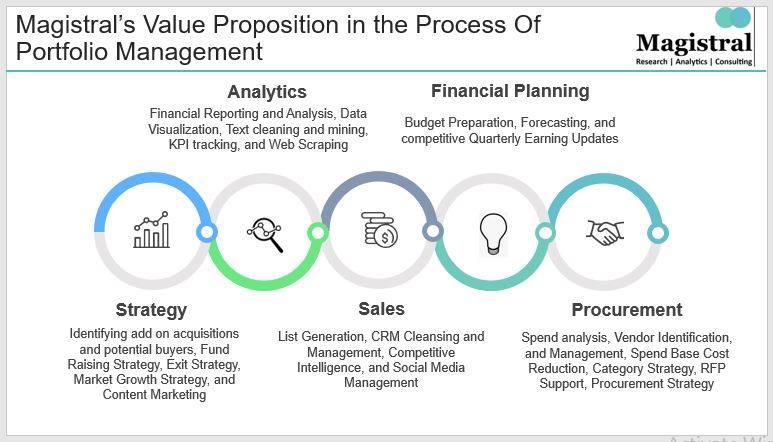

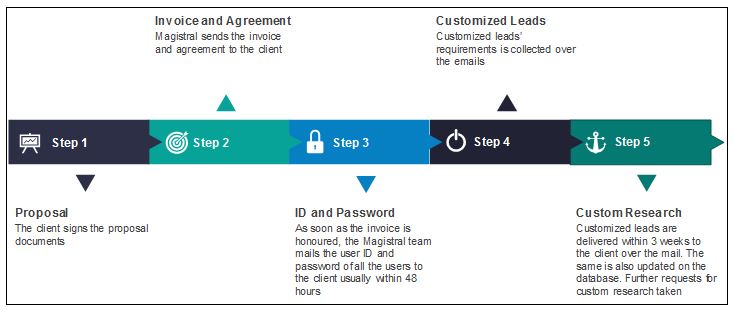

Magistral Consulting offers a comprehensive suite of services tailored to help organizations navigate the complexities of CPA compliance. Here, we explore four critical areas where Magistral Consulting can provide valuable assistance.

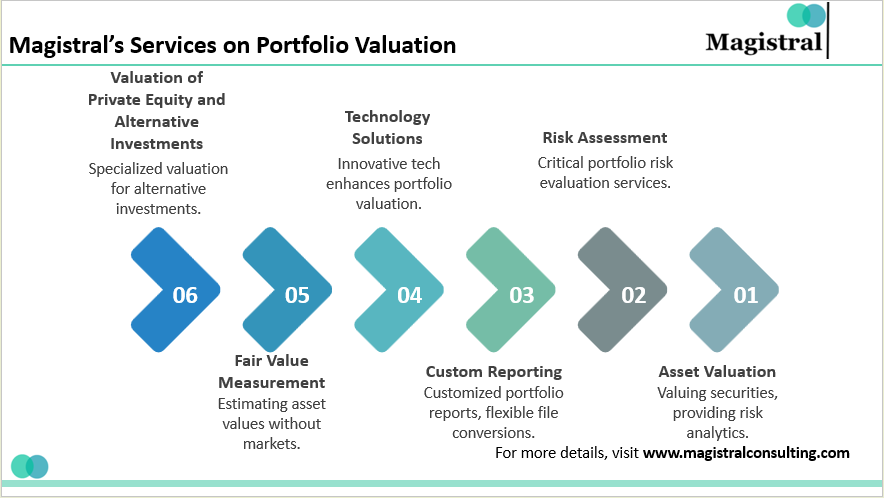

Risk Assessment and Management

Magistral Consulting conducts thorough risk assessments to identify potential compliance risks. This includes evaluating financial reporting practices, auditing processes, and ethical standards adherence. By identifying risks, organizations can take proactive steps to address them before they become significant issues. The consulting team develops robust risk mitigation strategies to ensure that identified risks are addressed effectively. These strategies may include enhancing internal controls, improving training programs, and increasing oversight in high-risk areas.

Policy and Procedure Development

Magistral Consulting provides assistance in the development of compliance policies that would allow clients to address specific organizational needs. Detailed documentation of policies and procedures addresses specific actions and behaviors required to be demonstrated by employees. Such tailored policies further clarify and make applicable the compliance requirements toward organizational activities of the organization. Effective policy and procedure development ensures consistency and thoroughness in the compliance framework.

Training and Education Programs

Magistral Consulting designs and provides training programs on specified organizations’ compliance needs. These programs involve regular training sessions and workshops that keep the staff up-to-date with compliance requirements and their changes. The firm thus offers targeted employee training to enable them to respond to new regulations and standards. Magistral Consulting also helps organizations meet their CPE requirements which ensures that all CPAs satisfy their CPE obligation and attain professional competence.

Monitoring and Auditing Services

Magistral Consulting offers extensive internal audits to determine the establishment of policies and procedures, and that they are adhered to or complied with. In cases when deemed necessary, it points out the differences and shortcomings of opinion. By performing regular internal audits, an organization is able to essentially verify that compliance is maintained over time and identify any problems that appear and deal with them at the earliest possible stage.

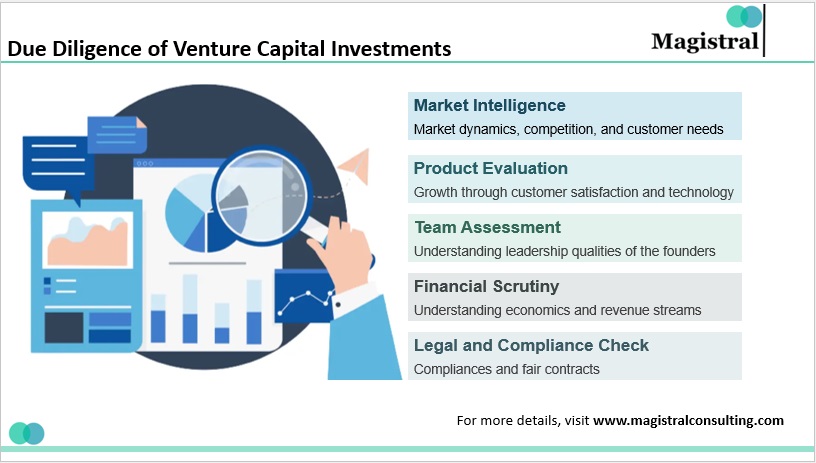

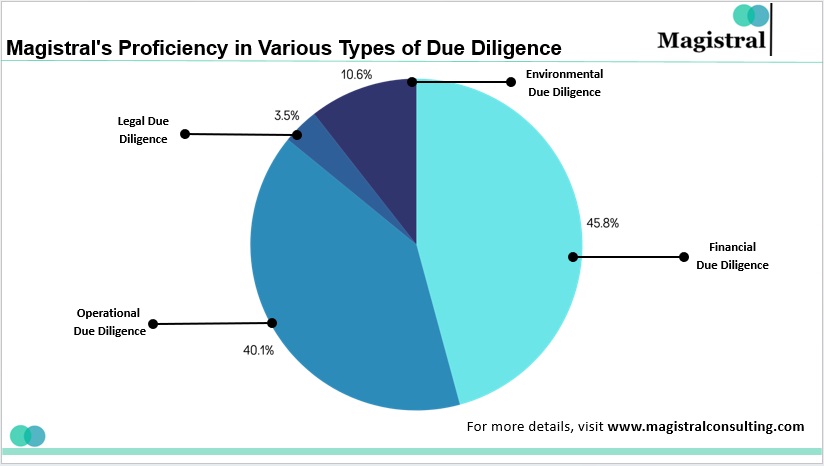

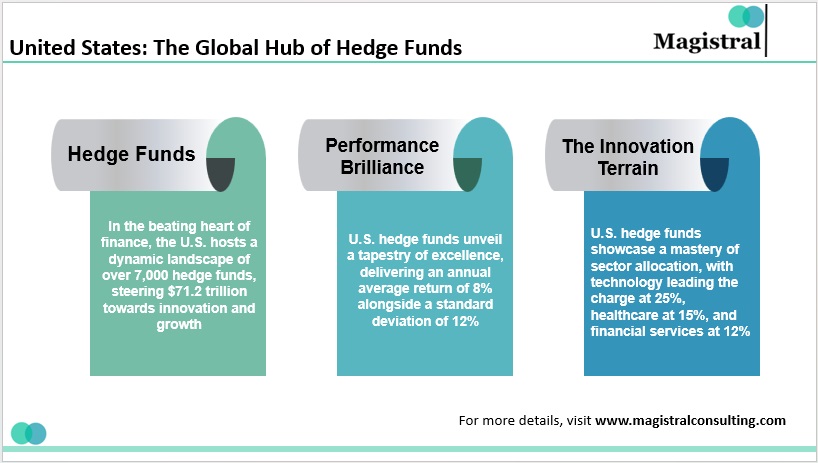

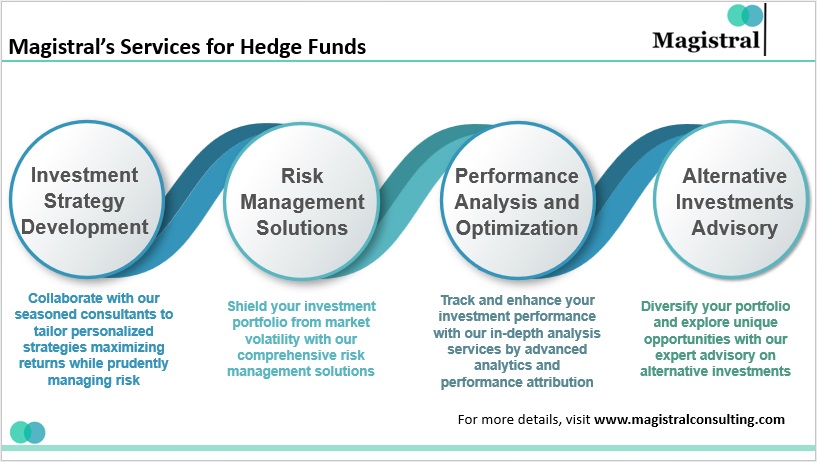

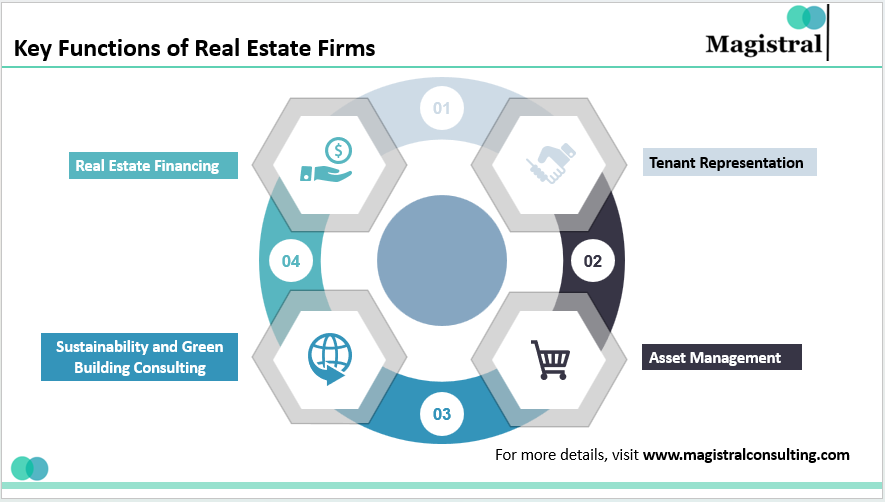

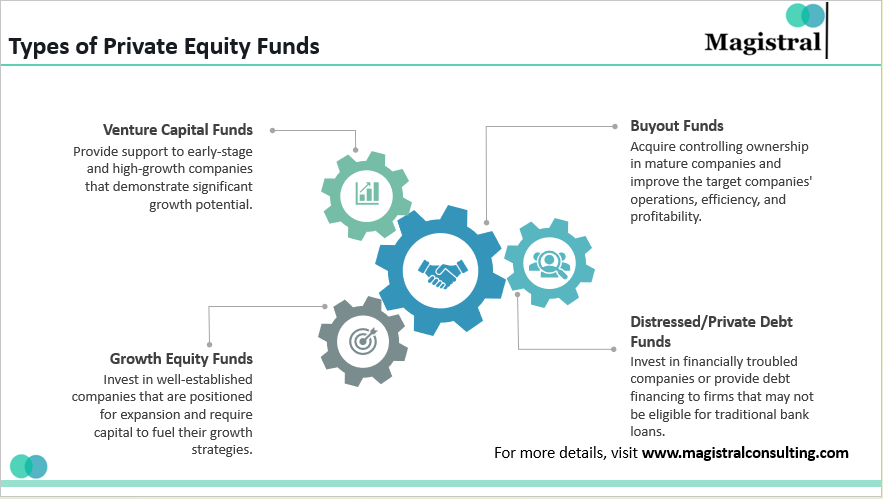

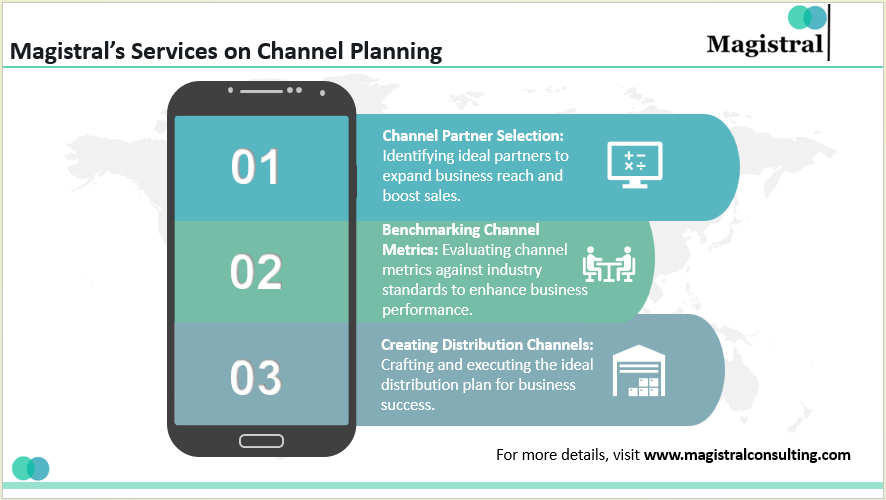

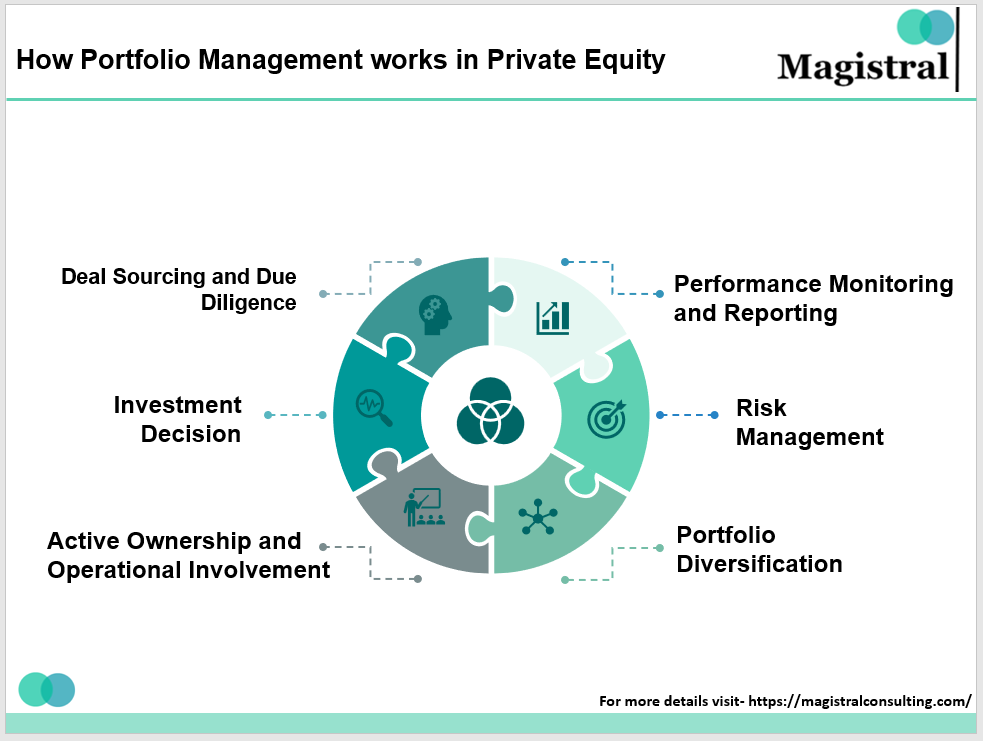

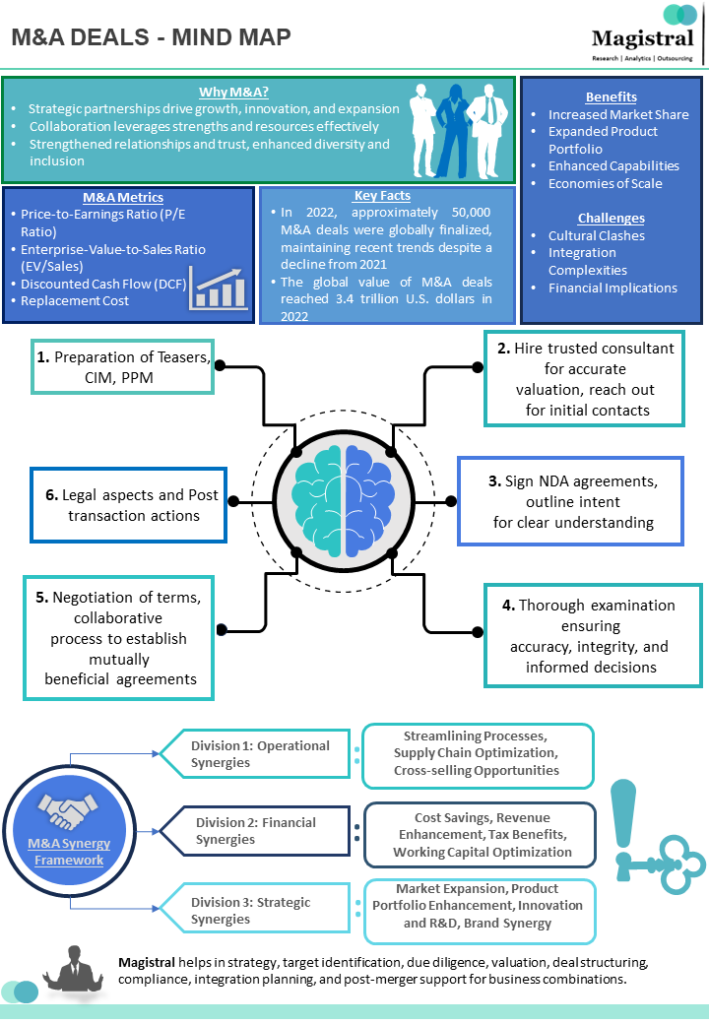

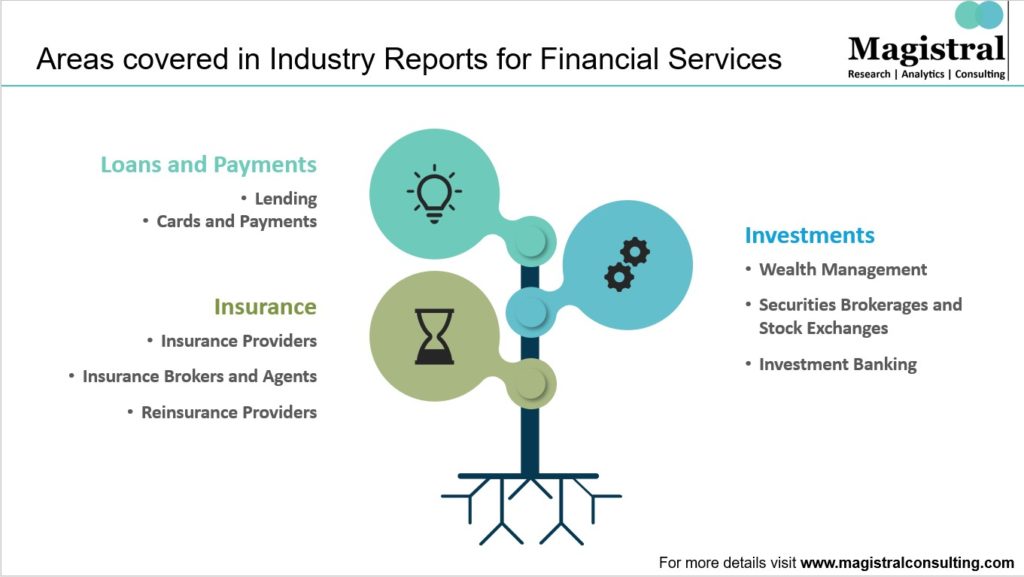

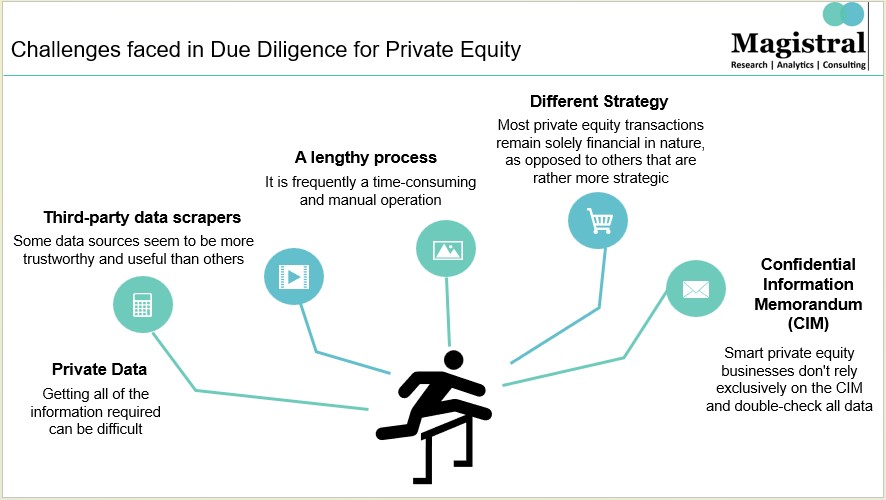

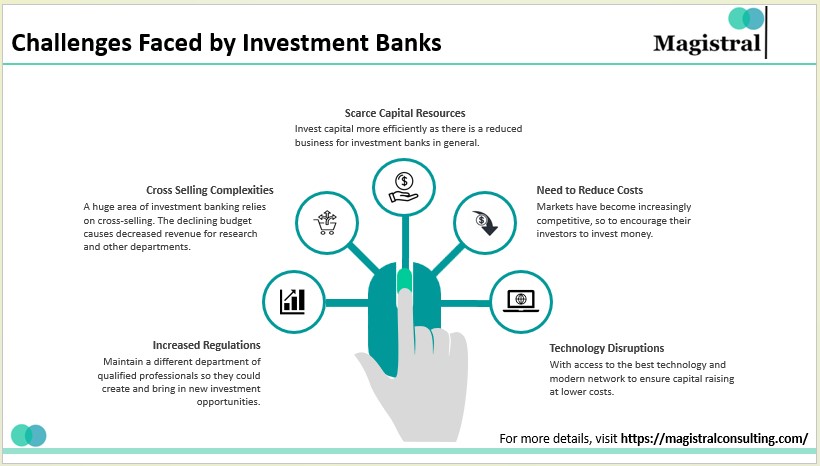

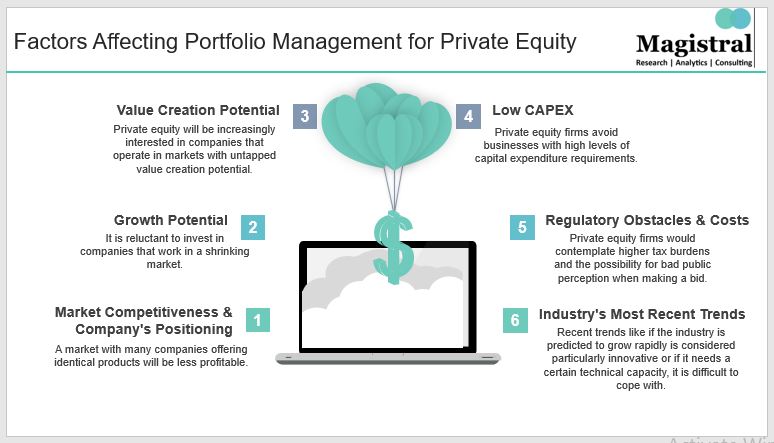

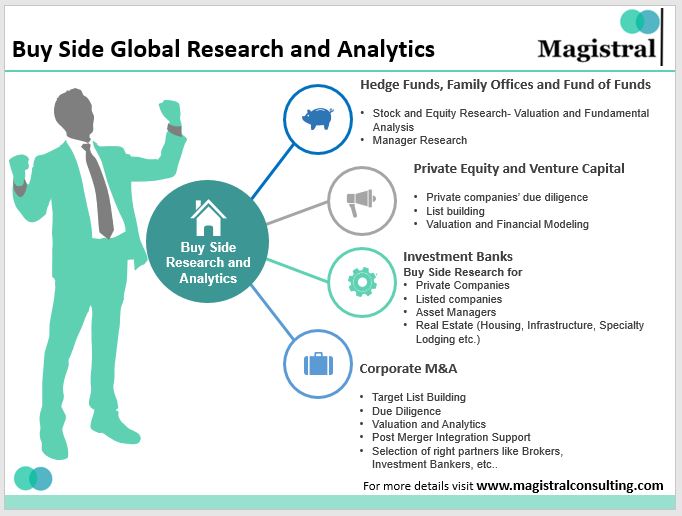

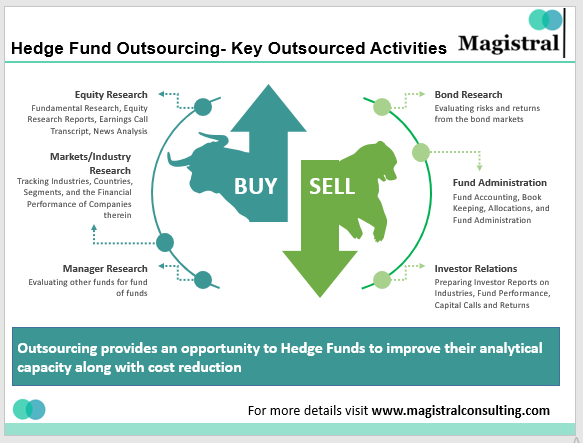

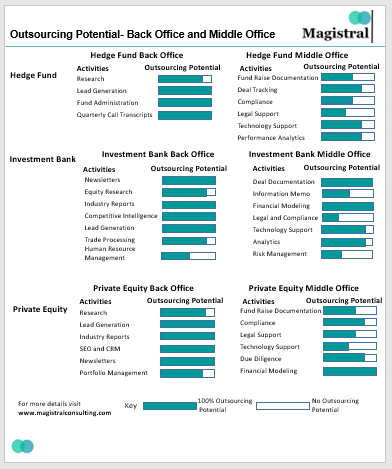

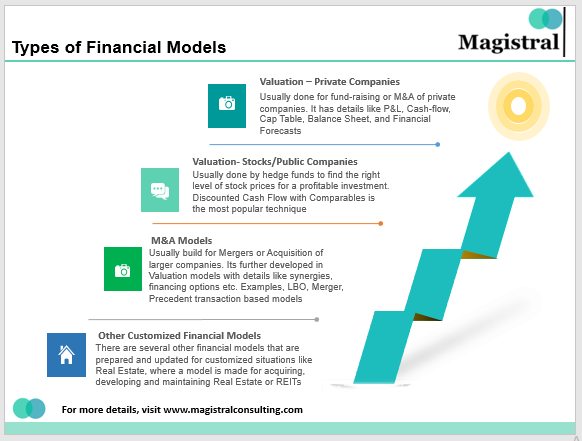

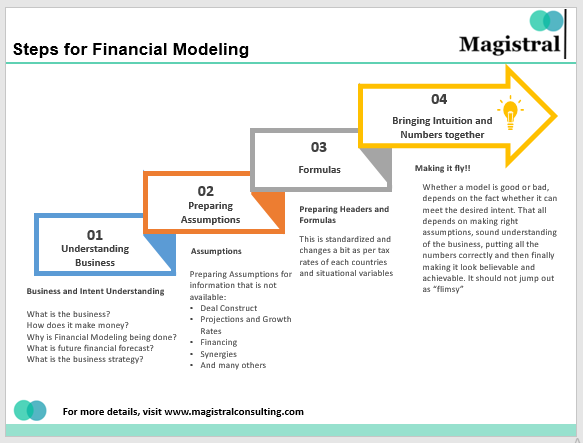

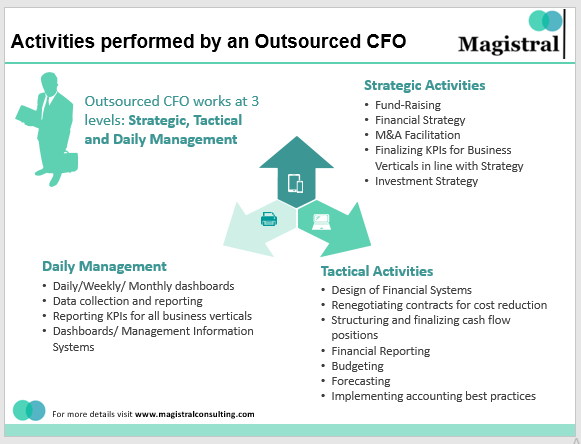

About Magistral Consulting

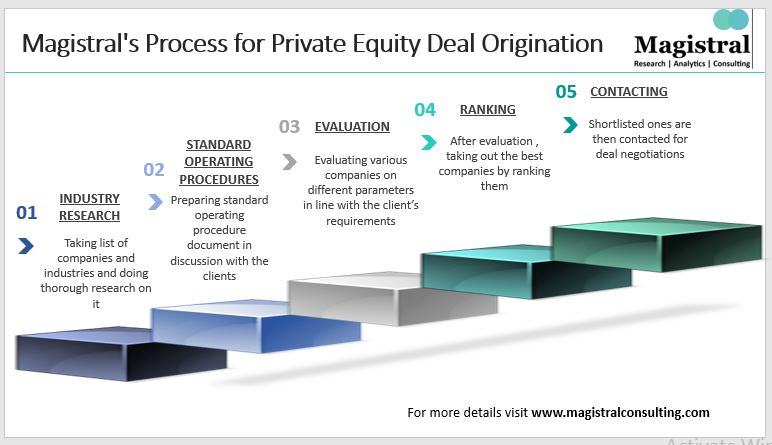

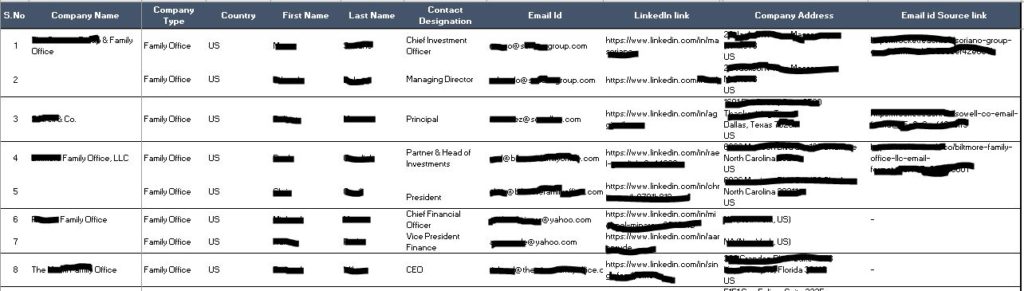

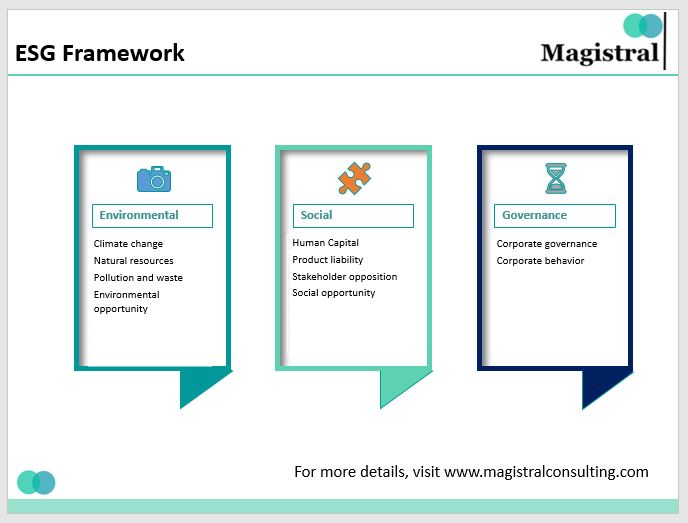

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Why is CPA compliance important?

CPA compliance ensures accurate financial reporting, protects stakeholders like investors and creditors, maintains the integrity and reputation of the accounting profession, and helps avoid legal consequences for non-compliance.

What are the key regulatory bodies involved in CPA compliance?

Key regulatory bodies include the American Institute of CPAs (AICPA), which sets ethical standards; the Public Company Accounting Oversight Board (PCAOB), overseeing public company audits; and the Securities and Exchange Commission (SEC), regulating financial disclosures.

What are the main components of an effective CPA compliance program?

An effective CPA compliance program includes risk assessment, detailed policies and procedures, regular training and education, and continuous monitoring and auditing to ensure adherence to compliance requirements.

How can technology enhance CPA compliance programs?

Technology can automate compliance processes, reduce human error, and use data analytics to identify compliance issues and trends, making compliance programs more efficient and effective in dynamic regulatory environments.

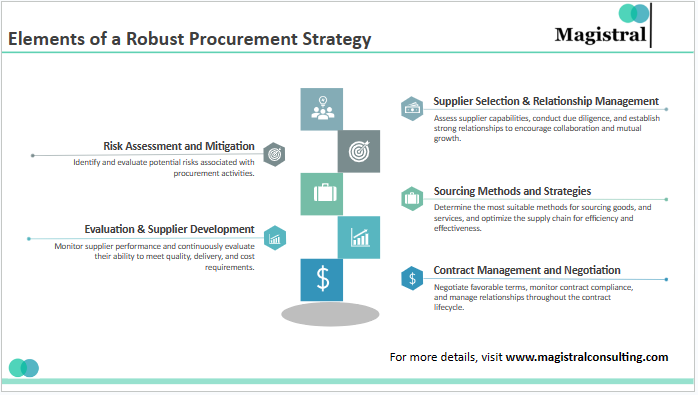

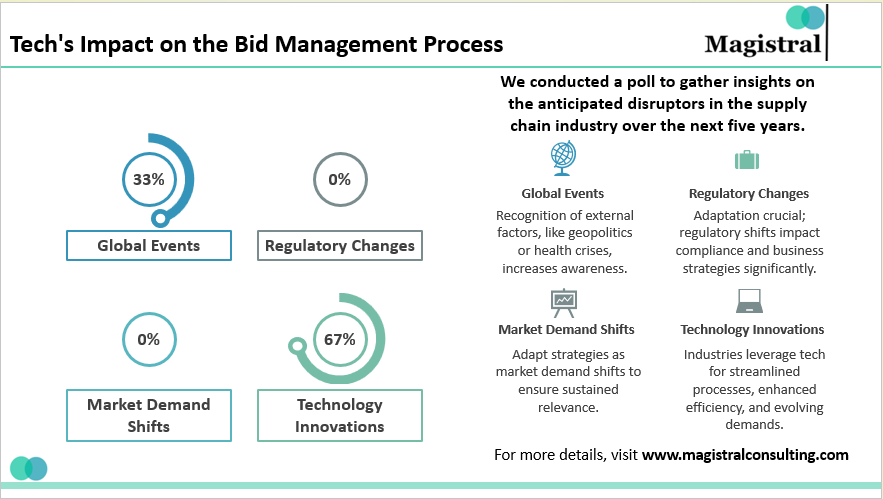

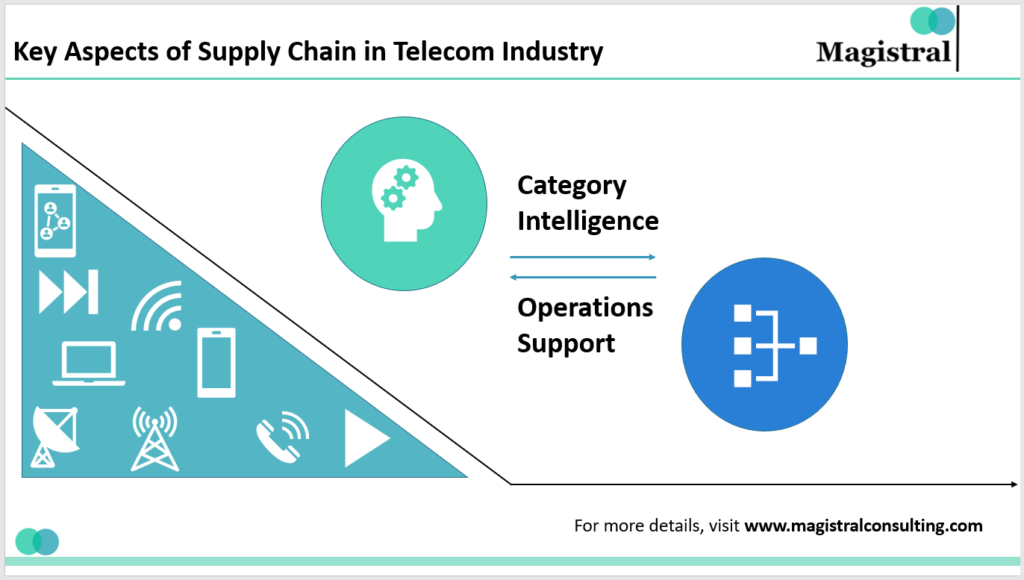

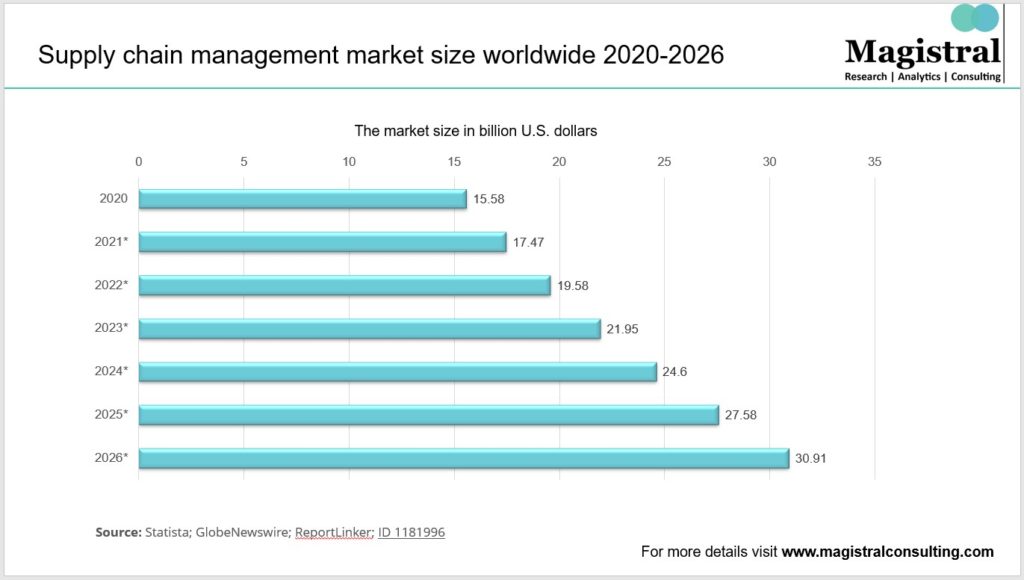

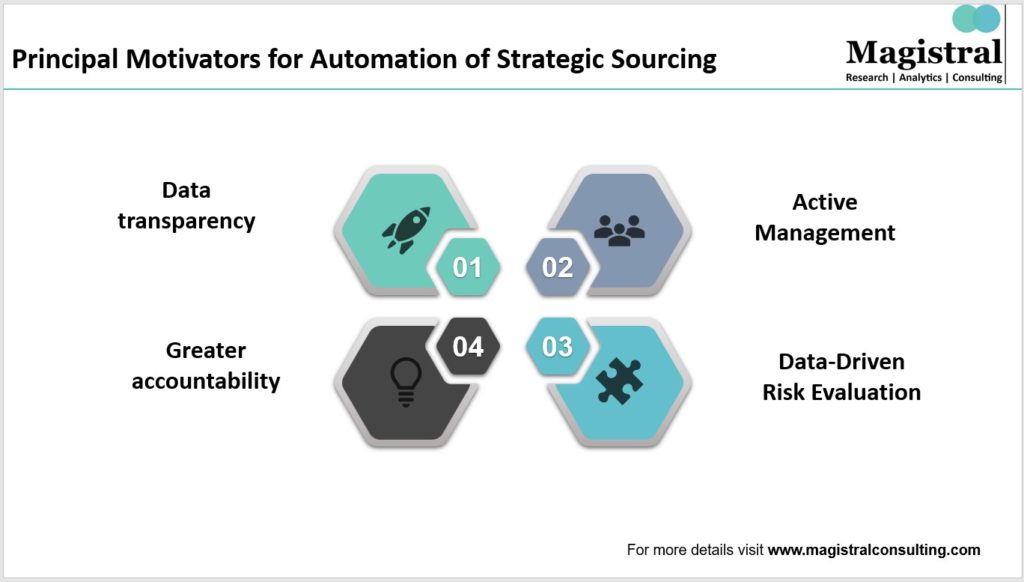

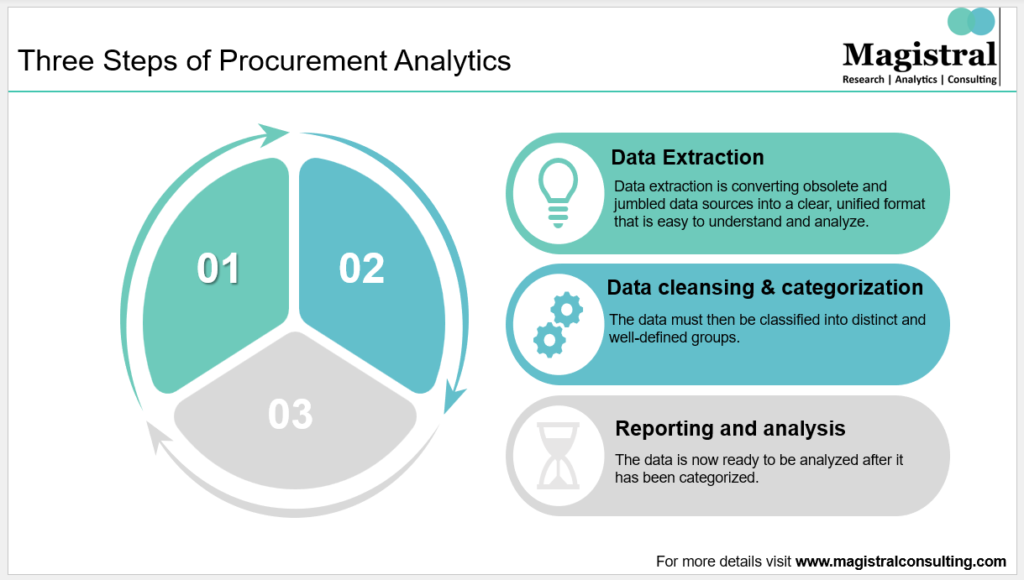

Procurement is an area where cost optimization strategies start to show an impact on bottom-line almost immediately. It’s one of the foremost areas, which is attacked by experienced turnaround professionals. Direct sourcing which almost decides the profit margins of the organization or even its competitive standing in the market hogs all the management attention. Indirect sourcing at the same time is complex and requires expertise that is usually not present in the organization.

Procurement is an area where cost optimization strategies start to show an impact on bottom-line almost immediately. It’s one of the foremost areas, which is attacked by experienced turnaround professionals. Direct sourcing which almost decides the profit margins of the organization or even its competitive standing in the market hogs all the management attention. Indirect sourcing at the same time is complex and requires expertise that is usually not present in the organization.