In the swiftly moving realm of finance, where accuracy and transparency reign supreme, the roles of fund administration and accounting are of utmost significance. These roles are vital for ensuring the seamless operation and reliability of investment funds spanning various asset classes. This article endeavors to delve into the intricacies of fund administration and accounting, elucidating their importance, processes, challenges, and optimal strategies.

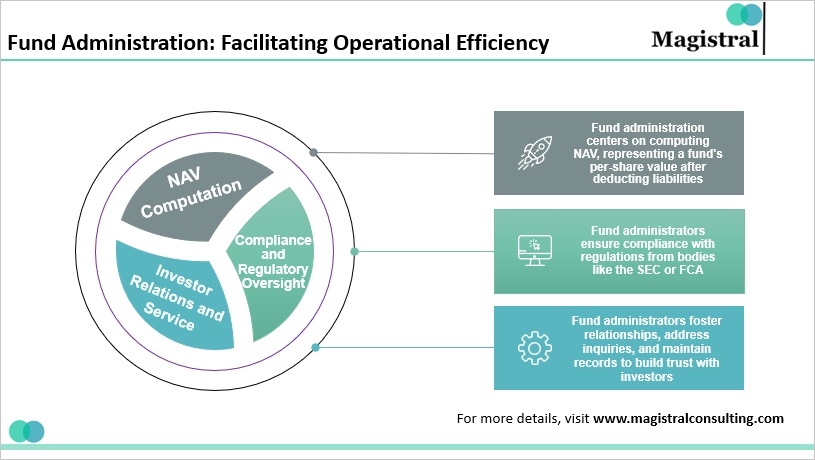

Fund Administration: Facilitating Operational Efficiency

Fund administration encompasses a diverse array of tasks aimed at facilitating the efficient operation of investment funds. From ensuring compliance with regulations to nurturing investor relationships, fund administrators play a central role in maintaining operational efficiency. Here are some pivotal aspects of fund administration:

Fund Administration: Facilitating Operational Efficiency

NAV Computation

At the core of fund administration lies the computation of Net Asset Value (NAV). This metric signifies the per-share value of a fund’s assets after the deduction of its liabilities and is typically calculated at regular intervals, often daily. Precise NAV calculation is imperative for both investors and regulators, serving as a pivotal performance indicator for the fund.

Compliance and Regulatory Oversight

Managing compliance and regulatory oversight is a crucial responsibility for fund administrators. They are entrusted with the task of ensuring adherence to regulations stipulated by governing bodies such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the UK. This involves meticulous record-keeping, reporting, and implementation of internal controls to mitigate risks and uphold regulatory standards.

Investor Relations and Service

Fund administrators serve as intermediaries between investment funds and their investors, fostering robust relationships and providing exemplary service. They address investor inquiries, facilitate subscriptions and redemptions, and maintain accurate records. By delivering seamless investor service, fund administrators cultivate trust and confidence in the fund, nurturing enduring relationships with investors.

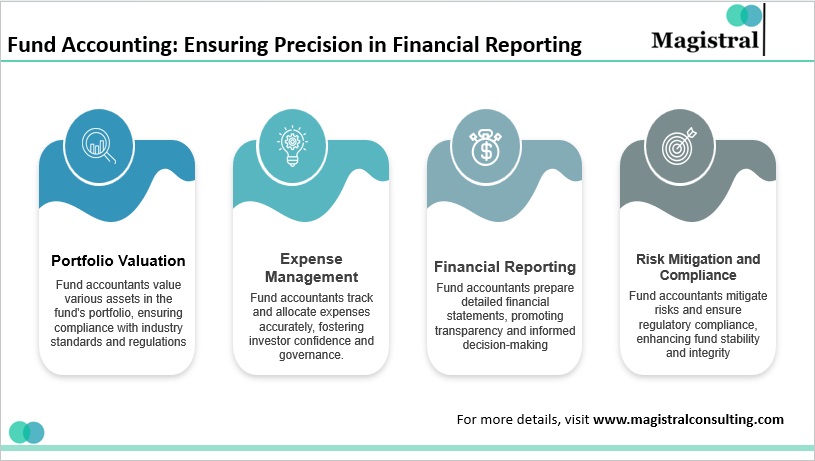

Fund Accounting: Ensuring Precision in Financial Reporting

Fund accounting serves as the bedrock of financial reporting for investment funds, encompassing specialized processes tailored to fund structures. Here are some key facets of fund accounting:

Fund Accounting: Ensuring Precision in Financial Reporting

Portfolio Valuation

Fund accountants are tasked with valuing the diverse range of assets held within the fund’s portfolio, spanning equities, fixed-income securities, derivatives, and alternative investments. Valuation methodologies must conform to industry standards and regulatory guidelines to ensure accuracy and transparency in financial reporting.

Expense Management and Allocation

Efficient expense management is imperative for optimizing fund performance and ensuring equitable treatment of investors. Fund accountants meticulously track and allocate expenses such as management fees, custodian fees, and administrative costs by the fund’s governing documents and regulatory requirements. Transparent expense allocation fosters investor confidence and bolsters overall fund governance.

Financial Reporting and Transparency

Fund accountants prepare comprehensive financial statements that offer stakeholders a clear insight into the fund’s financial position and performance. These statements encompass the income statement, balance sheet, and statement of cash flows, meticulously crafted to adhere to accounting standards and regulatory mandates. Transparent financial reporting enhances investor trust and facilitates informed decision-making by fund managers and stakeholders.

Risk Mitigation and Regulatory Compliance

Apart from portfolio valuation, expense management, and financial reporting, fund accounting also involves risk mitigation and regulatory compliance. Fund accountants play a pivotal role in recognizing and reducing risks linked with investment activities, and guaranteeing compliance with regulatory standards and internal protocols. Through the implementation of strong risk management strategies and adherence to regulations, fund accountants bolster the overall stability and credibility of investment funds.

Challenges and Considerations in Fund Administration and Accounting

Despite their pivotal role, fund administration and accounting encounter diverse challenges in today’s dynamic financial landscape:

Regulatory Complexity and Compliance Burden

The regulatory environment governing investment funds is characterized by its complexity and continual evolution. Fund administrators and accountants must navigate a labyrinth of regulatory requirements, spanning reporting obligations to compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Remaining abreast of regulatory changes and implementing robust compliance frameworks is essential to mitigate regulatory risks.

Data Management and Technological Integration

The exponential growth of data poses significant challenges for fund administrators and accountants, necessitating robust data management systems and technological solutions. Leveraging cutting-edge technologies such as artificial intelligence (AI), machine learning, and blockchain can streamline processes, enhance data accuracy, and mitigate operational risks. However, integrating these technologies necessitates careful planning and investment in infrastructure and talent.

Operational Efficiency and Cost Optimization

In an increasingly competitive landscape, fund administrators and accountants face pressure to enhance operational efficiency and optimize costs. Streamlining processes, automating routine tasks, and leveraging economies of scale through outsourcing are strategies employed to achieve operational excellence while containing costs. However, striking the right balance between efficiency gains and cost containment necessitates careful consideration of organizational priorities and strategic objectives.

Emerging Trends and Best Practices

In response to evolving market dynamics and technological advancements, fund administrators and accountants are embracing innovative trends and best practices:

Digital Transformation and Automation

The digitization of fund administration and accounting processes is revolutionizing the industry, enabling greater efficiency, accuracy, and scalability. Robotic Process Automation (RPA), artificial intelligence (AI), and cloud-based solutions are being leveraged to automate routine tasks such as NAV calculation, reconciliation, and reporting, freeing up resources for higher-value activities.

ESG Integration and Sustainable Investing

ESG (environmental, social, and governance) factors are influencing fund management strategies and investment choices more and more. In response to investor demand for sustainable and ethical investing, fund administrators and accountants are incorporating ESG issues into their reporting systems and investment analysis. Funds can reduce long-term risks related to environmental and social variables and attract more socially conscious investors by adhering to ESG standards.

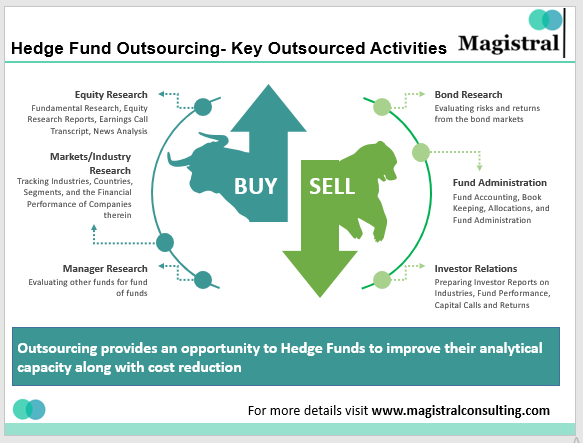

Outsourcing and Strategic Partnerships

In order to concentrate on their core skills, a growing number of fund managers are outsourcing non-essential tasks to specialized service providers, such as accountancy and fund administration. Businesses can obtain specialized knowledge, scalable infrastructure, and cost savings through outsourcing, which also lowers operating expenses and lowers compliance risks. Establishing strategic alliances with dependable service providers can improve operational resilience and agility, allowing businesses to more effectively adjust to shifting market conditions and regulatory demands.

Magistral’s Services on Comprehensive Fund Administration and Accounting Support

In the complex realm of finance, where accuracy and openness are essential, Magistral Consulting shines as a symbol of quality, providing thorough fund administration and accounting services customized to the specific requirements of investment funds. Committed to integrity, effectiveness, and client contentment, Magistral Consulting provides precise financial management solutions that enable clients to navigate the intricacies of the investment world with assurance and simplicity.

Fund Administration Expertise Unveiled

Our team specializes in providing fund administration services, leveraging a profound understanding of regulatory requirements and industry standards. From Net Asset Value (NAV) calculation to ensuring compliance and managing investor relations, we guarantee seamless operational efficiency for investment funds of all types and sizes.

Reliable Financial Reporting with Fund Accounting Solutions

Our fund accounting services are renowned for their precision and dependability. By utilizing advanced technologies and adhering strictly to accounting standards, we furnish accurate portfolio valuations, transparent expense management, and comprehensive financial reporting. Our focus on clarity and transparency empowers clients to make well-informed decisions and maintain trust among investors.

Tailored Solutions and Personalized Support

What sets us apart is our commitment to understanding the unique requirements of each client. Through personalized consultations and bespoke solutions, we ensure that every client receives the tailored attention and support they need. Whether it involves navigating regulatory intricacies or optimizing operational effectiveness, our dedication is to surpassing expectations.

Innovative Strategies for Today’s Challenges

In addressing contemporary challenges, we employ innovative strategies that prioritize staying ahead of the curve. Through the integration of automation, artificial intelligence, and blockchain technology, we streamline operations, enhance data accuracy, and minimize operational risks. By embracing a forward-thinking approach, we empower clients to navigate evolving market dynamics and seize emerging growth prospects.

The Future of Fund Administration and Accounting

The trajectory of fund administration and accounting is set for innovation and evolution as the financial landscape progresses:

Enhanced Regulatory Oversight and Transparency

Regulators are anticipated to heighten their supervision of investment funds, emphasizing the augmentation of transparency, investor safeguarding, and systemic resilience. This may involve regulatory enhancements such as elevated reporting obligations, more rigorous compliance criteria, and heightened scrutiny of fund governance frameworks. Fund administrators and accountants will be required to adjust to evolving regulatory directives and harness technology to bolster transparency and adherence to regulations.

Adoption of Blockchain and Distributed Ledger Technology

Increased efficiency, security, and transparency offered by distributed ledger technology (DLT) and blockchain can totally change accounting and fund administration processes. Fund administrators and accountants can use blockchain-based solutions for record-keeping, settlement, and transaction processing to increase data quality, streamline operations, and reduce fraud risks. However, for blockchain technology to become extensively used, industry stakeholders’ collaboration and governmental clearance are required.

Focus on Cybersecurity and Data Privacy

Amidst the proliferation of digital technologies and interconnected systems, cybersecurity and data privacy have risen to the forefront for fund administrators and accountants. Preserving the confidentiality of sensitive financial data, fortifying defenses against cyber threats, and adhering to data privacy regulations are essential focal points. It’s imperative to invest in robust cybersecurity measures, conduct routine audits, and implement data encryption protocols to effectively mitigate cyber risks and uphold investor confidence.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com