Introduction to Hedge Fund Outsourcing

Operations Outsourcing for Hedge Funds is slowly becoming a viable proposition to improve analytical excellence and reduce the operations’ cost. Almost all types of hedge funds can benefit from outsourcing and research support services. It aids the smooth functioning of Hedge Fund operations. Hedge Fund outsourcing not only helps in reducing operations cost, but it is also immensely helpful in raising the analytical standards of the fund.

Hedge Funds are investment vehicles that invest in stocks to give superlative returns to their investors. They follow multiple strategies like long-short equity, market neutral, merger arbitrage, convertible arbitrage, event-driven, credit, fixed income arbitrage, global macro, Short only, and Quantitative. Here is what these strategies are and what could be outsourced by each strategy

Long-Short Equity Hedge Fund

This is by far the most common form of Hedge Funds. Here the fund manager takes long and short positions on the stocks where he believes the stock will go up and the stock will go down respectively. Ideally, long positions should match short positions, so that risk from overall market movements is hedged. However, in practice, the ratio of long and short positions varies with every fund manager. Generally, there are more long positions than short ones. Taking long positions on expected winners acts as collateral to short positions in the expected losers

Long-short Equity is an extension of pairs trading, where a fund manager takes opposing positions in similar stocks in the same industry. If a stock looks overvalued as compared to another in the same industry, the fund manager goes short on the overvalued stock and long on the undervalued one. This relative positioning hedges the risks of market fluctuations in either direction

Hedge Fund outsourcing in long-short equity funds have reduced operations cost by 40-70% and at the same time is known to bring the new skills to the fold of the fund.

What could be Outsourced

Here is what could be outsourced conveniently in a Long-Short Equity Hedge Fund

-Equity Research

-Middle Office

-Fund Administration and Accounting

-Data Management (Collection, Cleansing, Automating and Templatizing for Insights)

-Industry Research

Market Neutral Hedge Funds

Market neutral hedge funds are long-short equity funds that hedge the value of long and short positions. The value and volume of long positions match the value and volume of short positions. This ensures that the risks of market movement are minimized. That also means that the returns from such hedge funds are far moderated than the funds that are biased towards long positions. As its type of a long-short equity fund, outsourcing carries similar potential.

Here is what could be outsourced conveniently in a Market Neutral Hedge Fund

-Equity Research

-Middle Office

-Fund Administration and Accounting

-Data Management (Collection, Cleansing, Automating and Templatizing for Insights)

-Industry Research

Merger Arbitrage Hedge Funds

This is a unique kind of event-driven hedge funds that play on a merger event. Whenever a merger event is announced, the fund manager buys the shares in the target company and shorts the shares of the acquiring company in the prescribed share swap ratio. It creates a spread that incentivizes the fund if the merger goes through. This is however a risky proposition and fund loses in case the merger does not go through due to any regulatory or internal reasons.

Apart from usual activities, here is what could be outsourced:

-News tracking related to M&A

-Merger Modeling

-Valuations

-Industry Reports

Convertible Arbitrage Hedge Funds

Convertible Arbitrage is securities that combine bonds and equity. Fund Managers are usually long on bonds and short on the equity that they convert to. Fund managers maintain a delta neutral position throughout. So if the equity value goes down, they need to buy more equity and hedge more if the stock price goes up. It forces fund managers to buy low and sell high. These funds return superior performance if there is volatility in the market.

There are multiple facets of operations that could be outsourced here

Event-Driven and Credit Hedge Funds

This is another unique type of hedge fund that thrives on special situations like bankruptcy. These funds focus on acquiring senior debt that gets paid over other kinds of debts in case of bankruptcy. Credit Hedge Fund on the other hand looks for arbitrage between senior and junior debt from the same issuer. They also trade between securities of different qualities from different issuers

Apart from regular operational aspects, here is what could be outsourced here

-Research around the events that allow the opportunity to kick in for the Hedge Fund

Fixed Income Arbitrage Hedge Funds

These Hedge Funds buy securities on one market and sell them on another market and make money from the arbitrage existing between the two market prices of the securities.

Global Macro based Hedge Funds

Some Hedge Fund focus on macro trends around countries, markets, commodities, trades, etc. to bet on different investment and trade from opportunities that these macro changes may throw-in.

Global macro changes research could be outsourced here.

Short Only Hedge Funds

These Hedge Funds bet on the failure of a company. They look for companies that may have unsustainable business models and go short on them. It’s the short part of the Long-Short Equity Hedge Fund.

All the elements of the Long-Short Hedge Fund could be outsourced.

Quantitative Hedge Funds

Quant based Hedge Funds solely depend on mathematical models to make buy or sell decisions. Their algorithms are obscure and they use tools like Machine Learning, Artificial Intelligence, High-Frequency Trading, and other technological tools to produce returns.

All regular activities related to Hedge Funds like Administration could be outsourced here.

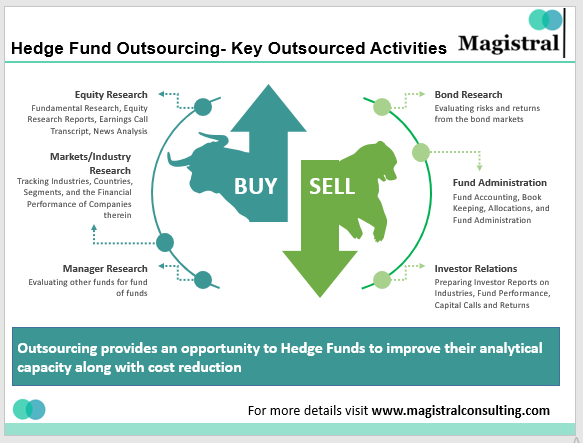

Here are the activities that Hedge Funds commonly outsource:

Activities that are commonly outsourced by Hedge Funds

Equity Research Outsourcing/ Hedge Fund Outsourcing

Equity Research Outsourcing is by far the most important element of Hedge Fund Outsourcing. Equity Research outsourcing helps the in-house team track more stocks and sometimes to give more depth to the same set of stocks that are tracked by the fund. Fundamental and technical equity research, both could be outsourced effectively. DCF models are prepared for each stock and then tracked progressively for any changes or news related to that particular stock. Earnings call transcripts are duly recorded and analyzed for a recommendation. A short 2-3-page report is prepared for every stock with the overall recommendation and the rationale for the recommendations. Hedge Fund Research tasks are completed seamlessly with the offshore team acting as a natural extension to the in-house team

Markets/Industry Research

If an investment theme is weaved around a specific country, industry or an emerging theme, its imperative to track that industry, market, or theme closely and regularly. A market is tracked for any macro-level changes like new tech, change in regulations, key movements, trends, etc periodically say quarterly. Several indices are also tracked regarding this. It’s quite common to track 14 S&P industries or some of its components therein. For index hedge funds, the performance of various indices is tracked

Typical examples may be tracking the insurance market in North Africa or metals and mining in South America. If your fund has a bigger interest in stocks that are based in those markets, it makes sense to have the key metrics of these industries reported to you regularly.

Manager Research

This is important for Fund of Funds. As part of their investment strategy, they are continuously on a look-out for hedge funds that fulfill a given set of criteria like vintage, past returns, investment themes, etc. Each fund is analyzed for risk-adjusted returns over a fairly long period like 10 years or so to find out the most suitable funds.

This requires getting in touch with multiple funds across the globe, collecting information, analyzing it, and then presenting holistic recommendations on where the fund stands. All of this could be outsourced.

Bond and Other Fixed Income Instruments Research

For hedge funds that operate on the lines of fixed income, the research is done that is related to sovereign and government bonds, corporate bonds, fixed income instruments, and several other investment options like that.

Fund Administration and Accounting

Fund Administration is outsourced for activities related to accounting, bookkeeping, and general administration of the funds. This also forms part of Hedge Fund Middle Office Outsourcing. Some bookkeeping aspects also come under Hedge Funds’ back-office outsourcing. It keeps the documentation trail of all the trades, makes sure all operational processes are followed and exceptions are duly approved. Hedge Fund books are maintained in the prescribed format. It also takes care of investor communications like portfolio allocations, portfolio valuation, capital calls, taxes, profits, fees, NAV, portfolio, etc. Customized Hedge Fund newsletters for investors is sometimes prepared and sent separately to current and potential investors.

Investor Relations

This is a subset of the Fund Administration process. However, some elements of organic investors’ reach out could be outsourced as well. A tool or a portal for all the investors with all relevant information for them is prepared for seamless and updated communication. This is communication related to the Hedge Fund investments made by the investors. This might be customized to carry Hedge Fund news, Strategy, Returns, and Performance. In the case of Fund of Funds, the performance of all the underlying funds is covered.

About Magistral

Magistral has helped multiple hedge funds in outsourcing operations. You can check www.magistralconsulting.com for more details.

About the Author

The Author, Prabhash Choudhary is the CEO of Magistral Consulting and can be reached at Prabhash.choudhary@magistralconsulting.com for queries on this article or business inquiries in general.