Introduction

For venture capital (VC) firms, the target companies through which investments are generated are a quest that makes for art and science combined. With money at risk combined with the high probability of failure, these project experts will really wade through the frightening landscape to identify startups with the capacity to deliver gargantuan returns. It is a technique that involves great due diligence, strategic thinking, and dynamic knowledge in the marketplace. This article highlights the key areas of concern and strategies that VC firms should observe and employ in picking the right target companies.

Understanding the Dynamics of the Market

Before getting into the criteria governing the decision on the target firms it will be important to have an understanding of the investment landscape underlying the investments in the Market. As gathered from the National Venture Capital Association assignment, NVCA capital investment reached a record of $156.2billion that was distributed across 10,521 deals. This is a sign of 14% loss from the $182billion invested in 2021- it represents the sensitivity amid economic cycles and technological change.

Sector-Specific Considerations

In various business areas, there are challenges and opportunities that every industry will be facing. It affects the criteria of how the investors choose the companies for Investments.

Disruption and innovation to the technology sector are all but very pivotal to the businesses in this industry. VC firms look for companies incorporating high-end technologies with the potential disruption of industries in redefining business conduct within them. For example, the global fintech market will grow from 105.8 billion in 2020 to 324 billion by 2026 at a CAGR of 23.58%, evidence of the attractivity of this sector and investments that the VC firms handle.

Any healthcare and biotechnology firms as well as projects are considered based on the ground of scientific evidence, regulatory mechanisms, and market needs. The global outlook size was estimated to reach a value of $752.88 billion in 2020. The growth period for the years 2021 to 2028 will increase at a compounded annual growth rate of 15.83% through these quoted venture capital firms; a thorough analysis of the success rate and timelines of clinical trials is conducted. For a new drug, for it to enter into the market, its estimated cost reaches up to $2.6 billion.

Brand strength, customer loyalty, and market trends are those factors that most want to turn out to be critical in this consumer goods sector for its growth. Those businesses can grow rapidly which can take advantage of the e-commerce and DTC models. The size of the global e-commerce market was $4.28 trillion in the year 2020. Moreover, it is projected to witness a CAGR of 14.7% from 2021 to 2028. This shows that there is massive room that is getting exposed in this very sector.

The factors pushing the Renewable energy sector, are demand for sustainable solution, regulatory support and development in technologies. End ¬ Renewable energy market which finished an assessment of 881.7 billion around 2020 will grow by a CAGR of 8.4 percent by value during 2021-2028.

Understanding the VC Investment Criteria

Venture Capital firms seek the potential investments based on the following key parameters and assess them.

Market Potential

The Venture Capital firms make search of target companies in large or high-growth ephemeral, with quality demand and lower barriers to entry. It looks for markets, which could project growths at a CAGR of 20-30% over the next five years. The global AI market that stood at $62.35 billion in 2020 will also see growth at a CAGR of 40.2 percent between 2021 and 2028, which will bring multiple scaling opportunities for startups.

Unique Value Proposition

Unique products or services presented in a unique way create unique opportunities for startups to create differentiation. It is more pronounced in order to seek a competitive advantage by the virtue of their differentiated customer experience.

Founding Team

A good founding team with complementing skills and domain knowledge is very crucial. Virtually all successful startups have good execution history. Though, it would be good to note, 23% of all the startups have failed because of their problems; they actually reinforce the necessity of serious observation of the dynamics in the team and the management capabilities during evaluation of the team.

Traction

A few signs of tractions are reflective of the stage of market validation and product-market fit, for example, user or sales growth.

Financial Performance

Actual projections and clear path to being profitably for even early-degree businesses.

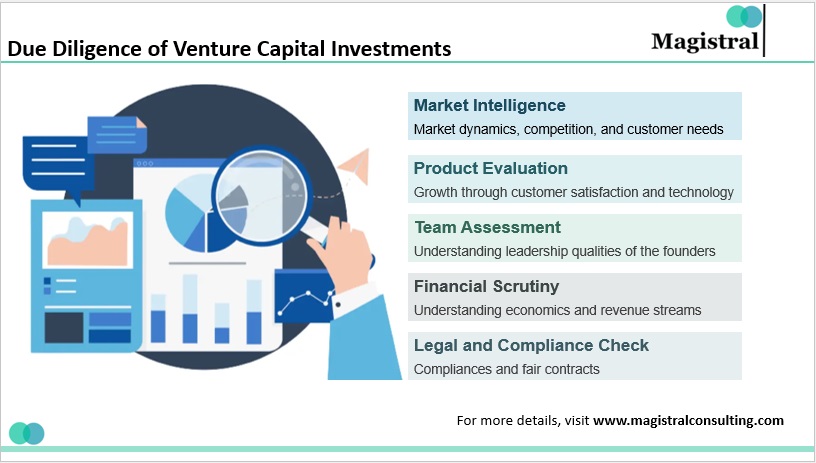

Due Diligence: The Cornerstone of VC Investments

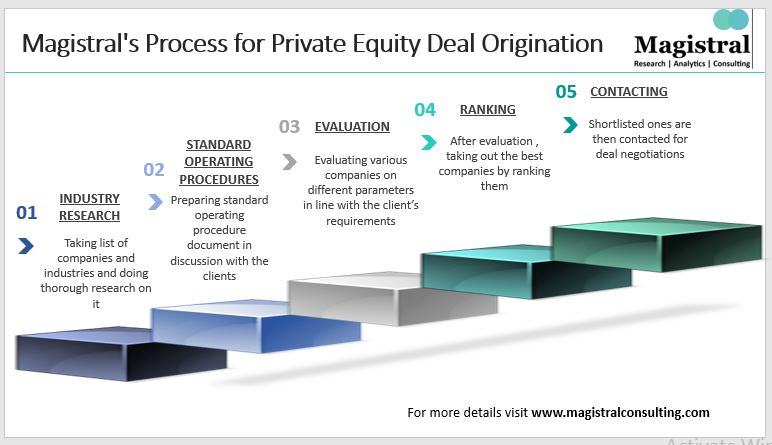

Due diligence is all about disciplined process of identifying a target company’s potential and risk. According to the investment bank – Kohlberg Kravis Robert, the following are the key steps involved in due diligence.

Due Diligence of Venture Capital Investments

Market Intelligence

This is about research and consulting with experts to know what our customers need, who our competitors are, and how the marketplace is doing.

Product Evaluation

Having our eyes constantly on our product to know whether they are being synthetic properly and if we will be able to grow through customer satisfaction and technology.

Team Assessment

We have to check on the abilities and work of our founders and particularly the team for a detailed view of their leadership qualities.

Financial Analysis

One has to be interested in the economic state of affairs, how we earn and what we require for it.

Regulatory Evaluation

It is required in order to make sure compliance good contracts and both in law and ethical protection of ideas or concepts.

Strategic Fit and Alignment

There are investment theses laid down by a venture capital firm. These theses always act as guidelines in every decision that a firm makes. It could be a business, funding diploma, geographical, or a return profile basis of decision-making. Also, it is miles very important that there is a strategic fit between a VC firm’s investment thesis and a target organization. Many venture capital firms have an industry focus, be it era, healthcare, or fintech, and often want their target companies to fit their understanding of the employer to be able to use their network and resources efficiently. Venture capital firms also have additional focusses on awesome investment degrees, seed, early-degree or increase -stage associated with their specific danger profile and capital needs. Geographical options, on the other hand, are also crucial because not many firms undertake a decision to invest in any particular geographical region owing to superior market information and local connections. Last but not least, it is also important to know about the return expectation of a VC institute as growth startups offering great exits fit rather well with agencies that want substantial returns.

Building a Strong Network

Venture Capital firms need to know all of the right people in order to have anything to assess. Entrepreneur, industry expert, investor and other thought leader relationships provide rich insights and deal flow to VC firms, and co-investment deal opportunities in many cases. VC firms that remain engaged with incubators, accelerators, and entrepreneur communities will be able to keep their finger on the pulse of emerging startups. But forging relationships with experts in the industry can provide profound insights into the market and validate a startup’s chances. Teaming up with co-investment partners: other investors expand deal flow, help share risks, and add extra eyes to the deal. Also, startups can leverage the resources and the distribution network of large corporations through strategic partnerships that also offer exit support.

Continuous Monitoring and Support

After investing, the VC firms have to guide and assist their portfolio companies in scaling up and reducing their risks. Such involvement includes:

Board Participation

It makes it possible for the VCs to guide in a strategic fashion, check on performances and perform sanity check to the extent it makes sense in light of the business plan by means of joining the board of the company. It also facilitates improvement in communication and making better decisions. It holds correct and instrumental the active role played by the board in more efficient communication and decision making.

Operational Support

Investments in operational infrastructure of marketing, sales, finance, and human resources can serve as that needed boost or rocket fuel to overcome those crucial challenges that let the startups scale with success. Obviously VC firms themselves have inhouse teams or networks to help them with it.

Follow-on Funding

Most start-ups need more substantial capital to achieve their most critical goals. Some Venture Capital firms will offer it to them; some will assist in obtaining follow-on funding, either from them or other sources themselves.

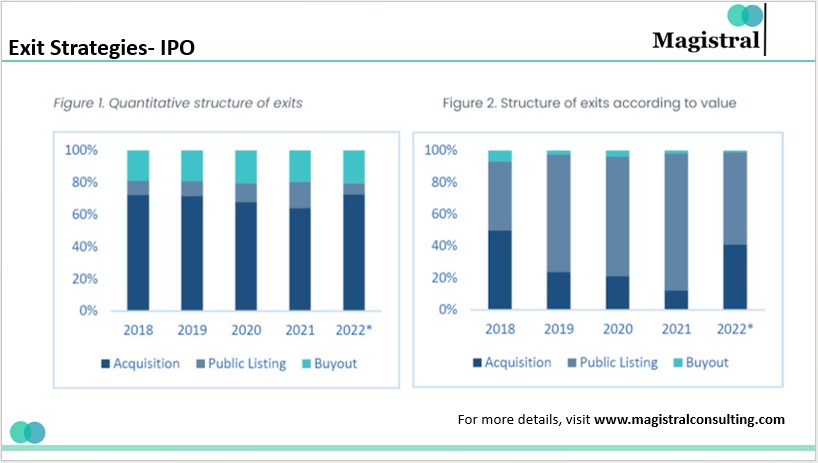

Exit Strategy

For profits to be realized, it is essential that the exit strategies in the form of mergers and acquisitions (M&A), or IPOs be planned. These investors, in turn, collaborate with their portfolio companies to ensure appropriate exits of such investments, which typically come in the form of an IPO, acquisition, or merger. As many as 162 VC-backed IPOs and 1,065 mergers and acquisitions were completed in 2022 as well, encourage capital outflow through all possible channels of exit. The target companies will have to meet the investment horizon, return and other demands of Venture Capital investors.

Exit Strategies- IPO

Magistral Consulting’s Services

Considering our rapidly changing world and the fluid nature of venture capital (VC), choosing the best target companies for VC funding requires both an art and science. After thorough research, Magistral Consulting has developed a strategy for finding those exact startups. We provide research based due-diligence, market intelligence, and strategic alignment bridges to VC firms enabling them to make informed investments.

Understanding Market Dynamics

Magistral Consulting offers a detailed outlook for sector trends. Discover Disruptive Innovations Spurring Growth from AI to Fintech in Technology and navigate complexities in healthcare and biotech with scientific evidence assessments, regulatory landscapes, and market needs.

VC Investment Criteria

Magistral Consulting lends a helping hand to VC firms in evaluating some key criteria of their investment. Recognize target companies which are in emerging markets that enjoy high growth prospects. Appraise ventures that propose by a distinctive product or service to sustain competitive advantage. Market and discipline competencies play a significant role in the founding teams’ appraisal. Determine the degree of market acceptance and prospects for initial revenue and probability calculations for profitable further development through our services.

Strategic Support and Alignment

Ensure the correct investment goals match the particular guidance offered by Magistral Consulting service. Magistral Consulting ensures that the investment goals match the requirements of firms through Strategic Support and Alignment. We help sensitize strategic alignment with investment theses towards better decision making. establish suitable connections with the entrepreneurs, industry specialists, and investors for creating the continuous flow of the deals and co-investment for its constant growth.

Continuous Monitoring and Support

Achieve targeted goals for portfolio companies with the help of continuous cooperation with Magistral Consulting. We help you closely connect with portfolio companies via board involvement to improve strategic interactions, information flows, governance, and evaluation. We also help develop strategies for exit; mergers, acquisitions, and IPOs, which would give the best returns in terms of meeting the investment goals of the fund. Venture capital investment is an efficient tool that allows an organization to access financing for its business projects from investors who expect to receive a share of profits in exchange for risks they are going to bear.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What are the key criteria VC firms look for in target companies?

VC firms target large market potential companies with distinct predictions. Again, ones that have a very experienced founding team, and that market driving factors evident, such as increased user numbers. Also, clearly laid down financial plans leading to profit growth.

Where does due diligence fit in VC investing?

Due diligence provides an understanding of company potential and its associated risks. There is also Market research for product viability, analysing growth potential, verifications on capability of founding team, company's financial health, and its legal framework.

How do VCs ensure that they attain a strategic fit with companies targeted?

The VC firms either have an industry focus, investing in technology or health care, for example, or an investment stage, like seed or early-stage. They look at the geographical focus and then the return potential of the company into which they are putting money aligns with the expectations concerning big exits.

What role do networks play in the success of VC investments?

In this case, strong networks with entrepreneurs, industrialists, and other investors are critical. Such networks facilitate the feedback, improve the scale of opportunities, and further aid in carrying out the implementation through business development. This is in collaboration with incubators and accelerators with the aim of remaining in the loop in terms of new start-ups.

How do VC firms further help their portfolio companies once the investment is made?

VC firms come with constant helping hands in the form of board participation, strategic advise and assistance with some major functions like marketing and finance. They also help to secure additional financing as well as exiting strategies getting in place such as mergers acquisitions or IPOs which may provide an optimal return yield on investment.