Introduction

Deal origination for Private Equity or Deal sourcing is the process by which investment firms identify opportunities. Larger volume deals are sourced to maintain a viable deal flow. Building a deal flow is the most important step because making good investment decisions is reliant on seeing many deals and selecting the best among them to pursue.

The effectiveness of the deal origination process ensures a healthy portfolio of investments that further ensures healthy returns to the Limited Partner investors. Hence its business-critical for a Private Equity firm to make sure the deal origination process works, and works well to meet the investment objectives.

Some venture capitalists, private equity investors, and investment bankers use various methods to source deals whereas some firms reach out to a team of specialists to help with the process of deal origination via outsourcing.

Deal Origination Process for Private Equity

There are multiple approaches to Deal Origination for Private Equity Firms. Some of them are

Traditional Outbound Approach

Here, the deal origination and sourcing largely depend on a wide area of personal networks, contacts, and the good reputation of the firm. Having knowledge of specific industries and the idea of similar deals taking place in the market is an added advantage for placing bids. This approach becomes successful only on the firm’s broad network of contacts, referrals, and a good reputation among founders. Firms compete against each other in process of bidding and their success depends on gaining specific industry knowledge. This typically leads to overvalued assets as all VCs and PEs are looking at the same deals.

Pros of outbound deals:

- No matter how much things have changed but still the fundamentals of sales remain the same as they are based on human nature. And that makes outbound deals still very successful

- It’s predictable and gives immediate results on the outbound process as it involves getting instant feedback from the prospective targets

Inbound deals

Inbound deal sourcing refers to all incoming leads, whether they come from existing relationships or unknown founders seeking investment. This is when a founder approaches the firm due to networking, good reputation, or word of mouth about the firm.

Pros of inbound deals:

- Owners and operators are more likely to meet when they share a connection with you already

- A shared network gives more knowledge which helps in creating more personalized interactions, giving a competitive edge

- These deals move comparatively faster as introductions are warm and made only when seeking investments

Outsourced Approach

Traditional methods are nowadays giving way to modern online dealing platforms. Several financial technology companies help in deal origination for private equity firms and enable them to go beyond their network of contacts and source deals by reaching a broad audience on the basis of various criteria. Some parts of the investing value chain are outsourced to reduce operations costs while still maintaining quality and effectiveness.

Pros of Outsourced Approach:

- Cost-effective

- It casts a wider net of reaching out to target companies, that ensures exclusive deals that may help a Private Equity firm in delivering outsized IRRs for its Limited Partner investors

- The deal pipeline continues to be populated in spite of multiple demands like new deals from the top management of the firm

- The SOP ensures standardized elimination of targets not suitable to PE’s investment philosophy

- Netting in the assets that are fairly valued

Magistral’s Process of Deal Origination for Private Equity Firms

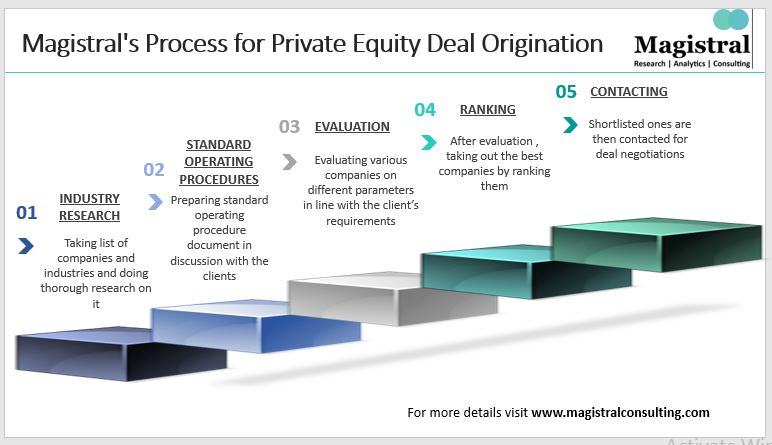

There are various steps involved in the deal origination of private equity firms. These steps include Industry Research, Making SOPs, Evaluating, Ranking, and Contacting the shortlisted companies.

Deal Origination Process for Private Equity

Industry Research

This step focuses on taking out a list of companies that looks fit in terms of market position, competitive advantages, multiple avenues of growth, stable and recurring cash flows, low capital requirements, strong management team, favorable industry trends, etc. The inputs from research feed into the next step of SOPs

SOPs

This step is considered majorly after discussion with the clients, standard operating procedures (SOPs) are prepared in order to take care of the requirement of Private Equity clients while performing deal origination and deal sourcing process. A formal signoff is taken from the client once all the steps in detail are identified. Magistral performs this step for its clients without any cost to them

Evaluation

Various criteria are looked into while evaluating a target. Some of these are related to investors such as the investor’s ability to fund, if multiple investments can be made, if the investor has an interest in lead investing, his level of portfolio diversification, etc. The major part of the evaluation of the target is to ensure it meets the investment philosophy of the investor and is in a position to generate value over the investment horizon. The factors like industry, sub-industry, niche, management, team, past fundraising, strategy, marketing, finances, etc are evaluated for targets.

Ranking

On the basis of the above research, the analysts rank the various targets which best align with the investment philosophy of the Private Equity firm. The targets are ranked as per the suitability

Contact

The final shortlisted investors are then contacted via mail or calls in order to close the best possible deal for a private equity firm. All the support required during the negotiations is provided as well.

Magistral’s Private Equity Deal Origination/ Deal Sourcing Case Study

The client and the business situation

A leading private equity company, investing in a broad range of markets such as energy, retail, and technology. The client wanted to deploy the capital to meet up its investment strategies and therefore wanted Magistral to find the best deals for the company at good valuations.

Magistral’s PE Deal Origination/ Deal Sourcing Case Study

Magistral’s solution

- Magistral appointed a dedicated manager for taking the existing list of potential target companies, populate it further, and review them carefully

- Standard Operating Procedures were made at no cost to the client to nail down the process to its finest details along with research and ranking methodology

- A team of analysts started evaluating and ranking targets on different parameters already set out in the SOP

- Shortlisted companies were contacted via call or mail and then the agreement was taken forward for all the documentation and deal negotiations

Outcomes

- Within 6 months, the firm was introduced to more than 30 opportunities.

- The effort resulted in detailed due diligence with two transactions that were quickly closed

Typical Outcomes of Magistral’s Deal Origination Services for Private Equity

According to a recent survey, 88% of private equity investors indicate their most important 2021 objective is deploying capital- a nearly 10-point increase from last year.

While working with Magistral, IRR is improved due to an exhaustive scan of the investible universe. There is approximately a 30-50% reduction in operational costs for target screening. Database costs are justified through rationalized services.

Over the years, Magistral has delivered multiple analyses that go into supporting and facilitating million-dollar global transactions. The team has so far worked with 200+ clients and facilitated transactions worth billions of dollars.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com