Private Equity Trends: A Driving Force in Global Finance

Private equity is a powerful force shaping investment strategies, fostering innovation, and influencing economic landscapes. As we move into Q1 2024, it is essential to analyze current trends, challenges, and opportunities in the private equity space.

The Resilience of Private Equity Trends Amidst Global Uncertainty

Private equity continues to demonstrate remarkable resilience despite economic and geopolitical uncertainties. This strength stems from key strategies that help firms navigate market volatility and sustain growth.

Diversification Strategies

Private equity firms are actively pursuing diversification strategies to spread investment risks. By expanding across industries and regions, they mitigate sector-specific downturns and geographic vulnerabilities.

For instance, while hospitality and retail may face economic challenges, healthcare, technology, and renewable energy offer stability and long-term growth. Additionally, geographical diversification enables firms to tap into emerging markets while hedging against risks in established economies. Expanding into Asia, Latin America, and Africa offsets slow growth in mature markets.

Flexibility in Deal Structures

To navigate market uncertainties, private equity investors are embracing flexible deal structures. They are shifting away from traditional approaches and adopting innovative investment models.

Minority investments allow firms to acquire strategic stakes in companies without full control. This provides flexibility in resource allocation and exit planning. Convertible securities, such as preferred stock and bonds, offer downside protection while allowing participation in potential upside gains. Structured exits, including recapitalizations, secondary buyouts, and IPOs, optimize investor returns under favorable conditions.

Focus on Operational Value Creation

Operational excellence is becoming a top priority for private equity firms. By working closely with management teams, investors aim to improve efficiency, reduce costs, and accelerate revenue growth.

Operational value creation initiatives encompass a wide range of strategies, including:

Streamlining Operations

Private equity firms collaborate with portfolio companies to identify inefficiencies, streamline business processes, and eliminate redundant costs, enhancing operational agility and responsiveness.

Implementing Growth Strategies

Private equity investors work closely with management teams to develop and execute growth strategies, including market expansion, product diversification, and strategic acquisitions, to capitalize on emerging opportunities and drive top-line growth.

Enhancing Organizational Capabilities

Private equity firms invest in talent development, leadership training, and organizational restructuring to strengthen management teams, foster innovation, and build sustainable competitive advantages within portfolio companies.

Technology and Innovation: Catalysts for Private Equity Growth

Technological advancements are reshaping private equity investment strategies. Investors are increasingly focusing on innovative ventures, particularly in fintech, AI, and cybersecurity.

Technology and Innovation in Private Equity

Emphasis on Digital Transformation

Private equity firms are actively seeking companies that drive digital transformation. Investments in cloud computing, cybersecurity, and e-commerce are growing rapidly. The demand for digital solutions that enhance customer experience, optimize workflows, and improve operational efficiency is rising.

Firms are also investing in cybersecurity startups to combat rising cyber threats. These companies provide advanced threat detection, data protection, and risk mitigation solutions for businesses.

Investment in Industry-specific Solutions

Private equity investors are not only diversifying their portfolios across industries but also targeting companies offering industry-specific solutions to capitalize on niche market opportunities. In Private Equity Trends, healthcare technology emerges as a prominent investment area, with private equity firms investing in companies that develop innovative medical devices, healthcare IT solutions, telemedicine platforms, and digital health services. The convergence of healthcare and technology presents lucrative opportunities for private equity investors to drive innovation, improve patient outcomes, and optimize healthcare delivery systems.

Renewable energy also garners significant attention from private equity investors, with firms targeting companies involved in solar energy, wind power, hydroelectricity, and other renewable energy sources. Private equity trend for investment in renewable energy projects and sustainable infrastructure initiatives reflects a broader commitment towards addressing climate change, reducing carbon emissions, and promoting environmental sustainability.

Strategic Partnerships and Acquisitions

To stay competitive, private equity firms are forming alliances with technology companies, research institutions, and industry experts. These collaborations facilitate knowledge sharing and accelerate innovation.

ESG Integration: A Paradigm Shift in Private Equity

Environmental, Social, and Governance (ESG) considerations have emerged as pivotal factors shaping investment strategies across industries. In Private equity trends for Q1 2024, firms are actively integrating ESG principles into their decision-making processes, aligning investments with sustainability goals. This paradigm shift underscores a broader commitment towards responsible investing, resonating with stakeholders and driving long-term value creation.

Key initiatives driving ESG integration in private equity include:

ESG Integration in Private Equity

ESG Due Diligence

Private equity firms are conducting comprehensive ESG due diligence to assess environmental risks, social impact, and governance practices within target companies. Private equity trends entail evaluating factors such as carbon footprint, resource usage, labor practices, diversity and inclusion policies, and board governance structures. Through rigorous ESG due diligence, private equity investors can identify potential risks and opportunities, inform investment decisions, and enhance value creation initiatives.

Impact Investing

Private equity investors are increasingly allocating capital towards impact investing opportunities that generate positive social and environmental outcomes alongside financial returns. The impact investments may focus on areas such as renewable energy, affordable housing, healthcare access, education, and community development. By aligning investment strategies with the United Nations Sustainable Development Goals (SDGs) and other global sustainability frameworks, private equity firms contribute to addressing pressing societal and environmental challenges while generating competitive financial returns.

Stakeholder Engagement

Private equity firms are engaging with stakeholders, including investors, portfolio companies, employees, customers, regulators, and local communities, to promote transparency, accountability, and sustainable business practices. For private equity trends, stakeholder engagement initiatives may include regular ESG reporting, dialogue sessions, sustainability workshops, and collaborative projects. By fostering open communication and collaboration, private equity investors can build trust, mitigate risks, and unlock new opportunities for value creation in alignment with ESG principles.

Long-term Value Creation

ESG integration in private equity extends beyond compliance and risk management to drive long-term value creation for investors and society at large. Private equity firms are implementing ESG-focused value creation initiatives within their portfolio companies, such as energy efficiency improvements, supply chain optimizations, product innovation for sustainability, and responsible corporate governance practices. By embedding ESG considerations into business strategies and operations, private equity investors enhance resilience, reputation, and competitive positioning, ultimately driving sustainable growth and financial performance over the long term.

Geopolitical Dynamics: Navigating Challenges in Private Equity

The geopolitical landscape casts a shadow of uncertainty over private equity markets, influencing investment sentiments and risk perceptions. Private equity trends have been characterized by geopolitical tensions, trade disputes, and regulatory changes pose significant challenges for private equity firms operating on a global scale. The ability to navigate through geopolitical complexities while seizing lucrative opportunities remains a defining factor for success in the private equity arena.

Key considerations for navigating geopolitical challenges in private equity include:

Regulatory Compliance

Private equity firms must stay abreast of evolving regulatory frameworks and geopolitical developments to ensure compliance with local laws and regulations governing cross-border investments.

Risk Management Strategies

Private equity investors are implementing robust risk management strategies, including scenario planning, hedging techniques, and portfolio diversification, to mitigate geopolitical risks and safeguard investment portfolios.

Strategic Partnerships and Alliances

Private equity firms are forming strategic partnerships and alliances with local investors, industry experts, and government agencies to navigate geopolitical uncertainties and capitalize on emerging market opportunities.

The Rise of Emerging Markets: Exploring New Frontiers in Private Equity

As traditional markets reach saturation points, private equity investors are increasingly turning towards emerging economies in search of high-growth opportunities. Private equity trends witness a surge in private equity activity across regions like Southeast Asia, Latin America, and Africa, fueled by demographic shifts, urbanization, and burgeoning middle-class populations. The allure of untapped markets coupled with favorable regulatory environments positions emerging economies as key drivers of private equity growth.

Key trends driving private equity investments in emerging markets include:

Sector-specific Opportunities

Private equity investors are targeting emerging market sectors poised for rapid growth, including consumer goods, healthcare, infrastructure, and technology, leveraging demographic trends and consumer preferences to drive value creation.

Strategic Partnerships and Local Expertise

Private equity firms are partnering with local investors, entrepreneurs, and industry experts to navigate cultural nuances, regulatory challenges, and market dynamics unique to emerging economies, facilitating deal sourcing, execution, and value realization.

Sustainable Development Goals

Private equity investors are aligning their investment strategies with sustainable development goals (SDGs), focusing on investments that promote economic growth, social inclusion, and environmental sustainability in emerging markets, thereby contributing to positive socio-economic impact and long-term value creation.

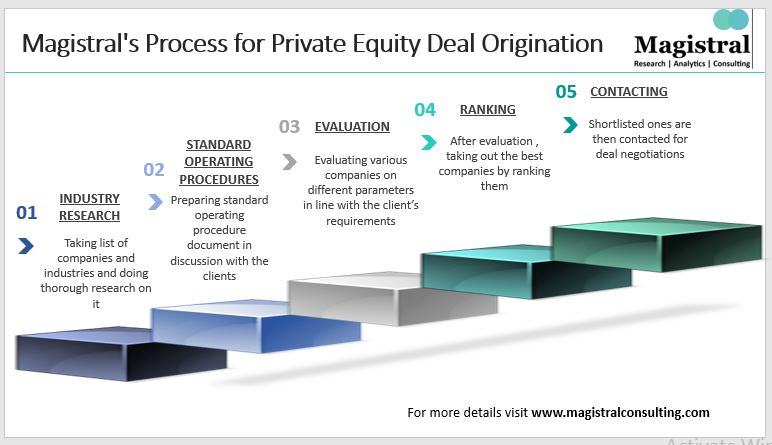

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com