Introduction

Before committing funds to private markets, due diligence for private equity outlines a potential investor’s procedure for evaluating an investment fund’s appeal, value, financial sustainability, and prospects. It is often performed by analysts and such specialists and includes gathering and processing information about a fund’s historical investment record, finances, and other aspects. A limited partnership’s decision to contribute capital to a fund is based on the findings of the due diligence process. Institutional investors often use sophisticated due diligence methods for all their public or private transactions, but due diligence in the private market presents different obstacles.

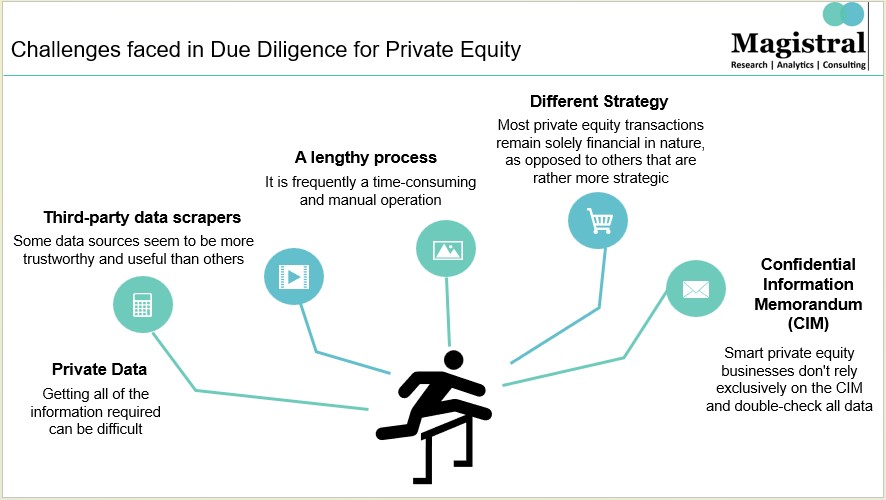

Challenges faced in Due Diligence for Private Equity

Although all due diligence processes share basic features, private equity teams face specific obstacles during due diligence, as explained below:

Challenges faced in Due Diligence for Private Equity

Private Data

Because the target firm is not publicly traded, less information is available—such as SEC filings—than would be for a public company. Fund managers typically prefer to invest in private businesses, which makes it challenging for the transaction team to gather all the information needed to feel confident.

Third-party data scrapers

Private equity funds now consider third-party providers offering private market data to support due diligence efforts. On the other hand, some data sources are more dependable and valuable than others. Some companies offer financial performance statistics scraped from publicly available information, often confined to a summary. Furthermore, some data sets could be too tiny for investors to trust their accuracy. Investors should seek primary-sourced data from a third-party private equity data provider rather than from pitch books or elsewhere online when evaluating a third-party data provider.

A lengthy process

It is frequently both a manual and time-consuming procedure. Investors increasingly use technology to speed up and streamline their due diligence procedures, ensuring they make the best decisions.

Different Strategy

As many private transactions seem to be financial instead of strategic — i.e., the private equity firm’s sole motivation is to profit from the transaction – the unique perspective. In this case, a private equity deal team may devote more time to the financial components of the transaction than to the managerial or commercial parts, requiring far more information about the company’s financial status.

Confidential Information Memorandum (CIM)

Private equity firms often use the company’s confidential information memorandum (CIM)—a comprehensive document containing financial data, management details, and commercial insights into the customer base, products, and competitors—to drive due diligence. On the other hand, Smart private equity firms do not rely only on the CIM and double-check the data.

The Steps involved in the Process of Due Diligence for Private Equity

Various steps are included in the process of due diligence, these include the following:

Steps involved in the Process of Due Diligence for Private Equity

Industry Due Diligence for Private Equity

The first aspect of due diligence for private equity is a detailed investigation of the target company’s sector. Understanding an industry takes time and based on how in-depth the private equity purchaser wants to go. The process may involve accounting, tax, and legal advisers analyzing the nuances of the business. Private equity buyers may discover other intriguing target companies or decide that a related industry better suits their investment criteria during their sector investigation.

Private equity investors tailor due diligence in the target company’s industry to meet the specific requirements of the transaction. Knowing the industry in which the target company operates, its competitors, and market trends are all part of the exercise. In such an exercise, the investor considers if the specific target industry is growing and how profitable an investment in that sector will be.

Quality of Earnings Assessment

Although the financial portion of due diligence for private equity examines the same papers as any other due diligence procedure. It emphasizes the ‘quality of earnings.’ Separating extraordinary revenues and expenses from past income statements examines what the target company can earn on an ongoing basis.

By removing these remarkable factors from the financial figures, the private equity client gains a more realistic picture of the company’s current growth and future trajectory. The ‘quality of earnings’ analysis can be as in-depth as the private equity buyer requires. It could, for example, include a worst-case scenario in which several of the target firm’s top clients cancel ongoing contracts and analyze the impact on the target company.

Legal Due Diligence for Private Equity

The deal team must be confident about proceeding before the firm invests time and money in legal due diligence for private equity.

The legal team conducts due diligence to assess the transaction’s legal implications. Then, confirm the firm’s assumptions, ensure legal compliance, and verify that the firm isn’t exposed to unforeseen liabilities.

Legal due diligence for private equity deals should focus on the following areas:

- The legal ramifications of a change of power at the target firm.

- Regulatory constraints of the target company.

- Agreements for exclusive supply or purchase.

- Contractual agreements with current vendors, suppliers, and customers and how the transaction affects them.

Operational Due Diligence for Private Equity

Any private equity transaction aims to improve the target company’s operations and rise in value before leaving the investment after a set period. As a result, the deal team will work with financial and legal experts. Identify all the prospects for value-generating operational changes at the target firm. Due diligence is learning about a manager’s internal processes to safeguard investors from losses caused by operational errors or, in the worst-case situation, fraud. With limited money and time, this can be not easy. On the other hand, minor infractions can fuel larger ones and create a culture where practices or norms gradually become viewed as mere toothless guidelines. Investors can choose fund managers measured based on and clear idea of the necessary operational risks. Improving the quality of their portfolios and avoiding potential reputational risk and economic loss.

Future of Due Diligence for Private Equity

Asset competition has been intense, and it is expected to continue. More investors are vying for a smaller pool of assets, and potential targets. Management teams are less capable or willing to devote time and resources to responding to diligence demands. As a result, due diligence for private equity companies is growing more complex as they increasingly analyze more data and look for ways to make purchases more efficient.

-Due to market conditions, private equity firms have had to reconcile risk mitigation and wealth development.

-More technology and analytics will be used, and more sell-side investigation.

Firms can do the following to fulfill the intention of making the diligence process much more efficient and digital:

-Utilize data and analytics technologies to generate quicker, more actionable insights by embracing digital diligence.

-Integrate sell-side diligence into their procedures the proper way.

-To the degree that it can underwrite investments, focus on value generation.

-Improve ESG diligence by collecting and analyzing data more consistently.

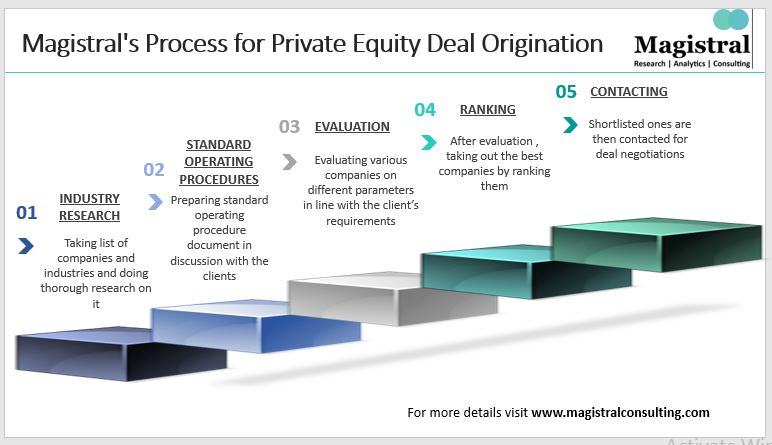

Magistral’s Services on Due Diligence for Private Equity

Magistral Consulting’s due diligence for private equity services ensures that an asset generates healthy returns. The services include:

Industry Research

With the acquisition target in mind, analysts examine the target industry for potential headwinds, tailwinds, and short- to medium-term security and returns.

Due Diligence

A detailed corporate profile is created utilizing primary and secondary research to detect any risks.

Due Diligence Questionnaire

This service involves the preparation of due diligence questionnaire leading to further analysis with targets and investors.

Primary Research

We conduct exploratory interviews with all stakeholders at the Target Company—including management, employees, ex-employees, vendors, and investors—to uncover any future liabilities.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is in Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com