Introduction

In the realm of finance, equity research plays a pivotal role for investors, serving as a guiding light to aid them in making well-informed investment decisions within the intricate landscape of financial markets. As investors traverse the complexities of this financial terrain in pursuit of lucrative opportunities, understanding the essence of it becomes paramount. This guide endeavors to shed light on various facets, encompassing its significance, methodologies, and best practices.

It holds indispensable value for investors as it furnishes a sturdy groundwork for assessing the performance and future potential of publicly traded companies. Through a thorough exploration of its intricacies, investors acquire invaluable insights that bolster their confidence in navigating financial markets.

Throughout the course of this guide, readers will immerse themselves in the fundamental tenets of equity research, delving into its methodologies and strategic approaches. From scrutinizing fundamental aspects to leveraging technical tools, this guide provides an exhaustive overview of the analytical methods employed by experts to discern opportunities and mitigate risks in the dynamic realm of the stock market.

Understanding Equity Research

It embodies a systematic and meticulous approach to dissecting financial data, with a primary focus on publicly traded companies. The overarching objective is to furnish investors with insightful recommendations, guiding them in pivotal decisions regarding stock purchase, sale, or retention. This multifaceted process entails a thorough examination of diverse factors, ranging from the company’s financial performance to prevailing industry trends, competitive dynamics, and broader macroeconomic conditions.

The Importance of Equity Research

The paramount significance of equity research cannot be overstated, as it serves as a linchpin in facilitating informed investment decisions. By unraveling the intrinsic value of stocks, it empowers investors to meticulously assess the associated risks and rewards inherent in each investment opportunity. Furthermore, it assumes a pivotal role for institutional investors, fund managers, and financial analysts, offering indispensable insights that underpin strategic investment formulations and portfolio management.

Methodologies in Equity Research

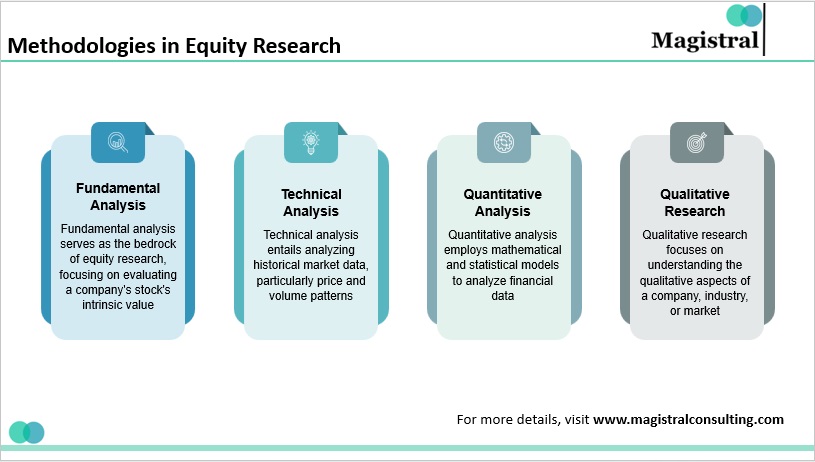

Analyzing financial data and market trends to gauge the performance and future outlook of publicly traded companies is a core aspect of equity research. Analysts employ a range of methodologies to collect data, assess information, and create investment suggestions. Below, we outline the primary methodologies that are commonly used:

Methodologies in Equity Research

Fundamental Analysis

Fundamental analysis serves as the bedrock of equity research, focusing on evaluating a company’s stock’s intrinsic value by examining its financial performance and qualitative attributes. Analysts meticulously review the company’s financial statements, including income statements, balance sheets, and cash flow statements, to evaluate metrics such as revenue growth, profitability margins, earnings per share (EPS), and return on equity (ROE). Additionally, qualitative factors such as the company’s business model, management team, competitive advantages, industry dynamics, and macroeconomic trends are considered. Fundamental analysis assists investors in understanding a company’s underlying value and making well-informed decisions regarding stock transactions.

Technical Analysis

Technical analysis is a strategy that involves predicting future price movements and spotting trading prospects by reviewing past market data, particularly price and volume patterns. Analysts utilize various technical indicators, chart patterns, and statistical methods to understand market trends and investor behavior. Commonly used technical indicators include moving averages, the relative strength index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence). This method is widely favored by short-term traders aiming to capitalize on market inefficiencies and exploit trends in price movements.

Quantitative Analysis

Quantitative analysis examines financial data using statistical and mathematical models to find trends or correlations that can inform investment choices. This strategy uses quantitative methods to quantify risk, forecast stock prices, and optimize investment portfolios. These methods include regression analysis, time series analysis, and machine learning algorithms. To produce extra returns, or alpha, in the financial markets, quantitative analysts, or “quants,” often use quantitative models or unique trading methods.

Qualitative Research

Qualitative research focuses on understanding the qualitative aspects of a company, industry, or market that are difficult to quantify. Analysts conduct interviews with company management, industry experts, suppliers, customers, and other stakeholders to gain insights into the company’s strategy, competitive positioning, growth prospects, and potential risks. Qualitative research also involves analyzing industry reports, news articles, regulatory filings, and other non-financial sources of information to gain a holistic understanding of the investment opportunity.

Key Components of Equity Research Reports

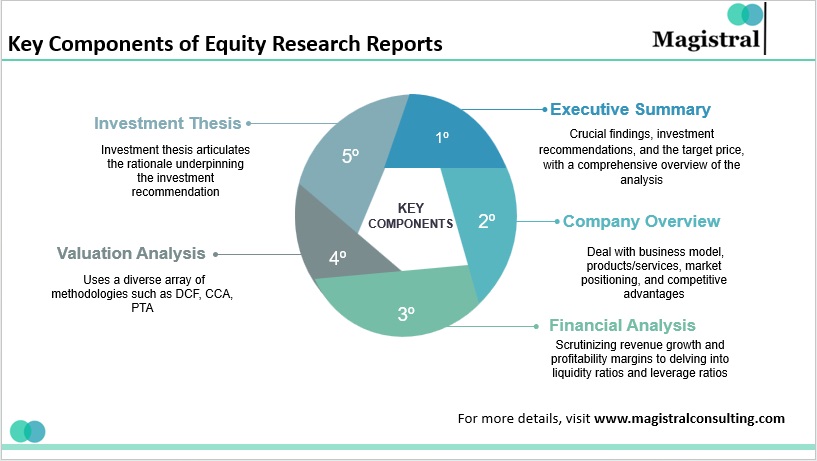

Equity research reports are vital tools for investors, providing comprehensive insights into the performance and potential of publicly traded companies. These reports typically consist of several key components, each playing a crucial role in informing investment decisions. Below are the essential elements commonly found in its reports:

Key Components of Equity Research Reports

Executive Summary

Functioning as the pivotal snapshot, the executive summary serves as the distillation of the research report’s essence. It concisely delineates crucial findings, investment recommendations, and the target price, furnishing stakeholders with a swift yet comprehensive overview of the analysis.

Company Overview

This segment delves deeply into the intricacies of the company under scrutiny, presenting a panoramic exploration of its business model, products/services, market positioning, and competitive advantages.

Financial Analysis

A meticulous dissection of the company’s financial performance constitutes the cornerstone of this section. From meticulously scrutinizing revenue growth and profitability margins to delving into liquidity ratios and leverage ratios, analysts proffer an exhaustive assessment of the company’s financial robustness and operational efficacy.

Valuation Analysis

Valuation analysis assumes pivotal importance within Equity Research, endeavoring to gauge the intrinsic value of the company’s stock. By harnessing a diverse array of methodologies such as discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions analysis (PTA), analysts strive to ascertain a fair and precise valuation.

Investment Thesis

Representing the apex of exhaustive analysis and contemplation, the investment thesis articulates the rationale underpinning the investment recommendation. Irrespective of bullish or bearish sentiments, the investment thesis furnishes stakeholders with a crystalline insight into the research findings and analysis, empowering them to make judicious investment decisions.

Challenges and Limitations of Equity Research

Despite its indispensability, it is not devoid of challenges and limitations, necessitating a nuanced understanding:

Information Asymmetry

Analysts often grapple with the challenge of accessing timely and accurate information, leading to information asymmetry among market participants.

Bias and Conflicts of Interest

The specter of bias and conflicts of interest looms large in Equity Research, especially in cases where analysts are affiliated with investment banks or brokerage firms. Such affiliations may potentially compromise the objectivity and impartiality of research reports.

Market Volatility

Effectively predicting stock prices and valuations is extremely difficult due to the inherent volatility of financial markets and the unpredictability of economic situations. It demands for a versatile and adaptable strategy.

Regulatory Compliance

Compliance with an array of regulatory requirements, including Regulation AC and MiFID II, imposes additional burdens on its analysts, necessitating meticulous adherence to regulatory stipulations.

Magistral’s Equity Research Services

Magistral Consulting emerges as a reliable entity in the industry, known for its comprehensive Research services. With a firm dedication to delivering insightful and actionable research, Magistral Consulting stands out as a prominent provider of equity analysis services in the financial market.

Fundamental Analysis

Our service enhances fundamental analysis through a range of offerings including customized models tailored to investors’ needs for assessing financial statements and predicting future performance, detailed quarterly earnings reviews highlighting key financial metrics and trends, transcripts and reviews of earnings calls providing insights into management perspectives and expectations, and thematic reports focusing on specific equity sectors or industries, enabling investors to gain deeper insights into industry dynamics and make more informed investment decisions.

Quantitative Analysis

We support quantitative analysis through data processing (cleansing, mining, classification), data analysis (statistical tools, correlation, regression), and specialized commodities performance tracking, enabling investors to gain valuable insights and make informed decisions in financial markets.

Credit Analysis

We aid credit analysis through Country and Company Risk Analysis. It assesses economic and political factors in different countries and evaluates individual companies’ financial health, management quality, and industry dynamics, empowering investors to make informed credit decisions.

Content Marketing

We boost content marketing with Industry Reports, Indices Tracking, and Event/News Analysis. Its insightful reports attract audiences, data-driven analysis enhances credibility, and timely updates keep marketers informed. Overall, Magistral enables compelling content creation, driving engagement and building brand authority.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com