Introduction

Investment Banking is a special type of banking that helps organizations or individuals raise capital and provides consulting services to them. It helps in conducting large complicated transactions such as mergers or acquisitions or raising an initial public offering (IPO) using underwriting.

Investment Bankers are experts in the field of finance who have their fingers on the pulse of the market. As acknowledged worldwide this is one of the most complex financial mechanisms in the world.

As has been the case with different sectors, it has been for some time now that organizations have started investment banking outsourcing services to third-party vendors as well. Outsourcing one means giving the authority to outsource one of its services to these third-party vendors so that the company can save on operating costs and get specialized services from highly skilled staff- all this while ensuring adequate data security and adherence to regulatory compliances.

This helps organizations not only streamline their services but also provide value-added services to customers that they couldn’t have thought about earlier.

It is important to note that the nature of investment banking outsourcing and the services provided by vendors have evolved alongside technological advancements. The first and foremost is business digitization, which has resulted in increased transparency and visibility for clients, as well as a better end-user experience for customers. This has resulted in improved strategic partnerships and, as a result, higher quality work being outsourced by investment banking outsourcing clients, which can only be met with strategic partners.

Challenges Faced by Investment Banks

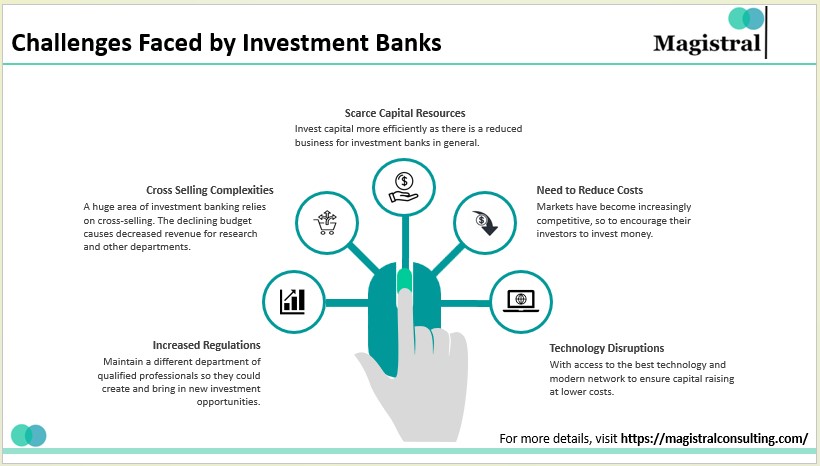

Modern investment banking faces various kinds of challenges that are listed below:

Challenges Faced By Investment Banks

Scarce Capital Resources

Due to recession and depression all over the world, almost all markets, companies, and individuals are not comfortable investing their money in the capital markets. This has created a world where capital resources have become scarce. The job of an investment banker is to invest capital more efficiently, but due to the scarcity of resources, there is a reduced business for investment banks in general.

Need to Reduce Costs

Markets have become more competitive. As a result, the cost of goods and services is decreasing. This has an impact on the finance industry as well. Investment banks’ margins are shrinking, and thus their cost of capital is decreasing. As a result, they must reduce costs to encourage their investors to invest money.

Increased Regulations

The new structured products created and sold by investment banks go through strict regulations since the mortgage crisis in 2008. This creates a limit on the operations of investment banks. These increases cost for investment banks and they have to maintain a different department of qualified professionals so that they could create and bring in new investment opportunities after scrutinizing them.

Technology Disruptions

Rapid technological advancements have drastically altered every industry in the world, including investment banking. The fintech industry has emerged over the years as new technology. This industry revolves around providing the same financial services at a lower cost. They have access to cutting-edge technology and a modern network, allowing them to raise capital at a lower cost.

Cross Selling Complexities

A huge area of the investment banking services sector relies on cross-selling. For example, if someone is looking for mergers and acquisitions, the investment bankers provide them with the services such as issue management, capital structure advisory, and many more. This way they bring value to their clients. But due to limited budgets, they are limited to the services they offer. The declining budget causes decreased revenue for research and other departments.

Benefits of Investment Banking Outsourcing

There are several reasons why investment banking outsourcing is becoming increasingly popular. We have tried to highlight some of these reasons below. They are:

Benefits of Investment Banking

Focus on Core Business

Investment banking outsourcing can help companies in focusing on their core competencies rather than focusing on mundane tasks and being worried about their day-to-day operations.

Controlled Costs

Cutting operational costs is a challenge that exists with organizations throughout. Investment banking outsourcing provides an avenue where companies can take care of differences in the relative value of currencies to derive as much as 30-50% savings in costs.

Increased Efficiency

Investment banking outsourcing is a specialized operation and the workers who work for these banks need to be highly skilled for this. A similar talent of MBA’s exists in low-cost destinations like India where the operations can be outsourced to them. Highly skilled talent helps in improving the efficiency of investment banking services.

Changing Economic Factors

In today’s uncertain world, the political dynamics are changing daily. This has an impact on the economies of the world and since we are so intertwined today the ripple effects of adverse conditions in a globally connected country are bound to have effects on the whole world. Investment banking outsourcing ensures the risks are well hedged with specialized partners operating from different geographies across the world.

Technological Changes

Investment banking outsourcing has ensured that the companies are up to date with the latest technological advancements that are occurring worldwide at a fraction of the cost had they invested real-time into adopting them. The use of the latest technologies by third parties ensures that all the technological challenges are met.

Time Zone Advantage

The gap in time zones between your country and the area you are outsourcing to, in addition to the cost advantage, is another important benefit. By doing so, you can focus on your primary tasks all day long while also having finished your day-to-day operations by the time you get up the next day. It gives you the benefit of round-the-clock business operations.

Magistral’s Services on Investment Banking Outsourcing

The outsourcing of investment banking may be a way to cut operating expenses. In an era of growing complexity in both established and new industries, investment banks are extremely nuanced. Smaller investment banks have a difficult time juggling their project pipelines and manpower needs. Medium-sized banks are eager to develop their expertise in emerging industries, which are bustling with activity and volume. However, large banks are more concerned with cutting costs while maintaining the quality of the services they provide to their customers. Magistral provides a range of service options to support Investment Banks.

Some of the services that are associated with Investment Banking Outsourcing that is offered by Magistral consulting are:

-Deal Sourcing: Performing industry and market analysis, finding potential targets, and publishing newsletters are various kinds of services provided under deal sourcing.

-Data Cleansing: Data cleansing and mining are done to perform analysis on suitable data.

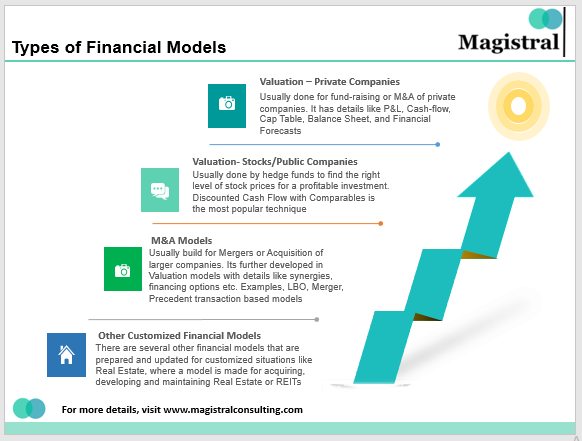

-Valuations: Valuations are done by creating financial models by various methods such as LBO/DCF Modelling, Comparable Analysis, Precedent Transaction Analysis, and Impact Analysis.

-Due Diligence: Research-based due diligence both primary and secondary are performed to uncover the true potential of an asset while giving a completely independent opinion on investment quality.

-Deal Execution: Teasers and Investment Memorandums are made along with identifying the potential investors/buyers.

-Portfolio Management: Providing ESG compliance monitoring, preparing financial reports, business development support, and procurement support is provided.

-Equity Research and Analysis: The services provided under this head include fundamental analysis, quantitative analysis, credit analysis, and country analysis.

-Marketing: This includes creating white papers, case studies, thought papers, CRM management, etc.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com