Introduction

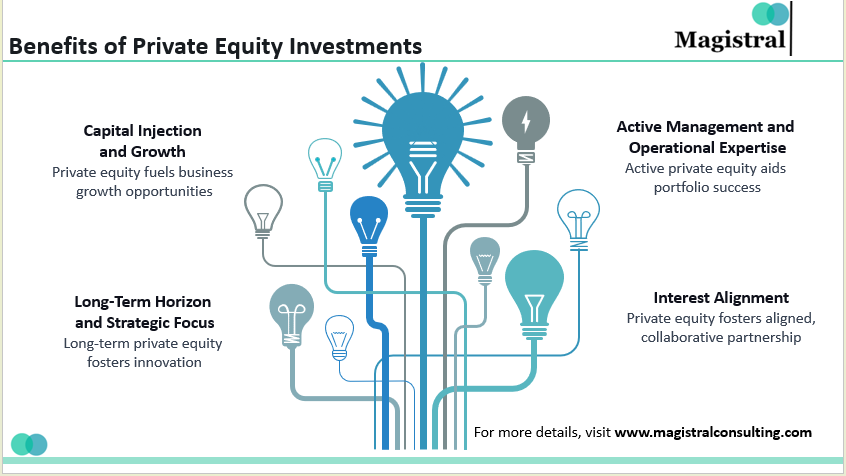

Investment in real estate involves a classic way of building a diversified portfolio, a hedge against inflation, and a fairly steady source of income. Property investment is a foundation investment for any, but major private equity firms are the most sophisticated real estate investors, signifying its importance that conscientious decision-making is required. The article unveils the consequences of making such an irreversible investment decision and the level of concentration applied for selection.

Prime Investment Areas of Private Equity Firms

In the province of real estate, the degree of ownership in investment plays a vital role. The levy of acquisition depends on the extent of authority. The extension of authority broadly covers:

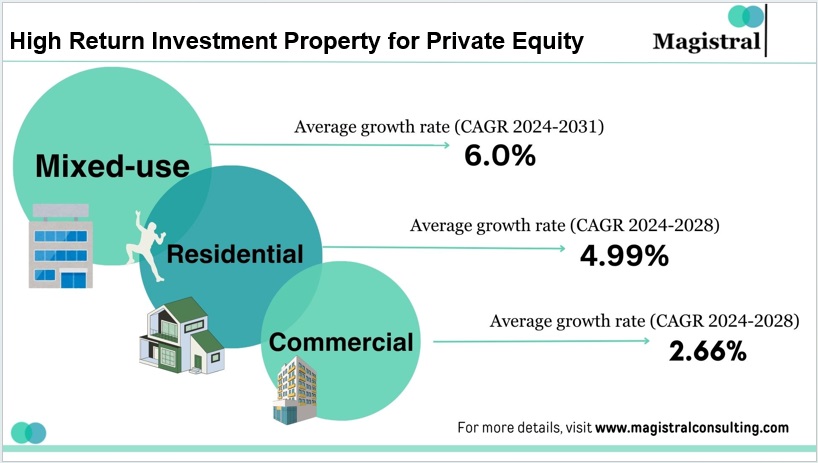

High Return Investment Property for Private Equity

Commercial Property

A high-deposit non-residential property is invested for an official purpose. The anatomy of investment in these requires adequate savings, profits, and security. Commercial real estate is a long-term game that allows firms to ride economic waves. However, the post-pandemic picture unfolds an ousting reality of private equity firms and venture capital investment in commercial real estate as it faces a sharp decline from an investment of $37 billion in 2023 compared to $52.08 billion in 2021. As the world is getting back to normal, notwithstanding the unfortunate period faced, commercial real estate is all set for revival.

Residential Property

The eternal need for a home has made the residential property traditional, stable, and consistent in demand. The synonym of stability serves its investors as a sense of security making them less susceptible to market fluctuations. The rise in central bank interest rates to fight back surging inflation has shown a noteworthy impact on economic activities, which weakened the demand for self-owned houses. Even the strongest economies around the globe are refusing to show a surge. Although during the pandemic the buyers paid top dollar for these residential properties now even the potential buyers continue to face a bidding war. Considering all the residential properties continue to be an attractive asset class for investors the normalization of interest rates will rewind time.

Mix-used Property

In the era of innovation, the areas of investments got upcycled. Innovation brings in new and investments are no exception to it. Mix-use properties are a combination of both commercial and residential under the same roof. Referring to the surging opportunities, mixed-use is the next phase of the mall’s natural evolution to a more viable and sustainable investment. An analysis by JLL revealed insights about the U.S. mall redevelopment program that 70 out of 153 are mixed-use projects that incorporate at least three different useful properties. Major areas for such investments are California, Texas, and Florida with the fastest-growing populations. The major driving force for such evolution is the redundancy of the retail market as it seems impossible to visualize a pure-play retail mall full. As investment in properties has become a point of convenience over a point of location, investment in mixed-use properties is a billowing opportunity for private equity firms, and by tapping the same investors, they can make their pockets deep. There are two common types of this multi-parting structure:

Horizontal Mixed-Use Development

The redevelopment of the former Landmark Mall property in Alexandria now known as West End Alexandria is a definitive explanation of the horizontal mixed-use structure with roughly 4 acres of publicly accessible parks and open space and the 11-acre hospital campus which counted for a great moment for private equity firms. In the pipeline, currently, Hudson Yards in the U.S. is an ongoing real estate project that is catching the eyes of investors and will be an illustrious opportunity.

Vertical Mixed-Use Development

Located along Manhattan’s East River, the Freedom Plaza created history by introducing a single project with a multi-purpose floor-wise division each dedicated to a particular area, the building behaved as a model of blazing investment. Projects like these are designed for those with high ambitions and who prefer a close connection within the periphery, with only one space dedicated to public accessibility.

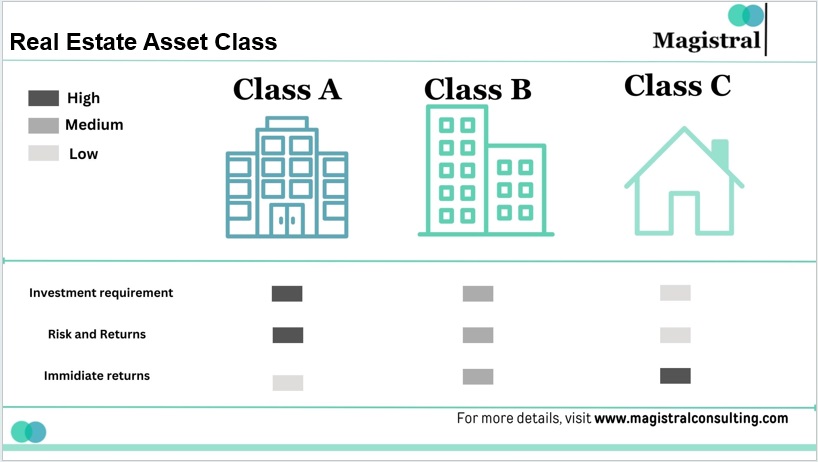

Further, these properties are classified into classes based on the combination of physical, geographical, and demographic characteristics. They can be classified into three classes:

Real Estate Asset Class

Class A

Professionally managed, properties with high-income earning tenants with low vacancy rates. It’s the finest choice a private equity firms can have with high investment and low or no maintenance cost. Popular geographies like California U.S., including areas like San Francisco, San Diego, Los Angeles, Santa Barbara, and Silicon Valley embody significant opportunities for investors.

Class B

A step down in investment cost with hot demand and higher risk. Its class is comparatively low, but it manages to provide handsome returns to investors. A lucrative option for investors with a value-added strategy. The returns are based on the condition of the property.

Class C

Sits on the opposite end of the spectrum from Class A. Functional space with substantial refurbishment requirements can be an exemplary option for investors with tight pockets. Although, these are popular for their immediate returns and also present an opportunity to purchase, renovate and flip.

The decisions of the private equity firms are broadly based on three main factors which are investment requirement, risk and return, and immediate returns.

Magistral’s services for Private Equity Firms

We offer outsourcing services by bringing deep industry knowledge, market insights, and best practices in terms of offshore capabilities and capacities to help global Private Equity Firms tide through resource constraints without breaking the banks. Here are our service offerings:

Deal Sourcing

A pathway through which financial groups find various investable worthy deals to keep an uninterrupted deal flow.

Target Evaluation

It is an approach that aims to identify and secure high-quality targets with substantial development potential.

Financial Modelling

An efficient presentation of numerical data of a company’s operations in the past, present, and future.

Due Diligence

An integrated investigation and verification followed by companies to avoid any potential conflicts.

Data Room Management

Management of a data room which contains legally sensitive documents and files (usually related to merger and acquisition).

Portfolio Monitoring

Involves tracking and analyzing the performance of the portfolio.

Deal Execution

The final word of contract for merger and acquisition.

Exit Support

A walk-off strategy for unproductive parts of the business.

How do our Financial Modelling services give a deep investment analysis to our clients?

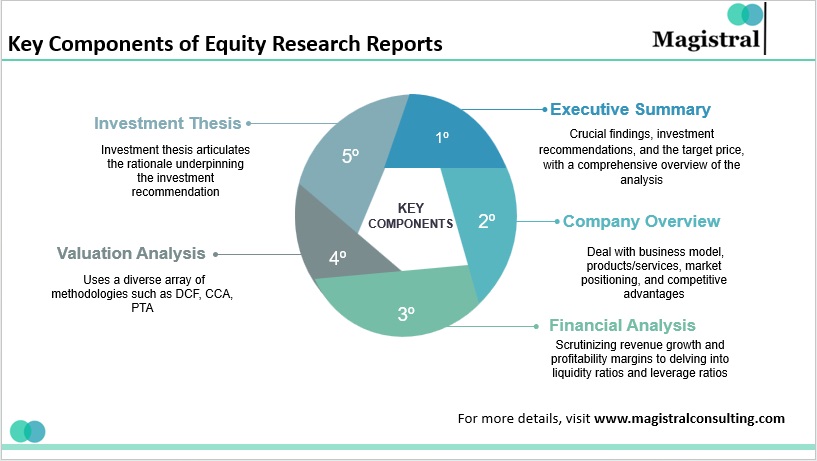

With our specialized finance team, we serve not only a theoretical model but also prepare an all-encompassing platform to accommodate all available quantitative and qualitative inputs from multiple stakeholders.

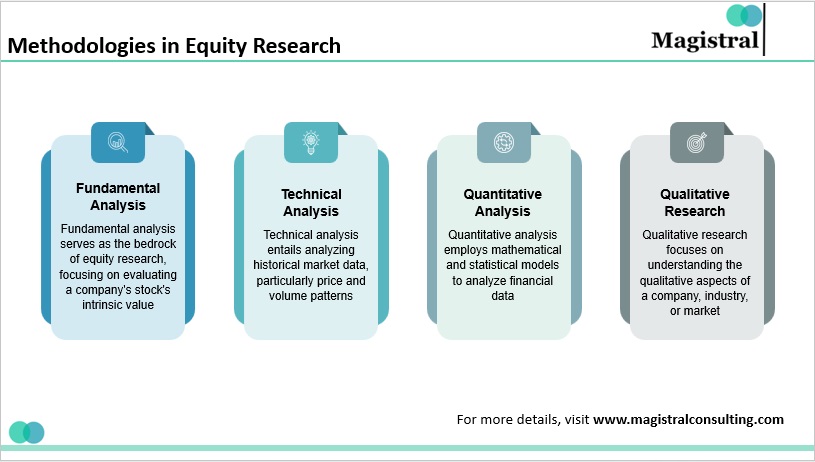

What methodology do we follow to serve our clients efficiently?

We render an offshore team that acts as an extended team with highly flexible hours of service in different time zones, an AI-led solution for data protection, and all project iterations are completed without any additional cost making the whole experience cost-effective.

How do we help our clients to gain a competitive edge in the market?

We provide services related to hedging such as GP profiling, GP due diligence, and GP list generation and discussion facilitation which helps our clients gain a competitive edge in the market.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com