Introduction

Private equity has evolved as a trusted and prominent force in the global financial scene, attracting both high-yielding investors and growing enterprises. Private equity investments have become a crucial route for driving innovation, fueling development, and maximizing shareholder value in a period of rapidly changing markets and disruptive technologies. As the economic climate evolves, new private equity trends shape the industries, impacting investment strategies and offering value creation opportunities.

Private equity trends involve the practice of investing in privately held companies to acquire a majority or significant stake in the company. In line with current private equity trends, firms in this sector adopt a longer investment horizon compared to public markets, facilitating patient funding and a strong focus on growth. This approach aligns with the evolving private equity trends, enabling investors to engage deeply in active management, driving operational enhancements, implementing growth strategies, and fully realizing a company’s potential.

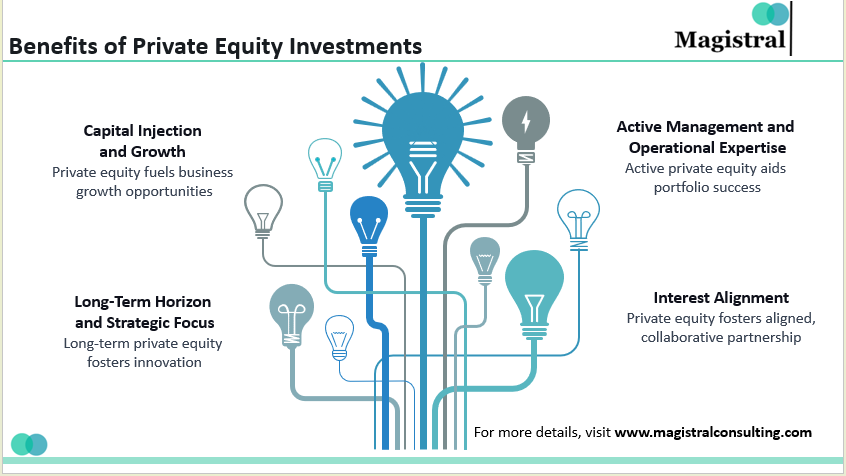

Benefits of Private Equity Investments

Private equity investments have several specific features that make them an appealing alternative for both investors and businesses:

Benefits of Private Equity Investments

Capital Injection and Growth:

Amidst current private equity trends, private equity provides companies with access to substantial capital resources, empowering them to embark on expansion projects, finance strategic acquisitions, and invest in research and development (R&D). This injection of capital, in accordance with prevailing private equity trends, can serve as a catalyst for companies, enabling them to not only scale their operations but also venture into new markets, thus expediting their growth trajectories.

Active Management and Operational Expertise:

Unlike traditional investors, private equity firms often play an active role in managing their portfolio companies. They provide extensive industry knowledge, operational skills, and access to a network of resources to these organizations, guiding them towards achieving operational efficiencies, improved financial performance, and a stronger market position. This collaborative approach helps portfolio companies overcome various challenges.

Long-Term Horizon and Strategic Focus:

Compared to public markets, private equity investors have the advantage of a longer investment horizon. Rather than being influenced by short-term market pressures, portfolio companies may concentrate on strategic objectives and sustained growth thanks to this longer-term commitment. Private equity firms can assist companies in putting innovative ideas into practise, investing in them, and laying strong foundations for long-term success.

Interest Alignment:

Private equity companies frequently co-invest with management teams in order to align their interests and promote a partnership-based strategy. Given that all sides are focused on maximising the value and profitability of the company, this alignment promotes collaboration, responsibility, and strategic decision-making. This convergence of interests establishes a solid base for promoting long-term value development and sustainable growth.

Techniques for Private Equity Trends

Analysts can use a number of strategies to analyze and pinpoint private equity trends. These methods assist businesses and investors in gaining understanding of market dynamics, new opportunities, and potential threats. Here are a few methods that are frequently used to monitor private equity trends:

Research and Data Analysis:

In-depth data analysis and research are essential for comprehending private equity trends. Analyzing macroeconomic statistics, assessing industry-specific data, and reviewing previous investment trends are all necessary for this. Investors can spot new trends and decide wisely by looking at investment data, deal flow, exit activity, and sector performance.

Sector and Industry Analysis:

In-depth analysis enables investors to pinpoint potential hotspots for development and innovation. It entails assessing consumer behaviour, technical improvements, legislative changes, competitive environments, and market dynamics. Investors might have a deeper understanding of the potential and problems within particular businesses by concentrating on those areas.

Peer Group Analysis:

Assessing the performance of portfolio companies and investment targets against that of similar businesses in the same sector might reveal important information. Investors can evaluate financial measures, operational effectiveness, and growth rates through peer group analysis. It enables a thorough assessment of a company’s competitive position and opportunity to create value within a particular industry.

Market Research and Surveys:

These activities might offer qualitative insights into private equity trends. It entails getting input from important stakeholders, market players, and industry experts. Consumer trends, technology disruptions, new markets, and legislative changes can all be from surveys and market research studies.

Collaboration with Consultants and Advisors:

Consulting and advisory firms with private equity experience may be able to offer specialized analyses and insights. These experts can provide market information, assistance with due diligence, and strategic advice. Utilizing their expertise and experience can assist in spotting and taking advantage of private equity trends.

Challenges in the Private Equity Landscape

Many advantages come with private equity investments, but one should also carefully consider their drawbacks:

Challenges in the Private Equity Landscape

Due Diligence and Risk Management:

Effective risk management depends on thorough due diligence when assessing potential investment possibilities. To make wise investment selections, private equity investors must undertake thorough analysis, review financials, assess market dynamics, and pinpoint potential dangers. Thorough due diligence increases the likelihood of success by reducing potential risks.

Capital Intensity and Financial Leverage:

Some industries have high levels of financial leverage and are in need for significant capital investments. Capital-intensive tactics can accelerate growth but they also expose portfolio firms to financial dangers. To achieve long-term sustainability and stability, private equity firms must strike a balance between funding expansion ambitions and managing debt well.

Exit Plans and Liquidity:

Because private equity investments are inherently inert, effective exit plans are frequently necessary in order to realize returns. These could be secondary buyouts, trade sales, or initial public offerings (IPOs). To maximize profits and obtain the correct exit multiples, exit timing and execution are essential. To take advantage of exit possibilities and produce favourable returns for their investors, private equity firms must carefully plan and monitor market conditions.

Magistral’s Services for Private Equity

As a trusted outsourcing partner for research and analytics services, we play a vital role in supporting private equity firms and businesses throughout their investment journey.

Investment Research:

The team of skilled analysts at Magistral is capable of conducting in-depth investment research and carrying out thorough due diligence on possible targets. They analyse market trends, review prior performance, examine financial documents, and spot potential dangers. With the help of Magistral’s research, private equity companies can make well-informed investment choices that are in line with their investing philosophies and risk tolerance.

Impact Investing and ESG Considerations:

ESG factors are increasingly being taken into account by private equity firms when developing their investment strategy. Magistral can assist in evaluating the ESG performance of possible investments by looking at things like corporate governance, social impact, and sustainability practises. Private equity firms can address the rising demand for socially responsible investing by aligning their investments with ethical and sustainable practises by adopting ESG factors.

Technology & Innovation:

Disruptive innovations and technological developments are transforming industries all over the world. Private equity firms can use Magistral’s research and analytics services to find technology-driven investment possibilities, evaluate market potential, and assess the effects of emerging technologies on portfolio companies. To promote digital transformation within their investments, private equity firms can leverage technological breakthroughs.

Industry-Specific Insights:

Private equity investments are made across many different industries, each with its own dynamics and difficulties. Magistral can offer industry-specific insights and analysis according to their sector-specific experience. Magistral’s research services can be used to assess market trends, competitive landscapes, regulatory frameworks, and growth possibilities within particular industries, including healthcare, technology, consumer products, and energy. This specialized knowledge promotes value development initiatives and improves decision-making.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com