A constant look for assets that contribute to the ousting of the portfolio is equally important to the one responsible for its resilience. These assets usually perform poorly due to financial challenges, ineffective management, or unfavorable market conditions. Finding the appropriate distressed assets is a complex process that necessitates a well-organized approach. This article outlines the important steps and considerations for investment firms in selecting distressed assets, divided into five primary sections: Understanding Distressed Assets, Market Analysis, Financial Due Diligence, Strategic Fit, and Risk Management.

Understanding Distressed Assets

Distressed assets refer to companies or properties that are facing significant financial challenges. These difficulties can arise from high levels of debt, reduced revenues, or adverse market conditions. For private equity firms, such assets offer unique investment opportunities. By acquiring these assets at reduced prices, private equity firms can apply restructuring strategies to potentially generate substantial returns. Recognizing the different types of distressed assets is essential for private equity firms to find opportunities that match their investment goals and areas of expertise.

Types of Distressed Assets

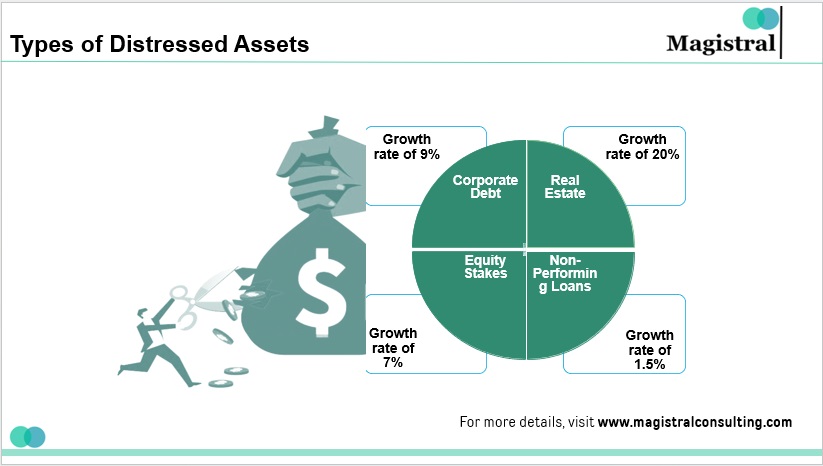

Firms typically deal with several categories of distressed assets, each possessing unique challenges and opportunities:

Types of Distressed Assets

Corporate Debt

Corporate debt refers to financial obligations issued by companies experiencing financial distress. For firms, purchasing corporate debt can be an entry point to gain control or influence over the troubled company. By restructuring the debt or negotiating new terms, firms can work towards stabilizing the company’s financial health. Successful debt restructuring can lead to significant value appreciation once the company recovers.

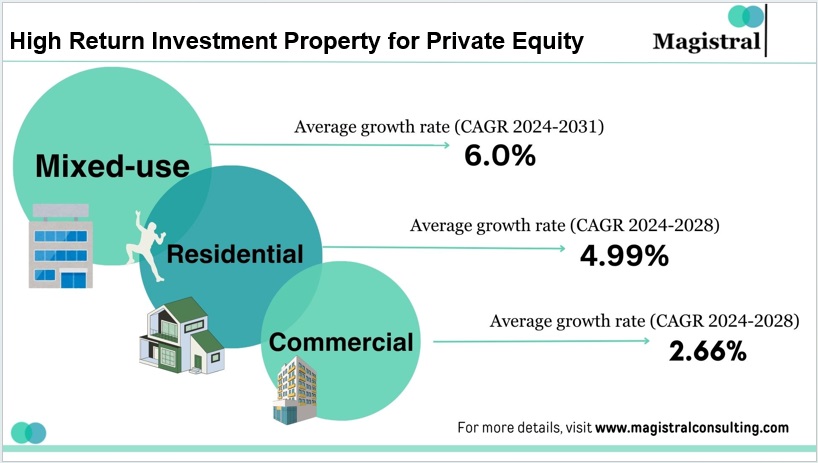

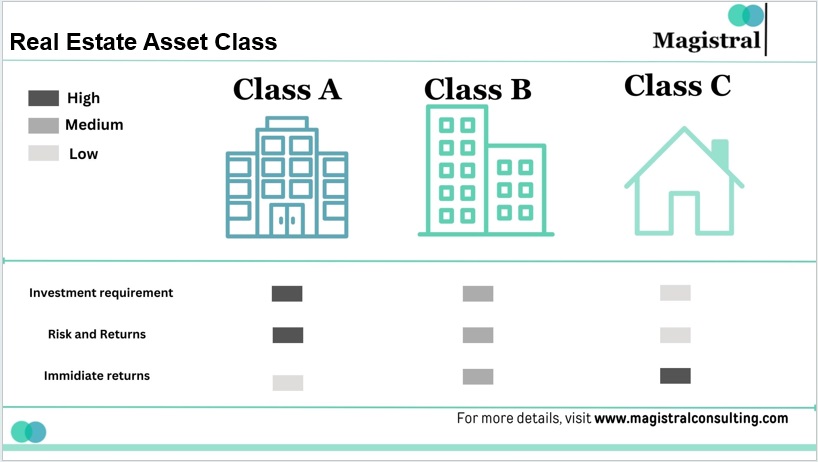

Real Estate

Distressed real estate involves properties that are struggling due to various issues such as market conditions, poor management, or economic downturns. These properties including commercial buildings, residential complexes, and undeveloped land face consequences of being undervalued or underutilized, presenting an opportunity for them to invest. By renovating, repositioning, or improving management practices, these firms can enhance the property’s value and profitability.

Equity Stakes

Distressed equity stakes involve acquiring shares in companies whose stock prices have fallen sharply due to financial difficulties. Firms can provide capital, management expertise, and strategic direction to help distressed companies recover and turn the challenge into opportunity. Successful interventions can result in substantial equity value appreciation, benefiting the firm upon exit through a sale or public offering.

Non-Performing Loans (NPLs)

Non-performing loans are loans that borrowers are no longer able to repay. These can be found in various sectors, including consumer loans, mortgages, and business loans. Usually bought at a discount by firms then work to recover the owed amounts through restructuring, renegotiation, or legal actions. The recovery of these loans can lead to significant financial returns, although the process can be complex and requires specialized expertise.

Distressed Securities

Distressed securities include any financial instruments issued by companies in financial trouble, such as bonds, preferred stocks, or convertible securities. These securities typically trade at a significant discount due to the issuer’s precarious financial position. By investing in distressed securities, firms can influence the restructuring process and potentially convert these investments into equity or other favorable financial instruments once the issuer stabilizes.

Market Analysis

Thorough market analysis is essential for investment firms considering distressed assets. The process involves understanding the broader economic environment, identifying promising sectors, and evaluating the competitive landscape to make informed investment decisions.

Industry Trends

An in-depth analysis of industry trends involves examining economic factors, including growth rates, consumer demand, and technological advancements. Additionally, understanding the regulatory environment is crucial, as changes in laws and regulations significantly affect industry performance. By identifying sectors poised for recovery or growth, firms can target assets with the highest potential for value appreciation.

Identifying Target Markets

By prioritizing industries or regions facing temporary difficulties rather than long-term structural issues Private Equity firms can manage distressed assets that are likely to provide substantial returns. For instance, a temporary economic slump in the travel and tourism industry might offer lucrative opportunities as the market is likely to rebound. Conversely, investing in a sector experiencing a prolonged downturn, such as declining manufacturing industries in certain areas, may present higher risks with uncertain returns.

Competitive Landscape

Firms must understand the major players within the industry, their market shares, and the overall competitive dynamics to assess the potential for business turnaround and growth. By identifying weaknesses and gaps in the market, investment firms can determine strategic insight vital for devising plans to enhance the value of acquired assets and achieve competitive advantages.

Market Position and Dynamics

Analyzing the asset’s current market share, brand strength, customer base, and operational capabilities, firms must assess whether the asset has the potential to regain or enhance its market position through strategic interventions.

Financial Due Diligence

Conducting financial due diligence is a decisive step for private equity firms when analyzing distressed assets as it entails a thorough examination of the target’s financial condition to uncover potential risks and opportunities. This section delves into the essential components of financial due diligence, including assessing financial health, valuation methods, and identifying value creation opportunities.

Evaluating Financial Health

This requires a detailed scrutiny of various financial documents and metrics:

Reviewing Financial Statements

Private equity firms must meticulously examine financial statements to grasp the overall financial status to identify warning signs such as consistent losses, declining revenues, or cash flow difficulties that may indicate underlying financial issues.

Analyzing Debt Structure

Understanding the nature, structure, and terms of existing debt is essential. Assessing the company’s ability to service its debt reveals whether the current debt levels are sustainable or necessitate restructuring.

Revenue Evaluation

Analyzing the sources of revenue, including their stability and diversification, holds significance. Firms need to ascertain if revenue streams are dependable or if they overly rely on a few customers or markets, which could pose risks.

Valuation Methods

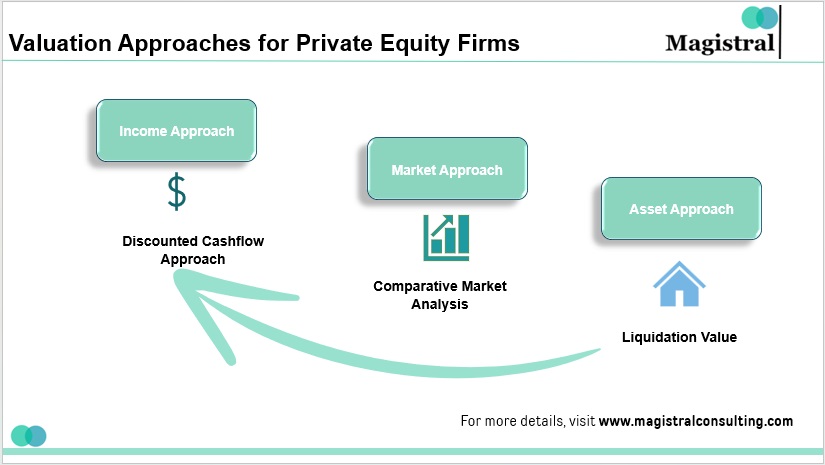

Valuing distressed assets is intricate and often requires employing multiple approaches to arrive at an accurate valuation. Private equity firms utilize various methods to determine the fair value of these assets:

Valuation Approaches for Private Equity Firms

Discounted Cash Flow (DCF) Analysis

The method entails projecting the future cash flows of the distressed asset and discounting them back to their present value using an appropriate discount rate. This technique aids in understanding the asset’s intrinsic value based on anticipated future performance.

Comparative Market Analysis

Comparing the distressed asset to similar assets in the market to gauge its relative value. By analyzing recent transactions of comparable assets, firms can estimate a market-based valuation.

Liquidation Value

Estimating the net value of the asset if it were to be liquidated promptly. It considers both tangible and intangible components of the asset and is often used as a baseline valuation in worst-case scenarios.

Identifying Value Creation Opportunities

Identifying avenues for value creation is a crucial aspect of the due diligence process. This entails pinpointing opportunities to enhance the asset’s performance and increase its value post-acquisition:

Operational Improvements

Assessing operational inefficiencies and identifying ways to streamline processes, reduce costs, and enhance productivity can significantly augment the asset’s value.

Financial Restructuring

Evaluating and implementing necessary adjustments to the financial structure, such as renegotiating debt terms or refining working capital management, can stabilize the asset’s financial health.

Strategic Repositioning

Assessing the asset’s market position and exploring new markets or customer segments can spur growth. This may involve rebranding, expanding product lines, or enhancing sales and marketing strategies.

Risk Management

Firms recognize the inherent risks associated with investing in distressed assets. Understanding and addressing these risks are crucial for successful investment outcomes. This section explores the various aspects of risk management in the context of distressed asset investment.

Identifying Risks

Investing in distressed assets presents several risks that firms must identify and evaluate:

Market Risk

The possibility of further market downturns impacting the asset’s performance, leading to decreased value or liquidity challenges.

Operational Risk

Risks stemming from operational inefficiencies within the asset, such as poor management practices, inadequate infrastructure, or supply chain disruptions.

Financial Risk

The risk of deteriorating financial health, including increasing debt burdens, declining revenues, or cash flow constraints, which could ultimately lead to insolvency.

Mitigating Risks

Once identified, firms can develop strategies to mitigate these risks effectively by using any or combination of:

Restructuring Plans

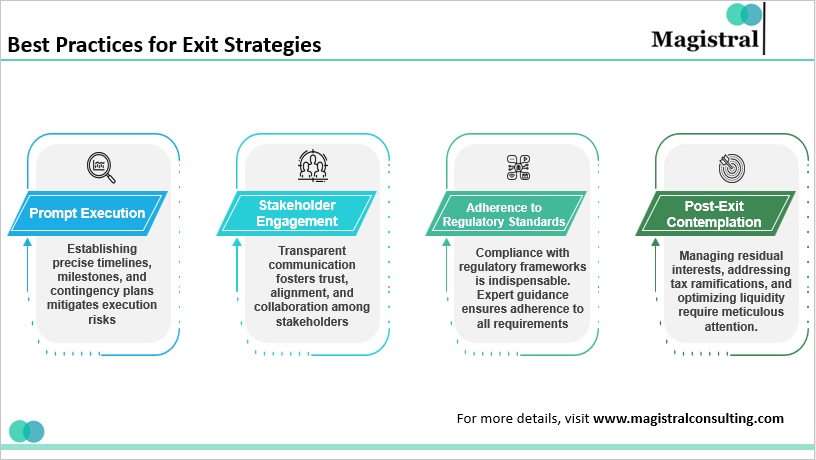

Developing comprehensive restructuring plans aimed at addressing operational inefficiencies, optimizing cost structures, and improving overall financial health.

Contingency Planning

Establishing contingency plans to prepare for unforeseen challenges, such as economic downturns or unexpected market volatility. These plans should outline alternative strategies to mitigate risks and minimize potential losses.

Diversification

Maintaining a diversified portfolio across different asset classes, industries, and geographic regions to spread risk and minimize exposure to any single asset or sector.

Magistral Consulting’s Services

Magistral Consulting offers specialized services tailored to meet the unique needs of private equity firms aiming to invest in distressed assets. Our suite of offerings is meticulously crafted to support firms at every stage of the investment lifecycle, from initial due diligence to post-acquisition value enhancement. Here are the key services we provide:

Distressed Asset Identification

Our dedicated team conducts rigorous market research and analysis to pinpoint distressed assets with the highest potential for value creation. Using advanced data analytics and proprietary screening methodologies, we identify opportunities across diverse asset classes and industries.

Strategic Due Diligence

Magistral Consulting conducts thorough due diligence assessments to evaluate the financial health, operational efficiency, and market positioning of targeted distressed assets. Our seasoned professionals assess crucial risk factors and pinpoint potential value drivers to guide investment decisions.

Restructuring and Turnaround Management

We collaborate closely with private equity firms to develop and execute comprehensive restructuring plans geared towards enhancing operational efficiency, optimizing capital structure, and improving overall performance. The team provides hands-on support throughout the turnaround process, implementing strategic initiatives to foster sustainable growth and profitability.

Performance Monitoring and Optimization

Magistral Consulting delivers ongoing performance monitoring and optimization services to track the progress of distressed assets post-acquisition. We assist firms in establishing key performance indicators (KPIs) and implementing reporting mechanisms to gauge performance against investment objectives and facilitate continuous improvement.

What are distressed assets, and why do private equity firms target them?

Distressed assets are companies or properties facing significant financial challenges, such as high debt levels or declining revenues. Private equity firms target them because they offer unique investment opportunities at reduced prices, allowing firms to apply restructuring strategies for potentially substantial returns.

What types of distressed assets do private equity firms typically deal with?

Private equity firms typically deal with various types of distressed assets, including corporate debt, distressed real estate, equity stakes in troubled companies, non-performing loans (NPLs), and distressed securities.

How do private equity firms conduct market analysis for distressed asset investment?

Private equity firms conduct thorough market analysis by examining industry trends, identifying target markets with potential for value appreciation, and analyzing the competitive landscape to assess business turnaround opportunities.

What is involved in financial due diligence when analyzing distressed assets?

Financial due diligence for distressed assets entails evaluating the target's financial health through reviewing financial statements, analyzing debt structures, and assessing revenue stability. Valuation methods such as Discounted Cash Flow (DCF) analysis and Comparative Market Analysis are also crucial.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com