Exit strategies play a fundamental role in the realm of private equity (PE) investments, serving as the cornerstone for investors to navigate the process of exiting their investments, reclaiming capital, and ultimately achieving profitable outcomes. In this comprehensive guide, we embark on an in-depth exploration of the intricate landscape of exit strategies tailored specifically for PE investments.

Understanding the Significance of Exit Strategy for Private Equity (PE)

In the domain of private equity investments, the importance of crafting a robust Exit Strategy for Private Equity goes beyond mere planning; it acts as the beacon guiding investors towards lucrative returns. Functioning akin to a strategic roadmap, the Exit Strategy for Private Equity delineates the path through which investors will disengage from their investments, reclaim their capital, and unlock profits. Far from being a peripheral concern, the Exit Strategy for Private Equity assumes a central role in the investment decision-making process, exerting influence over every facet of the investment journey.

At its essence, an Exit Strategy for Private Equity molds the foundational premise of an investment thesis. It offers clarity and direction, furnishing investors with a clear understanding of the ultimate destination towards which they intend to steer their investments. Whether investors opt for an ambitious Initial Public Offering (IPO), a strategic sale to a synergistic buyer, a secondary sale in the open market, or a comprehensive recapitalization, the selection of the Exit Strategy for Private Equity significantly impacts the trajectory of the investment.

Moreover, the choice of Exit Strategy for Private Equity is intricately entwined with the valuation of the investment. Investors must meticulously evaluate potential exit scenarios and their corresponding valuations to ensure alignment with their investment objectives. A well-defined Exit Strategy for Private Equity not only fosters transparency but also facilitates more accurate valuation assessments, thereby reducing the risk of misalignment between investor expectations and market realities.

In the broader context of the investment landscape, the Exit Strategy for Private Equity assumes a pivotal role in shaping the overall investment strategy. It informs decisions regarding capital deployment, portfolio diversification, and risk management, guiding investors towards opportunities that resonate with their desired exit outcomes. By establishing a clear Exit Strategy for Private Equity upfront, investors can optimize their investment approach, capitalize on market opportunities, and mitigate downside risks.

Ultimately, the significance of an Exit Strategy for Private Equity investments cannot be overstated. It serves as a guiding compass, leading investors through the intricacies of the investment lifecycle and towards the realization of their investment objectives. By delineating a clear Exit Strategy for Private Equity from the outset, investors can traverse the investment landscape with confidence, certainty, and a definitive sense of purpose.

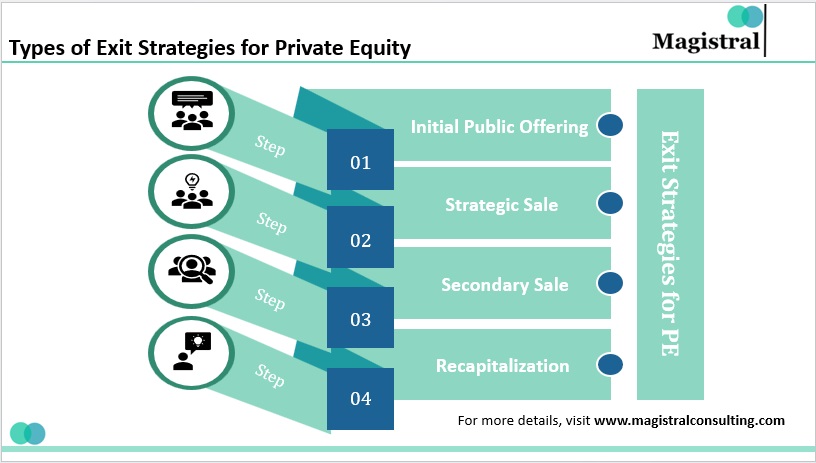

Exploring the Types of Exit Strategies for PE

There are various types of actions that firms use in deploying their Exit Strategy for Private Equity. Some of these are:

Types of Exit Strategies for Private Equity

Initial Public Offering (IPO)

An Initial Public Offering (IPO) is a pivotal event in the lifecycle of a privately held company. It marks the transition from a private entity to a publicly traded company by offering shares to the general public for the first time. IPOs present investors with the opportunity to convert their investments into liquid assets by selling shares on a public stock exchange. This process not only provides liquidity but also enhances the company’s visibility and offers the potential for significant returns.

However, executing an IPO is a multifaceted and demanding process that demands meticulous preparation, stringent regulatory compliance, and precise market timing. Companies contemplating an IPO must conduct extensive due diligence, including financial audits and regulatory filings, to ensure compliance with the stringent requirements imposed by regulatory bodies such as the Securities and Exchange Commission (SEC). Additionally, engaging investment banks to underwrite the offering, determine share pricing, and facilitate marketing and distribution to potential investors is crucial. The timing of an IPO is paramount, as market conditions, investor sentiment, and broader economic factors can profoundly impact its success.

Strategic Sale

A strategic sale, also known as a trade sale, involves the sale of a portfolio company to a strategic buyer, typically a competitor or a firm operating in a complementary industry. Strategic sales are pursued to capitalize on synergies, expand market reach, or consolidate market share. Unlike IPOs, which involve selling shares to the public, strategic sales usually result in the acquisition of the entire company by the buyer.

Strategic sales offer various advantages, such as the potential for higher valuation multiples, quicker execution compared to IPOs, and the opportunity to leverage the buyer’s existing resources and infrastructure. However, executing a strategic sale requires meticulous negotiation, due diligence, and strategic planning to ensure that the transaction maximizes value for both the seller and the buyer. Moreover, regulatory considerations, antitrust issues, and integration challenges must be carefully addressed during the negotiation and execution phases.

Secondary Sale

In a secondary sale, investors sell their ownership stakes in a private company to other investors in the secondary market. Secondary sales provide liquidity and flexibility for investors seeking to exit their investments before the company undergoes an IPO or is acquired by another entity. Unlike IPOs or strategic sales, where shares are sold directly from the company to investors, secondary sales occur between existing shareholders and new investors in the secondary market.

Secondary sales can take various forms, including the sale of individual shares, blocks of shares, or entire ownership stakes in the company. While secondary sales offer liquidity for investors, they may entail discounts to fair market value, as buyers in the secondary market may demand lower prices due to the lack of control and information asymmetry compared to primary market transactions. Additionally, regulatory constraints, such as transfer restrictions and securities laws, may impact the execution of secondary sales and necessitate careful compliance.

Recapitalization

Recapitalization involves restructuring a portfolio company’s capital structure to optimize financial performance and create value for stakeholders. Recapitalization strategies may include refinancing debt, issuing new equity, or implementing financial engineering techniques to enhance liquidity, reduce financial leverage, or improve capital efficiency.

Recapitalization serves various objectives, such as improving the company’s balance sheet, funding growth initiatives, or facilitating ownership transitions. By optimizing the capital structure, recapitalization enhances the company’s financial flexibility, increases its ability to withstand economic downturns, and positions it for long-term growth and success.

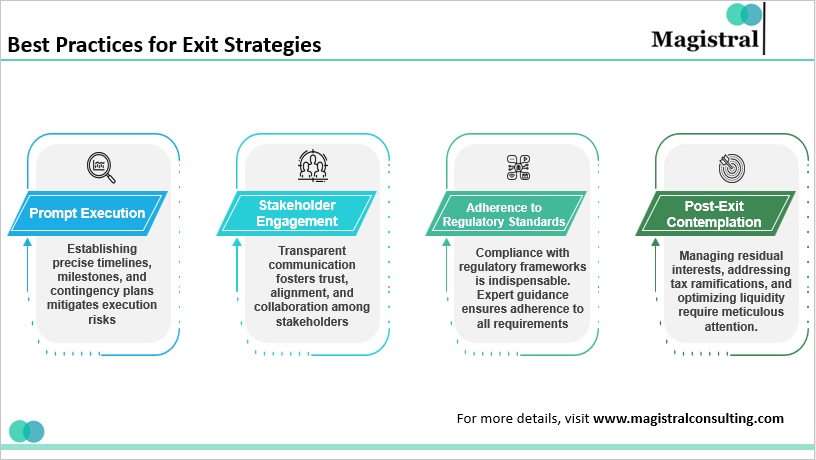

Optimal Implementation Practices for Exit Strategies for PE

Navigating the intricate landscape of Private Equity investments requires not only astute decision-making during the investment phase but also meticulous planning for the eventual exit. Implementing effective exit strategies is essential to realizing the full potential of investments and maximizing returns for stakeholders.

Best Practices for Exit Strategies

Prompt Execution

Effective execution is vital for capitalizing on advantageous market conditions and maximizing outcomes. By establishing precise timelines, milestones, and contingency plans, investors can mitigate execution risks and ensure a seamless transition from their investments. In the dynamic realm of private equity, where market dynamics evolve rapidly, seizing opportunities promptly can significantly impact exit results.

Stakeholder Engagement

Transparent and consistent communication forms the bedrock of successful exit strategies. Maintaining open channels of communication fosters trust, alignment, and collaboration among stakeholders throughout the exit process. Regular updates, timely sharing of information, and proactive involvement of investors, management teams, and other pertinent parties facilitate smooth transitions and minimize the likelihood of misunderstandings or disputes.

Adherence to Regulatory Standards

Compliance with regulatory frameworks is indispensable in exit planning endeavors. Navigating the intricate landscape of securities laws, antitrust regulations, and tax considerations necessitates expert guidance from legal, tax, and regulatory professionals. Engaging these experts early in the process ensures adherence to all regulatory requirements, reducing the risk of legal entanglements or regulatory sanctions that could impede the exit process.

Post-Exit Contemplation

Concluding an investment mark the inception of a subsequent phase of post-exit considerations. Managing residual interests, addressing tax ramifications, and optimizing liquidity demand meticulous attention and strategic planning. Crafting comprehensive post-exit strategies that anticipate and resolve these considerations promptly is imperative to maximize value realization and facilitate a seamless transition for all involved stakeholders.

Maximizing Returns: Magistral Consulting’s Tailored Exit Strategy Services for Private Equity

Private Equity investments demand significant capital, time, and resources, aiming for optimal returns upon exit. Magistral Consulting understands the complexities of exiting private equity investments and offers customized services to maximize returns. With a focus on strategic planning, transparent communication, and regulatory compliance, Magistral Consulting navigates the exit process effectively.

Strategic Planning: Crafting Customized Exit Strategies

At Magistral Consulting, strategic planning drives its exit strategy services. Recognizing each investment’s uniqueness, Magistral Consulting collaborates closely with clients to develop tailored exit strategies. Through thorough analysis and due diligence, it identifies potential exit scenarios, evaluates their feasibility, and designs strategic plans for value optimization. Whether through IPOs, strategic sales, secondary offerings, or recapitalization, Magistral Consulting helps clients choose the most suitable exit route to achieve their investment goals.

Transparent Communication: Fostering Trust and Alignment

Transparent communication is pivotal for successful exit strategies. Magistral Consulting prioritizes open dialogue throughout the exit process, ensuring clients are informed at every step. Regular updates, timely insights, and proactive guidance foster trust and alignment among stakeholders, facilitating smoother transitions and minimizing misunderstandings or disputes. With Magistral Consulting, clients navigate the exit process confidently, knowing their interests are safeguarded.

Regulatory Compliance: Navigating Legal and Regulatory Complexities

Navigating legal and regulatory requirements is crucial for exit planning. Magistral Consulting’s team of experts adeptly handles these challenges, providing comprehensive guidance and support. From securities laws to tax considerations, it ensures clients remain compliant. By engaging with regulatory authorities, conducting due diligence, and implementing robust compliance measures, Magistral Consulting helps clients mitigate legal risks and preserve value throughout the exit process.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com