In recent years, the asset management sector has been experiencing a major change that is being driven by heightened fee pressures, regulatory complexities and fast-paced technological advancements. To remain profitable while providing better returns, many firms have taken up outsourcing as one of their strategies. This means that they can hand over some of their operational tasks to specialized third-party providers; thus, enabling them to concentrate on their primary areas like management of portfolios and relationships with clients.

The Rising Demand for Asset Management Outsourcing

The asset management outsourcing sector has seen a scramble in recent years due to operational difficulties, escalating costs and the requirement for specialized skills. According to The Cerulli Report—U.S. Vendor Management & Operations Outsourcing, 33% of asset managers are now using asset management outsourcing to help with their entire back-office operations, while just 20% do so in the middle office function. Cost savings are the biggest draws behind this trend, as 73% of managers cite them as their main reason for asset management outsourcing. Moreover, 65% of asset managers say that outsourcing helps them exploit external capabilities as well as boost productivity levels internally.

Many companies have been forced to reevaluate their operating models because of cost problems or more specifically fee compression. As a result of passive investment vehicles like ETFs, the fees charged by active managed funds have been declining. This trend has made it hard for asset managers to keep their margins intact. By outsourcing non-core functions including regulatory reporting, compliance and data management; companies are able to lower operational expenses while still ensuring that they maintain good quality service.

In addition, the growing complexity of worldwide rules has led to a booming demand for specialized compliance services. To ensure that asset managers stay within the bounds of these evolving regulations, such as anti-money laundering (AML) and environmental, social and governance (ESG) regulations, they can engage asset management outsourcing partners who specialize in regulatory reporting and governance to help them avoid non-compliance risk.

Regional Variations in Outsourcing Trends

The global outsourcing market reached $971 billion in 2023, marking a 7.76% increase from $901 billion in 2022.

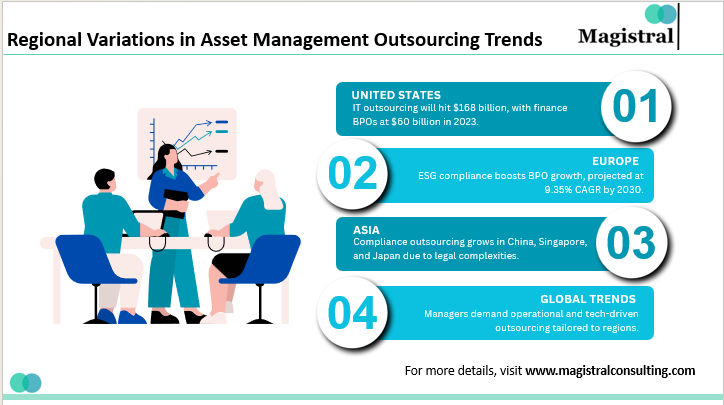

Regional Variations in Asset Management Outsourcing Trends

United States

The IT outsourcing industry in the U.S. will see immense growth, with projections estimating it to be worth $168 billion by the year’s close in 2023. This owes to how much of its outsourcing sector roots lies here. The general business process outsourcing (BPO) market for finance and accounting services in America is expected to amount to about $60 billion this year alone, primarily fueled by demand for more efficient and cheaper solutions.

The collection of ESG data and report preparation has become so critical for asset managers in Europe due to the pressure from authorities in charge of maintaining environmental standards. This has led to an increase in demand and subsequently growth for services like asset management outsourcing since asset managers have become more aware that compliance with government regulations is no longer optional, but a necessity.

Europe

This pushing for ESG compliance has made it crucial for asset managers to use asset management outsourcing to contract out their gathering of ESG information and reporting as well. Owing largely to rising acceptance levels regarding regulatory compliance services, the European market for BPOs is expected to grow by 9.35% CAGR between 2023 and 2030.

Asia

Due to intricate legal structures, specialized compliance outsourcing through asset management outsourcing is quickly gaining traction in Asia, more so in markets like China, Singapore and Japan. The business process outsourcing (BPO) sector in Asia is anticipated to extend because of the ongoing transition by companies into hybrid models that blend classical choices with cloud-based ones.

Common Trend Across Regions

Worldwide, managers look for asset management outsourcing partners who provide both operational assistance and advanced technological solutions.

The intricacy of global asset management necessitates adaptable, customized outsourcing models that correspond to different geographical contexts.

Impact of Technological Innovation on Outsourcing Strategies

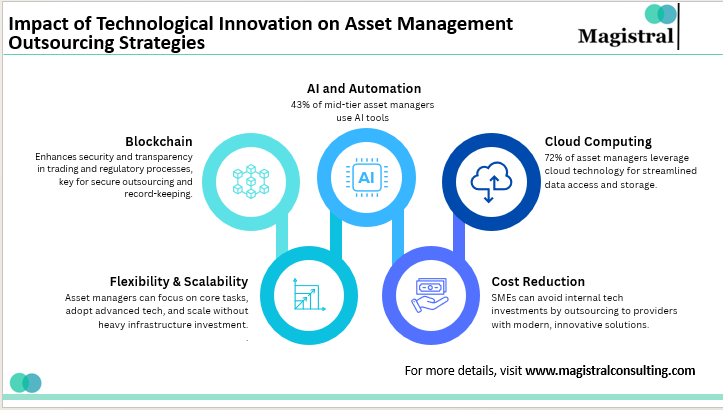

By being more adaptable and expandable, these technological advancements allow asset managers to focus on core decisions while improving service delivery operations.

Impact of Technological Innovation on Asset Management Outsourcing Strategies

Artificial Intelligence (AI) and Automation

Estimations suggest that 43% of mid-tier asset management companies have adopted AI-enabled software, which enhanced their stock trading and reporting accuracy, besides promoting decision-making with data. Also, the use of artificial intelligence tools such as robo-advisors and chatbots in asset management became popular, making operations more efficient.

Cloud of Computing

72% of asset management companies have adopted it in order to streamline data storage and access. Real-time data access from any location through cloud technology enhances the decision-making process as well as operational transparency.

Blockchain technology

The decentralized nature of blockchain technology improves transparency and security, especially while using asset management outsourcing for tasks such as running trading processes or regulatory mechanisms. Hence, blockchain has been employed in the process of asset management outsourcing strategies for secure transaction processing and record-keeping.

Flexibility and scalability

Outsourcing models, which have come to epitomize the modern era, are something as flexible and scalable. Through this means, asset managers can therefore focus all their concentration on specific fields like data management or regulatory compliance, adjust accordingly, and hence source advanced technology without necessarily having to invest heavily in their own infrastructure.

Cost reduction

This is true, particularly for small and medium enterprises where there will be no need for internal investments in technology. Companies may therefore use asset management outsourcing for their technology requirements from externally-based providers who have modernised solutions or more sophisticated systems that will help them in getting new innovations.

Magistral’s Services for Asset Management Outsourcing

Magistral Consulting offers a full suite of asset management outsourcing services designed for the operations of asset management companies. Magistral Consulting provides a comprehensive suite of services designed to support asset managers in these operational functions. Magistral’s offerings include:

Investment Research and Analysis

Magistral helps firms track global and regional market trends to provide essential insights through industry reports. The firm also offers in-depth equity and fixed-income research, analyzing the risks and returns of various securities. Additionally, portfolio analysis allows organizations to enhance their effectiveness, assess themselves in relation to competitors, and handle risk/reward issues in a balanced manner.

Fund Administration and Reporting

Magistral ensures that the reporting of funds’ performance occurs promptly and accurately. More so, our professionals are versed in the preparation of other checklist compliance documents such as financial statements and investor reports which are fundamental in achieving local and international compliance standards.

Risk Management

The risk management services offered by Magistral enable asset managers to delegate risk monitoring and reporting functions and regularly assess portfolio risks. The company additionally provides support within the scope of operational risk management aimed at reducing risks linked to processes, systems, and people, thus building a stronger, more robust operational structure.

Middle and Back-Office Operations

Magistral enhances the efficiency of trade processing and settlement operations, taking care of trade execution, confirmation, and settlement processes. Corporate events such as payment of dividends, mergers, etc. are also handled so as to observe all the necessary procedures.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What is the role of ESG compliance in outsourcing trends?

ESG compliance has become critical in regions like Europe, where asset managers outsource data collection and reporting to ensure they meet regulatory requirements and align with environmental and social governance standards.

How can small and medium asset management firms benefit from outsourcing?

Outsourcing allows small and medium firms to access advanced technologies and specialized services without the need for substantial internal investments, making them more competitive and efficient in operations.

How does outsourcing help asset managers stay compliant with regulatory requirements?

Outsourcing partners specialized in regulatory reporting and compliance help asset managers adhere to complex and evolving regulations, such as anti-money laundering (AML) and environmental, social, and governance (ESG) reporting, reducing the risk of non-compliance penalties.