Introduction

The real estate industry, which involves a wide array of activities from property development to meticulous management, holds a significant position within the global economy. Real estate firms are crucial components of this sector, serving as essential facilitators of transactions and providers of vital services. In this article, we delve into an exploration of the multifaceted world of real estate firms, emphasizing their pivotal role, the challenges they encounter, and the diverse range of services they offer.

Real estate firms are central to driving the dynamics of the industry. They act as intermediaries between buyers and sellers, landlords and tenants, developers and investors, facilitating transactions and negotiations to ensure the smooth functioning of the real estate market. Their expertise in market analysis, valuation, and legal intricacies provides valuable guidance to clients, fostering trust and confidence in the process. In this article, we delve into an exploration of the multifaceted world of real estate firms, emphasizing their pivotal role, the challenges they encounter, and the diverse range of services they offer.

Understanding Real Estate Firms

Real estate firms hold significant positions within the industry, operating across sectors such as residential, commercial, industrial, and retail. They utilize their expertise to navigate the complexities of each sector. In addition to facilitating transactions, these firms provide a range of essential services for the smooth operation of the real estate ecosystem.

Real estate firms excel in orchestrating complex transactions, leveraging their market insights and negotiation skills to ensure favorable outcomes. They play crucial roles in high-value acquisitions and the development of various projects. Furthermore, these firms effectively manage diverse portfolios, optimizing returns on investment while minimizing risks. Their proficiency in property management, lease administration, and asset enhancement strategies adds substantial value to clients’ holdings.

Embracing technology is a growing trend among real estate firms, leading to streamlined operations and enhanced client experiences. Digital platforms facilitate property searches and virtual tours, while advanced analytics aid investment decision-making. By harnessing data-driven insights and automation, these firms deliver efficiency, transparency, and agility to clients.

Real estate firms act as catalysts for growth and prosperity in the industry, providing expertise, innovation, and personalized service. As the market evolves, they remain committed to delivering value and establishing lasting partnerships with clients globally.

Key Functions of Real Estate Firms

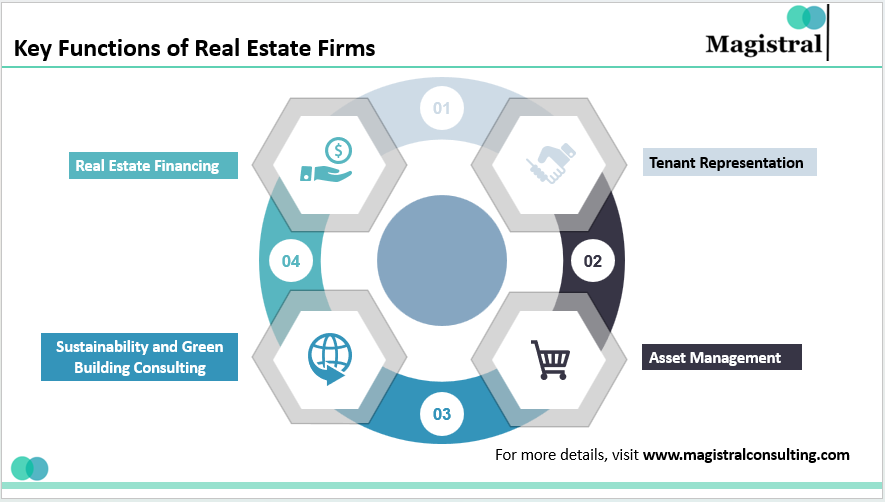

Real estate firms serve a multitude of functions within the industry, each contributing to the efficient operation and growth of the real estate market. Some key functions of real estate firms include:

Key Functions of Real Estate Firms

Tenant Representation

Additionally, real estate firms offer tenant representation services. They assist tenants in finding suitable spaces for lease, negotiate lease terms on their behalf, and advocate for their interests throughout the leasing process.

Asset Management

Apart from property management, real estate firms engage in asset management activities to maximize the value of real estate portfolios. This involves strategic planning, performance analysis, and implementing value-add initiatives to enhance asset performance and investor returns.

Sustainability and Green Building Consulting

Real estate firms offer consulting services in green building practices and sustainability initiatives. They advise clients on incorporating energy-efficient technologies, sustainable materials, and green certifications into their projects to reduce environmental impact and enhance long-term value.

Real Estate Financing

Many real estate firms offer financing services to clients, connecting them with lenders and financial institutions to secure funding for property acquisitions, development projects, and investment opportunities. They assist clients in navigating financing options, structuring deals, and securing favorable terms to meet their financial objectives.

Challenges Faced by Real Estate Firms

Market Volatility

The real estate landscape is inherently susceptible to fluctuations in economic conditions, interest rates, and investor sentiment shifts, all reverberating through property prices and demand. Economic expansions fuel optimism and drive-up property values, while downturns instill caution, leading to decreased demand and softened prices. Interest rate changes, influenced by monetary policy and market dynamics, directly impact borrowing costs, thereby influencing property affordability and investment decisions. Furthermore, shifts in investor sentiment, driven by geopolitical tensions or market speculation, can trigger abrupt changes in demand and market dynamics. Navigating these volatile market conditions requires a nuanced understanding of economic indicators, risk management strategies, and agility in adapting to changing market sentiments.

Regulatory Changes

The real estate sector operates within complex regulatory frameworks that exert significant influence on property development and investment decisions. Regulatory changes encompass zoning regulations, building codes, environmental policies, and tax laws, among others, all of which shape the feasibility and profitability of real estate projects. Legislative shifts, driven by societal concerns, political agendas, or economic imperatives, can introduce uncertainties and alter the competitive landscape. Compliance with regulatory requirements demands meticulous planning, legal expertise, and often entails substantial time and resource allocation. Moreover, navigating regulatory complexities necessitates ongoing monitoring, proactive engagement with policymakers, and strategic adaptation to regulatory changes to mitigate risks and capitalize on emerging opportunities.

Competition

The real estate industry is characterized by fierce competition among market participants, ranging from individual investors to multinational corporations. In this hypercompetitive environment, differentiation through unique services and market expertise is imperative for sustaining competitive advantage and capturing market share. Real estate firms employ various strategies to differentiate themselves, including specialization in niche markets, innovative service offerings, and leveraging technology for enhanced customer experiences. Moreover, cultivating strong relationships with clients, fostering a reputation for reliability and integrity, and investing in talent development are essential for building enduring competitive advantage. By continuously innovating and evolving in response to market dynamics, real estate firms can effectively navigate competitive pressures and position themselves for long-term success.

Economic Uncertainty

The interconnected nature of the global economy exposes the real estate sector to economic uncertainty stemming from geopolitical events, trade tensions, and economic downturns. Global events such as geopolitical conflicts, natural disasters, or public health crises can trigger market volatility and erode investor confidence, leading to hesitancy in investment decisions and tightening of financing availability. Economic downturns, characterized by recessionary pressures, declining consumer spending, and rising unemployment, exert downward pressure on property prices and demand across various real estate segments. Navigating economic uncertainty requires proactive risk management strategies, diversified investment portfolios, and a focus on liquidity and financial resilience. Moreover, maintaining robust relationships with financial institutions, staying abreast of macroeconomic trends, and leveraging data analytics for informed decision-making are essential for mitigating risks and capitalizing on opportunities amidst economic turbulence.

Magistral Consulting: Tailored Solutions for Real Estate Firms

Magistral Consulting specializes in offering tailored services to real estate firms, addressing their unique challenges and needs.

Magistral’s Services on Real Estate Firms

Strategic Fundraising Campaigns

Magistral Consulting specializes in crafting bespoke fundraising campaigns tailored to the specific needs and goals of real estate firms. Leveraging their expertise in market dynamics and investor relations, they develop compelling narratives and engagement strategies designed to attract potential investors. Through meticulous analysis of market conditions and investor preferences, they identify optimal fundraising opportunities and guide clients through every stage of the fundraising process.

Targeted Investor Engagement

Magistral Consulting excels in cultivating meaningful relationships with potential investors who are aligned with the investment objectives and philosophies of their clients. Using tailored outreach efforts and personalized communication strategies, they identify and engage with high-net-worth individuals, institutional investors, family offices, and other relevant stakeholders. By aligning clients’ investment propositions with the interests and preferences of prospective investors, they establish mutually beneficial connections that lay the foundation for successful fundraising campaigns.

Comprehensive Funding Environment Analysis

Magistral Consulting conducts thorough analyses of the funding environment, offering real estate firm’s valuable insights into market trends, investor sentiment, and capital allocation dynamics. Through rigorous research and data-driven analysis, they monitor macroeconomic indicators, regulatory developments, and industry trends that influence the investment landscape.

In-depth Macroeconomic Research

Magistral Consulting stands out in the field of macroeconomic research, providing real estate firms with actionable insights into broader economic trends and their impact on the real estate market. By analyzing key indicators such as GDP growth, interest rates, inflation, and employment figures, they assess the overall economic health and identify potential drivers of real estate demand and investment activity.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com