Introduction

A rent rolls is an indispensable tool with well-organized details about tenant information, lease terms, rent amount, property details, and monthly and annual rental income summaries. It is the foremost document that is required by both lenders and investors to access a significant amount of data for an informed decision-making process. This replacement against dozens of documents serves as a focused view to the investors for two critical purposes, the first being the analysis of potential properties for acquisition and the other being to track the performance of already owned properties for better management of investments.

Requirements of Rent Rolls: When is it used?

In order to realize the true worth of the property, the rent roll is analyzed in different ways for various decision-making under varied situations.

Investment Analysis for Informed Decision-Making

This seems to be a simple document consisting of extremely important financial information required to calculate significant financial performance formulas such as net operation income, gross rent multiplier, and internal rate of return (IRR). All these formulas along with other calculations (if required) are used for analyzing the investment muscles of the commercial property.

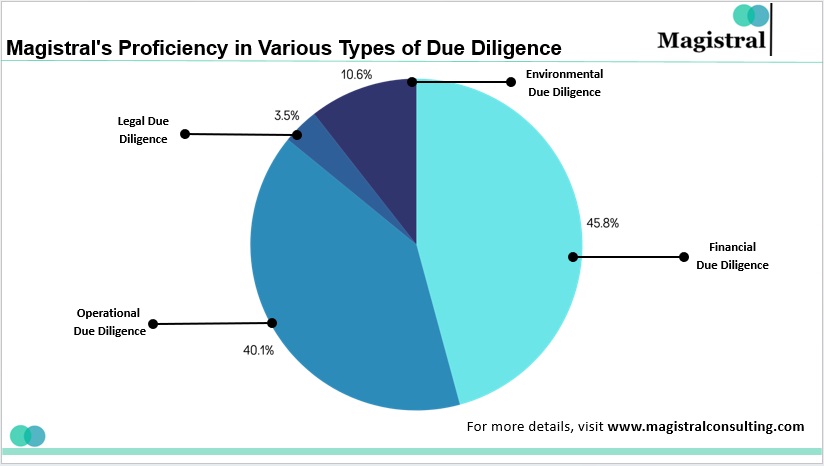

Due Diligence

While processing the acquisition of the commercial property investors and potential buyers use the document as part of their due diligence. It provides the evaluation of the property’s financial performance which is usually based on factors like property type, square meters/feet, location, and condition. In the case of commercial property, the potential risk and overall suitability becomes critically important.

Magistral’s Proficiency in Various Types of Due Diligence

Property Management

Owning a lot requires detailed management and the details revealed by the rent roll aid the management process for the investors. With details and facilities like tracking rental payments, management of lease expirations, and monitoring occupancy rates along with other details like pricing, tenant retention, lease negotiations, and overall property management it allows the investors to supervise their holdings.

Analysis of Market and Valuation

By analyzing the marketing deeply and broadly through the details in the document a comprehensive market comparison of other transacted rent rolls is done to obtain a multiplier. Based on the multiplier the management fee is calculated based on factors like average weekly rent, property-to-landlord ratio, ancillary fees and charges, arrears rate, staff and wages, economic factors, and compliance with the legislature. Synthesizing all a base for valuation is created for applying the required valuation method.

Application of Loan and Financing

It is needed by Investors to evaluate their decisions based on information like the rental income of the property, occupancy rate, and lease terms. It is the most popular document in the world of commercial property for analyzing future cash flow based on the current details the document holds aiding strategic financial decision-making.

Negotiations and Lease Renewals

The document is referred by the property owners and interested managers majorly for assessing the lease expiration dates and occupancy status of the property based on which negotiation of lease terms, evaluation of tenants’ rental strategies, and any necessary rent rate adjustments can be done for a better comparative analysis for long term investment.

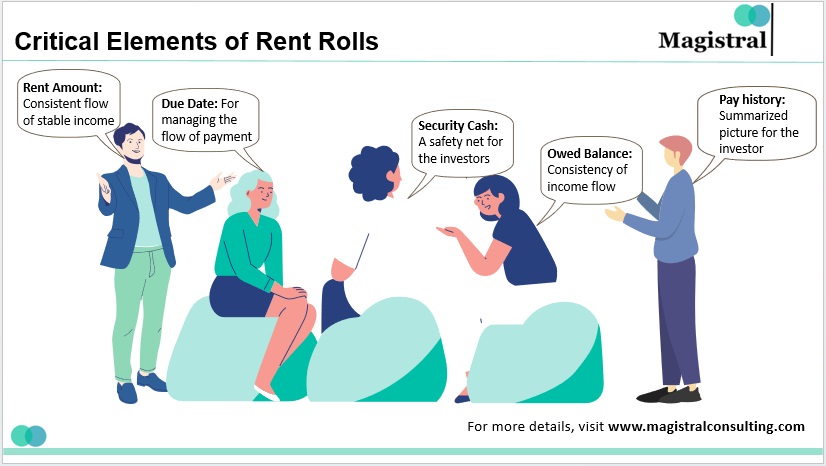

Critical elements of Rent Rolls: What an investor should look for

Analysis of the rent rolls is a thorough and lengthy process as it traditionally involves a lot of paperwork. The document is prone to regular updation which requires constant evaluation. Although it consists of a lot of information that may overwhelm the investor while evaluating, given that the following key elements can be analyzed for a wholesome viewpoint:

Critical Elements of Rent Rolls

Unit ID

A Unit ID is a unique identity of the property. It is a combination of a unit name and a property name which will always be unique in nature for different properties. This ID allows a handy organization of properties by investors.

Tenant’s Information

It reveals how “seasoned” tenants are. The long-term stay of tenants builds a sense of reliability and assurance in the minds of investors and increases the creditability of the property in the market.

Lease Dates

When it will start and when will be called off allows investors to plan their investment time, period, and amount. Scheduling the expiration of leases investors take bulk in or out investment decisions.

Lease Deeds

A formally constructed contract between the lessor and the lessee that provides legal protection to the concerned parties by defining their roles, responsibilities, and obligations.

Rent Amount

From the investor’s aspect the amount of rent is the stable income received against investment. The higher the stability more will be the reliability of the investor. However, properties with low levels of income are comparatively cheaper than the ones with stable income.

Due Date

It helps investors keep their financial ducks in a row and manage the payments accordingly.

Security Cash

The security amount provides a safety net to the investors. It acts as a buffer for investors in case the terms and situation are imbalanced.

Owed Balance

By keeping a count on what is yet to be cleared and received investors analyze the consistency of income flow. Long dues indicate poor strength of the property and a critically unfit situation to remain invested.

Pay History

Perfectly correlated with the owed balance and due date, pay history gives a summarized picture of what twists and turns investors encounter.

Apart from these elements guarantor information (if applicable), lease type, any renewal and termination option, and any lease-related documents attached (for example amendments in the lease contract) are some more critical aspects that should be covered while analyzing the rent roll.

Magistral Services for Rent Rolls Analysis

By following an in-depth analysis of the property’s rent roll Magistral acquires all relevant and necessary details and builds a database to manage the data sequentially for a better comparative analysis. The data is used for calculating metrics such as total rental income, occupancy rates, lease expiration schedules, and any delinquencies or vacancies to identify potential risks and opportunities based on the rent rolls. Using the results Magistral generates detailed reports and presentations to serve its clients with the best possible opportunities for investment and management. The major steps Magistral follows to serve its clients are:

Data Collection

Gathers data on the property by analyzing the rent rolls including tenant information, lease deed, lease dates, and lease type and some major factors.

Financial Analysis

By judging the financial health of the property Magistral applies various tools and techniques to frame a constructive picture for the client.

Market Comparison

By comparing different properties’ rent rolls a detailed comparative analysis is done by experts.

Risk Assessment

Through analyzing the comparative study, potential risks and opportunities are listed.

Reporting

A structured and detailed report is shared with the client for an informed decision.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does Magistral provide Due diligence services based on rent rolls?

Magistral conducts deep industry research for detailed company profiling and competitive landscaping by extracting necessary details from the rent roll based on elements like the lease deed, rent amount, pay history, and any lease-related documents attached (for example amendments in the lease contract).

What services does Magistral serve for maintaining coordination?

Magistral arranges a support system for routine maintenance, repairs, and inspections of the rental property to support its clients.

What elements does Magistral analyze in Rent rolls for risk management?

The major elements used by Magistral for analyzing and managing the risk are – the lease date, lease deed, due date, tenant’s information, owed balance, and pay history of the property.

What customized services Magistral produce for commercial real estate investors?

Rather than having a standardized approach Magistral follows a more customized path by providing unique solutions to typical problems such as portfolio management for multiple properties or specialized reporting requirements to serve its clients with the best possible solution at the best possible cost.