Introduction

Around the globe, there is a trillion-dollar business of investing in all sorts of assets like equity, both public and private, real estate, and upcoming assets like cryptocurrencies. Once the investment is made, the task on the part of the investor shifts to investment management. There are many activities of investment management that could be outsourced and that is what leads us to analyze the stream of investment management outsourcing. Investment management and hence investment management outsourcing takes all forms depending on the asset being invested in, and the prime business of the asset or investment manager.

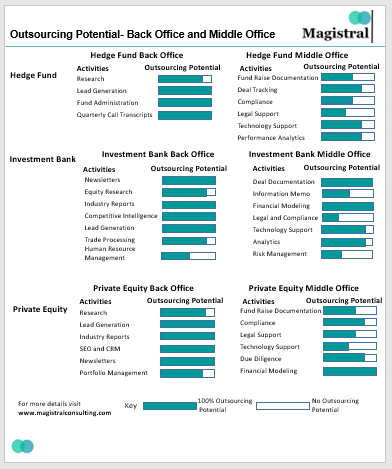

Here we take a look at major activities of each type of investment manager or asset manager which could be effectively outsourced to save on costs and improve quality.

Who Should Outsource Investment Management and How?

Outsourced Investment Management for different types of Asset Managers

Private Equity and Venture Capital firms

The underlying asset that a Private Equity or a Venture Capital firm invests in is equity. Sometimes it’s for stocks listed on exchanges but most of the time these are private investments, the target of which are start-ups are unlisted companies.

In the PE/VC value chain of investing, there are activities like Fundraising, Deal origination, Deal execution, and Portfolio Management. Quite a few activities in these departments are outsourceable. For fundraising, the activities like investor reach-out, investor profiling, CRMs, newsletters, white papers, and data management jobs could be effectively outsourced. Regarding, Deal origination, the deal pipeline management has a great potential of outsourcing along with initial due diligence. Deal execution processes like valuation and financial modeling are templatized and could be considered. Portfolio management has varied activities and outsourcing potential vary as per the nature of the business of the portfolio companies. Most activities related to Strategy and Marketing have great potential for outsourcing when it comes to Portfolio Management.

Hedge Funds

For the most common type of hedge fund out there, that is a long-short equity hedge fund, multiple activities should be considered for outsourcing. Equity Research is the foremost one. The research that is done for the investors is almost always best to be outsourced. Apart from Equity Research, Fund Administration and Fund Accounting are better done when outsourced. It makes sense from the cost and expertise point of view. Marketing activities almost always have great potential for offshoring.

Real Estate

Managing a real estate asset after the investment comprises standardized work-streams. Most of it relates to collecting data, analyzing it, making reports, and raising red flags if any. Accounting and administration along with research has a great potential for outsourcing

Investment Banks

Investment Banks are into all sorts of assets directly or for their clients. For the varying types of their work pallet, there is varying potential for outsourcing. For investment banks, activities that are commonly outsourced are Equity Research, Security-based Investment Research, development of excel or other automated models, investment research for private investments, marketing, deal origination, and deal execution. In fact, 30-50% of all activities performed by an investment bank has a solid potential for outsourcing that may be explored

Asset Management Firms

These are for specialized asset managers like managers managing a portfolio of crypto or commodities. There is no one size fits all approach to outsourcing for these asset managers. As a thumb rule, everything related to technology like platform development, automation, website development, or software development can be outsourced. Also, anything that is of support function’s nature like Strategy or Marketing could be looked at.

Models of engagement with the outsourcing vendor

Once you have made your mind to explore outsourcing, the biggest concern is around the way an outsourced vendor or the service provider would work with you and your team. There are three established models of working while outsourcing. These are FTEs, Retainer, and Ad-hoc. Some progressive vendors like Magistral are signing up success-based contracts too.

Investment Management Outsourcing Engagement Model

FTEs

FTE the most common engagement model for investment management outsourcing.

FTE stands for Full-Time Employee equivalent. It’s like a virtual employee who is operating from a different country. This virtual employee could be coordinated with, on email, video calls, WhatsApp, chats, or any other mode that is suitable to the client and is convenient as per time zone differences. It looks like a person is aligned with the client full time and he works seamlessly with the client. That is always the case, but the vendor, his processes, training, supervision, and culture play a big role in ensuring the continuity of services. A vendor enables the FTE to perform optimally by providing training and desired supervision. The vendor’s processes ensure that the client is insulated from the bad performance of FTE as the work is supervised by more senior resources. In case the individual decides to leave the organization, similarly, qualified and trained professionals are available on the bench for the replacement. That is the reason it makes sense to work with individuals through the service providers who may be an established name in their industry. Working directly through freelancing websites or hiring directly exposes clients to manage costs and risks, which is not the case while dealing with an established service provider.

This also is the cheapest model on per hour basis. But it is inflexible as there may be contractual obligations for a minimum period of support. This case is more prominent when resources are specialized in niche skills

Typical jobs that require FTE engagements are operational, where the offshored team works with the onsite team seamlessly. So, if a task is part of your ongoing investment management operations, mostly it will be outsourced on FTE-based engagement.

Retainer

You know there is a need for outsourcing tasks. At the same time, you think a full-time individual working on these jobs may be overkill. In these situations, where tasks just require some hours every month, the retainer model of engagement comes in handy. Say rather than hiring an FTE or a full-time virtual employee, you would only want 100 hours’ worth of tasks outsourced every month. A retainer is far more flexible than FTEs but costs higher on per hour cost basis. Typical jobs that are suitable for retainer-type outsourcing are newsletters, MIS, reports preparation, and other marketing-related tasks.

Ad-hoc Projects

As the name suggests the engagement is for one-time projects only. A client gives out the scope of the project. The service provider or the vendor provides a proposal that carries, scope of work, timelines, and commercials. The project kicks off after the client signs off the proposal and is paid after the delivery of the project. Almost any project that is strategic and is not expected to be repeated on an ongoing basis is an ideal candidate for ad-hoc based outsourcing. Also, it’s an ideal mode, if you would want to test the services of a vendor before signing a longer-term contract. It is the most flexible outsourcing arrangement as projects may start or end at your convenience, but at the same time, it is costliest in terms of cost per hour basis.

Success Based

Most traditional service providers shy from signing a success-based engagement. The fear stems from the trust deficit, performance fears, and the complications of defining a success scenario. Magistral signs success-based engagements with clients, with whom it has existing relationships. Existing relationships take the risks related to trust deficit and performance. A mutually agreed “success” scenario could also be defined in those situations. The tasks that are outsourced under these arrangements usually relate to fundraising, deal sourcing, and meetings’ set up

Magistral has helped more than 100 clients in outsourcing and offshoring multiple activities related to the Investment Management process. To start a conversation drop a line here.

About Magistral

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The Author, Prabhash Choudhary is the CEO of Magistral Consulting and can be reached at Prabhash.choudhary@magistralconsutling.com for any queries or business inquiries.