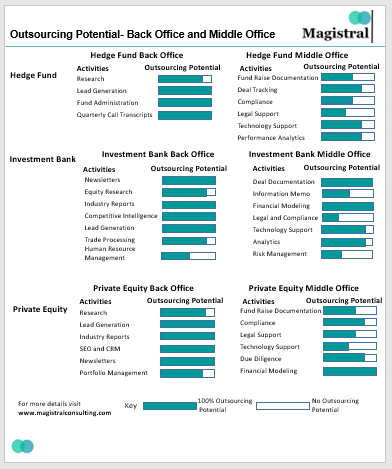

Activities under Back and Middle Offices and their Potential for Outsourcing

Back Office Outsourcing has been around for over a decade and picked up the pace since the financial meltdown of 2008. Middle Office Outsourcing is something that is picking up now and is expected to gather pace after the Corona pandemic. So, what is Back and Middle Office outsourcing, and does it make sense for financial services firms like Investment Banks, Private Equity, Venture Capital, and Hedge Fund firms to outsource these activities?

What is a Back Office?

There are not many definitions that clearly demarcate back-office activities from middle-office. A front office at an Investment Bank or a Private Equity firm is the one that interacts with the clients. It comprises people who are in touch with the market like traders, deal makers, Investor relations, and rainmakers. On similar lines, back-office functions are ones that never interact with clients, like fund administration, accounting, record keeping, etc. Back Office has now long been designated as the right candidate for outsourcing to reduce operational costs.

What is Middle Office?

Middle Office are the functions that coordinate between the front and back office. Similar functions in similar financial institutions can often be categorized as Middle Office, back office, or even Front Office. So, there are lots of blurry lines between Middle and Back Office definitions. Also, an activity that will form a Back Office activity at an investment bank can be categorized as a Middle Office activity at a Hedge Fund. Technology is now getting all the more important than it was ever before. Biggest of Investment Banks now have more than 30% of their employees working in technology-related functions. Technology and Risk Management functions are commonly being categorized as Middle Office functions across financial institutions like Investment Banks, Hedge Funds, Private Equity, and Venture Capital firms.

Potential of Back Office Outsourcing

Back Office needs to be outsourced is a forgone conclusion. It was probably a matter of discussion a decade back. Almost all big Investment Banks have outsourced their back office. Private Equity, Venture Capital and Hedge Funds are playing catch-up when it comes to back-office outsourcing. The reason for them lagging behind is that their teams are comparatively smaller to start with, which leads to limited cost advantages of outsourcing for them. Hedge funds have rather taken the technology way to reduce costs with developments like AI, ML, and Automation. Traders on most trading floors have been replaced by robots now. The conclusion here is that if your firm has a well-demarcated back office, it needs to be outsourced, big, or small. As the industry has started to rely on back-office outsourcing defacto, it will be difficult to compete in the market for those who decide to keep it in-house.

Potential of Middle Office Outsourcing

Middle Office Outsourcing is a hot topic now. It is gaining ground with investment banks who were pioneers even in the back office outsourcing space. Increased capabilities of vendors, further pressure to reduce costs and improve bottom-lines, and competitive pressures are the major trends that are aiding the phenomenon. It’s not right to suggest that all functions of the Middle Office could be outsourced right away. It depends on the processes, culture, and cost structure of the financial institution in question. In conclusion, Middle Office Outsourcing is something that is still taking shape. Though a lot of it could be outsourced, the moot subject is what and how much.

Outsourcing for smaller firms

If an Investment Bank, Private Equity firm, Hedge Fund or a venture capital firm is around 20 people or less, they are continuously caught up in the dilemma to outsource or not. A big firm with hundreds and hundreds of traders would save millions of dollars by outsourcing, the same could not be said about the smaller firms. Smaller firms operate in a niche and fear losing the competitive edge if they go for outsourcing. The low-quality perception of outsourcing does not help give them confidence either. It was so far so good. Some smaller players did survive the last financial meltdown on the back of their superlative services and the network of loyal clients. It’s debatable if they will survive the current pandemic too. In the changed scenario, it is almost imperative for a smaller firm to outsource both the back office and middle office if they need a worthwhile shot at survival. When we talk about the back office and middle office of a smaller financial services firm, it’s pretty much all of their analyst capacities. Thousands of one-man shops are thriving on the formula of outsourcing when the deal is there and conserving the cash when it is not.

Middle Office and Back Office Outsourcing Trends

Multiple trends are evident in the market. Some of the prominent ones are:

Back Offices at bigger financial institutions have been outsourced. A mode could be different in a way having owned captives in a low-cost country or giving a big contract to a leading vendor, but the fact remains, that the physical location of the back office now is a low-cost country.

Middle Office Outsourcing is in a transitional phase: A middle office is being planned to be outsourced. Some players have outsourced the junior positions with mid-level and senior positions in-house. Some are toying with outsourcing the simpler functions over the complex ones

Outsourcing is catching up with Private Equity, Venture Capital and Hedge Funds: Investment Banks definitely took a lead in outsourcing but now even typically smaller financial institutions like Private Equity, Venture Capital, Family Office, Hedge Funds, Real Estate, and Asset Management firms have also started to experiment with varying degrees of exposure to outsourcing

It’s not only about costs: Outsourcing has come a long way from being a lever of only saving costs. Vendors have developed advanced skills and now are in a better position to enhance the skill of the in-house team. It is possible because the vendor is working across geographies, financial institutions, and investment philosophies. A vendor can now bring a fresh eyes’ perspective to the operations and help the financial institution up its game

Pandemic will relay the rules: If outsourcing was just an option before the pandemic, it may not be so afterward. Financial institutions are expected to face cost-related headwinds that will force them to outsource to survive

Increasingly complicated assignments being outsourced: Assignments like Financial Modeling, Investment Research, Outsourced CFO, Fund Administration Process, Hedge Fund Analytics, Pitch Decks, Portfolio Management, etc. are increasingly being outsourced by Investment Banks, Private Equity, Venture Capital and Hedge Fund firms.

Overall back office and middle office outsourcing are at different stages of maturity across the financial institutions. While large investment banks are pared to the bone when it comes to taking advantage of outsourcing, the mid-sized and smaller investment banks have only started recently experimenting with the trend. While Investment Banks, in general, are more mature and warm towards outsourcing, firms like Private Equity, Venture Capital, Hedge Funds, Family Offices, Real Estate, and Asset Management are now opening more and more to the idea. What large institutions identified as a tool to maintain their profit margins, smaller institutions are finding that tool to be the key to survival and profitable growth.

Service Offerings of Magistral Consulting

Here are the service offerings that Magistral provides:

-Daily/Weekly/Monthly Review of NAVs

-Reconciling Cash Trades and Portfolios

-Monitor Trades and Corporate Actions

-Maintain Investment Book of Records

-Independently price the portfolio

-Performing Investor Allocations

-Reporting Profit and Loss

-Client reporting for funds

-Reviewing and preparing all financial statements

-Managing relationships with service providers

-Providing tools to monitor systems and processes

Magistral Consulting (www.magistralconsulting.com) is a premier outsourcing firm that has helped multiple firms like Investment Banks, Private Equity, Venture Capital, Hedge Funds, Asset Managers, Real Estate, and Family Offices in outsourcing their back and middle office. To schedule a free discussion without any commitment, drop a line at https://magistralconsulting.com/contact/

The Author Prabhash Choudhary is the CEO of Magistral Consulting and can be reached at Prabhash.choudhary@magistralconsulting.com for any queries on the article of business inquiries in general