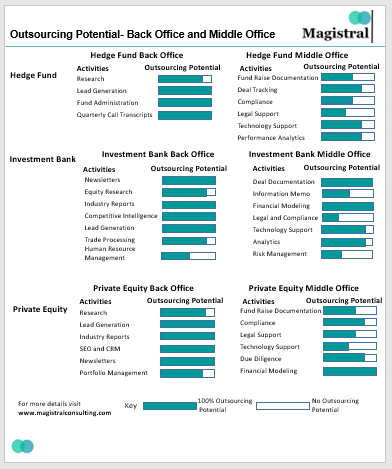

Middle office outsourcing has emerged as a strategic option for businesses looking to increase productivity and streamline operations in the fast-paced financial landscape of today. Serving as an important middleman between the front and back offices, the middle office handles trade assistance, compliance, risk management, portfolio valuation, and reporting, among other critical tasks.

This article delves into the concept of middle office outsourcing, examines its benefits, highlights the challenges involved, and offers insights on how organizations can maximize the advantages of this approach.

Introduction to Middle Office Outsourcing

Middle office outsourcing involves entrusting specialized external service providers with the operational functions and activities of the middle office in a financial institution. The middle office serves as a vital connection between the revenue-generating front office and the settlement and custody functions of the back office. It encompasses a range of tasks, including trade support, risk management, compliance, portfolio valuation, and reporting.

Through middle office outsourcing, financial institutions can capitalize on the expertise, technological infrastructure, and scalability provided by external service providers. These providers assume responsibility for essential tasks like trade processing, risk analysis and management, compliance monitoring, performance measurement, and reporting. This arrangement enables the financial institution to concentrate on its core competencies, such as devising investment strategies, acquiring clients, and nurturing relationships. The outsourcing partner assumes responsibilities such as trade processing, risk management, compliance, and reporting, enabling organizations to reallocate resources and concentrate on revenue generation and relationship management.

Benefits of Middle Office Outsourcing

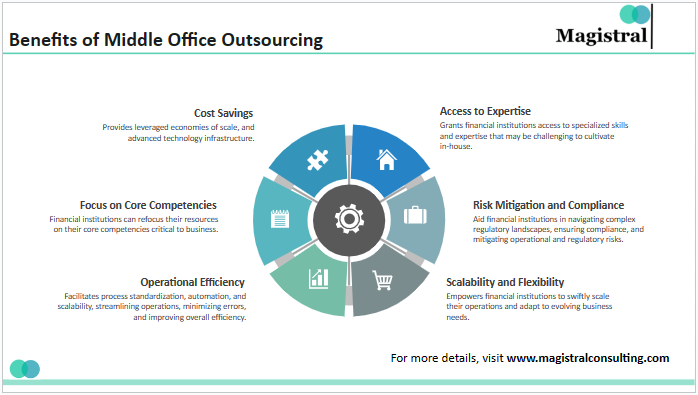

Financial institutions can reap numerous benefits that contribute to their overall efficiency through middle office outsourcing, here are some common benefits:

Benefits of Middle Office Outsourcing

Cost Savings

Financial institutions can realize cost savings by opting for middle office outsourcing. External service providers leverage economies of scale, specialized expertise, and advanced technology infrastructure, enabling them to perform these functions more efficiently and cost-effectively. This leads to reduced expenses related to infrastructure, technology, staffing, and training.

Focus on Core Competencies

Financial institutions can reallocate their resources to their core competencies by outsourcing non-core middle office operations. This covers topics including client acquisition, relationship management, and investment techniques. This increased focus on core operations frequently results in better performance and increased market competitiveness.

Operational Efficiency

Process automation, scalability, and standardization are made possible by middle office outsourcing. Service providers reduce errors, increase overall efficiency, and streamline operations by utilizing cutting-edge technology like robotic process automation, artificial intelligence, and machine learning. Decision-making that is better informed is made possible by the quicker trade processing, improved risk management, and timely reporting that follow.

Access to Expertise

Outsourcing middle office functions grants financial institutions access to specialized skills and expertise that may be challenging to cultivate in-house. Service providers employ professionals with extensive experience in various middle office disciplines. This ensures the execution of critical tasks with a high degree of quality and accuracy.

Risk Mitigation and Compliance

External service providers are well-versed in industry best practices and legal standards. They support financial organizations in managing operational and regulatory risks, assuring compliance, and navigating complicated regulatory environments. Strong risk management frameworks are frequently in place at service providers, supporting businesses’ risk mitigation tactics.

Scalability and Flexibility

Middle office outsourcing empowers financial institutions to swiftly scale their operations and adapt to evolving business needs. Service providers offer flexible service models that accommodate growth, facilitate the introduction of new products, and support geographical expansions. This scalability and flexibility can be achieved without significant internal investments or operational disruptions.

Challenges and Considerations of Middle Office Outsourcing

While middle office outsourcing offers numerous advantages, it is essential to consider the following challenges and factors before embarking on such a strategy:

Data Security and Confidentiality

Financial institutions must prioritize data security and confidentiality. It is essential to ensure that potential service providers have robust data security measures and strict protocols in place to protect sensitive information. Conduct thorough due diligence to assess the provider’s track record, data protection practices, and adherence to industry standards and regulations.

Vendor Selection and Due Diligence

Thorough due diligence is necessary in order to choose the best outsourcing partner. Examine the service provider’s standing, capacity for handling risk, technological setup, adherence to laws and regulations, and experience with the particular middle office tasks that are being outsourced. Decision-making can be aided by openness in the selection process as well as suggestions and references from colleagues in the field.

Transition and Change Management

Successful outsourcing requires effective change management strategies. Plan the transition meticulously to minimize disruptions to day-to-day operations. Implement adequate communication and training programs to prepare employees for the changes and ensure a smooth handover of responsibilities.

Maintaining Control and Oversight

Establish strong governance frameworks to maintain control and oversight throughout the outsourcing process. Regular monitoring, performance reviews, and robust service level agreements should be in place to ensure that the service provider meets the desired standards and fulfils contractual obligations. This helps to maintain transparency and accountability.

Cultural and Organizational Fit

Consider the cultural and organizational fit between the financial institution and the outsourcing partner. Alignment of values, work ethics, and operational processes contributes to a successful partnership. A collaborative and compatible relationship between both entities enhances the overall outsourcing experience.

Financial institutions should minimise risks and optimise middle-office outsourcing benefits by taking proactive measures to address these issues and circumstances. Thorough assessment, thorough investigation, and efficient administration are necessary to guarantee a fruitful outsourcing collaboration and attain the intended results.

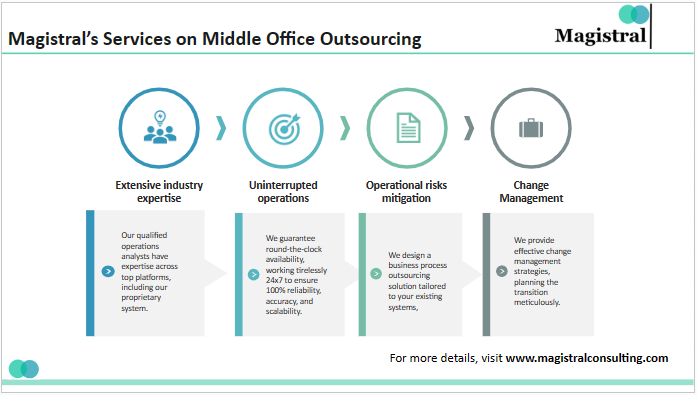

Magistral’s Services on Middle Office Outsourcing

Magistral’s Services on Middle Office Outsourcing

Magistral Consulting Services is a renowned industry leader, specializing in delivering extensive and customized solutions for middle office outsourcing. Leveraging our deep expertise and vast experience, we provide tailored services to financial institutions aiming to streamline their operations, achieve cost savings, and gain a competitive edge. Our comprehensive middle office outsourcing services cover a wide range of critical functions, including trade processing, risk management, compliance, portfolio valuation, and reporting.

Extensive Industry Expertise

Our team consists of industry experts who possess a wealth of operational and fund accounting knowledge gained from over two decades of serving the asset management industry. Our qualified operations analysts and accountants have comprehensive expertise across top platforms, including our proprietary system.

Uninterrupted Operations

We guarantee round-the-clock availability, working tirelessly 24×7 to ensure 100% reliability, accuracy, and scalability. Our middle-office services leverage a skilled workforce, digital processes, and innovative technology to provide exceptional support. This empowers you to maintain control while dedicating your focus to core activities and investment decisions.

Mitigation of Operational Risks

Through utilizing our services, you can expand your business without recruiting more staff or taking on more risk involving significant individuals. In addition to helping, you select and deploy the most suitable technology for your particular requirements, we can provide a business process outsourcing solution that is customized to work with your current systems. We provide strong controls, improve transparency, and reduce operational risk by leveraging digital processes and audit trails.

Change Management Strategies

We offer efficient change management tactics, painstakingly organizing the shift to reduce interruptions and guarantee a seamless transfer of duties.

Partnering with Magistral Consulting Services for middle office outsourcing equips financial institutions with the capacity to streamline operations, reduce costs, enhance efficiency, mitigate risks, and focus on their core competencies. We place the highest priority on data security, conducting thorough due diligence, and providing extensive support throughout the entire outsourcing journey.

About Magistral

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative:

visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com