Introduction

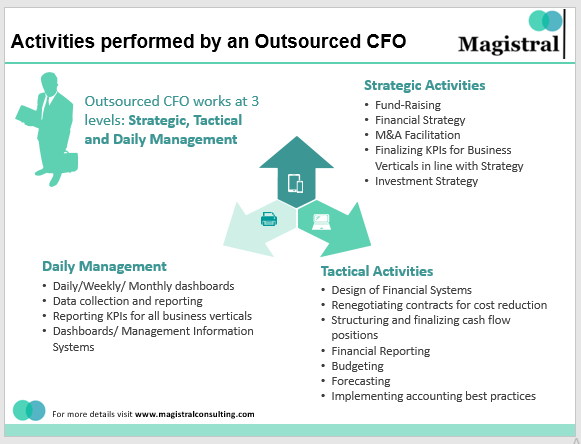

An Outsourced Chief Financial Officer (CFO) is a financial professional who delivers CFO services to other organizations. They add value to the business by providing the same level of expertise as an in-house CFO but at a lower cost. These financial professionals assist firms in managing their finances, improving financial performance, and making sound business decisions.

Traditionally, CFOs were responsible for managing the finance department, supervising accounting processes, and verifying the accuracy of financial accounts. They were also in charge of the company’s financial health and offered high-level financial advice to the management team. The CFO function has developed over time to include a greater variety of tasks. CFOs nowadays are expected to be well-versed in economics, to have strategic business expertise, and to be able to drive advancement and creativity. They must also negotiate complicated regulatory settings while dealing with rising business concerns like market volatility, technology change, and global rivalry.

Outsourced CFO services have emerged in response to shifting expectations and demands placed on CFOs. Outsourced CFOs provide firms with access to high-level financial expertise and strategic assistance without the cost and commitment of hiring a full-time, in-house CFO. This adaptable and cost-effective solution has grown in popularity among startups, small to medium-sized organizations, and major corporations.

Benefits of an Outsourced CFO

Outsourcing CFO services may assist organizations of all sizes improve their financial performance, manage risks, and meet their financial objectives while saving time and money. Needless to mention the availability of talent and worldwide access to it without incurring significant operating costs. These abilities are merely at the disposal of a third party, from which organizations might gain.

Benefits of an Outsourced CFO

Here are some of the advantages of hiring an outsourced CFO:

Knowledge and Skills

An outsourced CFO delivers an abundance of financial skills and experience to a company without the expense of employing a full-time CFO. This enables organizations to gain access to the financial management skills required to make educated decisions and achieve their financial objectives.

Reduced Expenses

Instead of recruiting a full-time CFO as part of the team and incurring the additional price of covering their salaries and benefits, you can hire an Outsourced CFO for a fraction of the cost and obtain the same level of service as if you had a CFO employee within your firm.

Adaptability

Depending on the demands of the organization, outsourced CFOs might work part-time or full-time. This enables firms to obtain the required financial management assistance without committing to full-time employment.

Prioritize Business Affairs

Outsourcing CFO services helps organizations focus on their core capabilities while experts handle financial management. Businesses can benefit from this by improving their overall performance and profitability.

Minimized Risk

A remote CFO can assist companies in managing financial risks such as credit, market, and operational risks. This can assist organizations in making educated decisions and avoiding costly errors.

Time Savings

An outsourced CFO maintains your financial strategy and aids you in ensuring you’re prepared for any financial emergency, with responsibilities for cash flow management, budget preparations, tax-saving plan, and contact with bankers, attorneys, and vendors.

Proficient

Outsourcing CFO services provide better professionalism, accuracy, and dependability in accounting service administration that meets the professional needs of enterprises and organizations.

Configurability

As a company grows, its financial management requirements may shift. Outsourced CFOs can provide scalable solutions that can adjust to changing corporate needs without requiring extra staff.

Choosing the right Outsourced CFO services

The suitable outsourced CFO should be a trusted partner who can provide your company with the financial management experience and insights it requires to succeed and develop. Outsourced CFOs can provide the business with perspectives that are unlikely to be found elsewhere. Furthermore, because of the nature of their job, they are usually up to speed on the latest software, tools, accounting standards, and trends in the industry.

Businesses can select an outsourced CFO who is the best fit for their specific needs and goals by taking these essential considerations into account:

Strategic Knowledge

Consider the outsourced CFO’s experience in the industry or market in which your company works. Look for an outsourced CFO with appropriate industry knowledge who can provide significant insights and recommendations to help the business succeed.

Services Provided

Examine the services provided by the outsourced CFO to ensure they are in line with your company’s specific financial requirements. Choose an outsourced CFO who can supply your firm with the services it requires.

Communication Skills

When working with an outsourced CFO, communication is essential. Look for a responsive outsourced CFO who communicates clearly and effectively. They should be able to convey financial ideas in simple terms to non-financial stakeholders.

Price Quoted

Consider the expense of hiring an outsourced CFO. While money is not the sole consideration, it is a crucial one. Look for an outsourced CFO who offers high-quality services at an affordable cost.

Availableness

Consider the outsourced CFO’s availability. Choose an outsourced, adaptable CFO who can meet your business’s needs.

References

Ask the outsourced CFO for references. Contact current and prior clients to learn about their experiences working with the CFO. This will allow you to conclude whether an outsourced CFO fits the business well.

Network

A capable outsourced CFO may cast a wide net for future referrals and obtain intelligent comments from their peers on a problem.

Education

A successful outsourced CFO should have a solid educational foundation in finance, accounting, or a comparable discipline, while also having extra certifications, industry-specific education, and continual professional development.

Magistral expertise in offering CFO services

Magistral provides Portfolio Management services for many types of company portfolios, such as Private Equity or a Venture Capital fund. We assist portfolio managers in centralizing their Marketing (primarily digital), Strategy (Fundraising and Exit), and Finance functions at a fraction of the cost of having specialized functions in each portfolio firm, large or small. The off-shored extended team also ensures no expertise is lost for similar projects across firms. Many company projects can run concurrently, prioritized according to the board meeting calendar. Of course, learning is interconnected across initiatives.

Magistral’s Expertise in Offering CFO Services

Our portfolio and services that we provide are as follows:

Strategy — Identifying add-on acquisitions and potential purchasers, funding, exit plan, growth strategy, and content marketing.

Analytics — Financial reporting and analysis, dashboard creation, data visualization, text cleaning and mining, predictive modeling, KPI tracking, and web scraping.

Sales — List development, CRM cleansing and administration, competitive intelligence, and social media management.

Financial planning — Budgeting, predicting, and updating competitive quarterly earnings.

Procurement — Spend analysis, vendor identification and management, spend base cost reduction, category strategy, RFP support, and procurement strategy.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative: visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com