In 2025, market strategy is no longer a supporting actor in the world of capital allocation—it is the script. Due to the accelerating pace of digital transformation, and the boldness of customer prospects, as well as the interests behind the scenes in the fight of political parties, investments not only need the efficiency of identifying and sourcing the market but also require the understanding and acquisition of the market to be implemented. How effectively a target firm can segment its market, differentiate its offering, and scale profitably influences not just its topline but also its exit multiple. In this landscape, strategy is capital.

From early-stage underwriting to portfolio management and eventual monetization, market strategy has evolved into a key determinant of risk, reward, and resilience. Today’s investors must ask not just “what does the company do?” but “How does it succeed—and is it possible to scale it sustainably?”

The Strategy Diligence Framework: Metrics That Matter

From Metrics to Market Mastery: A New Investor Lens

It is true that before finance and qualitative measures for productivity were the main contrast factors in enterprise valuation. Nowadays, the indicators of success still play a very important role for strategists, but they are too little in number. For investors, they now assess the company’s potential and figure out how much the market can grow beyond its current leading position. A constant growth SaaS company of 40% will be considered excellent, but if it doesn’t have a strong strategy straightened out by segments, the efficiency of customer acquisition, and retention that better be, then it will not have substantial growth post-investment.

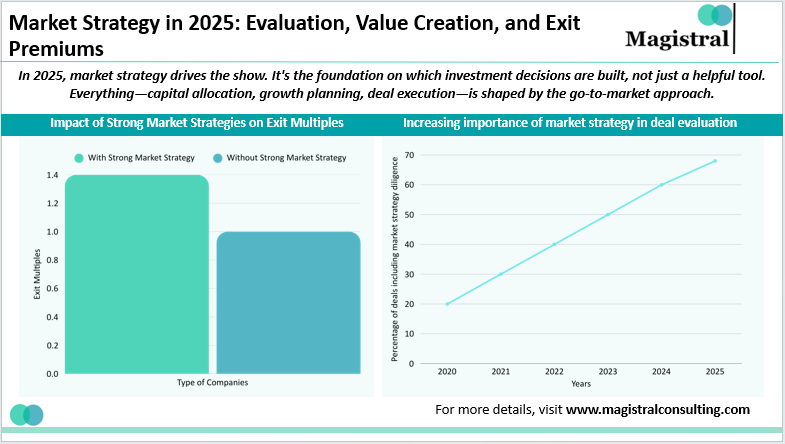

According to Bain & Co.’s 2024 Global Private Equity Report, 68% of deals now include a separate market strategy diligence stream. Investors are leveraging third-party firms to assess everything from product-market fit to customer behaviour analytics—long before a term sheet is signed.

Strategy as the Driver of Value Creation

For private equity firms, market strategy is now the pivot of the initial 100 days after acquisition. Top players such as TPG and Carlyle trigger immediate strategic overhauls—streamlining value propositions, realigning ICPs (Ideal Customer Profiles), and re-tuning pricing and channel strategies.

This movement away from old financial engineering towards strategic enablement is observable throughout. A McKinsey survey discovered that 45% of PE companies raised strategic engagement in portfolio firms over the past two years.

In VC, companies such as Sequoia and a16z are placing GTM advisors on cap tables, infusing strategy as early as Seed and Series A. They are focusing on channel testing, content-led growth, and GTM experimentation as requirements to scale—not merely as byproducts of it.

Market Strategy’s Role in Exit Premiums

Investment bankers recognize the connection between perception and valuation. For them, strategy drives perception—and in turn perception drives price. A well-defined go-to-market strategy, tested channels, and customer loyalty build a story of predictable growth, which buyers and public investors reward.

During M&A or IPO processes, the “Strategy” section in pitch books and S-1 filings has become a focal point for institutional investors. It signals sustainability. According to PitchBook, software companies with strong market strategies earn exit multiples 1.4x higher than those without. As such, investment banks are increasingly engaging with strategy consultants to sharpen positioning ahead of sell-side processes.

Four Megatrends Impacting Strategy

Data-Driven Targeting

Organizations are capitalizing on first-party and third-party data as a method of advancing campaign segmentation and increasing ROI. Enabled by platforms like Salesforce Einstein, Segment, and Clear bit, the segmentation of buyer behaviour is more profound, hyper-targeted engagement has become more practicable, and Customer Acquisition Cost (CAC) management takes much less time.

ESG as a Differentiator

Investors are rewarding brands that tell a clear ESG (Environmental, Social, Governance) story. Examples can be seen in Blackrock’s 2025 report on why companies that weave sustainability into their market communications can expect higher customer engagement and loyalty, critical factors that lead to sustainable alpha. Ultimately, this trend is about reconciliation around values (or at least perception).

The Rise of Vertical SaaS and Specialized Plays

Niche SaaS platforms that can support workflows within an industry have been generating outsized interest. With high retention, clear ICPs, and deep workflow integration, vertical SaaS businesses inherently possess a clearer, more defendable market strategy.

Omnichannel Execution

Especially in healthcare and consumer sectors, companies must master cross-channel execution. A blend of online, offline, mobile, and partner routes creates a “distribution advantage” that investors equate with durable revenue.

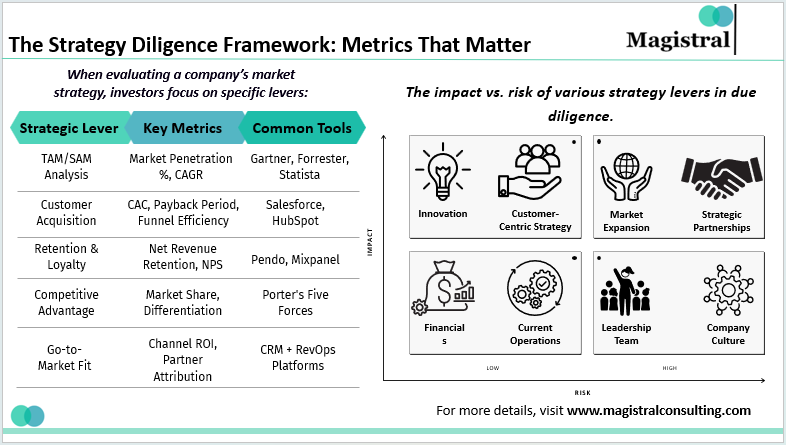

The Strategy Diligence Framework: Metrics That Matter

A well-articulated market strategy includes both qualitative and quantitative elements. Below is an illustrative chart based on CB Insights and Deloitte PE playbooks that shows where investors evaluate strategy levers during due diligence:

Market Strategy in 2025: Evaluation, Value Creation, and Exit Premiums

Data-Backed Proof: Strategy Drives Outcomes

Quantitative data highly corroborate the strategic perspective. Deloitte’s 2025 PE report states that 61% of general partners currently incorporate GTM evaluations into IC memos. Bain discovered that organizations with good market clarity cut post-acquisition revenue surprises by 33%.

These findings affirm what savvy investors already understand: strategy isn’t qualitative nonsense—it’s a measurable performance metric.

Example: Thoma Bravo’s strategy with Medallia

Thoma Bravo’s latest investment in Medallia is a clear example of how market strategy influences deal decisions. Rather than pursuing just scale,

- The firm saw an opportunity to expand Medallia’s market into adjacent verticals (e.g., insurance and financial services),

- Improve GTM execution through channel partners, and

- Tighten enterprise focus via vertical-specific product bundles.

This precision allowed them to reposition Medallia not just as a customer experience platform, but as a mission-critical vertical SaaS leader—improving pricing power and cross-sell potential.

Constructing Portfolios with Strategy Alignment

For investment managers, developing a strong portfolio in line with strategy is one of the best ways to help future performance. Firms like Capital Group and Wellington are using forward-looking strategy measures, in the context of stock picks, rather than simply historical earnings, in their analysis of companies, for things such as:

- Innovation pipeline

- Plans to expand into new markets

- Proposition of new customer-focused product development

- Strategic partnerships and ecosystem play

In an environment where generating alpha can be harder to achieve, being able to invest in companies with sound market strategy that is durable and articulated, provides distinct advantage.

Market Strategy Beyond the PE/VC Lens: Broader Business Implications

Its evolution does not solely pertain to the financial stakeholders of an organization. It is pushing marketing teams, product managers, and CEOs alike to re-think about growth. In 2025:

- 93% of marketers leverage AI to provide tailored engagement to customers

- Accordingto 73% of Millennials, they are willing to pay extra for products that have eco-friendly

- 81% of Gen Z buyers buy products from a brand based on environmental alignment

This highlights that it is not just a tool for capital allocators it is also the operating system for contemporary growth.

Conclusion: Clearly Defining the Strategy is Alpha

In 2025, smart money won’t simply follow the numbers, it will follow clarity of strategy. In the current, and evolving, investment environment, numbers tell a story—but strategy tells the future. Firms who clearly define how they acquire and retain customers, mix channels and differentiate their products will not just deliver stronger returns, they will also lower risk, improve predictability and drive long-term success.

Strategy is no longer just an appendix; it’s part of the underwriting, part of the value creation, and part of the exit premium. As market conditions fluctuate, one thing remains stable: the value of a company’s strategy in defining its investability. For today’s capital allocators, strategy is alpha.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How has the role of market strategy evolved in investment decisions?

Historically, financial metrics and operational KPIs dominated deal evaluations. However, in 2025, investors also prioritize scalability, defensibility, and go-to-market efficiency. Market strategy diligence has become a standard part of deal evaluation, with 68% of deals including a separate market strategy diligence stream.

What is the significance of market strategy in value creation for PE and VC firms?

For PE firms, market strategy is central to the first 100 days post-acquisition, involving strategic reviews and realignment of value propositions. VC firms embed GTM advisors early in the investment process, focusing on channel testing and GTM experimentation as prerequisites for scaling.

How does a strong market strategy impact exit premium?

A well-defined market strategy enhances exit multiples by creating a narrative of predictable growth. Companies with strong market strategies earn exit multiples 1.4x higher than those without, as they are perceived as more sustainable and valuable by buyers and public investors.

How do investors use market strategy to construct portfolios?

Investors develop strong portfolios by aligning with sound market strategies. This includes innovation pipelines, plans to expand into new markets, customer-focused product development, and strategic partnerships. A well-articulated market strategy helps in generating alpha and improving future performance.