In the modern environment where many investors are looking to make their different portfolios competitive, new databases have changed the way in which private equity (PE) and venture capital (and even asset management) firms fundraise. Rather than simply a means of collecting contact information, they have evolved in scope and function, offering targeted fundraising, deal-making, and investor relations capabilities. With the increase in competition, the expansion of capital markets, and because of big data, database is invaluable as an assistance to raising capital.

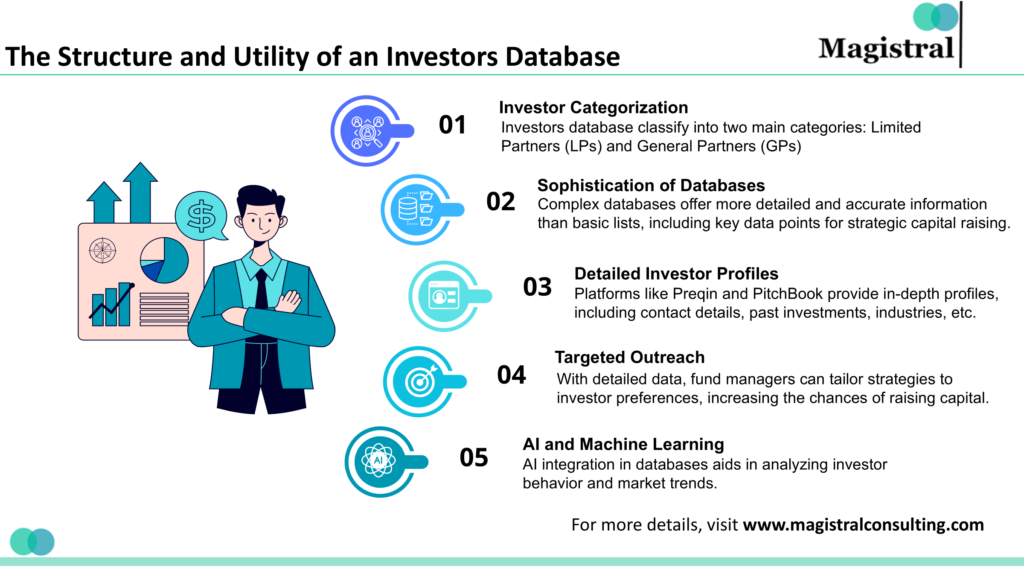

The Structure and Utility of an Investors Database

The database of investors is a tactical tool which provides information on the particulars of the investors, their likes and dislikes, enabling the fund managers to tailor their marketing and reach out initiative and create the best investment prospects.

The Structure and Utility of an Investors Database

Investor Categorization

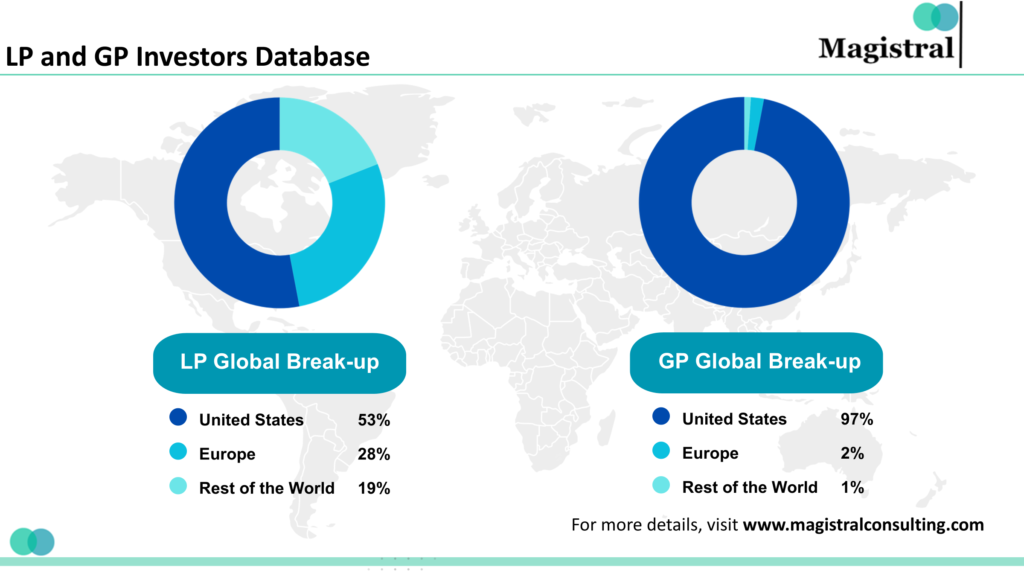

An investors database classifies the investors mainly in two categories Limited Partners (LPs) i.e. the providers of capital, and a range of institutional investors including pension funds, endowments, family offices, sovereign wealth funds, insurance companies, and fund of funds, and the second category consists of General Partners (GPs) who Are the fund managers that utilize the funds deposited by the LPs to invest in various ventures

Sophistication of Investors Databases

Analyzing the simple structure of basic investors databases vs complex contact databases. They contain far greater detail and accuracy than what is found in basic databases which makes the complex databases far superior. They also offer more information than any list of names that contains the relevant data points essential for making strategic choices when it comes to raising funds.

Detailed Investor Profiles

Market research platforms like Preqin, PitchBook, and CrunchBase provide rich profiles of individual investors consisting of the following contact details, past investments made, industries interested, the average amount spent per deal, risk tolerance, and locations targeted.

Targeted Outreach and Strategy

The more information available to fund managers, through investors database, the more relevant and customized strategies for outreach can be implemented to meet the individual needs of the investor. It also increases the likelihood of raising capital because investors, who have historically shown interest in their fund, are approached.

AI and Machine Learning Integration

In today’s dynamic marketing, these investors database has now got AI (Artificial Intelligence) in them and even machine learning packages. This is because these technologies are useful in behavioral analytics of investor’s preferences and propensities which in turn help us to keep tabs on economic and investment forecast trends enabling appropriate changes from the fund managers before the markets react.

The Growing Importance of Data in Fundraising

The increasing use of data for purposes of fundraising is of great importance in light of the sustained growth of the global private capital industry. Private markets’ assets under management (AUM) were estimated at $11.7 trillion in 2022, with projections to reach over $15 trillion by 2025. With more and more asset managers looking for funds, i.e. money, it is essential to have the proper equipment to deal with the related competition. An investors database provides the data-driven intelligence required to target LPs and ensure effective fundraising.

Precision Targeting with Investor Profiling

Investors database profiles are advanced features that allow GPs to classify LPs based on various factors such as investment history, sector, geographical region, risk appetite, and ticket size. This ensures that fund managers reach out only to the specific group of LPs in the investors database but it also complements the investment strategy of the fund, thus enhancing the efficiency of outreach efforts. Funds employing comprehensive investor profiling reduce their fundraising cycles significantly, as there is less effort on unnecessary meetings with non-targeted investors, and more focus on the right investors through investors database.

Enhancing Fundraising Efficiency with Data Analytics

Data analytics also aids fundraising activities in that it assesses the impact of outreach and enables managers to adjust their strategy during implementation. For instance, if the data reveals that the investment GPs are more likely to succeed when they meet the investors in person as opposed to online, then the investment GPs will prefer meeting the investors in person rather than on zoom which increases their chance of getting investors.

Real-Time Updates and CRM Integration

Investors database, such as Preqin and PitchBook, provide information about portfolio company limited partners’ activity on a real-time basis to the extent that general partnerships will always have the most current information to act on. This is especially useful as relying on these investors database structures prospects with the CRM system which does all follow-ups and some of the personalized emails automatically. Investor relations effectiveness and investor satisfaction rise for organizations that adopt integrated CRMs.

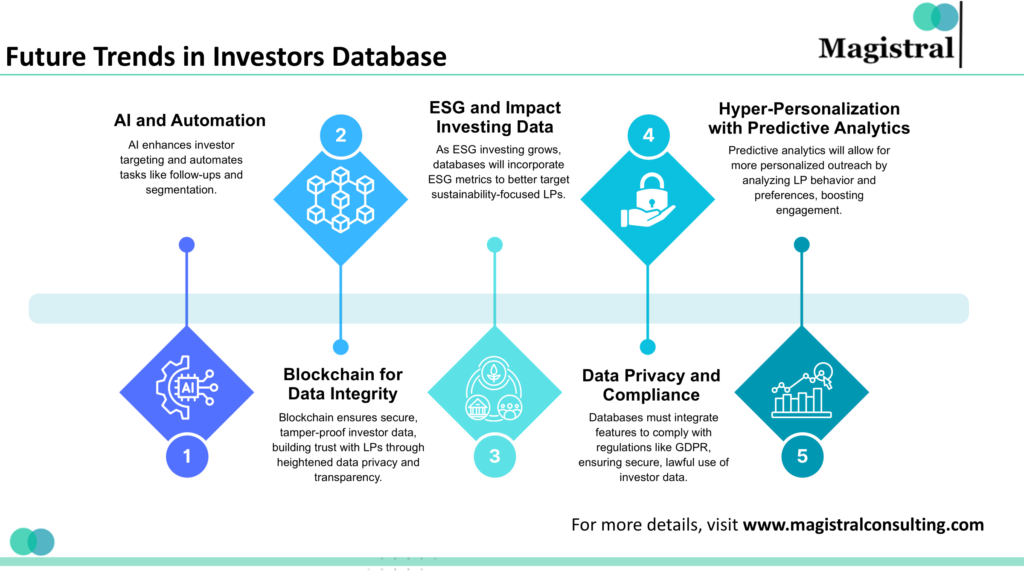

Future Trends in Investors Databases

As technology continues to evolve and LP preferences shift, several future trends are expected to reshape the way investors database are used in capital raising.

Future Trends in Investors Database

AI and Automation

AI will continue to play an increasingly prominent role in automating investor outreach and refining targeting strategies. As predictive analytics tools become more sophisticated, GPs will be able to forecast investor behavior with greater accuracy, allowing for hyper-personalized engagement strategies. These developments will further streamline the fundraising process by automating routine tasks such as follow-ups and investor segmentation based on engagement patterns.

Blockchain for Data Integrity

Blockchain technology has the potential to enhance the security and transparency of investors database. By using blockchain to store investor data, GPs can ensure that information is immutable and tamper-proof. This heightened security can build trust with LPs, especially as concerns around data privacy and compliance continue to grow.

ESG and Impact Investing Data

With ESG investing on the rise, investors database will increasingly need to incorporate ESG metrics and impact investing data. GPs will need to leverage databases that allow them to segment LPs based on their commitment to sustainability, ensuring that ESG-focused funds can target the right investors.

Hyper-Personalization Through Predictive Analytics

Predictive analytics will continue to drive hyper-personalization in fundraising outreach. By analyzing past investment behavior, market conditions, and LP preferences, future databases will offer curated investment opportunities to LPs, improving the relevance of outreach efforts and maximizing engagement.

Data Privacy and Compliance

As global data privacy regulations become stricter, investor’s databases will need to ensure compliance with regulations such as GDPR in Europe and similar laws in other regions. This will require databases to integrate compliance features that protect LP data and ensure its lawful use in fundraising activities.

Magistral’s Database Features

Magistral Consulting’s investors database services aim to give a competitive advantage in capital raising through the provision of comprehensive, data-oriented tools. We offer the following services:

LP and GP Investors Database

Affordable Cost

The investor database of Magistral is one of the most affordable available in the market which also makes it applicable to smaller funds and newcomers.

Guaranteed Relevant Leads

The subscription to the database offers 500 relevant leads that are fitted to the needs of every client to enhance outreach.

Essential Fundraising Information

It contains significant particulars such as email addresses and telephone numbers of investors to ensure that they can be reached directly for any fundraising activities.

Data Integration through APIs

The internal systems of the business can be integrated with the database as APIs are made available for easier management of data.

Custom Research Support

Support of an analyst for the custom research is provided for the clients, thus allowing even more personalization of the service to fit specific business requirements.

Scope of Database and Customized Lead Generation

Diverse Investor Categories

There is a wide range of investor types with 5,000+ Limited Partners, 17,000+ General Partners, 6,500+ Angel Investors, 6,500+ HNIs, and 10,000+ investors covering all investor categories in Magistral’s database.

Detailed Lead Information

Every lead comprises requisite details, for instance: the name of the entity, its nature, i.e., Family Office, PE, VC, country, contact person’s name, designation, email, LinkedIn page and the address of the company, in order to cover all the bases for outreach.

Customized Lead Generation Service

Upon database access, clients provide their preferred investor type, industry focus, and geographical scope. Within three weeks, Magistral will have delivered 500 leads that will fit these requirements and will contain current and relevant contacts.

Delivery and Timelines

Timely Delivery of Customized Leads

Custom lead lists are provided no later than three weeks following of the final confirmation, therefore meeting the client’s demands in a timely manner.

Dedicated Client Support

Every client is assigned a dedicated point of contact who constantly supports the client throughout the project. This is to ensure the convenience of the clients.

Output Formats

The deliverables are available for clients in both MS Excel and MS Powerpoint applications which enables their easy incorporation into the clients’ work processes.

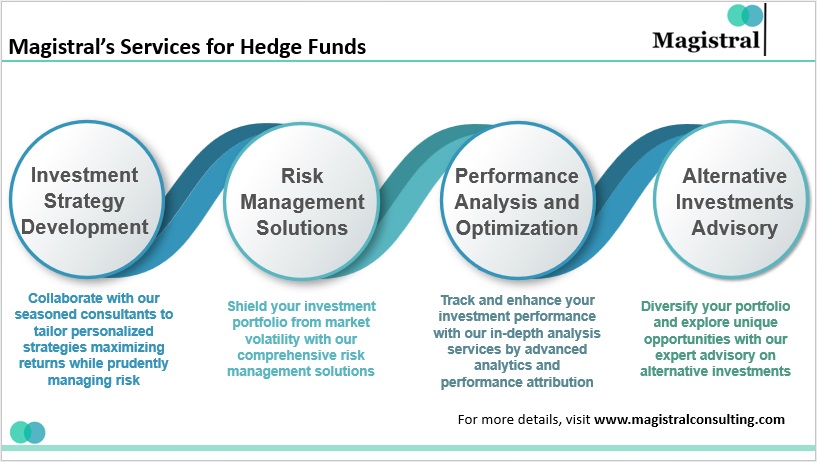

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com

What types of information are included in an investors database?

An investors database typically contains details such as investor contact information, investment history, industry preferences, risk tolerance, geographical focus, and preferred deal size. Advanced databases also track real-time activities, allowing fund managers to adjust strategies accordingly.

How does AI improve the functionality of investors databases?

AI enhances investors databases by analyzing investor behavior, preferences, and market trends. It helps predict investor responses and improves targeting by offering personalized outreach strategies. This results in more effective fundraising and stronger investor relationships.

What role does ESG play in modern investors databases?

ESG (Environmental, Social, and Governance) metrics are increasingly important for many institutional investors. Investors databases now include ESG-related preferences, enabling fund managers to identify and engage with investors focused on sustainability and responsible investing.