Investment banks hold a crucial position in offering various types of research services for the clients from the financial industry, particularly the buy-side entities. Some of these clients are asset management firms, hedge funds, pension funds, insurance financial institutions, and private equity among others who rely on the services of investment banks to gain relevant information and recommendations that could help in decision making regarding investments.

Non-transactional activities are other areas where investment banks can assist. With all these advantages in place, these firms rely on their skills, capital, and economic insight to deliver customized research services that will meet the needs of their institutional clients. Therefore, investment banks assist institutional investors to search for investment opportunities or yields, evaluate the risks inherent in companies, industries or macroeconomic factors affecting them, and necessarily, manage portfolio performance. Investment banks have to maintain a strategic relationship with the clients to understand their investment goals, risk tolerance level or their preferences regarding sectors and so on so forth, through this process, investment banks have to make sure that the research reports have some valuable tips for the clients.

The reasons for institutional investors relying on buy-side research generated by investment banks include the following. It gives them a good source of information about the market trends, industry or group of stocks, etc, thereby enabling them in decision making. Besides, it also assists them in unearthing alpha opportunities and risks for making investment decisions. It also assists institutional investors in understanding the latest regulatory changes, shifts in global political climates, and other macroeconomic factors affecting returns on investment.

Types of Buy-Side Research

Research arms of investment banks also provide a number of reports that vary depending on different categories of institutional investors. These categories are relevant when try to organize and categorize buy-side research activities, while some intersections may occur depending on the objectives of the research.

Types of Buy-Side Research

Equity Research

This is used in examining single stocks, with emphasis being put on the fundamental and relative analysis, performances, and growth projections of stocks. Equity research reports are comprised of estimates of Corporates’ future earnings, the intrinsic value of the Corporates and advice on investing in stocks, managing a portfolio etc.

Fixed Income Research

In a way of analysing credit state, yield, and some level of interest rate change, the type of research covers correlating bonds with debt securities. Reports offer the framework to evaluate trends in bond issuers, credit ratings, and markets to effectively and efficiently maintain optimal fixed-income portfolios together with managing interest rate risk.

Macroeconomic Analysis

Examining broad economic trends such as GDP growth and inflation, this analysis identifies market opportunities and risks. Reports offer insights into economic indicators, central bank policies, and global market dynamics, aiding investors in strategic asset allocation and risk management.

Industry Research

Industry research presents information regarding certain industry, its trends within the industry, stated relationships between players in the specific industry and shifts in the regulatory environment. Such reports investigate market size, growth conditions, and legal restraints to facilitate the investment decision-making process by analyzing risks in certain sectors.

Thematic Research

Although focused on newer trends such as ESG investing or disruption technology, this research is valuable to investors with long horizons. Research produces estimates assessing drivers, investment recommendations, and factors of concern related to a specific theme to help investors integrate themes into their investment plans.

Benefits of Buy-Side Research

Benefits of Buy-Side Research

Informed Decision-Making

Buy-side research enables institutional investors to gain knowledge on the market, environment, and security. This assists them in making the right decisions when investing in various activities. In this way, they can find good investment prospects and develop a more accurate portfolio approach.

Risk Mitigation

It offers an exhaustive analysis of individual companies, sectors, and macroeconomic factors. Overall, through considering aspects such as balance sheets, competition and legislations, the investors can be in a position to mitigate some of the risks since they are able to avoid high risks.

Alpha Generation

A key motivation of buy-side research is generating Alpha, or returns above a particular index. Through ‘stock picking,’ which involves detailed examination of a company’s balance sheet and issuing research to locate mispriced securities, investors can achieve better returns per unit of risk.

Portfolio Diversification

It also assists investors in expanding their portfolios both across various asset types, industries, and geographical locations. This does not concentrate much in one sector and makes the overall portfolio to be very strong. In this way, financial investors can invest in a diversified portfolio by means of gaining insights from different analyses of various sources.

Competitive Advantage

It is, hence, expected that very few institutional investors use buy-side research to create a lead over their competition. It helps them identify new trends, analyze the potential of the market, and invest in opportunities others cannot see. In this manner, they will remain relevant to new trends in the market and to research findings, hence helping position them in ways they can outperform the rest.

Long-Term Perspective

The ability to take a long-term view about what is really driving investment performance empowers investors to construct resilient portfolios that help one get through short-term market ups and downs and deliver stable returns over time.

Research Process followed by Investment banks

Gathering of data

Reputable information is to be collected for financial reports, industry reports, official filing, and market data.

Financial Analysis

During this stage, the analyst considers the data gathered using various techniques or tools from financial analysis. It may be done by ratio analysis, cash flow analysis and forecast, and discounted cash flow evaluation to analyze and compare the health and performance of firms.

Qualitative Research

Other than the standard financial analyses that might be performed, qualitative techniques are utilized to understand the underlying market environment and competition landscape.

Scenario Analysis

Assessing how different scenarios might affect investment returns, in light of factors such as the state of the economy, changes in legislation and policies, and political risks. It is important to note that the use of the scenarios assists investors to evaluate the robustness of their implemented investment strategies and test for risks and opportunities.

Client Collaboration

It also means that there is constant coordination to ensure that the research solutions achieved are in tune with the client goals. Investors are asked to provide feedbacks and inputs as to how the research reports are relevant to the investment requirements, including investment strategies, risk tolerance and preferred sectors.

Customization and Presentation

The research reports can be developed specifically to meet the needs of this or that client.

Compliance and Quality Assurance

Measures are put in place for research activities to adhere to the legal requirements and other requirements of the trading standards such as conflict of interest, insider trading and Material Non-Public Information. Compliance professionals manage the research processes to ensure adherence to all applicable regulations and that the research products are honest, accurate, and impartial.

Industry Trends

Alternative Data Sources

Growing demand for non-traditional data sets, including satellite imagery and social media sentiment analysis.

ESG Integration

Stable growth in the integration of environment, social and governance into the research process related to investments.

Technological Advancements

AI, Machine Learning, and NLP Adoption for Quick Analytics, Personalization of Research, and Student Retention

Collaborative Approach

Closer collaboration between investment banks and institutional clients in jointly creating a customized research solution

Dynamic Landscape

Evolving trends highlight the need for investment banks to adapt and innovate in the buy-side research space.

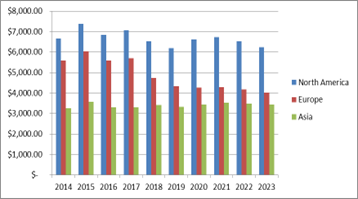

Buy-Side Spending on Investment Research

Buy-side investment research spending dropped by 3.5 percent in 2023 to $13.7 billion, 19.4 percent below the peak of 2015. Financial uncertainty in markets, falling banks, high interest rates, and weak initial public offer markets, couple with changes in regulation with regard to the payment for research, are drivers. Sell-side and independent research has been in decline; large fall in fundamental equity research.

Buy-Side Research Services by Magistral Consulting

Customized solutions for Equity Research

Magistral Consulting excels in the delivery of equity research solutions customized for its clients. These include fundamental and relative analysis, performance evaluation, and projection of growth potential of single stocks. Magistral adds amazingly valuable detailed reports pointing out future earnings estimates and intrinsic value assessments that would really help an investor to make wise decisions while investing in stocks and managing a portfolio.

Comprehensive Fixed Income Analysis

Magistral Consulting offers in-depth fixed income research on credit states, yields, and interest rate changes. Its reports consist of frameworks for assessing bond issuer trends, underlying markets, credit ratings, and interest rates. It assists its clients in maintaining optimal fixed-income portfolios along with empirical management of interest risks.

In-Depth Macroeconomic Analysis

Focusing on broad economic trends—GDP growth, inflation—Magistral Consulting delivers macroeconomic analysis that pinpoints the opportunities and risks in markets. Their judgments about economic indicators, the policy of central banks, and the dynamics of global markets assist investors in the key areas of strategic asset allocation and risk management.

Industry and Thematic Research Expertise

Magistral Consulting focuses on a wide array of industry-specific research with a view to providing insights into the size of the market, its growth conditions, and changes in its regulatory shifts. Not only that, but they also undertake thematic research on such emerging trends as ESG investing and disruptive technologies, thus guiding their linking by investors into long-term investment strategies.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What is buy-side research in an Investment bank?

Buy-side research encompasses an entire gamut of research services provided to institutional investors such as asset management firms, hedge funds, pension funds, and private equity. More definitely, it would be the research that helps clients make the right kind of investment decisions based on market or company/industry/macro trends and corporate and macroeconomic facts.

What are the types of Buy-Side Research offered by an Investment Bank?

The buy-side services of an investment bank involve equity, fixed income, macroeconomic, sector/industry, and thematic research.

How does buy-side research control risk?

Buy-side research controls the risks by facilitating assessments at the corporate, sector, and macro levels for the investors. This actually enables awareness and avoidance of the high-risk potential investments since the analysis includes points on balance sheets, competition, and regulatory changes.

Why is alpha generation important in buy-side research?

This would matter due to the fact that alpha generation attempts to generate return in excess of a benchmark index. Buy-side research helps the investor in identifying mispriced securities through in-depth company analysis, thereby aiding the investor to extract better returns for every unit of risk taken.

Why are institutional investors benefited by buy-side research?

Buy-side research Institutional investors utilize it for onboarding wise decision-making, mitigating the risks involved, diversifying the portfolio, achieving a competitive edge, and attaining a long-term perspective. It helps an investor to look for investment opportunities, manage associated risks, and work on resilient port.