Introduction to Sell Side and Buy Side

The financial world is full of transactions of all sorts. Whenever a transaction happens, there is a party who sells the asset and there is another party that buys the asset. The party selling the asset is the sell-side and the party buying the asset is the buy-side. Assets could be private or public companies, real estate, and other financial assets that give returns or value appreciation over time. Buy-Side research plays a vital role in the success of a transaction.

The parties could be an Investment Bank, A broker, A Company, A Hedge fund, An asset manager, or any other type of entity owning the asset or representing the owner

What is Buy-Side Research and Analytics?

Buy-Side Research and Analytics concern with identifying the full potential of the asset that is being bought. It attempts to answer the following crucial questions about the asset being transacted. Finding the asset itself to buy is the most crucial part of the Buy-side research

– Does the asset have the potential to generate returns or value appreciation over time?

– Is the asset valued rightly?

-Are there any risks associated with the asset? If yes, what are the risks?

-Is everything makes sense from a legal point of view?

-Are the documents right and portray the complete picture?

-Are there any other assets that may be more suitable?

Buy-Side research attempts to uncover all aspects of the asset to ensure the transaction achieves its objectives of maximizing returns for its investors

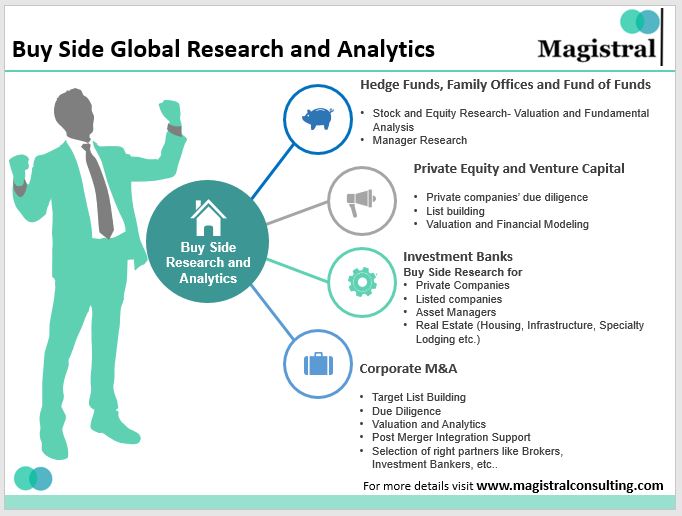

Buy-Side research is a regular function at institutions like Investment Banks, hedge Funds, Family Offices, Fund of Funds, Private Equity, Venture Capital and M&A departments in Corporates

Types of Buy-Side Research

Buy-side research could either be categorized as per the asset class like public companies, private companies, funds, etc. or as per the institutions like Investment Banks, Fund of Funds that undertake them

Buy-Side Research Types

Buy-Side Research- Hedge Funds

Hedge funds operate on multiple investment themes. However, the most common one, the long-short equity hedge fund uses the buy-side research which is predominantly equity research. This comprises researching the stocks which are being taken a position on, long or short. A fundamental analysis using methods like DCF or comparables is quite popular with hedge funds. Apart from researching the stocks, the industry, or geography, or any other aspect related to the stock or Hedge funds’ investment theme is also researched. For hedge funds that take positions for the long term for a few stocks, the research is fairly detailed.

Buy-Side Research- Family Office

There is no set template or scope for buy-side research when it comes to family offices because investment mandates of family offices vary greatly. In family offices, buy-side research is mostly about equity research, manager research, asset research, and private company due diligence. Quite a lot of partner and broker research is also common. Equity research as with hedge funds revolves around the fundamental analysis of the listed stocks. Manager Research is about finding asset managers who could deliver superlative returns as per the investment thesis of the family office. A typical example of this would be say finding hedge funds that are investing in China and have delivered more than 10% returns annually over 10 years or more, with moderate or little risk. The assignment involves the collection and analysis of huge data to find the best performing hedge fund managers for the family office.

Asset research is done for family offices with an investment philosophy around a specific asset. A typical example here would be getting into the details of a Real Estate asset deal or a Real Estate fund or a cryptocurrency-based fund. Family offices work with all types of brokers, investment agents, and investment banks. Finding the right partner who has experience in the relevant area of investment and offers a competitive fee for the services is also common for family offices to research.

Buy-Side Research- Fund of Funds

Fund of Funds and Family Offices research funds to park their money. Here buy-side research concerns about finding the best manager to manage the funds. Information is collected on dozens of fund managers, analyze their performance for an objective evaluation on their potential to generate alpha.

Buy-Side Research- Private Equity and Venture Capital

Private Equity firms deal with both private and public companies whereas venture capital firms solely deal with private companies, sometimes very small ones. Buy-side research here revolves around the due diligence of the companies that are intended to be invested in. Another important aspect of the research here is finding the targets that fulfill the criteria for investments. A typical assignment would be to generate a list of all the SaaS firms with revenue more than $10 million, looking for Series B or beyond, with presence in the United States and products centered around blockchain. This is typically followed by profiling the right set of companies for investments or acquisitions. For smaller companies, there is primary research that is done to talk with people who may have information about the industry and the company

Buy-Side Research- Investment Banks

Research here acquires as many types as the investment banks themselves. It can range from Equity Research as in the case of hedge funds or list generation and company profiling as in the case of Private Equity or Manager Research as in the case of Limited Partners or Fund of Funds. The only difference here is that Investment Banks perform these tasks for their clients who may be looking for investments

Buy-Side Research-Corporate M&A

Bigger corporates continually evaluate targets for synergies with their business. Inorganic growth is a well-accepted way to grow. Not only growth but companies evaluate targets to acquihire, getting a tech, enter geography or industry or to eliminate competition. Buy-Side research in these cases pertains to building target lists as per the acquisition criteria and profiling companies.

Characteristics of High-Quality Buy-Side Research

Whether one is looking to outsource Buy-side research or building an in-house function. These are the qualities of good buy-side research, that should be paid attention to:

Characteristics of high quality buy side research

Depth of Research

Research on the surface seems easier, but intellectual curiosity is required to get into the depth of the information presented. A company that appears to be satisfying a criterion may not have any business in the key area that is the source of synergies. This requires studying lots of data and information to make sure if the target has all the right attributes for evaluation. Primary research and ghost interviews help the cause of getting into more details. Asking the right questions to management and analyzing the documents provided by the company holds the key to get into in-depth research.

Rapid Research

Deals are time-bound. Sometimes it requires quick and dirty analysis and other times it requires studying hundreds of documents over months. Whatever is the case, your outsourcing partner needs to be reliable about sticking to the promised timelines. Sharing interims before the finalized deliverables help too.

Expertise

Expertise in buy-side research ensures research is being done the right way. It ensures the right questions are being asked, the right information is being sought and the information is analyzed with all relevant angles to arrive at an objective opinion. Buy-side research outsourcing partner needs to be an expert in the financial sector generally and buy-side research particularly

Outcomes

All the research that does not yield any outcome is useless. Researching a target and then not acquiring it because of red flags pointed by research is still an outcome, which saves millions of dollars for the client. Whatever is the case the research outsourcing partner needs to keep an eye on the business outcomes of their research activities.

Accountability

Most research partners are great order-takers. If a list is to be generated, it is generated as suggested. But a great research services partner goes a step further and takes accountability. After making the list from secondary research, they do primary research to make sure the information collected from secondary sources is correct. They ask the right questions from Asset Managers to ensure the client gets what they are looking for and not “unverified” data in an excel sheet.

Engagement Flexibility

A great buy-side research outsourcing player offers complete flexibility to their clients, with scalable engagement models, and have contracts that carry no significant exit barriers. Whatever is the engagement model the work quality is not hampered

Magistral Consulting has helped multiple Investment Banks, Family Offices, Hedge Funds, and Private Equity firms in outsourcing buy-side research functions. It has clients based out of the United States, the United Kingdom, Europe, and Australia. To drop an inquiry get in touch here

About Magistral

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The Author, Prabhash Choudhary is the CEO of Magistral Consulting and can be reached at Prabhash.choudhary@magistralconsutling.com for any queries or business inquiries.