Introduction

Investment banks are engaged in the business of sell side research services to broad categories of clientele within the financial industry. The main clientele, however, remains those involved in the business of sourcing funds or selling securities, and they include corporations, financial institutions, management companies, private equity, venture capital firms, and so on, that remain on the sell side of the market. One must also consider that the provision of sell side research is not some sort of service that investment banks, exalted with deep expertise, immense capital, and exceptional understanding of the markets at their command, offer in their purely transactional capacity. Rather, it is a researched service that is for their sell-side clients.

It is through this intense market segmentation, company analysis, and critical examination of the various factors that may characterize the market that investment banks help clients to make the right decisions, deal with challenges in the markets, and realize their strategic goals.

There are several reasons why a sell-side client would look up to an investment bank. This research will help to enrich their understanding of market trends and investment opportunities, strategic management, optimize capital allocation, and embolden movement amidst regulatory and macroeconomic challenges.

Types of Sell Side Research

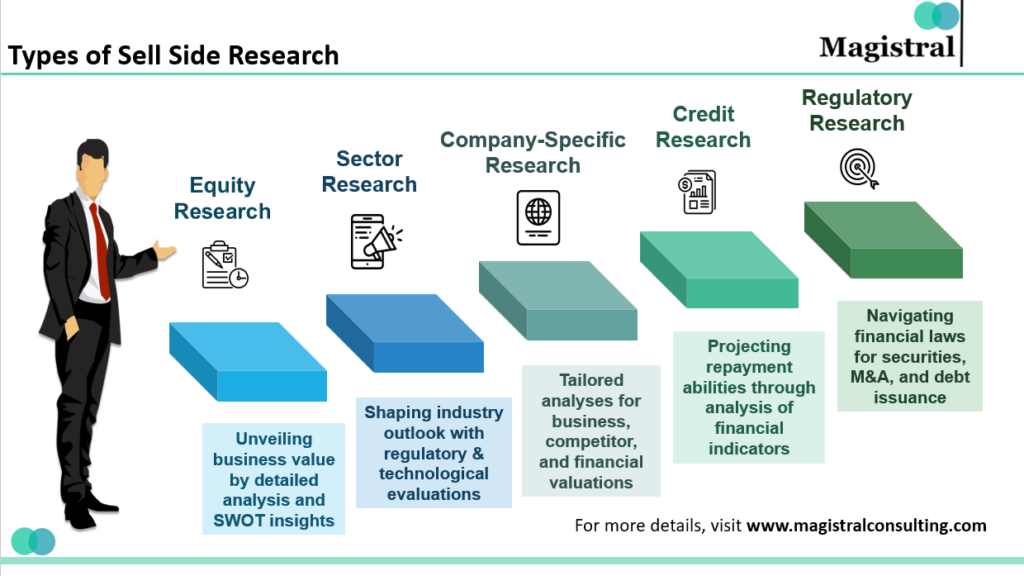

Types of Sell-Side Research

Equity Research

Equity Research refers to the study of individual business entities listed with the stock bourse, the historical performance of the business, expected performance, and models for the calculation of business values. This research also helps in determining the rightful price of IPO, secondary offering, or equity placement at times of underwriting. Therefore, with an accurate breakdown of the SWOT analysis, it allows investment banks to get the right target audience and come up with attractive marketing materials for their sales and trading divisions.

Sector Research

General outlook for large industries and their evolution; this would involve evaluations of, among other factors, economic, regulatory, and technological that impact a certain industry.

Target Identification & Valuation: Sector research helps in the identification of possible acquisition targets in a growing industry for M&A, and their valuation is assessed based on industry benchmarks for Debt Capital Markets.

Market Risk Assessment: Understanding the debt levels in an industry, the trends in financing, and associated risks aid in the designing of appropriate debt instruments for clients on the Debt Capital Markets and evaluating potential risks in prospective mergers and acquisitions.

Debt Pricing & Market Conditions: Research into interest rates, credit spreads, or studies about investor demand in an industry segment dictate the debt pricing for their offerings in the debt capital markets.

Company-Specific Research

Clients may require Company-directed research because of the nature of the business and the services that are rendered. This may further include the development of difficult tools for business financial analysis, competitor analysis, or even valuation reports.

M&A Due Diligence & Valuation: This consists of special studies concerning certain companies of interest to a client, including financial projections or competitive analysis or valuation, if needed.

Underwriting Due Diligence: Done for Underwriting itself, it provides elaborate analysis of the financial health, risk factors, and growth potential when a company issues an IPO or, similarly, secondary offerings.

Structured Finance Collateral Evaluation: It refers to estimating credit quality in the underlying assets for structured finance transactions, whether loans or any other type of account receivables.

Credit Research

Credit Research refers to analysis used to project an estimate of the ability of a company or government to repay lent money. It entails researching companies’ revenues, balance sheets, growth rates, debt levels, and other economic indicators.

Debt Issuance Structure: The quantum of interest, the time period for which money is borrowed, and the conditions for its repayment to obtain the lowest possible borrowing cost—based on the credit rating of the firm volumes issuing the debt.

Investor Targeting: Knowledge of investors’ preferences about various credit ratings means that advisors are able to approach the right investors for debt issuance, to achieve the right placement of the debt.

Regulatory Research

Research in laws and rules related to various financial transactions, such as the offering of securities, merging, acquisition, and debt issuance.

Compliance and Risk Mitigation: That every activity on the part of the client under the regime of pertinent regulations mitigates probable legal or financial risks.

Deal Structuring: Considering the associated regulatory requirements, advisors structure transactions in such a way so as to ensure that the legal and compliance standards for its execution process go smoothly.

Impact of Sell Side Research on Client’s Decision

Investment decisions

It is through investment banks that institutional investors are given specific information on stocks, sectors or industries in stock markets which have the power to influence investments in buying, holding or selling of shares. Corporate customers use these reports to gauge market sentiment and investor perceptions, helping them with strategic decisions regarding capital allocation, acquisitions, divestments and financial planning.

Risk Management

The sell side research assists clients to analyze risks associated with their investments or business strategies by giving them an insight into market trends, regulatory changes, competitive dynamics as well as macroeconomic factors. These reports are used by institutional investors who would like to assess risks and adjust their portfolio allocations so as to minimize possible losses and maximize risk-adjusted returns.

Accessing Capital Markets

Corporate clients receive help from investment banks in accessing capital markets through underwriting securities offerings such as secondary offerings (debt issuances), IPOs together with other forms of financing where a thorough research and analysis of the market exists behind it. These activities enhance the confidence of both firms’ investors as well as attracting interested parties thereby making it easier for them to exploit profitable opportunities.

Strategic Decision-Making

Research has been found to produce actionable opinions and strategic recommendations for sale-side customers that are specific to their goals and situations. Companies use such deductions to sharpen operational strategies, identify expansion opportunities, counteract competitive threats, and boost stockholder worth.

Stakeholder Communication

Reports not only provide sell side clients with a rich source of information for investor relations, but they also help in providing useful information to other stakeholders including the regulators, analysts, investors and media. Credibility and transparency in well-researched reports contribute towards building trust as well as collaboration among key stakeholders.

Benefits of Sell Side Research

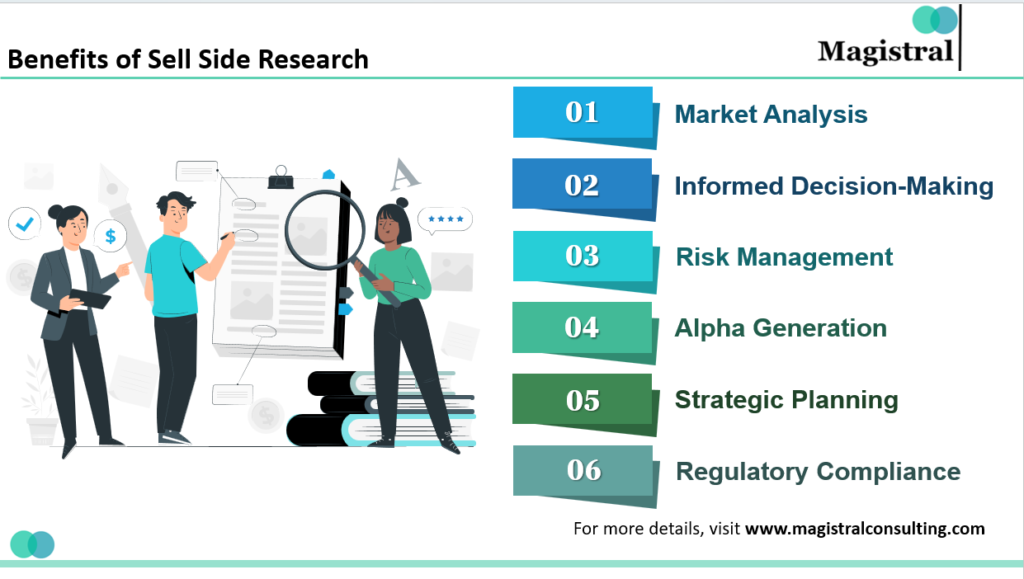

Benefits of Sell Side Research

Market Analysis

The investment banks perform a thorough market analysis of the industry dynamics, market trends and individual securities thus providing our clients with important information about emerging trends in the market.

Informed Decision-Making

Through essential research reports, an investment bank guides its clientele towards making a satisfactory investment decision on the basis of sound analysis and data.

Risk Management

Sell side research helps clients identify, estimate, and address the potential risks associated with investment alternatives or strategies, in an effort to institute effective risk management systems toward minimizing potential losses.

Alpha Generation

It is through these institutions that most investors generate returns known as alpha since such companies discover low-priced stocks, possible mergers as well and some other activities which are presently undervalued by the entire market hence leading them to outperform other similar entities.

Strategic Planning

The insights given by sell side research enable our clients to formulate and improve their strategic plans through an understanding of the direction of industry trends, competition, and expansion opportunities.

Regulatory Compliance

The financial institutions try to get ahead of the regulatory change while remaining within the ambit of current legislation through its purposeful communication to the customers about any changes or updates in regulations concerning the investments.

Magistral Consulting’s Services on Sell Side Research

Magistral Consulting specializes in sell side research and related superior services, thereby helping clients navigate financial markets optimally and justify respective decisions in the best possible manner.

Complete Equity Research

Magistral Consulting maintains thorough equity research on organizational business entities represented by listed shares on a stock exchange. This will include historical performance reviews, future performance projections, and business valuation models. The company sees that IPOs, secondary offerings, and equity placements are priced satisfactorily with comprehensive SWOT analysis. Research of this nature helps an investment bank in focusing on the target audience or preparing marketing materials for their sales and trading divisions.

Sector Research and Market Insights

Magistral Consulting provides full-scale sector research, analyzing the key industries based on various economic, regulatory, and technological issues. The services also provide insight into potential acquisition targets, estimate market risks, and measure debt levels by sector. Taking interest rates, credit spreads, and investor demand into account, it advises debt pricing strategies that ensure the best market conditions for a client in the debt capital markets.

Customized Company-Specific Research

Company-specific researches are customer-focused analyses that form the magistral consulting company’s offerings to clients. These include general investigative due diligence, M&A due diligence, financial projections, competitive analysis, and valuation reports. The firm also provides underwriting due diligence, which entails an overall assessment of financial health, risk factors, and growth potential at initial public offerings and secondary offerings. Their structured finance collateral evaluation helps estimate credit quality for a range of structured finance transactions.

Credit and Regulatory Research

Magistral Consulting excels in credit research, which deals with projecting the ability of a company or government to repay principal and interest. The analyses applicable in such a case are revenues versus balance sheets, growth rates, and economic indicators. This investment firm structures debt issuance to yield the lowest possible borrowing costs and tailors just the right mix for targeted investors for placements. Moreover, Magistral Consulting provides regulatory research on compliance issues much needed in dealing with mitigation in financial transactions. Their advisors structure deals to meet legal standards and meet execution smoothly, in a manner devoid of any controversy. The wide scope of sell side research services by Magistral assists clients with actionable insights to help them navigate financial markets and strategize goals.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What are the types of sell side research prepared by the investment bank?

The various kinds of sell side research provided by investment banks include equity, sector, and company-specific research, together with credit and regulatory research.

How does equity research assist the clients of investment banks?

Equity research also enables client investors to analyze business units listed on the stock markets, to interpret the right price for IPOs and secondary offerings, to conduct a SWOT analysis for device hinterland target audience, and to frame the right marketing material.

What is the role of sector research in sell-side services?

Sector research defines the key sectors, identifies acquisition targets, quantifies market risks, and makes a case for the pricing strategy of debt so that the most optimal conditions for the client are brought to the fore in the capital debt markets.

How does sell-side research influence client decision-making?

Sell-side research professionals should enlighten clients on trends in markets, regulatory changes, competitive dynamics, and macroeconomic factors in the best possible way to provide better ways of investment decisions, risk management, capital market offering, strategic planning, or communication with stakeholders.