Introduction

A crucial component of fund management in the realm of private equity and venture capital is soliciting money from limited partners (LPs). However, given the cutthroat environment of the investing sector, finding and interacting with potential LPs can be a difficult endeavor. A Limited Partners Database can be used in this situation as a strong tool to speed up the fundraising process and open up investment prospects. A Limited Partners Database is a thorough database of prospective investors interested in contributing money to venture capital and private equity funds. It helps fund managers, investors, and other stakeholders find potential LPs, interact with them, and manage their relationships with them. In this article, we’ll examine the value of a Limited Partners Database and all of its features and advantages.

The private equity and venture capital sectors prosper when they can raise money from investors to invest in ventures with strong potential for growth. However, the battle for capital has grown fierce as a result of the market’s growing number of funds and LPs. A well-maintained Limited Partners Database can give fund managers a competitive edge in this market. It provides a centralized database of data about possible investors, allowing fund managers to quickly find and target LPs compatible with their fund’s objectives and investment strategy.

Efficiency is a key advantage of utilizing a Limited Partners Database in fundraising. Fund managers can streamline their efforts by utilizing the database to manage investor relationships, track communications, and maintain up-to-date information on investor preferences and commitments. This allows for targeted communications and updates, enhancing the fundraising efforts by providing relevant information to potential LPs. Fund managers can also analyze investor data from the database to identify trends, preferences, and areas of interest, which can inform their fundraising strategies and increase their chances of success.

Due diligence is another crucial aspect of the fundraising process, and a Limited Partners Database can significantly aid in this process. The database provides valuable insights into potential investors’ historical investment activity, portfolio composition, and performance. Fund managers can analyze this information to assess the suitability of potential LPs based on their investment track record, risk appetite, and alignment with the fund’s investment strategy. This helps fund managers make informed decisions about partnering with the right LPs for their funds, mitigating potential risks, and maximizing returns.

Transparency and effective communication with LPs are essential for building trust and maintaining long-term relationships. A Limited Partners Database enables fund managers to generate timely and accurate reports on fund performance, distributions, and other relevant updates. It also helps in tracking investor inquiries, requests, and feedback, enabling fund managers to provide timely responses and address investor concerns. This transparency and effective communication foster investor confidence, strengthen relationships and increase the likelihood of repeat commitments from LPs.

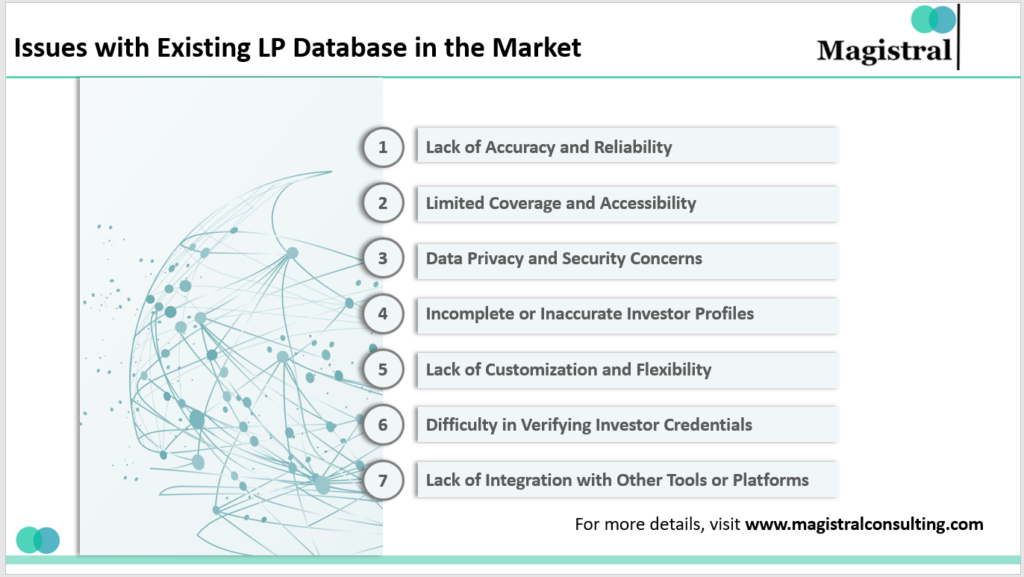

Issues with existing Limited Partner Databases in market

Currently, there are some issues with the limited partner databases, available in the market. Let’s look at some of these major issues:

Issues with Existing LP Database in the Market

Lack of Accuracy and Reliability:

One of the primary challenges with limited partner databases available in the market is the accuracy and reliability of the data. The information on potential investors may not always be up-to-date, comprehensive, or verified. This can lead to incorrect or incomplete investor profiles, causing fund managers to waste time and resources on pursuing investors who are not a good fit for their fund.

Limited Coverage and Accessibility:

Another issue with some limited partner databases is the limited coverage of investors. Not all databases may have a comprehensive list of potential LPs, and some may focus on specific geographies or industries, limiting the options available to fund managers. Additionally, the accessibility of the database may be restricted, requiring costly subscriptions or memberships, which can be a barrier for smaller fund managers or startups.

Data Privacy and Security Concerns:

Privacy and security of investor data are critical concerns in today’s data-driven world. Fund managers need to ensure that the limited partner database they are using complies with data protection regulations and maintains robust security measures to safeguard investor information. Breaches or mishandling of data can lead to legal and reputational risks for both the fund manager and the LPs.

Incomplete or Inaccurate Investor Profiles:

Many limited partner databases rely on self-reported information provided by investors themselves. However, this can result in incomplete or inaccurate profiles, as investors may not always update their information or may provide inconsistent details across different platforms. This can lead to fund managers making decisions based on incomplete or unreliable data, potentially resulting in wasted efforts or missed opportunities.

Lack of Customization and Flexibility:

Some limited partner databases may lack the flexibility and customization options needed to cater to fund managers’ unique needs and preferences. Fund managers may require specific search filters, analytics, or reporting features to effectively identify and engage with potential LPs. If the database does not offer such customization options, it may limit the usefulness and effectiveness of the tool for fund managers.

Difficulty in Verifying Investor Credentials:

Verifying the credentials and legitimacy of potential LPs is a critical aspect of due diligence for fund managers. However, some limited partner databases may lack robust verification processes or rely solely on self-reported data, making it challenging for fund managers to assess the credibility of potential investors. This can expose fund managers to the risks of partnering with unsuitable or fraudulent investors.

Lack of Integration with Other Tools or Platforms:

Fund managers may use a variety of other tools and platforms to manage their fundraising and investor relations efforts. However, some limited partner databases may lack integration capabilities, making synchronizing data or streamlining workflows difficult. This can result in duplicate efforts, manual data entry, or inefficient processes, reducing the overall effectiveness of the limited partner database.

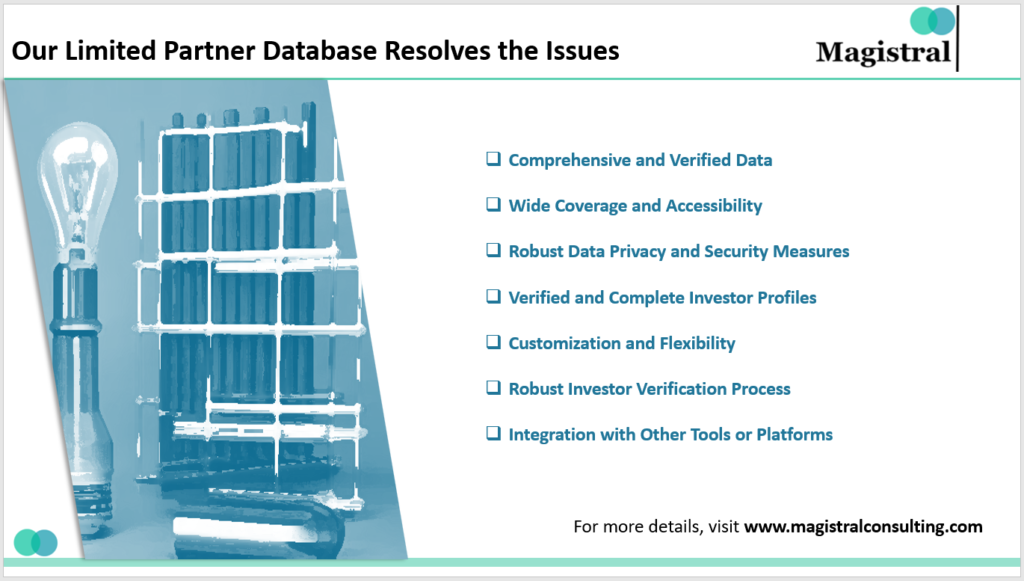

How Our Limited Partner Database resolves the issues

Our limited partner database has the following key characteristics and supporting activities to tackle the various issues with limited partner databases in the industry:

Our Limited Partner Database Resolves the Issues

Comprehensive and Verified Data:

Our limited partner database addresses the issue of accuracy and reliability by ensuring that the data on potential investors is comprehensive, up-to-date, and verified. We use multiple sources to gather data and verify it through rigorous validation processes, ensuring that fund managers have access to accurate and reliable investor profiles.

Wide Coverage and Accessibility:

Our limited partner database offers wide coverage of potential LPs, including investors from diverse geographies and industries. We strive to provide an extensive and diverse list of potential LPs, giving fund managers a broad range of options to choose from. Additionally, our database is easily accessible without any costly subscriptions or memberships, making it accessible to fund managers of all sizes.

Robust Data Privacy and Security Measures:

We prioritize data privacy and security in our limited partner database. We comply with all relevant data protection regulations and maintain robust security measures to safeguard investor information. We ensure that investor data is handled securely and confidentially, mitigating the risks of breaches or mishandling of data.

Verified and Complete Investor Profiles:

Our limited partner database ensures that investor profiles are complete and verified. We use a combination of self-reported information and third-party validation to create comprehensive investor profiles, reducing the chances of incomplete or inaccurate data. This enables fund managers to make informed decisions based on reliable and complete information.

Customization and Flexibility:

Our limited partner database offers customization and flexibility options to cater to fund managers’ unique needs and preferences. We provide various search filters, analytics, and reporting features that can be customized to suit the requirements of different fund managers. This allows fund managers to effectively identify and engage with potential LPs based on their specific criteria.

Robust Investor Verification Process:

Our limited partner database has a robust investor verification process in place. We verify the credentials and legitimacy of potential LPs through multiple channels and sources, reducing the risks of partnering with unsuitable or fraudulent investors. This helps fund managers in their due diligence process and ensures that they can assess the credibility of potential investors accurately.

Integration with Other Tools or Platforms:

Our limited partner database is designed to integrate seamlessly with other tools or platforms that fund managers may use for their fundraising and investor relations efforts. We provide integration capabilities to synchronize data and streamline workflows, reducing duplicate efforts and manual data entry. This enhances the overall effectiveness and efficiency of the limited partner database.

Magistral’s Limited Partner Database

Limited partner databases are essential tools for private equity and venture capital firms to manage and leverage their investor relationships. These databases provide comprehensive information on limited partners, including their investment preferences, portfolio size, and track record, which can help firms identify potential investors and tailor their fundraising efforts. Here are some key services offered by our limited partner databases for clients:

Access to comprehensive and up-to-date investor data:

Limited partner databases offer access to a wealth of investor data, including contact information, investment history, and fund commitments. This enables clients to have a complete and up-to-date picture of potential investors, helping them make informed decisions in their fundraising efforts.

Customized search functionality:

Limited partner databases often come with powerful search functionality that allows clients to filter and sort investors based on specific criteria, such as location, investment size, or investment focus. This customization helps clients narrow down their search and identify the most relevant limited partners for their fundraising campaigns.

Secure and confidential data management:

Data security and confidentiality are given top priority in limited partner databases, protecting client and investor information from unauthorised access or breaches. Customers may rest easy knowing that their private information and investor relations are secure and handled in accordance with applicable laws.

Dedicated customer support:

We provide dedicated customer support and assistance to clients, ensuring that they receive prompt help and guidance when needed with the database. This can include technical support, training, and consulting services, helping clients maximize the value they get from the limited partner database.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com