ESG – An Introduction

With increasing changes in business needs and businesses tuning onto global trends like climate change and responsible corporate social responsibility, ESG Investing has emerged as one of the hottest trends in corporate parlance and governance. Its imperative then it is considered while making investment decisions aka ESG investing

ESG stands for Environmental, Social, and Governance. It is a non-mandatory part of financial reporting. But as it stands out, to differentiate itself from others as well as the need to project itself as a responsible company with a truly global outlook more and more companies are incorporating them in their financial reports.

Although much needs to be done on this front, there are bodies like the Sustainability Accounting Standards Board (SASB), Taskforce on climate-related Financial Disclosures (TCFD), and Global Reporting Initiative (GRI) that have taken on themselves the onus of setting standards and benchmarks for the companies to follow through. The oldest framework of course is the GRI which has been adopted by more than 13,000 organizations in more than 90 countries.

The market for green bonds has boomed. According to a report by Climate Bond Initiative green bonds are set to reach $400 Bn to $500 Billion in 2021 which is nearly double than that in 2020 when its value was $270 Billion.

According to BAML, 90% of bankruptcies in the S&P 500 during the period 2005-15 were of companies with low ESG scores.

Not only big companies but this is also bound to have an impact on how institutional investors decide on their investment targets.

Emerging Trends in ESG Investing

Global sustainable investment is now more than $30 Trillion which is a tenfold increase in spending since 2004. The coronavirus pandemic has further led to much unrest and the onus is now on the companies to create a resilient, sustainable, and responsible organization.

To illustrate the above factors, let us for instance focus on the trending issue of climate change which is a pressing environmental concern. Climate change is a challenging global problem and it requires us to think in different ways in not only understanding the key problems but also think in different ways in how we can reduce greenhouse emissions. It requires adapting not only new technologies but more importantly a human mindset whenever we try to address this problem.

Similar is the case with social compliance. As the world diversifies into a seemingly single entity where the borders between nations are blurring. So, is the pace of change in organizations where key studies in organizational behavior and strategic human resources management are compelling one to take a different view of how organizations should operate. Since the times of Peter Drucker and his theories on management, it has but become imperative to adopt these management concepts in a manner that not only broadens the viewpoints of the individual but also of the organization at large.

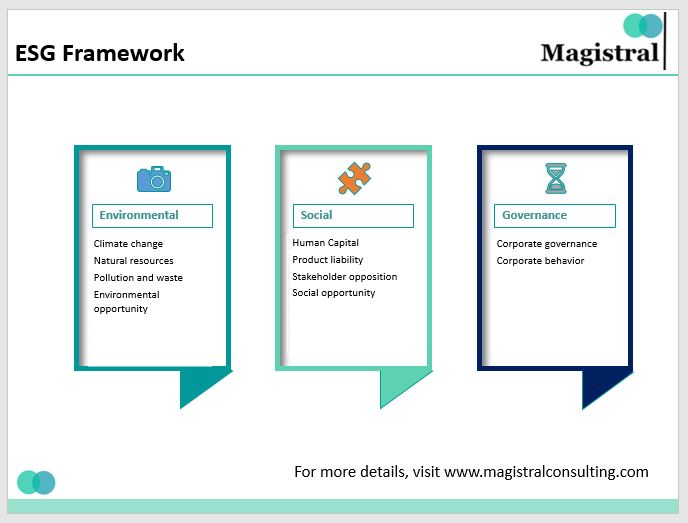

Although there are several ESG frameworks in practice, for simplicity’s sake a sample ESG framework has been given below.

ESG Framework

Companies are benchmarked on these standards although there are more standards to abide by. Each ESG framework allocates a different criterion and scorecard based upon which the companies are rated and then an overall score is provided.

Impact of ESG on Business and Investing

There are a few major points that affect how business functions when it comes to ESG factors influencing them.

1. Company reporting – As discussed above we are still in a working stage when it comes to industry benchmarks set by boards like SASB, TCFD, and GRI. Hence, the companies who comply with their norms are more likely to have the first-mover advantage and consequently be viewed as long-term responsible companies both in the eyes of the clients as well as the shareholders.

2. Impact on investor analysis and decisions – Investors rely on a mix of internal and external data when it comes to making decisions as to investing in a particular company. In fact, there are ratings provided by companies like Magistral consulting which help investors in decision making.

3. Responsible investor reporting – An increased ESG compliance gives companies a key advantage in regions such as Europe which are looking to adhere to the new standards. Besides it is a matter of time before these standards become a norm rather than a guideline

4. Improvements in productivity – Significant cost reductions and operational efficiencies are achieved by companies that have adopted these frameworks.

5. Better resource utilization– ESG frameworks adoption ensure better long-term utilization of resources (eg. plant and machinery) when considered over a long term

6. Increased environmental awareness among consumers– Thanks to climate change becoming a hot topic in the recent decade, consumers have now become more socially aware and more than 65% of them are willing to pay a premium for “green goods”

7. Greater employee productivity – When employees look at a company that is committed to environmental and social causes as well as following good governance practices it has been observed that companies see greater loyalty as well as ownership among its employees simply because the company cares for issues that are over and above itself

A pertinent question to ask is how does it affect sectors like private equity and hedge funds? The answer is that they are more likely to invest in companies with ESG compliance especially after the aftermath of the COVID 19 pandemic. They have started to incorporate ESG factors into their decision making which is why they have invested close to $21 Billion into ESG focused funds in 2019 alone.

According to a survey business ethics, bribery and corruption and occupational health and safety were the top 3 factors when it came to private equity investments with more than 80% of respondents citing it as the top factors. Other factors included waste management, employee development, and talent attraction and retention.

A sample ESG scorecard: A sample ESG scorecard of Magistral consulting is given below to show how ESG is benchmarked and rated.

Magistral’s Sample ESG Scorecard

The best way to incorporate ESG in investing decisions

Though ESG and its impact on investments are growing exponentially, it’s still a relatively new development. Expertise is limited.

If one is interested in incorporating principles of ESG in investment decisions, the best way to go about it is by outsourcing the research and analysis process to an expert service provider like Magistral

Magistral not only brings years of expertise in evaluating investment opportunities from an ESG lens, but it does also so in a very cost-effective way by combining expertise with outsourcing to locations where the assignment could be delivered cost-effectively.

The result is more robust investment decisions with savings in operations costs!!

Why Magistral consulting?

Magistral consulting offers solutions in the following categories –

ESG policy and frameworks- Magistral consulting ensures that appropriate ESG policy and frameworks are applied to the company as would best fit their requirements.

Target company due diligence (financial, operational, and ESG)- Performing adequate due diligence not only in terms of financial but also ESG compliance standards.

ESG scoring, rating, and benchmarking—A value-added service where companies are rated and scored as well as benchmarked as per the standards laid out in the ESG framework.

ESG compliance monitoring- Magistral consulting also ensures that not only are companies benchmarked as per the standards laid out in the ESG framework but they are also following the norms once it comes to the day-to-day running of activities in the organization. This is what is called ESG compliance monitoring.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

The article is an effort of the Marketing function of Magistral Consulting. For any business inquiries, you could reach out to prabahsh.choudhary@magistralconsulting.com