Introduction

Portfolio and fund management are integral to financial success for both individuals and institutions. Whether you’re an individual investor aiming to grow your wealth or a professional fund manager entrusted with significant sums on behalf of clients, understanding the principles and strategies of portfolio and fund management is essential. In this guide, we’ll explore the fundamentals of portfolio and fund management, including key concepts, strategies, and best practices to help optimize your investment approach and achieve your financial goals.

Understanding Portfolio Management

Portfolio management involves strategically allocating assets to achieve specific investment objectives while mitigating risk. Portfolios can comprise various asset classes, such as stocks, bonds, real estate, commodities, and alternative investments. The primary goals of portfolio management include capital preservation, capital appreciation, and risk mitigation.

Diversification serves as a fundamental principle in managing portfolios, involving the allocation of investments across various asset classes, sectors, and geographic regions. This approach aims to mitigate the risk of substantial losses resulting from the underperformance of individual investments. Asset allocation, another critical element, entails determining the optimal combination of assets based on factors such as risk tolerance, investment horizon, and financial objectives.

Strategies for Portfolio Management

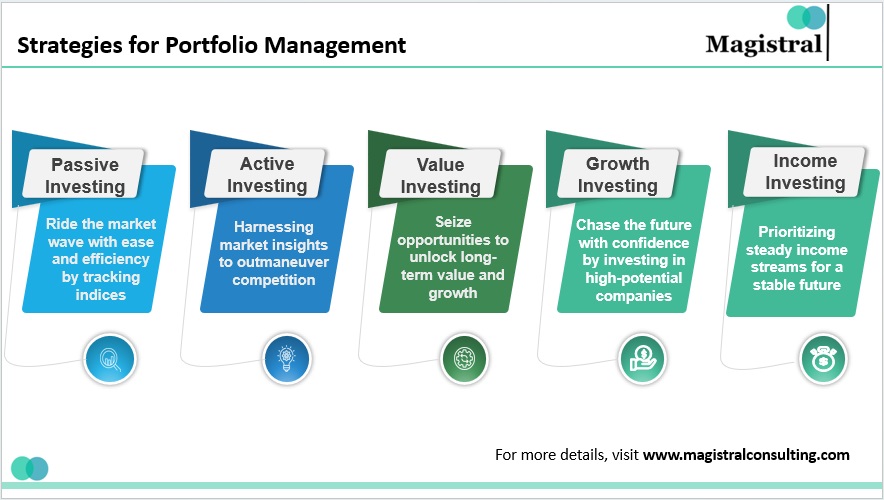

Several strategies can be employed in portfolio management to achieve specific objectives:

Strategies for Portfolio Management

Passive Investing

Passive investing refers to a strategy where investors track a market index or benchmark using low-cost index funds or exchange-traded funds (ETFs). The objective of this approach is to mirror the performance of the overall market while keeping fees and transaction costs minimal.

Active Investing

Active investing entails actively buying and selling securities in an attempt to outperform the market. This strategy requires thorough research, market analysis, and continuous monitoring of portfolio holdings.

Value Investing

Value investing revolves around identifying undervalued securities trading at prices below their intrinsic value. Investors following this strategy seek to capitalize on market inefficiencies and generate long-term returns.

Growth Investing

Growth investing focuses on investing in companies with strong earnings growth potential. While this strategy typically involves higher levels of risk, it can lead to significant capital appreciation over time.

Income Investing

Income investing emphasizes the generation of a steady income stream by prioritizing dividends, interest payments, or rental income. This strategy is commonly favored by retirees or investors seeking reliable cash flow.

Risk Management

Risk management is a vital component of portfolio management, playing a central role in protecting against potential losses and safeguarding capital. Various techniques are utilized to effectively manage risk, thereby ensuring the resilience of the portfolio in the face of market volatility and unforeseen circumstances. Below are some common risk management techniques:

Asset Allocation

Asset allocation is a fundamental aspect of managing risk. It entails distributing investments across various asset classes like stocks, bonds, real estate, commodities, and others. By diversifying investments in this manner, investors seek to reduce reliance on any single asset or market. This diversification strategy plays a crucial role in mitigating the impact of underperformance in one asset class on the overall portfolio, thereby enhancing its stability and resilience.

Portfolio Rebalancing

Regularly assessing and adjusting a portfolio is vital to ensure it stays aligned with the investor’s risk tolerance and investment objectives. Market shifts and fluctuations in asset performance may lead to deviations from the desired asset allocation over time. Portfolio rebalancing involves selling assets that have appreciated substantially and reallocating the proceeds into underperforming assets. This approach aims to uphold the intended asset allocation and risk profile of the portfolio.

Stop-loss Orders

Utilizing stop-loss orders is a proactive risk management strategy designed to curb potential losses within a portfolio. These orders establish a predefined price at which a security will automatically be sold if its price drops to that level. By employing stop-loss orders, investors safeguard their investments from substantial declines in value, thus lessening the impact of unfavorable market shifts on the portfolio.

Hedging Strategies

Hedging strategies involve using derivative instruments such as options or futures contracts to reduce potential losses in a portfolio. These strategies are aimed at protecting against adverse price movements in specific securities or asset classes. For example, investors might use options to hedge against downside risk in their equity holdings or utilize futures contracts to hedge against fluctuations in commodity prices. By hedging against potential losses, investors can minimize the impact of unfavorable market movements on the overall value of their portfolio and fund management.

Fund Management: Overview and Strategies

Fund management encompasses the supervision of pooled investments, such as mutual funds, hedge funds, or pension funds, on behalf of investors. Fund managers bear the responsibility of making investment decisions, executing trades, and overseeing the fund’s assets in accordance with its defined objectives and investment strategy.

Types of Funds

Mutual Funds

Under the direction of qualified fund managers, mutual funds combine the capital of several individuals to make investments in a variety of securities.

Hedge Funds

Hedge funds are non-traditional investment vehicles that use a variety of methods to produce returns for investors. These strategies include global macro, event-driven, and long-short equity.

Exchange-Traded Funds (ETFs)

Exchange-traded funds, or ETFs, are financial instruments that are exchanged on stock exchanges and track the performance of a certain index or asset class.

Pension Funds

Employers set up pension plans as assets for investment to give their staff members retirement benefits. In order to generate returns over time, these funds usually invest in a variety of stocks, bonds, and other assets.

Fund Management Strategies

Fund management strategies encompass a range of approaches used by fund managers to achieve specific investment objectives while mitigating risk. These strategies are tailored to the unique goals, risk tolerances, and market conditions faced by investors. Here are some common fund management strategies:

Fund Management Strategies

Benchmarking

Fund managers often compare the performance of their funds against relevant benchmarks or indices to assess their relative performance.

Active vs. Passive Management

Fund managers must decide whether to adopt an active or passive investment approach based on their investment philosophy and market outlook.

Risk Management

Fund managers employ various risk management techniques, including diversification, hedging, and portfolio optimization, to mitigate risk and protect investor capital.

Performance Evaluation

Evaluating fund performance involves analyzing key metrics such as risk-adjusted returns, alpha, beta, and Sharpe ratio to assess how effectively the fund has achieved its investment objectives.

Regulatory Environment and Compliance

Fund managers operate in a highly regulated environment, subject to oversight by regulatory authorities such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Compliance with regulatory requirements is crucial to maintaining investor trust and confidence.

Services Offered by Magistral Consulting for Portfolio and Fund Management

With a full range of services designed to satisfy the various demands of investors and businesses, Magistral Consulting is a shining beacon of excellence in the financial services industry. Magistral Consulting is a company that is dedicated to providing exceptional and innovative services in a range of fields, including Portfolio and fund management and outsourced CFO services.

Portfolio Management

Portfolio management is the cornerstone of successful investment strategies, and Magistral Consulting excels in this arena. Leveraging a combination of in-depth market analysis, risk assessment, and strategic asset allocation, Magistral Consulting helps clients optimize their investment portfolios to achieve their financial objectives. Whether it’s maximizing returns, minimizing risk, or aligning investments with specific goals, Magistral Consulting provides personalized portfolio management solutions tailored to each client’s unique needs.

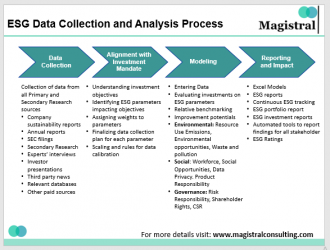

ESG Compliance Monitoring

Environmental, social, and governance (ESG) aspects play a major role in influencing investment decisions in the contemporary socially conscious world. Magistral Consulting helps customers navigate complex ESG rules and integrate sustainable concepts into their investment strategies by offering ESG compliance monitoring services. Magistral Consulting helps clients make informed investment decisions that align with their beliefs and long-term sustainability goals by evaluating ESG risks and opportunities.

Outsourced CFO and Financial Reporting

Magistral Consulting provides outsourced CFO services to companies looking for strategic financial assistance without the overhead of a full-time CFO. Our seasoned CFOs offer complete financial management support catered to the requirements of each client, encompassing everything from budgeting and forecasting to financial planning and analysis. Furthermore, Magistral Consulting is an expert in the compilation and reporting of financial statements for Portfolio and fund management guaranteeing the precision, adherence, and openness of financial reporting procedures.

Business Development Support for Portfolio and Fund Management

Magistral Consulting goes beyond traditional financial services, offering business development support to help clients identify growth opportunities and expand their market presence. Whether it’s identifying add-on acquisitions or potential buyers, creating market and consumer strategy studies, or providing procurement support, Magistral Consulting partners with clients to drive business growth and success. Furthermore, for fund managers seeking efficient fund administration and accounting solutions, Magistral Consulting offers outsourced fund administration services, streamlining operations and enhancing fund performance.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com