Introduction

ESG investing has, of late, emerged as one of the most crucial sustainable investing solutions that is fast changing the financial markets. The elements of environment, society, and governance are considered by ESG elements and investors in investment decisions to create a sustainable future and gain better returns on money. It’s a strategy towards responsible investment that includes a company depending on their environment, their social responsibilities, and governance practices. The article covers growth factors, impact, and various strategies related to ESG investing. This thereby gives its importance and profitability relating to ESG investing in the US and European markets.

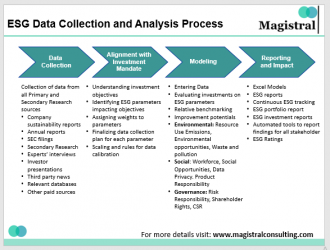

How to Engage in ESG Investing

Negative Screening

Negative screening is where companies or sectors whose activities or mode of operation bring damage to the environment or society, or raise ethical concerns, are excluded. For example, a company dealing in tobacco products and arms manufacture would, by default, compulsorily be outside an ESG investor’s investable universe. In another way, this means that using this approach, investments would align as best possible where investor values and ethical standards will be taken into consideration.

Positive Screening

Positive screening invests in those firms that seem to have better ESG performance or taken huge steps toward sustainability. A fund should look out for companies that clean up the environment or society. For example, an ESG investor can invest in companies that deal in clean energy, such as Tesla which designs and manufactures electric vehicles and other sustainable renewable energy products.

ESG Index Investing

ESG index investing strategies involve tracking one of the many available indices created by firms with desirable ESG practices. A host of ESG indices are used to preselect and select companies to comply with ESG criteria. For instance, a real estate investor can take an investment in the Vanguard ESG U.S. Stock ETF, which tracks the index of the FTSE US All Cap Choice to get to companies with exposure to the U. S. marketplace and high ESG performance.

ESG Exchange-Traded Funds (ETFs)

ESG ETFs are investment funds that track ESG-based indices or a basket of firms. They provide convenience and liquidity for investors to maintain a diversified pool of ESG-compliant assets. For example, iShares MSCI ACWI ESG Universal ETF is an index fund with wide coverage of firms that depict leading ESG practices.

Green Bonds

Green bonds are fixed-income investments designed to fund projects in the cause of the environment. They are mostly issued by governments, municipalities, or even corporations to develop renewable energy, clean transport, or even sustainable infrastructure projects. For example, the State of California has green bonds for setting up new solar energy projects, hence providing an investor with an opportunity to earn interest through investment in a clean energy initiative.

Impact Investing

Impact investing is an investment that generates measurable positive social or environmental impact, alongside financial return. Investors seek opportunities reflecting their values and specifically designed to meet such challenges as affordably priced housing opportunities or projects in clean energy.

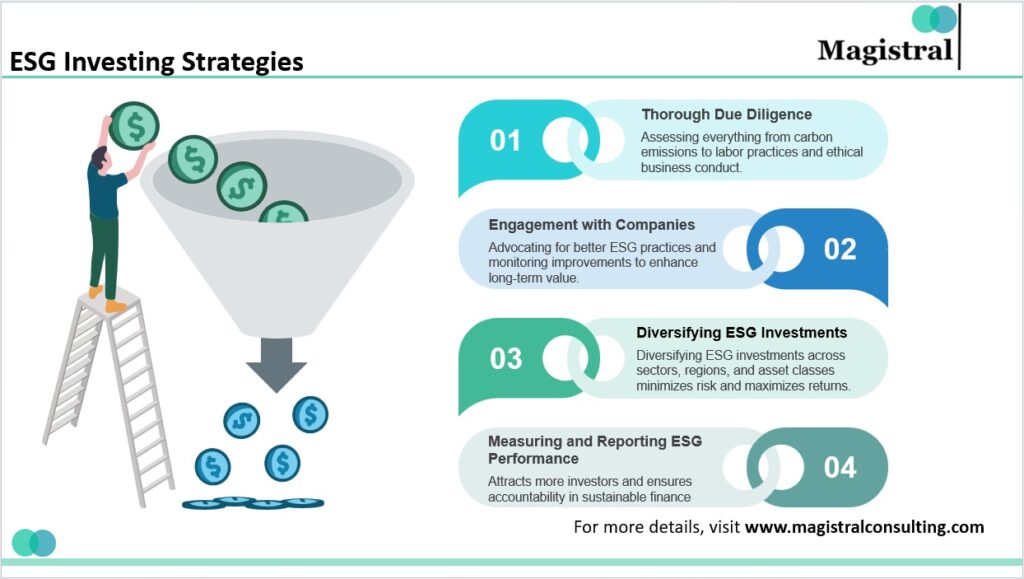

Effective ESG Investing Strategies

ESG Investing Strategies

Conducting Thorough Due Diligence

The most important factor is due diligence. For that matter, an investor needs to take proper assessment of the ESG practice by a company, all the way from environmental impacts to social sway and governance structures. They include carbon emissions, labor practices, board diversity, and ethics of doing business.

Engagement with Companies

The other major strategy concerning successful ESG investing is the concept of active engagement with companies. As an investor, one needs to engage deeply in the whole discourse of company affairs by discussing company management and advocating for improvements in ESG performance, analyzing trends over time. Often, this process surfaces meaningfully as improvements in corporate behaviors that enhance long-term values.

Diversifying ESG Investments

Diversification is a huge part of ESG investing and risk management. ESG portfolios should contain sector, region, or asset class diversification. This reduces exposure to a specific industry or geographic area, minimizing the potential risk related to industry-specific or geographic area-specific sectors and maximizing returns.

Measuring and Reporting ESG Performance

Investors should, therefore, be in a position to measure and report on the ESG performance of their portfolios. It directly follows that they have to measure the impacts of their ESG investments by specific metrics and frameworks previously set. Proper reporting is a critical tool for transparency and accountability and will draw more investors into sustainable finance.

Impact of ESG Investing

Impact of ESG Investing

Driving Investment in Sustainable Technologies

Funds significantly drive investment in clean energy and other sustainable technologies. Global Sustainable Investment Alliance records that global sustainable investment assets are positioning themselves in the area of clean energy to be at a record USD 8.7 trillion in 2022 alone. Inflows of such huge capital should be quite critical to the development and deployment of technologies for solving environmental problems.

Lower Greenhouse Gas Emissions at Corporates

ESG investing supports a low-carbon world by reducing greenhouse gas emissions of companies. Another case in point is how the number of companies that set science-based emission reduction targets under the Carbon Disclosure Project increased from just 200 in 2015 to over 2,500 companies in 2022—indicating that corporations are rapidly getting more serious regarding operating activities in parallel with the global climate objectives.

Improving Corporate Diversity and Inclusion

It has even made corporate diversity and inclusion better, as the 2022 World Economic Forum noted, wherein companies with gender diversity increased from 10% in 2015 to 50%. Changes to embrace more inclusive companies result in enhanced corporate culture and potential for better business performance.

The Future of ESG Investing

Increased Regulatory Backing

Finally, it has even made corporate diversity and inclusion better because, as noted by the World Economic Forum, the companies having gender diversity increased to 50% in 2022 from 10% recorded in 2015. Its changes to embrace these more inclusive companies come with enhanced corporate culture and the potential for superior business performance.

Technological Advancements

The future will be powered by technological innovation—including AI and big data analytics. Both technologies can enormously make possible the capacity to evaluate ESG factors, detect investment opportunities, and monitor performance. For instance, AI is capable of reading huge amounts of data for companies with leading ESG practices or even just raising flags where there are likely risks.

Rising Choices in ESG Investments

It will remain the case that investors continue to require an exceptionally wide choice of responsible investment products if they are to have the means of tailoring portfolios in line with their own values. A huge number of new ESG-specific funds and ETFs, and impact investing green bond issues, come to market to cater for an exceptionally wide and diverse range of investor preference and priority.

Lower Earnings with Enhanced Transparency

As interest in ESG investing continues to grow, firms can expect to be held accountable for their environmental, social, and governance practices to an even larger degree. In a similar way, this pressure from the investor community, regulators, and the general public has increased with respect to better performance and transparent performance in ESG by companies.

Magistral Consulting’s Services

Develop comprehensive ESG strategy

Magistral Consulting comes with deep experience in the development of comprehensive ESG strategies and objectives corresponding to what the companies want from their operations. This would involve mapping the present landscape in ESG and areas of key focus for betterment, then formulation of action plans fitted within goals of sustainability set by the clients. It will be designed in its approach so as to ensure companies are in a position to embed ESG policies right at the core of their business operations, bidding to attain excellently performing companies that sustain their reputation as well.

ESG Performance Measurement and Reporting

Magistral Consulting offers high-end tools and methodologies for properly measuring and reporting ESG performance to its clientele. Although the company customizes the ESG metrics and reporting framework for each client, it shall definitely be based on global standards that provide transparency and accountability. This service will help trace a client’s progress and commitment to sustainability while erasing doubts for ESG-focused investors.

Identification and Management of ESG Risks

Magistral Consulting identifies and mitigates the risks associated with ESG. At the core of its very highly specialized team are in-depth risk assessments exercised through three big factors that may, if not controlled, turn into a potential threat to an entity. It is ensured by the design of effective strategies in managing such risks that their investments go well-protected from vulnerabilities and thus give long-term growth assurance.

ESG Investment Advisory Services

Magistral Consulting provides strategic advisory services to clients for making decisions that have deeply ingrained knowledge of the ESG investment landscape. It provides insight into the latest emerging trends, opportunities, and hurdles by advising on how to create a diversified, resilient, and high-performance ESG portfolio.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What is ESG investing?

ESG investing simply incorporates aspects of the environment, social, and governance into any financial investment decision-making process. This trend takes into consideration not just a better future but increased financial gain as an effect of the impact a firm holds on the environment, social, and practices in governance.

What are the major growth factors of ESG investing?

This growth would depend on increasing demand from investors, the improved financial performance of ESG-compliant companies, and government policy. Indeed, sustainability practices surely build up long-term benefits considered accruable by investors.

Are There Implications of ESG Investing in Financial Markets?

ESG investing sends strong capital to sustainable technologies; it reduces the corporate greenhouse gas emission, enhances corporate diversity and inclusion; it has better performance compared to traditional funds. Increasingly, companies are adopting ESG with the aim of attracting ESG-focused investors, reducing risks and enhancing their reputation.

What would the common strategies in an ESG investing framework be?

Other common strategies include negative screening, avoiding companies engaged in harmful sectors; positive filtering into companies with top ESG practices; index investing in ESG-oriented indices; investment funds, namely, the ESG ETFs, also tracking ESG indices; Green Bonds, whose proceeds are used for projects with less adverse environmental impact, and Impact Investing in projects that have directly measurable positive social or environmental impacts.

What is in store for the future of ESG investing?

Indeed, impetus regulatory incentives have been on the rise along with technological greatness, raising investment options, and corporate accountability, slowly but progressively tightening the disclosure requirement—governments do what they shall do, with the related incentives already on their way. As far as technology is concerned, technologies such as AI, big data, and others further provide support for active enrichment of these technologies in updated ESG appraisals.