Introduction

A Cryptocurrency ETF, or Cryptocurrency Exchange-Traded Fund, is an investment fund that monitors the performance of one or more cryptocurrencies. It functions just like standard ETFs do, except instead of following conventional assets like equities or bonds, it concentrates on digital assets like Bitcoin, Ethereum, or other cryptocurrencies. With no need to actively own or manage the underlying digital assets, it enables investors to acquire exposure to the price and performance fluctuations of cryptocurrencies. For individuals and organizations interested in entering the cryptocurrency industry, it offers a regulated and well-known investment vehicle.

With the ability to purchase and sell shares at any time during the trading day, just like stocks, cryptocurrency ETFs are traded on conventional stock exchanges. They offer the comforts of liquidity, transparency, and trading simplicity, much like other ETFs. A cryptocurrency exchange-traded fund (ETF)’s value is based on the values of the cryptocurrencies it tracks. The fund aims to duplicate the performance of the underlying digital assets through direct ownership or derivative deals like futures or swaps.

Cryptocurrencies have rapidly emerged as a dynamic and transformative asset class, captivating investors around the globe with their potential for high returns and technological innovation. However, navigating the world of digital assets can be daunting for traditional investors, hindered by concerns over security, regulatory uncertainties, and the complexity of cryptocurrency ownership. Enter the realm of Cryptocurrency Exchange-Traded Funds (ETFs), a bridge between traditional finance and the rapidly evolving digital asset ecosystem. These investment vehicles offer a regulated and convenient means for investors to gain exposure to cryptocurrencies, combining the familiarity of traditional ETFs with the potential of this exciting new asset class.

Overall, ETF offers investors a structured and regulated means to obtain exposure to the potential returns and hazards of the cryptocurrency market without the complications involved with direct ownership and management of digital assets.

Types of Cryptocurrency ETFs

Cryptocurrency ETFs come in various types, catering to different investment preferences and strategies. Here are some common types of Cryptocurrency ETFs:

Types of Cryptocurrency ETFs

Single-Cryptocurrency ETFs:

Single-Cryptocurrency ETFs focus on tracking the performance of a single cryptocurrency, such as Bitcoin (BTC) or Ethereum (ETH). They provide investors with exposure to a specific digital asset and its price movements. These ETFs are designed for investors who have a specific interest in a particular cryptocurrency and want targeted exposure to its performance.

Diversified Cryptocurrency ETFs:

Diversified ETFs encompass a portfolio of multiple cryptocurrencies, offering investors a broader exposure to the digital asset market. They typically include a mix of established cryptocurrencies like BTC and ETH, as well as a selection of altcoins or smaller market-cap cryptocurrencies. These ETFs aim to provide investors with a more balanced and diversified exposure to the overall cryptocurrency market, spreading the risk across different digital assets.

Actively Managed Cryptocurrency ETFs:

Actively managed ETFs employ professional fund managers or investment teams who actively make investment decisions and adjust the ETF’s holdings based on market conditions and their research and analysis. Such ETFs may involve tactical asset allocation, taking advantage of market opportunities, and adapting to changes in the cryptocurrency landscape. Fund managers may also implement risk management strategies to mitigate downside risks.

Passive Index-Based Cryptocurrency ETFs:

ETFs with passive index support attempt to mimic the performance of a certain cryptocurrency index or benchmark. These ETFs adhere to a set of guidelines and hold cryptocurrencies in ratios that correspond to the index they follow. using a passive index Rather than actively managing the portfolio, cryptocurrency ETFs provide investors a passive investment strategy by attempting to mimic the performance of the selected index.

Leveraged and Inverse:

Leveraged ETFs aim to provide amplified returns by utilizing derivatives or other strategies to magnify the price movements of the underlying cryptocurrencies. For example, a 2x leveraged ETF may seek to deliver twice the daily return of its reference index.

On the other hand, inverse ETFs aim to produce returns that are the complete opposite of how the underlying cryptocurrencies perform. Investors can use these ETFs to profit from falling cryptocurrency prices or to protect their current cryptocurrency holdings.

Benefits of Cryptocurrency ETFs

Cryptocurrency ETFs offer a host of advantages that make them an attractive option for investors seeking exposure to digital assets. Some of the benefits include:

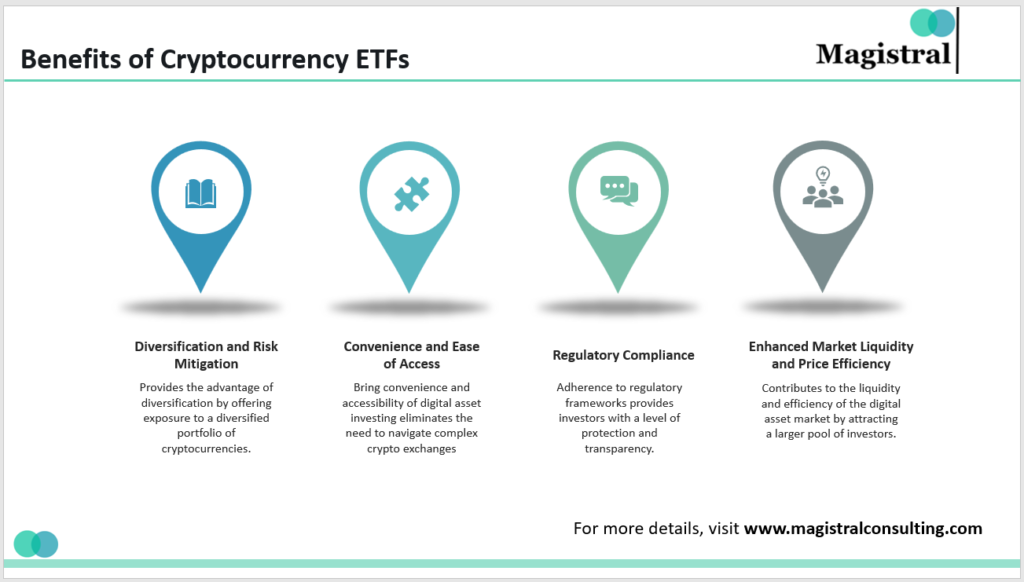

Benefits of Cryptocurrency ETFs

Diversification and Risk Mitigation:

Investing in ETFs provides investors with the advantage of diversification by offering exposure to a diversified portfolio of cryptocurrencies. By investing in an ETF, individuals can spread their risk across multiple digital assets, reducing their exposure to the volatility of any single cryptocurrency.

Convenience and Ease of Access:

Cryptocurrency ETFs bring convenience and accessibility to the world of digital asset investing. Being traded on traditional stock exchanges, they offer familiarity and ease of access for investors who are more comfortable with traditional financial markets. This eliminates the need for individuals to navigate complex crypto exchanges or manage their digital wallets.

Regulatory Compliance:

An important benefit of cryptocurrency ETFs is their adherence to regulatory frameworks, providing investors with a level of protection and transparency. Unlike unregulated crypto exchanges, ETFs operate under regulatory oversight, ensuring compliance and offering safeguards to investors. This regulatory compliance builds trust, particularly among institutional investors who are typically more cautious when entering the cryptocurrency market.

Enhanced Market Liquidity and Price Efficiency:

Cryptocurrency ETFs contribute to the liquidity and efficiency of the digital asset market. By attracting institutional investors and a larger pool of participants, these ETFs enhance market liquidity. This increased liquidity promotes smoother trading and fosters better price discovery, reducing the impact of market inefficiencies.

Challenges of Cryptocurrency ETFs

Cryptocurrency ETFs, or Exchange-Traded Funds, are investment vehicles that aim to mirror the performance of one or more cryptocurrencies. While they offer potential advantages, they also present several obstacles. Here are some of the main challenges associated with cryptocurrency ETFs:

Volatility and market risk:

Cryptocurrencies are known for their high volatility, with prices often experiencing significant fluctuations in short periods. This volatility poses risks for investors in cryptocurrency ETFs. Additionally, the lack of liquidity in cryptocurrency markets can make it difficult for ETFs to accurately track the underlying asset’s price, potentially resulting in tracking errors.

Security vulnerabilities:

Cryptocurrencies face inherent security risks due to their digital nature. Hacking, fraud, and theft are constant concerns in the cryptocurrency space. The security of the ETF’s underlying digital assets is crucial, and any security breaches or incidents could lead to substantial losses for investors.

Liquidity challenges:

Cryptocurrency markets can be relatively illiquid compared to traditional financial markets. ETFs require sufficient liquidity to ensure smooth trading and efficient price discovery. If the underlying cryptocurrency market lacks liquidity, it can impact the ETF’s ability to create and redeem shares, leading to wider bid-ask spreads and higher trading costs.

Price manipulation:

The decentralized and less regulated nature of cryptocurrency markets makes them susceptible to price manipulation. Activities such as pump-and-dump schemes and wash trading can distort cryptocurrency prices. If an ETF’s underlying assets are subject to manipulation, it can affect the ETF’s net asset value (NAV) and investor returns.

Custody and storage:

Secure digital wallets are required for the storage of cryptocurrencies. The management of these assets can be difficult, requiring specialised infrastructure and safety precautions. For bitcoin ETFs, ensuring proper custody and safety of the underlying digital assets is essential.

Limited historical data:

Cryptocurrencies, especially Bitcoin, have a relatively short history compared to traditional financial assets. The lack of extensive historical data makes it challenging to accurately assess long-term trends, correlations, and risk-return characteristics. This can make it difficult for investors to evaluate the potential risks and rewards of ETFs.

Some of these difficulties might be eased as the bitcoin sector develops and regulators create clearer regulations. Before purchasing bitcoin ETFs, investors should thoroughly weigh the dangers, as well as their risk tolerance and financial goals.

Magistral’s Services on Cryptocurrency ETFs

Magistral consulting services cater to ETFs and encompass expert advice and guidance provided by professionals or consulting firms well-versed in the domain of exchange-traded funds based on cryptocurrencies. Our extensive set of offerings includes:

Fund Structuring and Strategy:

Consultants offer recommendations on optimal fund structures and strategies for cryptocurrency ETFs, including determining the appropriate index or benchmark, defining the investment objective, and establishing asset allocation and rebalancing strategies.

Market Analysis:

We conduct comprehensive market research and analysis, providing clients with valuable insights into the cryptocurrency market and specific opportunities related to ETFs. This includes analyzing market trends, assessing risks and rewards, and identifying potential investment prospects.

Risk Assessment:

Our senior consultants perform thorough due diligence on prospective cryptocurrency ETFs, evaluating the quality and security of digital assets, assessing the fund’s management team, and analyzing associated risks.

Performance Monitoring and Reporting:

We assist clients in monitoring the performance of cryptocurrency ETFs, analyzing key performance indicators, evaluating tracking errors, and providing insights to optimize fund performance.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative:

visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com