Introduction

Industry Research refers to the process of gathering information and analyzing data related to a specific industry to identify trends, opportunities, challenges, and other relevant factors that may impact the industry. This research can involve various methods such as surveys, interviews, focus groups, data analysis, and market analysis.

The goal of industry research is to gain insights into the dynamics of a specific industry, such as market size, key players, regulatory environment, latest innovations, and emerging trends.

Businesses, investors, policymakers, and other stakeholders can use this data to make informed decisions and develop effective strategies.

Industry research can be conducted by in-house teams within a company or by outside research firms. The research findings may be published in industry reports, whitepapers, or academic journals. Industry research can help businesses understand their competition, customers, and market trends, as well as identify new opportunities for growth and innovation.

Importance of Industry research for investment analysis

Industry research is vital to companies and other decision makers because it offers an extensive understanding of a specific industry’s dynamics. Here are some of the main reasons why industry research is crucial:

Identifying opportunities:

Industry research can help businesses and investors to identify potential opportunities in a particular industry. By analyzing market trends and identifying gaps in the market, companies can develop innovative solutions to meet the needs of consumers.

Understanding the competition:

Industry research can assist businesses in better understanding their competitors and the strategies they employ. Companies can gain a competitive advantage by analyzing the strengths and weaknesses of their competitors.

Making informed decisions:

Industry research provides valuable insights that can help businesses and policymakers to make informed decisions. By understanding the current state of an industry, businesses can make decisions about investments, product development, and other important matters.

Keeping up with trends:

Research on the industry can assist organizations in keeping up with the most recent trends and advancements in their sector. This can aid them in maintaining their competitiveness and adjusting to market fluctuations.

Identifying potential risks:

Industry research can help businesses to identify potential risks and challenges in their industry. By anticipating these risks, companies can develop strategies to mitigate them and minimize their impact.

In order to make educated decisions, find opportunities, and maintain competitiveness in their sectors, corporations, investors, governments, and other stakeholders must conduct industry research.

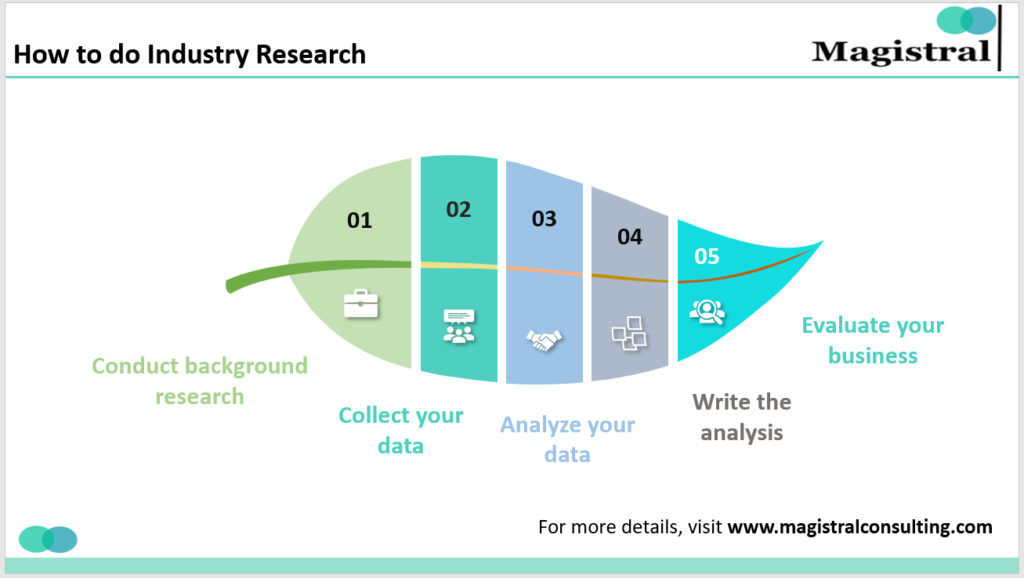

How to do Industry Research:

There are various steps involved in industry research which are explained as below:

How to do Industry Research

Conduct background research

To better understand your market, conduct extensive background study on your sector and rivals. Choose whether you want to investigate your whole industry or just a subset of it. Determine the topics you want your study to address, such as investment analysis, market growth, or industry standards. Make a list of your rivals and seek for ways to get information about them.

Collect your data

Gather information that can assist you in answering questions about the investment industry and your competition. You may also obtain extra information on the sector or any other issue by using secondary sources such as government statistics and data, financial reports, and journal articles. One may also collect data through the primary survey or through questionnaire.

Analyze your data

Analyze your data using tools or programing language. To examine the data you gathered, choose one form of industry analysis model. You may also compare your strengths with those of rivals to see how they stack up. When assessing data, consider the following elements that may have an impact on the figures:

Write the analysis

Present your results in a written report to make them easier to understand and share with others. It should use words, charts, and graphs to present the data and report your observations and respond to the questions asked in the goal section. Based on your study, list the long- and short-term impacts on the organization, as well as any potential future issues that may occur.

Evaluate your business

Use your report, particularly the analytical portion, and findings to help you decide on the company’s direction in relation to your emphasis area. For example, if you undertake industry research to see how quickly a competitor’s firm is developing and discover that they are growing at a rate of 12% per year, you may consider strategies to outperform that growth in your own business.

Tools and Techniques for Industry Research

There are various tools and techniques that can be used for industry research. Here are some of the most commonly used tools and techniques:

Market research surveys:

Surveys can be used to gather information from a large number of respondents about their opinions, behaviors, and preferences related to a particular industry. This information can be used to identify trends, preferences, and other insights.

Focus groups:

Focus groups involve a small group of people who are brought together to discuss a specific topic related to the industry. This can provide in-depth insights into consumer preferences, behaviors, and opinions.

Interviews:

Interviews with industry experts, stakeholders, and other key individuals can provide valuable insights into the industry. This can include information about current trends, challenges, and opportunities.

Secondary research:

Secondary research is gathering information from already published sources, including industry reports, scholarly journals, and other materials. This can give important historical context and industry insights.

SWOT analysis:

An industry’s strengths, flaws, opportunities, and threats can be found using the SWOT (Strengths, weaknesses Opportunities, and Threats) analysis, a strategic planning technique. Using this information, organisations can create plans that will maximise their strengths and minimise their flaws.

Porter’s Five Forces Analysis:

Another method for strategic planning that may be used to evaluate the competitive dynamics of a sector is Porter’s Five Forces Analysis. The threat of new competitors, buyer and supplier negotiating power, the threat of substitute goods and services, and the level of competitive rivalry are the five main aspects that are examined.

Data analysis tools:

Many different data analysis programs, including Microsoft Excel, Tableau, and SPSS, can be used to analyse and visualise data. Researchers can use these techniques to find patterns and trends in the data.

A combination of these tools and techniques can be used to provide a comprehensive understanding of the industry.

Magistral’s Services on Industry Research

Here are services offered by Magistral Consulting on Industry Research:

Magistral’s Services on Industry Research

–Fundamental analysis: Magistral provides the customized model, quarterly earning reviews, equity, and industry themed report.

–Credit analysis: The company provide the country risk analysis as well as company risk analysis which is very beneficial in industry research for investment analysis.

–Quantitative analysis: The quantitative analysis includes data processing, data analysis and the commodities performance tracking and analysis.

–Reports and Newsletter: Magistral provide the various industry report with the statistics and provide the event and news analysis

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com