Introduction

Portfolio Management for Private Equity and Venture Capital firms refers to the way in which the critical performance metrics are collected, measured, monitored, and tracked across the portfolio companies, and/or the active funds. Furthermore, such measures ensure that the capital is not subjected to excessive market risk. The capacity to make informed decisions underpins the entire process. Generally, Private Equity firms seek out underperforming or undervalued companies. By working with these companies, managers unlock significant value by:

– Improving business strategy

– Injecting managerial expertise

– Advance product technology

– Expanding distribution

Portfolio Management for Private Equity involves acquiring investment company ideas from a variety of sources and evaluating these to make an analytical decision. It is critical to rethink the portfolio regularly and practice the continual development of Portfolio Management methods.

Effective Portfolio Management for Private Equity leads to better IRRs for LP Investors

A PE or a VC firm invests in a company typically with 5+ years of the horizon. In early-stage investing, active management of companies to grow the valuation is imperative.

Even for late-stage investing, a well-balanced portfolio is critical in today’s world, as the perfect set of companies in a portfolio of private equity helps to grow. A good portfolio is a well-balanced combination of various companies, with funds allocated according to the firm’s tastes and risk tolerance. Building a portfolio is only the beginning of the task. In terms of returns and risk reduction, active management outperforms passive management.

Portfolio management is crucial because it reduces risk by diversifying and redistributing cash across different companies in the portfolio based on their performance. It also aids in the preparation of tax requirements. It also aids in the organization of money in times of need.

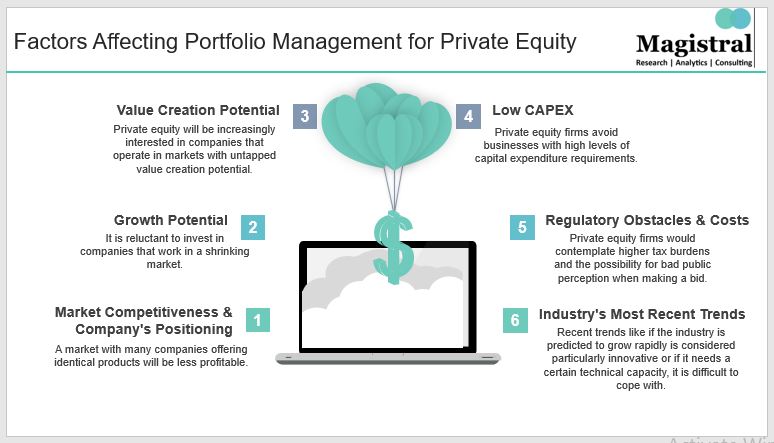

Factors affecting Portfolio Management for Private Equity

Private equity is undoubtedly a very competitive industry. It has been traditionally known for cutthroat business focused on cost-cutting and profit generation. This trend has slowly shifted in recent years. Now, Private equity looks for such companies in their portfolio which generate value over the long term.

Crucial Factors leading to the success of a PE portfolio

Some of the factors which are taken into consideration in Private Equity portfolio management are:

Market Competitiveness and a Company’s Positioning

The market’s competitiveness will significantly impact an individual company’s ability to achieve long-term success. A market with much competition offering identical items is likely to be less profitable.

Growth Potential

Private equity firms are increasingly talking about companies where they would infuse both financial and organizational capabilities and industries that can accomplish growth in numerous ways.

Value Creation Potential

The companies that operate in markets with untapped value creation potential are more attractive. Private equity firms prize the ability to minimize costs and increase existing capabilities for new revenue streams.

Low CAPEX

If a company operates in a sector that will necessitate a significant amount of initial funding, a private equity firm will view this as an obstacle and will want to spend less for the company. In contrast, if a company already has the capital it needs to perform business and expand, a private equity firm would be willing to pay a higher price for the acquisition.

Regulatory Obstacles and Costs

Regulatory barriers and costs could significantly impact the price of a company that operates in a particular sector. When making a bid to add a company to a portfolio, private equity firms recognize higher tax burdens.

Industry’s Most Recent Trends

The latest industry trends and possibilities for expansion have a significant impact on a company’s valuation. Companies that compete in the market can be more desired from private equity firms’ standpoint if the industry is predicted to proliferate, is considered particularly innovative, or needs a specific technological capacity that is hard to acquire.

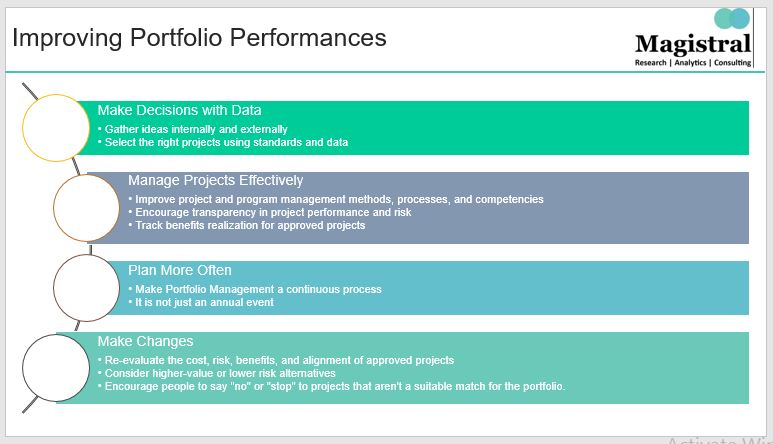

Improving Private Equity Portfolio Performance

Effective project delivery and the ability to make modifications are key to improving portfolio success. It cannot be expected that projects that have been approved will produce the intended outcomes. Their worth, risk, and cost must all be assessed regularly. Projects should be discontinued or replaced if underperforming and have better alternatives.

Data analysis should be considered when making decisions. It is critical to collect ideas both internally and externally and choose the correct initiatives based on standards and statistics. Projects must be effectively managed. Methods, processes, and competencies for the project and program management must be improved, while clarity in project performance and risk need to be encouraged.

Improving PE Portfolio Performance

Portfolio Management is a continual activity, not simply an annual event, so planning should be done more frequently. The cost, risk, benefits, and coherence of authorized projects should all be reevaluated, with higher-value or lower-risk alternatives being considered

Technology’s Role in Enhancing Portfolio Performance

Better technology ensures that data from other processes, such as project, resource, and economic management, is timely and accurate. It also allows for the detection of underperforming projects and reduces effort and time spent on portfolio management tasks, allowing for continuous planning. It enables speedier re-planning when budgets alter, or new projects are made mandatory by providing analytic support in considering numerous ideas and projects simultaneously. It also gives process participants, stakeholders, and constituents access to reporting and transparency.

Role of Outsourcing

Outsourcing is the practice of hiring a third-party organization to carry out services that were initially performed in-house. The shift towards a customer-oriented business model resulted in outsourcing and therefore it became an important part of business economics in the 1990s. In only a few decades businesses realized in order to stay relevant in the industry, they need to focus on increasing the customer value of their services or products. Since then, businesses turned more towards the concept of outsourcing.

Outsourcing is even more critical for PE acquired businesses as they need to create value and savings quickly due to their investors’ pressure.

Here are a few fundamental benefits of outsourcing:

– Reduced costs are one of the primary advantages of outsourcing. These costs only arise when the process is ongoing, when these processes are not required, no bills are generated.

– Outsourcing partners are experts in their domain; therefore, they are quick and efficient in the organization’s process.

– Their expertise leads to increase quality and better results. They deal with the specific task with a matter of routine and precision.

Experienced outsourcing vendors provide cost savings with expertise, therefore it’s a better return on the company’s investment.

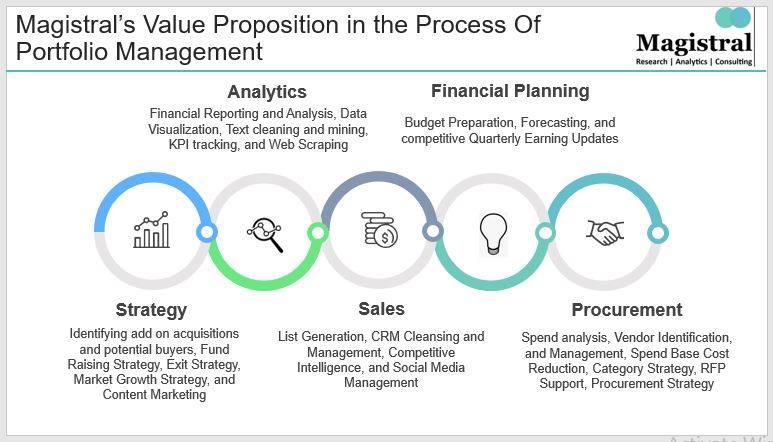

Magistral Service Offerings for Portfolio Management for Private Equity and Venture Capital

Magistral has helped multiple Private Equity and Venture Capital firms in managing their portfolio in the cycle of acquisition, value creation, and securing a profitable exit. Expertise when combined with Outsourcing brings quality and cost-effectiveness to the strategic decisions made at the portfolio companies.

Magistral’s Service Offerings for Portfolio Management for Private Equity and Venture Capital

So here is how Magistral helps:

Strategy

This is the most important part of the planning, which comprises the following:

– Identifying Add-On Acquisitions and Potential Buyers: Finding relevant M&A opportunities help in lowering the cost by merging the staff members with similar expertise, expanding into new regions, consolidating management and finances, and boosting the buying power.

– Planning Fund Raising Strategies: Here, a basic setup is made for fundraising such as LP research, LP reach out through calls & e-mails, preparing content, partner profiles, etc.

– Exit Strategy: Various exit strategies are made including a trade sale, which is the sale of a company to another PE firm, or a secondary buy-out for a medium or large portfolio company.

– Market Growth Strategy: Profitability, Growth, and Performance are the major objectives for Portfolio Management for Private Equity. Various strategies are formed to keep the portfolio growing.

– Content Marketing: This step helps in marketing the content for the acquisition of add-ons or potential buyers for private equity.

Analytics

The second major step involves analytics of portfolio management for Private Equity and Venture Capital. Analytics include the followings:

– Financial Reporting and Analysis: It is the process of documenting and communicating financial activities and performances over specific time periods. It depicts the financial health of the companies. This can be further done by performing trend analysis, common-size financial analysis, financial ratio analysis, and benchmark (industry) analysis.

– Preparing Dashboards: Various dashboards are prepared by cleaning the data, selecting the right chart, and building the perspective using predefined templates which helps in making a clear and better decision.

– Data Visualization: Information or data is then represented by visual elements like charts, graphs, and maps. It’s the most accessible way to see and understand trends, outliners, and patterns.

– Text Cleaning and Mining: Text cleaning and mining refer to artificial intelligence technology that uses natural language processing to transform the free text in documents and data into normalized structure data suitable for analysis.

– Predictive Modeling: It is a statistical technique using machine learning and data mining to predict and forecast likely future outcomes with the aid of historical and existing data. It works by analyzing current and historical data and projecting what it learns on a model generated to forecast likely outcomes.

– KPI Tracking: Key Performance Indicator (KPI) helps in monitoring performance metrics.

– Web Scraping: It’s the process of using bots to extract content and data from a website.

Sales

After analytics, the sale is taken care of by performing the following activities:

– List Generation: Final list is generated on the basis of various factors.

– CRM Cleansing and Management: It is performed to improve the overall quality of our data so that it increases the overall productivity of the portfolio.

– Competitive Intelligence: Competitive Intelligence research is the data gathered to know and analyze competitors. It helps in making better strategic decisions.

– Social Media Management: It helps in promoting the sales of a particular portfolio by the means of social media.

Financial Planning

Financial Planning while portfolio management for private equity is an important step as it helps in developing overall goals and creates a plan of action to achieve them. This step majorly includes the following:

– Budget Preparation: It’s a process of preparing an outline of planned future activities by making available funds, expenses, and future incomes into account.

– Forecasting: Historical data are used as inputs to make informed estimates that are predictive in determining the direction of future trends

– Competitive Quarterly Earning Updates: Final step is to make competitive earning updates.

Procurement

Its purpose is to develop a fully comprehensive picture of procurement. Following are the steps performed:

– Spend Analysis: In this, we analyze the past and projected procurement expenditure or spending for services or work

– Vendor Identification: In this, business requirements are identified and analyzed, and then developed to finally evaluate the vendors

– Spend Base Cost Reduction: This is performed to systematically boost productivity

– Category Strategy: It is an excellent tool that should be the procurement team’s work. It maximizes the value and efficiency

– RFP Support: RFP stands for Request for Proposal, it’s a business document that announces a project, describes it, and solicits bids from qualified investors

Typical Outcomes of our Portfolio Management Services

– 30-50% reduction in cost operations

– Up to 20% improvement in sales for companies operating in B2B segments

– Up to 20% reduction in Procurement spend base

– Up to 10% improvements in gross margins due to advanced analytics

– 30-40% improvement in plan compliance

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modeling, Portfolio Management and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com