Historical Investment Trends

Conventionally, a family office has usually taken the conservative route, with a heavy bias towards traditional assets such as equities, bonds, and real estate. This is a slightly deviated trend in the recent year. In fact, during 2023, with the onset of economic uncertainty, more than half of the family offices hiked fixed income and started moving into safer havens, while there was a retreat from public equity, with 38% of the family offices reduced exposure to equities.

Drivers of Change

Our research, where applicable, allowed multiple responses and uncovered some important drivers behind this change in investment trends at a family office: on the back of rising inflation, rising interest rates, and geopolitical conflicts notably US-China relations in the top echelons of concerns for family offices globally. If we rank the major concerns among a family office, these will be the findings:

Currency Risk (70%)

Inflation (56%)

US-China Relation (48%)

Stability of the Global Financial System (38%)

Market Volatility (34%)

Russia-Ukraine War (24%)

Deep diving into Emerging Investment Trends in North America

The landscape of North American family office investments is rapidly changing, with a growing appetite for alternative investments such as private equity, venture capital, and hedge funds. Thus, we can see that while Public Equity accounts for 23% of the total investment by a family office, fixed income makes up 11%, and Private equity funds and Private Equity Direct make up 11% and 14%, respectively. The family office has also given considerable funding to real estate, 16% for Real estate direct and 5% to real estate funds. Other minor investments by the family offices were Cash & cash equivalents at 10%, Hedge Funds 4%, private credit 3%, Arts & Commodities 2%.

Regional Perspectives

The regional breakdown of the total investments made by North American Family offices is as follows: 80% are invested in their region, 9% in Europe, 4% in the Asia Pacific excluding China, and 2% in China alone. This accounts for the total investments made by North American Family offices in those regions, while the remaining percent is focused on Latin America at 3%, and the Middle East & Africa at 2%.

Sector Preferences

Technology and Healthcare are the most popular sectors within the public markets, with 60% and 53%, respectively, of investments, suggesting a strategic tilt in favor of growth-oriented industries given the uncertainty presented by wider markets. Other significant investments took place in Real Estate, with 36%, Energy, 27%, Financial Services, 23%, and Industrials, with 21%. Consumer Goods and Materials take 13% and 7%, respectively, in terms of investments made by North American Family offices.

Global Overview

Real Estate Realities

Challenges Amidst Declining Values

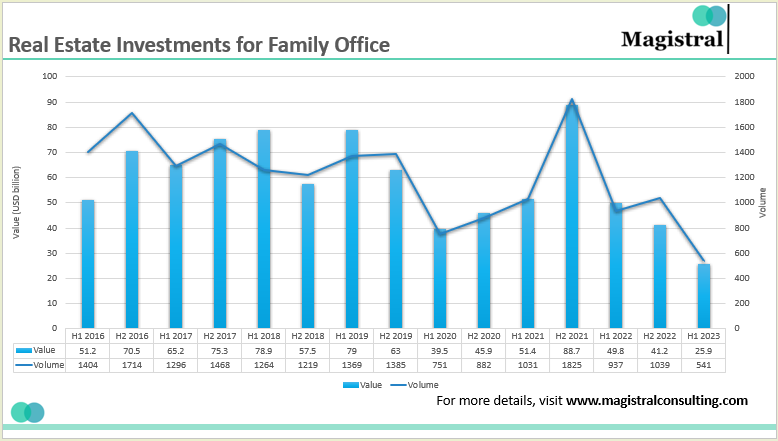

While the real estate segment reaches far into history, it is one that is confronting headwinds today with falling deal values and volumes amid broader market conditions. For real estate, the periods of the pandemic immediately created a downward spiral in investments, while volumes failed to reach pre-pandemic levels. This fall further confirms that a family office needs to carefully adapt to the ways of the changing markets in their quest for an alternative way to preserve and grow their wealth.

Real Estate Investments for Family Office

US leads Cross-border family office deals

For the year from July 2022 to June 2023, US real estate topped cross-border deals, both in value and volume, with 59 deals valued at $6,949 million. In comparison, while China and Germany, with $4,676 million and $2,577 million deal values, respectively, trailed the US, the number of deals was far lower, being only 20 for China and 36 for Germany. Following the US in several deals were Australia and Sweden with 55 and 53, respectively. However, their transaction value was considerably low, at $1,079 million for Australia and $619 million for Sweden.

Startup Investment Dynamics

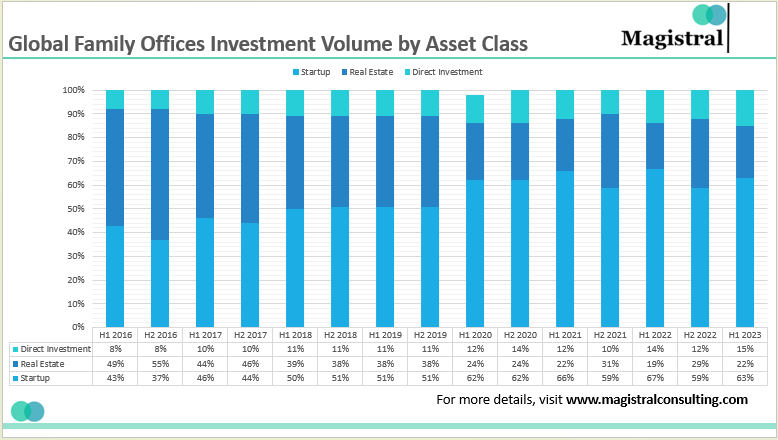

Shifting Investment Tides: From Real Estate to Start-ups

Dramatically, the investment landscape changed, as one could almost see a now-induced shift of family office allocations from traditional real estate toward emerging startup hubs. Whereas the second half of 2021 saw record-high investments across all asset classes, periods thereafter saw steady declines to eventually slip below pre-pandemic levels in volume and value. This decline indicates that the strategic push is toward more fleet-footed and innovative investment routes.

Global Family Offices Investment Volume by Asset Class

Club Deals and Sectoral Preferences

The landscape of startups has gone through its ups and downs, starting with the negative trend in volume and value of investments since 2022 around the globe. Be that as it may, family offices have continued to turn their bets in the landscape through club deals, placing increasing emphasis on collaboration and the diversification of risks. In terms of sectoral preferences, Software-as-a-Service (SaaS), Artificial Intelligence and Machine Learning (AI & ML), and FinTech have garnered substantial investments.

The USA still holds the top spot when it comes to the cross-border deals of Start-Ups

From July 2022 to June 2023, the US topped the list of destinations for family offices due to its strong ecosystem and easy access to capital. In the US, there were 385 deals valued at US$19.1 billion. India seconded it with 43 deals valued at $2.8 billion, making it still a long way behind the US both in deal number and value.

Direct Investments

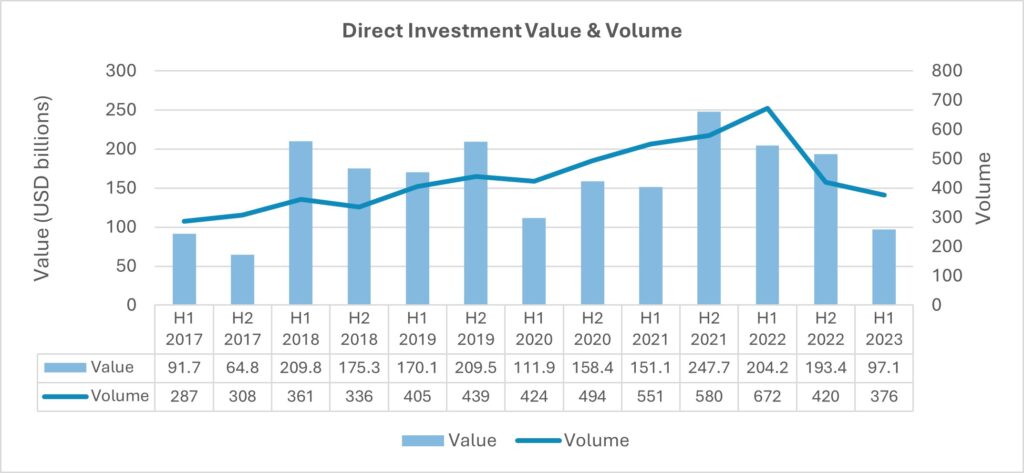

Volume and Value in a Balance

Direct investments are a cornerstone of family office portfolios that have slightly decreased in volume and value as a means of recalibrating risk appetites in light of market uncertainty. Notwithstanding the first half of 2023, which recorded significant declines in deal values, direct investments still dominate the lion’s share of the total portfolio of a family office, underlining continuing commitment toward strategic diversification and the creation of value over a long period of time.

Increasing Popularity of Club Structures and Smaller Deals

Family offices have indeed shown a greater interest for smaller deals. The increasingly relevant club deal structures speak volumes towards a greater takeaway on the collective pursuit of a risk management approach by family offices while maximizing their returns in uncharted territories.

Cross-Border Dynamics: The Rise of India

While the United States remains the top destination for cross-border investments, with 214 deals amounting to US$20.1 billion, India remains a close second, closing the deal-value gap with US$15.6 billion via just 42 deals.

Magistral Consulting Services

Investment Strategy Development

We develop bespoke investment strategies to meet the various needs of family offices. We merge traditional assets with the new alternative assets and seek maximum diversification and risk management. Our team has analyzed market trends and economic factors for a strong investment structure.

Alternative Asset Solutions

Magistral Consulting offers alternative investment opportunities through private equity, venture capital, and hedge funds, as well as all-inclusive management via sourcing, due diligence, and portfolio monitoring to make family offices realize high returns with resilience.

Regional Investment Analysis

Our detailed regional analysis takes it a step further and helps a family office to capitalize on both local and international opportunities. Knowledge of investment prospects in North America, Europe, the Asia Pacific, and other important regions leads to strategic decisions based on market conditions and their growth potential.

Real Estate and Startup Advisory

We offer a variety of consulting services, ranging from market feasibility studies to closing even the most complicated transactions in real estate investment and VC deals in startups. This helps a family office make the right decisions. We also assist with investments in startups, mainly focusing on emerging sectors and cooperation opportunities.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How do family offices allocate their investments regionally?

About 80% of investments are within North America, with the rest distributed across Europe (9%), Asia-Pacific (4%), China (2%), Latin America (3%), and the Middle East & Africa (2%).

What sectors are family offices currently focusing on for investments?

Family offices favor technology and healthcare, making up 60% and 53% of their investments, with significant allocations also in real estate (36%) and energy (27%).

What is the trend in direct investments for family offices?

Direct investments are essential for family offices, although there’s a slight decline in volume and value, alongside increased interest in smaller deals and club structures.