Introduction

Sensitivity Analysis establishes the impact of various independent variable values on a specific dependent variable under a specific set of assumptions. In other words, sensitivity analyses look at how different types of uncertainty in a mathematical model affect the overall level of uncertainty. This method is applied within defined parameters that are dependent on one or more input variables.

In the realm of business and the study of economics, sensitivity analysis is applied. It is sometimes referred to as a “what-if analysis,” and financial analysts and economists frequently employ it. Finance sensitivity analysis aids in the understanding of potential risks, uncertainties, and trade-offs related to financial decisions. It facilitates risk management, permits informed decision-making, and improves comprehension of the spectrum of potential outcomes in various financial circumstances.

Share price predictions for publicly traded firms can be aided by sensitivity analysis. A few elements that affect stock prices are the company’s earnings, the number of shares in circulation, the ratio of debt to equity (D/E), and the number of opponents in the market. Examining future stock prices can be enhanced by altering the underlying hypotheses or introducing new factors. Using this model, it is possible to determine how changing interest rates affect bond prices. It enables the use of actual historical data for forecasting. Carefully examining all the elements and potential outcomes can help one make crucial decisions about investment, businesses, and the economy.

Applications of Sensitivity Analysis

Sensitivity analysis is a popular tool in finance for determining how changes in input variables or assumptions would affect risk management, investment choices, and other financial applications. Finance sensitivity analysis offers insightful information about potential risks, uncertainties, and trade-offs related to financial models, investment choices, and risk management tactics. It helps with decision-making, risk quantification, portfolio optimization, and improving comprehension of the effects of numerous factors on financial results.

Applications of Sensitivity Analysis

The following are some crucial financial uses of sensitivity analysis:

Pricing and Estimation

Sensitivity analysis is essential for evaluating complicated derivatives, options, bonds, and other financial instruments. Analysts can determine how sensitive the value of an instrument is to various inputs, such as underlying asset prices, interest rates, volatility, or dividend yields. It aids in assessing the impact of changes in market conditions on the pricing of financial instruments as well as recognizing the main drivers of value.

Risk Mitigation

It is useful to comprehend how different market conditions affect portfolio returns, value-at-risk (VaR), or other risk assessments. Sensitivity analysis is used to facilitate stress testing, scenario analysis, and assessing the resilience of financial institutions or portfolios to volatile market conditions.

Asset Distribution and Portfolio Management

Asset allocation and portfolio optimization are accomplished through sensitivity analysis. Analysts can determine the best allocation techniques by evaluating how responsive portfolio returns, risk measures or other performance indicators are to changes in asset weights, correlations, or other portfolio parameters. It helps in assessing the possible effects of asset class returns, monetary considerations, or market conditions on portfolio performance and serves as a roadmap for portfolio modifications.

Making Decisions and Budget Allocation

Financial statement sensitivity to changes in revenue growth rates, cost structures, or interest rates can be assessed by analysts for financial statements like income statements, balance sheets, or cash flow statements. Sensitivity analysis supports decision-making by shedding light on the potential effects of various scenarios on financial performance.

Assessing Investments and Capital Planning

Analysts can determine the sensitivity of investment indicators such as net present value (NPV), internal rate of return (IRR), or payback duration by adjusting important parameters like cash flows, discount rates, or project timelines. This research aids in understanding the range of probable outcomes for various investment situations as well as the most important elements affecting investment profitability.

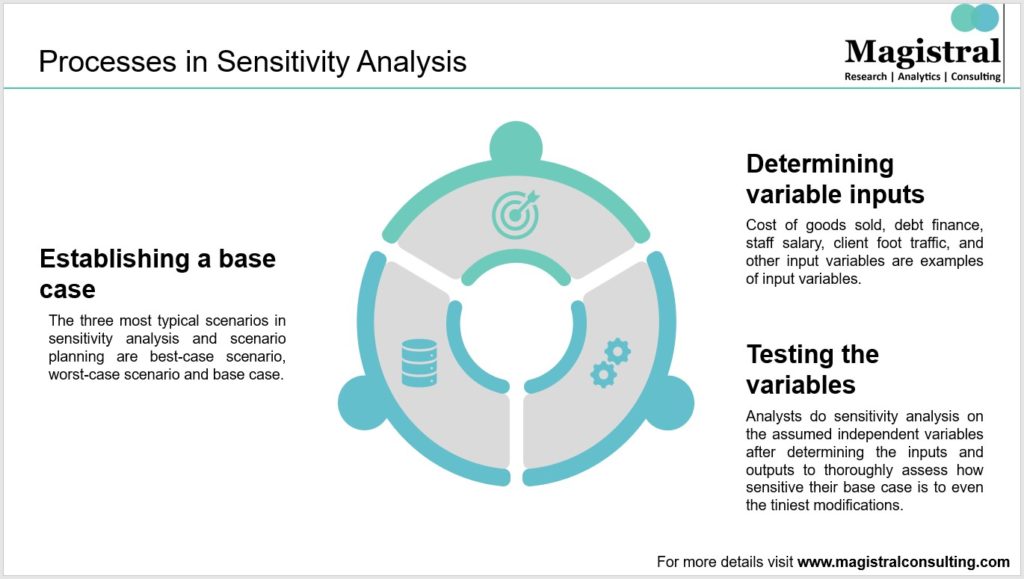

Benefits of Sensitivity Analysis

Sensitivity analysis in finance offers several benefits that contribute to better decision-making, risk management, and understanding of financial outcomes. It in finance aids in improved risk management, more informed decision-making, and a deeper comprehension of the range of possible outcomes. It aids in quantifying uncertainty, identifying crucial elements, and enhancing stakeholder communication, ultimately resulting in more solid and trustworthy financial strategies and plans. Here are some key benefits of sensitivity analysis in finance:

Benefits of Sensitivity Analysis

Risk Assessment of Sensitivity Analysis

Sensitivity analysis is a tool for evaluating and controlling risks related to financial models, portfolios, or investment choices. Analysts can detect and quantify potential risks by examining how sensitive financial outcomes are to changes in important variables. This knowledge improves the ability to adapt to various market conditions and enables the implementation of suitable risk mitigation techniques.

Measurement of Uncertainty

The uncertainty connected to financial models, projections, or investment decisions can be quantified with the aid of sensitivity analysis. Analysts can determine the range of possible outcomes and the likelihood of various scenarios by evaluating the sensitivity of financial outcomes to changes in factors.

Identifying Crucial Factors of Sensitivity Analysis

Sensitivity analysis aids in locating the most important factors or hypotheses that have a major impact on financial outcomes. Analysts can identify the factors that impact the outcomes most by changing the inputs and analyzing how those changes affect the outputs. Decision-makers can focus their attention and resources more effectively and strategically by using this knowledge to identify the most important aspects.

Stress Testing

Scenario analysis and stress testing, which are essential for evaluating the robustness of financial models, portfolios, or institutions, are made easier by sensitivity analysis. Analysts can track how financial outcomes react to difficult circumstances by modeling various scenarios and stress variables. This analysis aids in locating weak points, estimating the impact that extreme events might have, and creating backup plans or risk-reduction tactics.

Better Communication

Sensitivity analysis shows the connections between input factors and financial results simply and visually. Stakeholders and decision-makers can better understand the significance and influence of many variables with the aid of visual tools like tornado diagrams and sensitivity charts. This promotes dialogue, enhances stakeholder understanding, and increases the transparency of financial decision-making processes.

Magistral’s Services on Sensitivity Analysis

Financial models have a long history of being trusted tools for determining the boundaries of trade. Due to a recent surge of acquisitions where investors are willing to pay big premiums for rapid growth or a high-impact technology, traditional financial models have undergone qualitative changes. The following is ensured by Magistral’s sensitivity analysis:

-Analyzing the financial model’s unclear input values.

-Predicting potential outcomes and planning for unanticipated risks.

-Aiding the execution of risk assessment techniques.

-Establishing co-relationships between the model’s multiple inputs and output.

-Execution of well-informed judgments.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative: visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com