Introduction

Portfolio Management in the context of private equity (PE) involves the active management and oversight of a collection of investments in privately held companies. Private equity firms raise funds from investors, such as institutional investors, pension funds, and high-net-worth individuals, and use these funds to acquire ownership stakes in companies with the goal of enhancing their value and ultimately generating attractive returns.

Portfolio Management in the context of venture capital (VC) involves the active management and oversight of a collection of investments in early-stage startups and emerging companies with high growth potential. Venture capital firms provide funding, mentorship, and strategic guidance to these startups to help them scale and succeed.

Overall, it involves overseeing and optimizing a collection of investments in privately held companies. The goals of portfolio management in these fields differ from traditional asset management due to the unique characteristics of private investments.

How Portfolio Management works in Venture Capital

Investment Thesis and Focus:

Venture capital firms define their investment thesis, which outlines the types of startups they are interested in funding. This includes the industries, technologies, and business models that align with the firm’s expertise and strategic goals.

Deal Sourcing and Screening in Portfolio Management

Portfolio managers actively seek out investment opportunities by sourcing deals through networks, referrals, pitch events, accelerator programs, and other channels. Startups are screened based on their market potential, innovative solutions, founding team, and growth trajectory.

Investment Decision

After evaluating potential investments, portfolio managers decide which startups to fund. This decision involves assessing the startup’s business plan, market opportunity, competitive landscape, and scalability.

Investment Terms and Negotiation:

Portfolio managers negotiate the terms of investment, including the equity stake the VC firm will receive in the startup, the investment amount, and any additional rights or preferences.

Value Addition and Mentorship:

Venture capital firms provide more than just capital; they offer mentorship, guidance, and strategic support to help startups navigate challenges and accelerate growth. Portfolio managers might assist with product development, market entry, business development, and talent acquisition.

Follow-on Investments:

Successful startups often require multiple rounds of funding as they grow. Portfolio managers decide whether to participate in follow-on investment rounds to maintain their ownership stake and support the startup’s continued growth.

Exit Strategy in Portfolio Management

Venture capital firms plan exit strategies to realize returns on their investments. Exits can occur through acquisition by larger companies, mergers, or initial public offerings (IPOs).

Risk Management in Portfolio Management

Startups inherently carry a high level of risk, and portfolio managers assess and manage these risks by closely monitoring the startups’ progress, addressing challenges, and making adjustments as needed.

Performance Monitoring and Reporting:

Portfolio managers continuously monitor the financial and operational performance of their portfolio companies and provide regular updates to their investors.

Fundraising and Investment Strategy:

Private equity firms raise funds from investors, creating a pool of capital known as a private equity fund.

The firm outlines its investment strategy, which includes the types of companies it intends to invest in, the industries it will focus on, the geographic regions of interest, and the anticipated investment timeline.

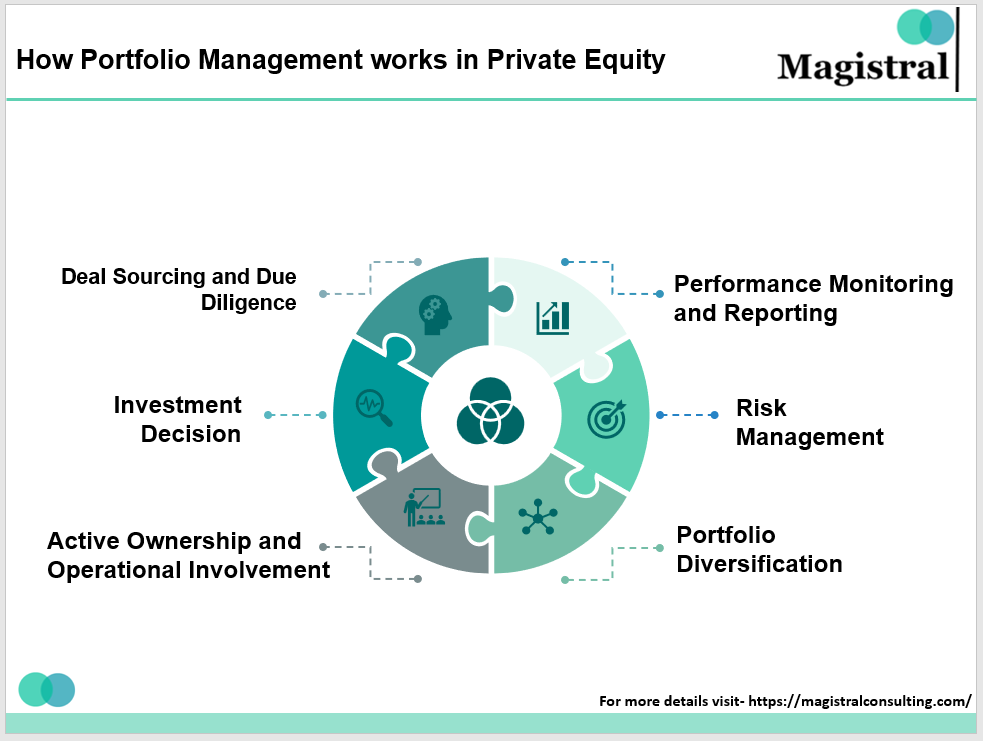

How Portfolio Management works in Private Equity

How Portfolio Management works in Private Equity

Deal Sourcing and Due Diligence:

Portfolio managers actively seek out investment opportunities by sourcing deals through various channels, including networking, industry connections, and proprietary research. Due diligence is conducted to thoroughly assess the target company’s financials, operations, market position, competitive landscape, growth prospects, and potential risks.

Investment Decision of Portfolio Management

Based on the findings of due diligence, portfolio managers decide whether to invest in the target company and negotiate the terms of the investment, including the purchase price, equity stake, and governance structure.

Value Creation:

After acquiring a company, private equity firms work closely with the company’s management team to implement strategic initiatives aimed at improving operations, increasing efficiency, expanding market share, and driving growth.

Streamlining operations, entering new markets, introducing new products or services, and optimising the capital structure are all examples of value creation strategies.

Active Ownership and Operational Involvement:

Private equity portfolio managers take an active role in the companies they invest in. They might appoint board members, provide strategic guidance, and leverage their industry expertise to help the company succeed.

Exit Strategy:

Portfolio managers develop an exit strategy to realize returns for the fund’s investors. This could involve selling the company to a strategic buyer, merging with another company, or taking the company public through an IPO.

Portfolio Diversification:

Private equity firms manage a diversified portfolio of investments to mitigate risk. They may invest in companies across different industries, geographies, and stages of development.

Risk Management:

Portfolio managers assess and manage risks associated with each investment, including industry-specific risks, regulatory changes, macroeconomic factors, and competitive pressures.

Performance Monitoring and Reporting:

Private equity firms closely monitor the financial and operational performance of their portfolio companies on an ongoing basis.

Regular reporting to investors provides transparency into the performance of the fund’s investments.

Distribution of Returns:

As portfolio companies achieve milestones and are eventually sold or exit the investment, the private equity firm distributes returns to its investors based on the terms of the fund.

Challenges in Portfolio Management

Following are the challenges in Portfolio Management:

Challenges in Portfolio Management

Value Creation:

Private equity portfolio managers need to implement effective value creation strategies within portfolio companies to enhance their performance and increase their value. Achieving operational improvements, strategic growth, and cost optimization can be challenging.

Exit Timing and Strategy:

Identifying the right time and strategy for exiting an investment is crucial. Economic conditions, market dynamics, and company-specific factors can all impact the success of an exit strategy.

Due Diligence Complexity of Portfolio Management

Conducting thorough due diligence on potential investment targets can be complex and time-consuming. Ensuring accurate financial information, evaluating operational risks, and assessing the quality of the management team are critical.

Management Team Alignment:

Aligning the goals and strategies of the private equity firm with the existing management team of the portfolio company can be challenging. Differences in management styles and objectives can hinder successful value creation.

Cyclical Industry Exposure:

Private equity investments can be exposed to specific industry cycles, economic downturns, and regulatory changes. Portfolio managers need to manage risk by diversifying across industries and adapting to changing market conditions.

Capital Allocation:

Allocating capital efficiently across a diverse portfolio of investments while maintaining a balance between risk and return can be a complex task.

Venture Capital

Following are the challenges faced by the venture capital firms:

Early-Stage Risk:

Venture capital investments are made in startups with high growth potential, but they also carry a significant level of risk. Many startups fail to reach profitability, making the success rate of investments uncertain.

Valuation Challenges:

Valuing early-stage startups can be challenging due to limited financial history and market comparable. Over- or undervaluing startups can impact the returns generated from the investments.

Exit Challenges:

The time and method of exit for venture capital investments can be uncertain. The IPO market may not always be favourable, and finding suitable acquisition opportunities can be difficult.

Portfolio Diversification:

Investing in startups requires diversification to mitigate risk, but building a diversified portfolio of early-stage companies can be resource-intensive and may require a large number of investments.

Information Asymmetry:

Gathering accurate and timely information from startups can be challenging, especially when startups are focused on growth and may not have standardized reporting.

Regulatory and Legal Complexity:

Startups often operate in industries with evolving regulatory landscapes, requiring portfolio managers to navigate legal and compliance challenges.

Magistral’s Services on Portfolio Management

Magistral provides portfolio management services for numerous kinds of businesses such as portfolios for venture capital and private equity funds. It is a hassle for all the investors who serve on numerous boards to apply what works in one portfolio business to another. When all businesses are in related industries and are contending with very comparable challenges, the issue becomes more serious. The lack of resources across companies, the short amount of time that board members may spend supervising, and the concentration of implementation expertise in a single portfolio company all work against board members.

Portfolio Management for VCs

We assist portfolio managers in consolidating their Marketing (mostly digital), Strategy (fund-raising and exits), and Finance at a fraction of the expense necessary to have specific duties in each portfolio firm, no matter how big or little. The off-shored extended team also makes sure that no information is lost for projects that are comparable across firms, and that several projects in different organizations can run simultaneously, prioritized by the calendar of board meetings.

Our service packages for Portfolio Management include:

Collecting Data– Collecting portfolio Data weekly/ monthly/ quarterly as per the client requirements.

Financial Models- Preparing various types of financials models, financial statements and cash positions.

Data visualization- Creating dashboards in consistent formats across portfolio companies.

Review Meeting- Attending review meetings and prepare actionable notes.

Audits- First level audit of the data collected to ensure the quality and reliability of the data.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative: visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com