Every great fund starts with a vision. A unique strategy, an untapped market, a brilliant thesis. You, the fund manager, are the architect of that vision. Your focus is singular: producing stellar returns throughout its prestigious legacy.

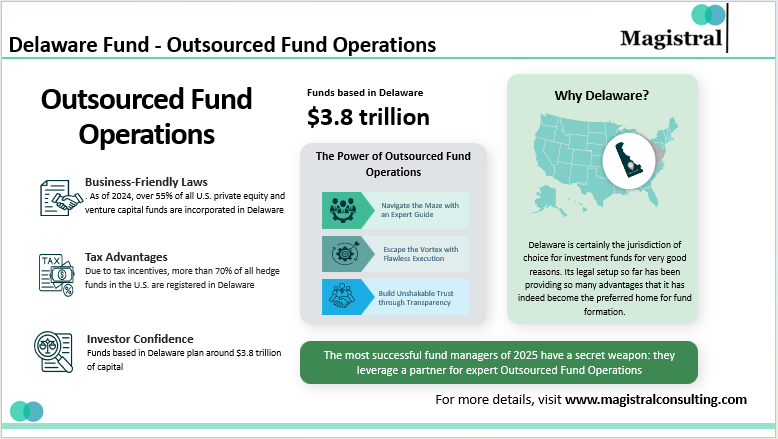

You plant a flag in Delaware-the undisputed gold standard for private equity, VC, and hedge funds. It’s an apt choice. With business-friendly laws and major tax advantages, this has become the bedrock of investor confidence. Funds birthed here manage more than $3.8 trillion of capital for a reason.

Delaware Fund – Outsourced Fund Operations

Your plans are well-laid out. But after getting all set up, a different reality drags itself into your view. Placing your fund creation between your eyes and spirit proves not a straightforward matter. It’s a mountain-best climb with expert outsourced fund operations.

Why Delaware? The Tax-Friendly Foundation of Fund Success

Delaware is certainly the jurisdiction of choice for investment funds for very good reasons. Its legal setup so far has been providing so many advantages that it has indeed become the preferred home for fund formation. Here are some of the main reasons why Delaware continues to be in great demand:

Business-Friendly Laws

Domestic and international funds choose Delaware LP and LLC structures for their flexibility, privacy, and robust asset protection. By 2024, managers incorporated more than 55 % of all U.S. private equity and venture capital funds in Delaware (Delaware Division of Corporations, 2024).

Tax Advantages

Delaware eliminates state corporate tax on out-of-state income, charges no sales tax, and grants investment entities favorable treatment. Thanks to these incentives, managers have registered over 70 % of U.S. hedge funds in Delaware (National Venture Capital Association, 2024).

Investor Confidence

Delaware-based funds now manage roughly $3.8 trillion in capital, earning the trust of investors worldwide (Delaware Division of Corporations, 2024).

Industry Trends & Insights

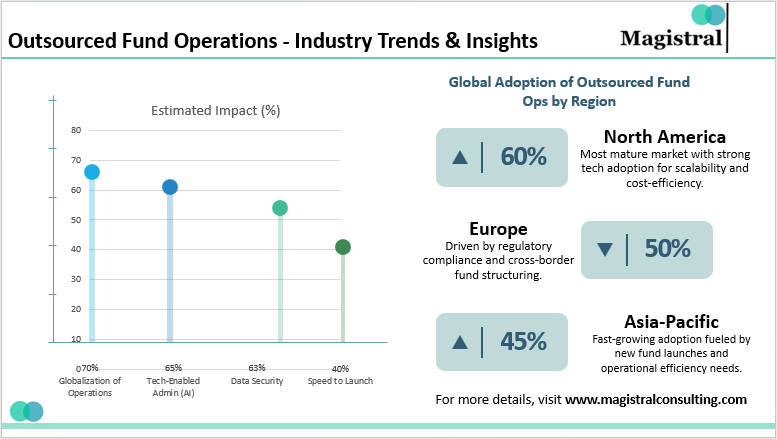

Some of the industry trends that underline the importance of fund operation outsourcing include the following:

Outsourced Fund Operations – Industry Trends & Insights

Globalization of Operations

Delaware funds increasingly serve international LPs, and outsourced partners help navigate cross-border compliance and tax complexities.

Tech-Enabled Administration

Leading firms now use AI and automation for faster, more accurate NAV calculations, reconciliations, and investor communications.

Data Security

In light of rising cyber risks, Delaware’s confidentiality laws combined with secure outsourced platforms provide peace of mind. The 2024 Cybersecurity & Data Protection in Fund Administration Report found that 63% of firms now prioritize data security as a core part of their outsourcing strategy.

Speed to Launch

With expert support, Delaware funds can go live in just 4-6 weeks, critical for managers seeking a first-mover advantage. According to a report 2024 data, 40% of funds now launch within 6 weeks of formation.

Growing Adoption

Over 55% of global asset managers now outsource some or all back-office operations.

The Power of Outsourced Fund Operations

The most successful fund managers of 2025 have a secret weapon: they leverage a partner for expert outsourced fund operations. This strategic shift allows them to conquer the operational mountain and focus entirely on performance.

The core value of outsourced fund operations: It does not merely save you money; it sells you back your most valuable asset: time, and truly terpenes the expertise into the fund’s composition.

Here’s how outsourced fund operations change the game:

Navigate the Maze with an Expert Guide

Instead of dealing with compliance issues, your partner ensures a smooth launch in 4–6 weeks, a key feature of premier outsourced fund operations.

Escape the Vortex with Flawless Execution

Imagine a world where every administrative task is executed with precision and efficiency. For a partner of this caliber, it cannot be otherwise!

Build Unshakable Trust through Transparency

With cutting-edge platforms, your partner in outsourced fund operations delivers the real-time reporting that modern investors demand.

Future-Proof Your Fund with the Power to Scale

As your fund grows, your operational support scales with you. 79% of fund managers now adopt these flexible models to manage growth effectively.

How Magistral Becomes Your Co-Pilot

At Magistral Consulting, an end-of-end solution is offered to fund managers. The services offered constitute specialized outsourced fund operations that take care of all aspects of your fund’s operations to ensure smooth functioning. Services will enable the funds to be launched, grown, and scaled efficiently, so you can focus on generating returns and building a legacy.

Comprehensive Fund Administration

We handle all the operational components so that your Fund may continue to operate efficiently, real-time NAV, investor reporting, and capital call management are some of them. Our team ensures that these critical functions are executed with precision, so you can maintain focus on the strategic aspects of your fund while we handle the day-to-day operations.

Regulatory & Compliance Fortress

Navigating SEC filings and tax compliance can be overwhelming, especially in a regulatory landscape that is constantly changing. Magistral Consulting offers expert handling of such matters, to make certain that your fund remains in compliance and that all legal exposures are kept out of harm’s way. We serve as a regulatory fortress before you, mitigating all risks while making sure that your operations are efficient and in accordance with legal requirements.

Scalable, Flexible Support

As the operational needs of a fund change with its growth, we, therefore, offer scalable and flexible support befitting the fund’s size and complexity. Whether you are a first-time manager or an established portfolio holder, our services grow with you and maintain operational efficiency at every stage.

Cutting-Edge Technology

Technology today plays a big role in operational success in this fast-paced environment. We use secure cloud environments and automation to provide real-time reporting, safe data storage, and smooth communication. Our technology allows you to get fund information in real-time from anywhere in the world while maintaining the highest levels of data security. Due to AI-powered analytics and advanced reporting tools, there is complete control over and visibility to be obtained of what goes on with the assets.

Proven Cost Efficiency

Outsourced fund operations to Magistral Consulting provides significant cost savings, with our clients seeing a reduction in operational costs by an average of 25%. In other words, with a blend of our team’s expertise and technology, you can keep overhead costs lean, instead choosing to focus on the things that really matter, whetting your investment appetite. Our solution is to give you maximum value at the most efficient costs, therefore offering you a competitive advantage without lowering any quality standards.

Case Study

A Story of Speed and Success – The $300M Launch

Background

A first-time private equity manager with a brilliant fintech thesis raised $300 million in commitments. They wanted to focus on sourcing deals and needed expert help with the entity formation, regulatory filings, and investor reporting.

The manager partnered with Magistral Consulting to navigate the operational complexities and ensure a timely launch.

The Challenge

Key operational tasks, such as forming the fund entity, meeting regulatory requirements, and ensuring accurate investor reporting, need to be handled seamlessly and efficiently. The manager required a trusted partner to manage these while they focused on deal sourcing.

The Solution

Magistral Consulting provided:

- Entity Formation: Ensuring compliance with Delaware regulations.

- Regulatory Filings: SEC and tax filings timely done.

- Investor Reporting: Transparent investor reports in real time.

With these outsourced fund operations tasks in expert hands, the manager could concentrate on their core strategy.

The Result

The fund was launched in just six weeks, impressing investors and gaining immediate momentum. The fund manager avoided common launch delays and established a solid operational foundation.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What are outsourced fund operations?

They involve delegating key back-office tasks—like fund admin, compliance, and reporting—to experts, allowing fund managers to stay focused on investment strategy.

How quickly can a fund launch with outsourcing?

With the right partner, a Delaware fund can launch in just 4–6 weeks—crucial for first-mover advantage and early investor momentum.

What challenges do fund managers face without operational support?

Without expert support, fund managers often face delays in fund launch, compliance risks, reporting errors, and high overhead costs—taking time and focus away from their core investment strategy.

Why are more fund managers adopting outsourced operations in 2025?

Rising complexity, tighter compliance standards, and investor demand for transparency are pushing fund managers to adopt outsourcing. It offers speed, accuracy, and flexibility without increasing internal overhead.