Fund accounting is the expertise that handles investment transactions in investment banking, private equity (PE), and venture capital (VC. With the growing complexity of the financial industries, high-level, sophisticated solutions have never been more in demand. Funds need accounting to guarantee transparency; track money; and manage performance. This makes it an important cornerstone of success in this kind of business.

Excavation of Complexity: Investment Banking Financial Transactions

Various financial operations will find their space within the sphere of investment banking. Such as capital raising and also mergers, as well as the management of multi-layered investment portfolios. In most cases, sophisticated systems are needed to manage complex financial structures. It is also needed to manage private equity funds, hedge funds, and SPVs.

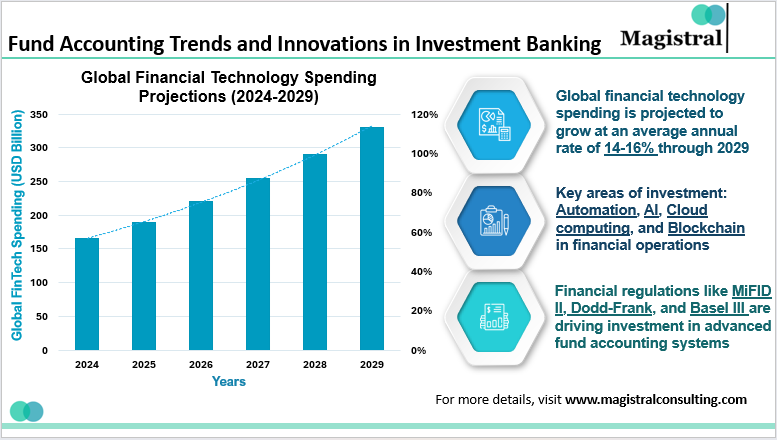

Fund Accounting Trends and Innovations in Investment Banking

Tracking Multi-Asset Portfolios

Investment banks typically maintain diversified large-sized portfolios. They might contain several asset classes and investment vehicles. Fund accounting keeps track of all the assets, liabilities, and performance metrics to ensure clarity amongst investors and stakeholders. It enables such aspects as capital calls, distributions, and other performance indicators of multiple funds. This way, proper tracking by investment banks ensures that the right capital as well as returns get reallocated. Thus, it helps in minimizing mistakes and maximizing value for investors.

Ensuring Compliance and Regulatory Reporting

With such complex global regulations coming into force as MiFID II, Dodd-Frank, and Basel III. Investment banks find great value in strong fund accounting systems to ensure continued compliance. Strong systems automate regulatory reporting, and tax calculations, and prepare banks for audits. The market of financial reporting solutions is also growing, at a projected 15% CAGR by 2026. It helps mainly in achieving regulatory compliance and transparency in the financial markets.

Technological Advances and Regulatory Requirements in U.S. Financial Markets

The United States is the biggest market for the activities of investment banking and private equity. It is where the subtleties are important and quite complex. In the U.S., fund accounting is marked by highly demanding regulatory requirements and extensively automated systems. It also has rapidly growing needs for real-time reporting because of a well-developed financial infrastructure. There are a lot of diverse players in the market as well.

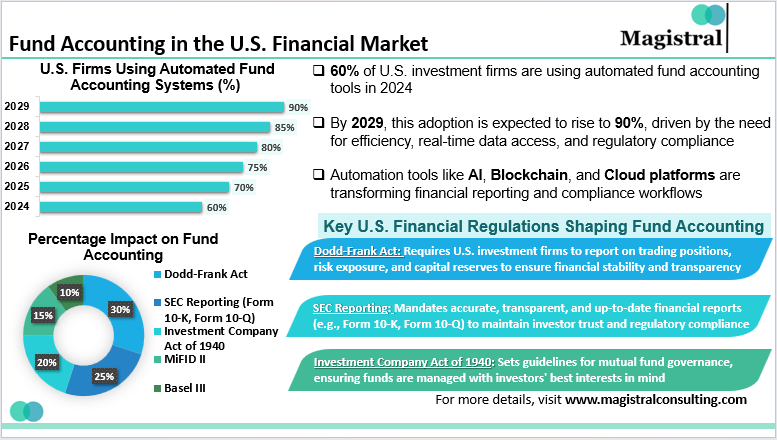

Fund Accounting in the U.S. Financial Market

Role of Fund Accounting in U.S. Regulation

The environment of regulations in the U.S. directly impacts the practices followed. The Securities Act of 1933, the Investment Company Act of 1940, and the Dodd-Frank Act more recently have been governing standards for the US investment banking system concerning good transparency and financial reporting. These regulations apply to the systems of the U.S. and often utilize automated features to prepare Form 10-K, Form 10-Q, and other required filings.

Another example is that the Dodd-Frank added requirements for detailed reports on trading positions and exposures to systemic risk, which made fund accounting even more important. This is because the U.S. Securities and Exchange Commission (SEC) has amped up the scrutiny on fund performance and transparency, among others, thus putting further pressure on U.S. investment banks to ensure highly precise, accurate, and timely reports to the accounting reports of funds.

Automated Solutions for U.S. Investment Firms

The firms in the U.S. have widely adopted cloud-based accounting platforms, which in turn have aided in the smooth-flowing processes, error rates being minimal, and compliance with regulatory norms. The quest for easy access to financial information is driving towards automation and integrated accounting solutions rapidly. According to a recent Deloitte study, 60 percent of U.S.-based investment firms use an automated accounting system in handling reporting and compliance functions.

Analysts predict that the U.S. financial services industry will spend over $10 billion on fintech innovation, including within the scope of fund accounting, over the next five years. Firms will increasingly automate these tools to enhance efficiency.

Managing Fund Valuation and Performance Metrics

The most complex area in the U.S. includes proper asset valuation and the reporting of performance metrics like Net Asset Value, Internal Rate of Return, or Multiple on Invested Capital. These measures are very essential since they allow investors to consider the various dimensions of fund performance and, hence, make prudent decisions on the capital dispensation.

For example, real-time data feeds swept across the US fund accounting solutions whereby, investment managers could get up-to-date, real-time asset valuations to respond in due time and make the appropriate adjustments based on the most current performance data available. In 2023, 87% of investment firms in the US revealed that they increasingly relied on technology and real-time NAVs, which influenced changes in their investment strategy.

Driving Innovation in Financial Operations and Reporting

Technology trends in fund accounting have emerged quite strongly. Investment banking houses in the U.S. are taking more advanced technologies, which include cloud-based accounting solutions, artificial intelligence, and blockchain, to enable streamlined management of fund activities.

Cloud-Based Solutions for Flexibility and Scalability

The cloud-based solution will bring much-needed flexibility and scalability to organizations.

>Today, most financial firms build their operations on cloud accounting systems, which allow them to access data in real time and manage financial transactions more efficiently. These systems offer scalability and flexibility, enabling firms to grow their business without making massive investments in IT infrastructure. As clients increasingly demand more operational efficiency, the need for transparency in financial management continues to rise. As a result, experts expect the market size for cloud-based financial management to reach $33 billion by 2026.

Artificial Intelligence and Automation

These powers are changing the old conception of fund accounting. The mechanization of transactions becomes instantly entry and reconciliation in the fund account besides financial forecasting. Artificial intelligence may go on to accelerate the processes of investment firms and pose restrictions on human error while making the outcomes predictable. AI algorithms can process volumes of data for the analysis of discrepancies, make forecasts, and even enhance investment strategies based on historical trends.

Finances will soon see a rise in AI adoption. The financial services sector is expected to grow at an 18% CAGR through 2030, and it’s believed that the areas that would use AI the most would be fund accounting.

Blockchain: Enhancing Transparency and Security

It is supposed to revolutionize the whole landscape of fund accounting and bring this decentralized and immutable record for financial transactions to the world. What technology does is provide real-time tracking of every transaction, which automatically leads to verifiable records and fewer cases of fraud. Therefore, blockchain becomes even more relevant for investment firms in the United States, which need to keep track of investments. They are spread across several jurisdictions in a risk-free manner that cannot be tampered with.

As the market for blockchain in financial services grows, by 2024, 35% of financial institutions based in the United States will upgrade their accounting systems with blockchain, making fund management processes smoother and financial data secure.

Magistral Consulting’s Services

Magistral Consulting provides a list of services to investment banks, private equity, and venture capital firms. It is to manage financial operations and observe compliance. We optimize fund management, improve transparency, and adhere to regulatory standards. In this domain, we offer four core services set out below:

Industry Research & Regulatory Compliance

Our team continually monitors market trends, emerging regulations, and compliance requirements specific to your industry. It is to ensure your firm stays fully prepared for any changes in the regulatory environment.

Customized Financial Reporting

Our team can create comprehensive, tailored financial reports, meeting the high requirements of the industry but the idiosyncratic requirements of your firm. All these reports are comprehensive about the NAV, IRR, and MOIC performance metrics and support strategic decision-making.

Technology Integration & Automation

We also empower businesses to implement such cutting-edge technology solutions. For instance, cloud-based accounting systems, AI-powered tools, or blockchain. It is in order to execute savings efficiencies fully with timely reporting of finances and intuitive data integrity.

Due Diligence & Investment Valuation

Our due diligence services comprise diversified asset valuations and financial forecasting that provide you with the most accurate and actionable data to make your investment decisions.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com

What kind of changes do the advances in AI, cloud computing, and blockchain technology bring to fund accounting?

AI, cloud computing, and blockchain automate processes, minimize errors, and maximize data safety, which helps firms manage portfolios more efficiently and in compliance.

Why does compliance become such an issue with investment firms' fund accounting?

The firms find it hard to be compliant with regulations such as MiFID II and Dodd-Frank, but the systems for fund accounting can automate reports and tax calculations for firm adherence to those legal requirements.

What is the role of fund accounting in determining asset value and reporting performance metrics like net asset value?

Fund accounting is important in ascertaining the reliability of asset valuation and for the calculation of key metrics, including NAV and IRR, which would be highly useful for investors to determine fund performance and make decisions.

How are U.S. investment firms embracing automated fund accounting solutions?

U.S. firms have taken the adoption of cloud-based, automated accounting systems. These offer real-time data access, reduce error rates, and improve regulatory compliance, supporting efficiency and growth.