Mergers and Acquisition Services will always be the main strategies for businesses that want to grow, innovate, and have a competitive edge.

The new situation is changing the expectations of the companies regarding Mergers and Acquisition Services. They are increasingly looking for support in value creation through services such as due diligence, synergy modeling, regulatory navigation, and digital integration rather than traditional deal execution.

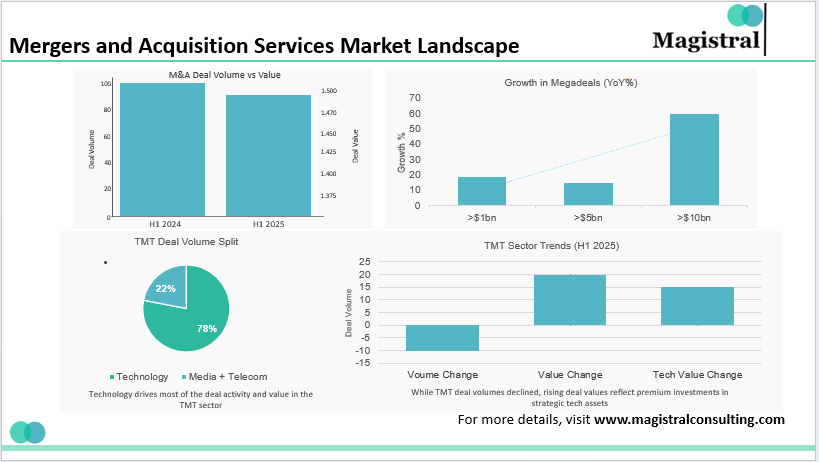

Current M&A Market Landscape and Key Data

Global volumes down, values up

As per the mid-year outlook of 2025, global M&A deal volumes going down by approximately 9% in comparison to the first half of 2024. On the other hand, the total transaction value grew by about 15%, from nearly US$1.3 trillion to US$1.5 trillion approximately.

Mergers and Acquisition Services Market Landscape

Megadeal momentum

The market is increasingly dominated by large, transformative transactions:

The yearly volume of deals over US$1 billion increased by nearly 19%. While that of deals above US$5 billion went up by about 16%.

Forecasts indicate that the total value of global Mergers and Acquisition Services in the first nine months of 2025 could reach US$1.9 trillion or even more. This mean a 10-25% rise compared to the corresponding period in 2024.

Reuters data reveal that the number of $10 billion+ deals in H1 2025 has increased by more than 60% compared to the previous year. This is a clear indication of a rise in megadeals.

Megadeals are particularly concentrated in technology, banking and capital markets, and power/utilities.

Sector picture: TMT still leads

Technology, media and telecommunications (TMT) continue to be a major engine of M&A:

According to a report, mid-year 2025 prognosis states that TMT deal volumes in the first half of 2025 fell by roughly 11% but at the same time, deal values rose by around 20%.

In the TMT area, technology deals alone account for nearly 78% of deal volume and 83% of deal value. This indicates that tech is the most significant player within the sector.

Analysts predict that technology deal values will have risen by about 15% in the first half of 2025. This is mainly due to the acquisitions of AI, cloud, and cybersecurity capabilities.

Key Opportunities in Mergers and Acquisition Services

Businesses and investors can seize abundant opportunities in this dynamic M&A environment by focusing on several strategic areas:

Key Opportunities in Mergers and Acquisition Services

Megadeal Strategy

Due to the increase of large transactions, it will be the service providers that are able to handle the intricacies of deal structures, compliance with regulations, and integration issues that will be the most successful. The increase in megadeals brings along large-scale needs for advisory, financing and due diligence services.

Technology-Driven Transactions

The main cause of this phenomenon is the procurement of new technology to strengthen the digital capabilities. Businesses have decided to go for Mergers and Acquisition Services of AI, software, and data analytics. There will be a great demand for Mergers and Acquisition Services providers who are capable of assessing tech assets and supporting digital success through integration in the merger.

Cross-Border Expertise

With an upsurge of cross-regional transactions, it becomes essential to grasp local rules, tax provisions, and political uncertainty.

Sustainability and ESG Integration

ESG factors are more and more frequently becoming the criteria for assessing M&A transactions. Mergers and Acquisition Services that include ESG hazards and financial appraisal in their scope of the work are thus creating value for the clients that are looking ahead.

Private Equity Activity

“Dry powder” means that private equity firms still have a lot of money waiting to be spent on big acquisitions and by playing a part in the market. This is a trend that is going to require even more specialized and custom-made advisory and transaction support for Private Equity firms.

Market Insights and Trends

A major trend influencing the Mergers and Acquisition Services process in 2025 is the balancing act between the wait-and-see approach taken in the face of uncertainty and the urgency to transform. Even as geopolitical tensions, policy uncertainties such as tariffs, and market volatility encourage finance professionals to take a wait-and-see approach, companies still actively pursue strategic growth through consolidation.

The technology, media and telecommunications (TMT) sectors are at the center of optimism. A slight decline in the number of transactions (11%) was compensated for by a remarkable rise of 20% in their values in the first part of 2025. Thanks to AI innovation, deregulation, and the possibility of lower interest rates that will raise the level of CEO confidence in selling and buying companies.

The energy and real estate assets acquired by the TMT sector indicate diversification strategies that accompany technology expansion.

In the case of emerging markets, Asia-Pacific and some regions in Africa are quickly turning into M&A activity centers because of the rising consumer bases and the growing middle classes. The Indian market is a good example of this trend with a huge increase in the number of transactions as well as in their sizes. This is especially in renewable energy which is a sector aligned with the global sustainability goals.

Mergers and Acquisition Services strategies are also influenced by the level of regulatory scrutiny. Governments are watchful and thus are taking preventive measures against monopolistic practices that are perhaps the main reason for firms to resort to taking strategic partnerships or doing joint ventures instead of outright acquisitions to grow without raising antitrust concerns.

Services Offered by Magistral Consulting for M&A

Magistral Consulting provides comprehensive, end-to-end support across the mergers and acquisitions lifecycle. From deal sourcing and valuation to execution, integration, and ongoing portfolio management.

Due Diligence & M&A Risk Assessment

Magistral truly partners with the clients through the whole process of making the right acquisition decisions. By performing comprehensive due diligence for the target companies, financial evaluations, and risk assessments of operations and legal & compliance. It also considers other factors specific to the deal.

Deal Origination & Target Screening

Our services cover assisting clients with discovering and assessing potential acquisition or investment target companies.

Financial Modeling & Valuation

We elaborate on various types of valuation models and venture to make predictions. In order to ascertain the valuation of the deal, synergies, and post-merger situations.

Transaction Execution Support & Deal Documentation

Facilitating the actual deal execution and producing the documentation required.

Fundraising / Capital Structure Advisory

Assisting with fundraising, structuring capital for acquisitions, and debt vs. equity advising, and optimizing capital structure.

ESG Analysis & Compliance

We provide ESG analysis and incorporation into M&A assessment. This makes sure that the green practices and the adherence to legal requirements are given consideration.

Back-office, Fund Administration & Accounting

To take the load off financial share out and merging transactions as well as their aftermaths.

Research, Market Intelligence & Documentation

Delivering the documentation for decision-making in M&A deals consists of industry research, competitive intelligence, reports, and supporting documents.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Tanya is an investment-research specialist with 6 + years advising venture-capital, private-equity and lending clients worldwide. A Stanford Seed alumnus with an MBA and an Economics (Hons) degree, she heads project teams at Magistral Consulting, delivering financial modelling, due-diligence and deal support on 3,000 + mandates. Her blend of rigorous analytics, sharp project management and clear client communication turns complex data into actionable investment insight.

FAQs

What defines the M&A landscape in 2025?

Which sectors are leading global M&A activity?

Why is India’s M&A market growing?

What key trends are shaping M&A services?

What is the future outlook for M&A services?