Fintech has added a complicated twist to the whole dynamics of retail lending solutions. The ever-mounting customer expectations, together with adverse regulatory policies, are bringing about a scale of customer service-oriented changes. Advances in increasingly recognizing the need to focus on customer satisfaction and satisfaction; with the whole area of banking and other money lending institutions’ doing away with the old lending formula.

Understanding Retail Lending in the Current Banking Scenario

Retail lending is concerned with the lending of loans to individuals for household purposes which could include home loans, car loans, personal loans, and credit cards. Until the evolution of the era of fintech, banking institutions and branches were the main sources of lending services.

During the last decade, quite several factors have played a pretty good role in informing the retail lending landscape. Some of them include:

Technological Innovations

This will allow for much more automation, artificial intelligence, and the use of big data to include much more informed decisions as well as faster loan approvals with an overwhelmingly personal experience with the customers.

Changing Consumer Expectations

Today, consumers expect retail lending solutions and their processes to be fast, seamless, and transparent. Traditional retail lending solutions and institutions are facing the challenge of satisfying customers with similar services.

Regulatory Changes

The dynamics of borrowing in retail lending solutions have changed as regulatory instruments have changed with more emphasis on the management of data, risk as well as lending compliance.

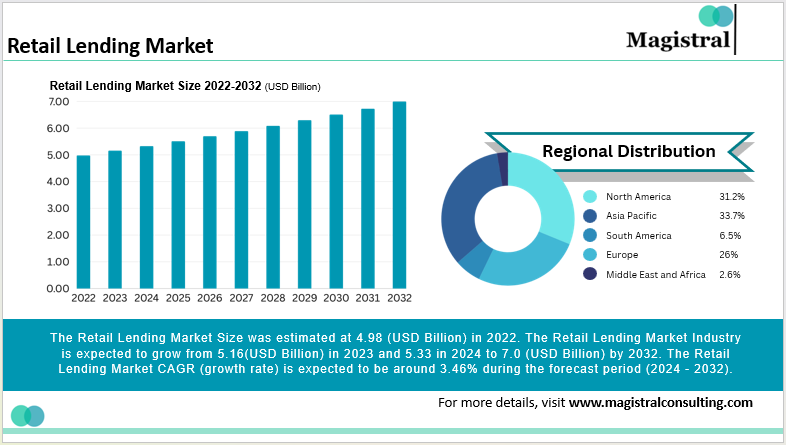

Retail Lending Market

The retail lending market reached a valuation of $4.98 billion in 2022, growing by 4% to a projected $5.16 billion in 2023, $5.33 billion in 2024, and finally hitting $7.0 billion in 2032. This translates into a projected compound annual growth rate (CAGR) of approximately 3.46% for the forecast period from 2024 to 2032.

Retail Lending Market

While the transformation of the banking industry brings opportunity, it also creates challenges as banks have to find a way to integrate risk management with other factors such as regulatory compliance, customers’ expectations, and the need for innovation as a competitive advantage.

Regional Lending Preferences

Here’s an overview of the key lending preferences and trends in two major regions: the United States and the European Union.

United States

Preferences of products

Mortgage loans make up the largest portion of financial consumer credit in the United States retail lending market. Representing about 70% of overall consumer borrowing, with other types of credit such as auto, education, and credit card loans trailing behind it. The Federal Reserve reported that outstanding consumer credit exceeded $4.7 trillion in 2023.

FinTech Adoption

Digital lending is quickly becoming more popular among U.S. consumers. Platforms like SoFi, Lending Club, and Upstart are transforming the personal loan market by shifting from traditional, in-person lending to fully online services.

Credit Scoring Dominance

Credit scoring systems in the U.S. are dominated by the FICO scores and Vantage Scores which are for the most part integrated in decision systems. The borrower’s credit history is always taken into account in such models, as well as the borrower’s repayment behavior.

European Union

Product Preferences

European customers tend to prefer secured loans and home mortgages. However, green project loans, such as financing energy-efficient buildings or eco-friendly renovations, also attract significant interest.

Digital Lending Trends

Techfin innovations are gaining ground across the whole of Europe, albeit with varied adoption levels between countries in terms of the different consumer behaviors and financial systems.

Alternative Scoring Models

In some European countries, alternative credit scoring systems are far more developed than in the U.S. Such models rely on real-time income and spending data and offer a better view of the financial situation of the borrower.

Emerging Trends in Retail Lending Solutions

The retail lending solutions landscape is evolving rapidly, driven by several emerging trends that are transforming how loans are underwritten, processed, and personalized for consumers.

Emerging Trends in Retail Lending Solutions

The Rise of Fintech and Digital Platforms

Overall, FinTech lenders simplify loan underwriting, credit checks, and loan approvals, speeding up the turnaround time on those loan types. The global FinTech lending market is expected to surge from $4.4 billion in 2023 to $420.4 billion by 2030, growing at a remarkable 25.7% CAGR. This rapid expansion reflects a rising consumer preference for seamless, technology-driven financial services.

Personalization in Lending

Customization becoming crucial in retail lending solutions. With the integration of big data and artificial intelligence, tailored lending is offered to individual customers. In fact, it has been gleaned from research that banks could hike their revenue by a staggering 15 to 20 percent through advanced analytics that touts personalization. However, they are now in a position to provide appropriate loan products. In line with the potential borrower’s income, needs, and credit rating due to a vast pool of customers’ information.

Digital-First and Contactless Solutions

The COVID-19 pandemic moved faster the digitization in retail lending solutions and as a result, banks have been forced to implement digital-first approaches. McKinsey notes that the advent of the crisis did not spare even retail banking as compressing timelines associated with the provision of service accelerated the use of the digital revolution. Banks and lenders have set up their own apps and online lender platforms. Allowing the borrower to fill in a loan application, submit the required papers, and receive a loan without leaving his premises.

Outsourcing to Drive Efficiency

With the increasing intricacies of retail lending solutions coupled with its technological orientation, most banks have opted for outsourcing. Acting as a way of freeing resources from non-core activities as well as minimizing operational costs. In this regard, a Deloitte study shows that banks have increasingly leveraged outsourcing. Especially in the post-COVID-19 era—to boost operational efficiency and meet growing demands.

AI and Automation in Credit Scoring

Finextra states that the use of AI in credit scoring systems is particularly useful in increasing the speed and accuracy of such systems. Along with encouraging retail lending solutions to more people in shorter periods.

>These improvements, allow also the banks to minimize the risk, as the AI systems are capable of detecting patterns and potentially fraudulent activity better than human experts.

Magistral’s Services for Retail Lending Solutions

At Magistral Consulting, we appreciate the fact that changes are taking place in retail lending solutions. Our company serves as a valuable ally to financial organizations by providing custom outsourcing services. This is how we assist our clients to outrun the competition in retail lending:

Loan Origination and Underwriting Support

We carry out in-depth borrower profiling combining AI and machine learning for quicker and more precise decisions. Our team processes every step of the application, thus ensuring a fast turnaround time whilst keeping accuracy and compliance intact. We assist in the prevention of such risks during the underwriting process by employing advanced analytics and pattern recognition tools.

Portfolio Management and Servicing

We help sustain loan performances and manage risks in the service of loan portfolios. Considering factors such as performance, defaulters, and the patterns of holidays caused by borrowers. We also provide implementation assistance of strategies focused on engagement for better retention and satisfaction of the users.

Risk and Compliance Management

We provide solid capabilities in the production of regulatory documents in relation to GDPR, CCPA, and other data protection laws. Our professional team of strategists also performs meticulous risk assessment, enabling the lenders to grow under the shadow of regulation. In addition, advanced tools and encryption methods are employed as a means of ensuring the privacy of data. Therefore, minimizing data privacy-related risks.

Data-driven Insights for Personalization

With the help of big data analytics, we segment the customers to identify cross-selling and up-selling opportunities for specific loan products. Our research teams monitor the dynamics of retail lending in order to help the clients cope with changes in the tastes and preferences of consumers, as well as the environment.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com

What is the projected growth of the global retail lending market?

The global retail lending market is expected to grow from $9.4 trillion in 2020 to $13.7 trillion by 2030, with a compound annual growth rate (CAGR) of 4.0%.

How is fintech impacting retail lending?

Fintech companies are revolutionizing the retail lending sector by:

- Leveraging AI, blockchain, and machine learning to streamline the loan application process.

- Offering faster, more transparent, and cost-effective lending solutions.

- Introducing peer-to-peer lending platforms and online marketplaces for easier credit access.

What role does personalization play in modern lending?

Personalization involves tailoring lending solutions to individual needs using big data and AI. Examples include:

- Customized loan offers based on spending habits.

- Personalized communication to enhance customer experience.

- Predictive analytics to match borrowers with relevant loan products.