Introduction

In the ever-evolving landscape of financial markets, integrating cutting-edge technologies is not merely a fleeting trend but rather a crucial strategic imperative. As a result, organizations must continuously adapt to stay competitive and capitalize on emerging opportunities. Amidst these groundbreaking advancements, the paradigm of Generative AI Investment has emerged as a revolutionary influence, transforming the way organizations approach investment strategies. This article explores the profound impact of Generative AI Investment on contemporary finance, scrutinizing its applications, benefits, and the strategic advantages it offers to forward-thinking enterprises.

Understanding Generative AI Investment

Generative AI Investment represents the convergence of artificial intelligence and finance, employing sophisticated algorithms to autonomously generate investment strategies. As a result, investors can capitalize on more precise forecasts of market fluctuations, enabling them to make well-informed and timely strategic investment decisions. Ultimately, this leads to a more robust and adaptive investment approach that aligns with evolving market dynamics.

The Evolution of Generative AI in Finance

Historical Context

The inception of Generative AI in finance dates back to the early 21st century, coinciding with the ascent of machine learning and data analytics in the financial sector. Following this era, continual technological progress has propelled Generative AI Investment to the forefront of strategic decision-making.

The Role of Machine Learning

A key component of generative AI is machine learning, a branch of AI that allows systems to learn and adapt without explicit programming. In financial environments, where standard models often fail due to dynamic markets, this adaptive learning aspect becomes very beneficial.

By embracing the innovative landscape of Generative AI Investment, organizations can navigate the complexities of modern finance with enhanced efficiency and strategic acumen.

Trends in Generative AI Investment

Generative Artificial Intelligence (AI) Investment has emerged as a transformative influence in the financial sector, reshaping conventional investment approaches and creating new avenues for strategic decision-making. As technological advancements persist, Generative AI Investment trends are rapidly evolving. It will provide unprecedented opportunities for businesses to optimize their financial portfolios.

Trends in generative AI investment

Finance’s Adoption of Generative AI is Predicted to Follow an S-Curve, with a Slow Start and Quick Growth as Institutions Acknowledge Its Revolutionary Promise. The S-curve indicates a future saturation point for financial strategies driven by AI innovation, which will occur as the technology develops and becomes more widely accepted.

Generative AI Adoption in finance will likely follow an S-curve

Source: BCG Analysis

Rise in Data Utilization

The cornerstone of Generative AI Investment lies in its ability to analyze extensive datasets, unveiling concealed patterns and trends. Furthermore, with the exponential increase in available data—driven by the expansion of digital platforms and Internet of Things (IoT) devices—Generative AI algorithms are becoming increasingly proficient at processing and interpreting vast and diverse data sources. This advancement significantly enhances the precision and depth of market analysis, thereby facilitating more informed and data-driven investment decisions.

Sophisticated Predictive Analytics

Advancements in machine learning algorithms are propelling Generative AI Investment towards more refined predictive analytics. These algorithms can scrutinize historical data, market trends, and even social media sentiments with remarkable accuracy. Consequently, investors can leverage more precise forecasts of market shifts, enabling them to make timely and strategic investment decisions.

Incorporation of Understandable AI

As the complexity of Generative AI models increases, there is a growing emphasis on integrating understandable AI techniques. Comprehending the decision-making process of these models is crucial for fostering trust and ensuring transparency in the investment process. Understandable AI enhances interpretability and facilitates adherence to regulatory requirements, a critical aspect in the financial sector.

Emphasis on ESG (Environmental, Social, and Governance) Criteria

Generative AI Investment is incorporating more and more ESG considerations into its decision-making process as a reaction to the growing public awareness of environmental and social issues. Investors understand how important it is to match ethical and sustainable activities with their holdings. These days, generative AI algorithms are being trained to assess businesses according to their ESG performance, giving investors the chance to encourage investments that align with social responsibility.

Personalized Investment Strategies

Generative AI is transitioning beyond generic investment approaches, with personalization emerging as a prominent trend. Algorithms are tailoring investment strategies to individual investor preferences, risk tolerance, and financial objectives. This customization ensures that investment portfolios closely align with the distinct needs of each investor, offering a more satisfying and efficient investment experience.

Collaboration Between AI and Human Experts

At the same time, while AI plays a pivotal role in data analysis and decision-making, the significance of human expertise remains unparalleled. Notably, an emerging trend is the increasing collaboration between Generative AI systems and human investment professionals. Through this synergy, AI effectively manages complex data analysis, whereas humans contribute intuition, strategic judgment, and nuanced insights that machines cannot replicate.

Benefits of Generative AI Investment

Generative AI Investment offers unparalleled benefits in finance, empowering professionals with data-driven insights for informed decision-making. Its automation capabilities enhance operational efficiency, enabling real-time adaptation to market changes, reducing human errors, and instilling confidence in strategic financial initiatives.

Benefits of generative AI investment

Enhanced Decision-Making

Generative AI Investment empowers financial professionals with data-driven insights, enabling them to make well-informed decisions. The ability to process vast datasets in real-time ensures decisions are based on the most up-to-date information, minimizing the impact of emotional or subjective biases.

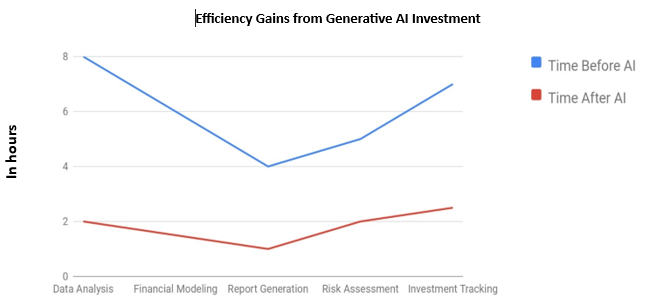

Improved Efficiency

The automation capabilities of Generative AI Investment streamline financial operations, leading to improved efficiency.

Adaptive Strategies

In a dynamic market environment, adaptability is a key determinant of success. Generative AI Investment enables organizations to develop adaptive investment strategies that respond quickly to changing market conditions. This flexibility is crucial for staying ahead of competitors and capitalizing on emerging opportunities.

Reduced Human Error

Human error has historically been a challenge in financial decision-making. Generative AI Investment minimizes the impact of such errors by automating routine tasks and providing data-driven insights. Consequently, this not only improves accuracy but also instills greater confidence in investment strategies. In turn, investors can rely on more precise data-driven insights, allowing them to make more informed financial decisions with reduced uncertainty.

Challenges and Considerations

Data Security

Protecting large datasets becomes a critical factor, highlighting the need for strong cybersecurity defenses. Protecting sensitive data and guaranteeing regulatory compliance require the implementation of robust security procedures.

Ethical Considerations

In the realm of advancing technologies, ethical considerations must take precedence in the decision-making process. It is vital to ensure that investments in Imaginative AI Finance align with ethical guidelines and industry norms, fostering trust among stakeholders.

Regulatory Compliance

Imaginative AI Finance must strictly adhere to regulatory frameworks governing financial markets. Conforming to these regulations is crucial to avoid legal consequences and uphold the integrity of financial operations.

Integration Complexity

The incorporation of Imaginative AI Finance into existing financial systems may pose challenges. Financial institutions need to allocate resources to streamline integration processes, optimizing the benefits of this technology without disrupting ongoing operations.

Magistral Consulting’s Innovative AI Financial Services

In the rapidly evolving realm of contemporary finance, Magistral Consulting stands out as a frontrunner in delivering state-of-the-art Innovative AI Investment services. Demonstrating unwavering dedication to excellence and an in-depth comprehension of the financial sphere, Magistral Consulting provides customized Consulting to empower enterprises to unlock the complete potential of Innovative AI for optimal financial results.

Magistral Consulting’s Innovative AI services are characterized by a methodical approach to data scrutiny, harnessing cutting-edge algorithms to derive meaningful insights. The organization’s team of seasoned data analysts and financial specialists collaborates to devise and execute personalized Innovative AI Investment strategies tailored to match the distinctive objectives and risk tolerance of each clientele.

Magistral Consulting’s proficiency spans diverse sectors, encompassing banking, wealth management, and investment enterprises. Moreover, the services provided by the organization not only aim to maximize yields but also emphasize risk mitigation and strict adherence to industry regulations. As a result, this balanced approach enhances both profitability and compliance, ultimately fostering long-term sustainability. Furthermore, by integrating advanced risk assessment and regulatory best practices, the organization minimizes financial uncertainties while simultaneously strengthening investor confidence and ensuring steady growth.

Beyond its advanced technological Consulting, Magistral Consulting sets itself apart through an unwavering commitment to continuous support and cooperation. Recognizing that the triumphant integration of Innovative AI Investment necessitates ongoing scrutiny, fine-tuning, and adaptation, Magistral Consulting’s client-centric methodology ensures that enterprises receive sustained guidance and aid to navigate the dynamic landscape of financial markets.

Future Outlook

Continued Innovation

The trajectory of Imaginative AI Finance indicates a promising future for the financial industry. Advances in machine learning, natural language understanding, and data analytics will contribute to refining and expanding imaginative AI algorithms. It will unlock unique opportunities for investors.

Collaboration and Knowledge Sharing

In an industry often marked by competition, fostering an environment of knowledge exchange and collaboration is advantageous. Such cooperation will accelerate the development and adoption of Imaginative AI Finance. It will ensure its evolution to meet the complex challenges of the financial landscape.

Investment in research and development- Imaginative AI

Democratization of Technology

As Imaginative AI Finance matures, the technology is expected to become more accessible. It will empower a broader spectrum of financial institutions to leverage its capabilities for strategic decision-making. This democratization will level the playing field, enabling even smaller organizations to compete on equal terms.

About Magistral consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com