Underwriting outsourcing services has become a very important business strategy for companies in the financial sector, providing substantial operational benefits. Outsourcing can help organizations save up to 40% of their operational costs and accelerate processing times by 30-50% using specialized technology. The practice has gained popularity in loan, mortgage, and financial underwriting markets due to increasing demand for efficiency, better risk management, and cost savings. This article reviews the main benefits of underwriting outsourcing, including scalability and cost efficiency along with faster turn-around times; however, in light of the new third-party underwriters along with advanced technologies like AI and data analytics reshaping the industry. The underwriting software market is expected to grow rapidly. As such, for business houses, it stands as a strategic imperative to outsource operations to streamline their efforts in a constantly dynamic financial world.

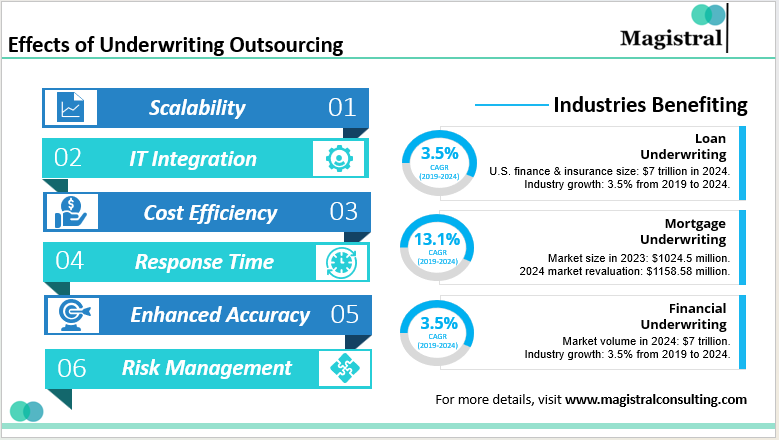

Effects of Underwriting Outsourcing

Underwriting outsourcing services would save up to 40% in operational costs as the specialized technology would help complete the process up to 30-50% faster. This has very much become a necessity in the loan, mortgage, and financial underwriting markets because of such operational efficiency, improved risk management, and cost reduction. Underwriting outsourcing is important because:

Effects of Underwriting Outsourcing

Scalability

Lenders can operate with changing volumes of loans using a minimal amount of in-house personnel, and especially at peak times, prevent disruption in service delivery.

Risk Management

Specialized third-party credit analysis reduces the rate of defaults by ensuring standardized and comprehensive appraisals, leading to better lending decisions.

Cost Efficiency

Underwriting outsourcing reduces overhead costs, which are recruitment, training, and maintaining underwriting teams through a more strategic use of resources.

Response Time

Automation combined with skilled teams means quicker loan approvals, resulting in faster turnaround time and higher customer satisfaction.

Enhanced Accuracy

They allow the underwriters with specific expertise in appraising properties and examining risks to increase the accuracy on results with more limited errors.

IT Integration

The services provider usually integrates advanced technologies that include AI together with data analysis for efficient processing of risk assessment and faster result generation. This leads to performance improvement in general underwriting outsourcing processes.

Industries Benefiting from Underwriting Outsourcing

Underwriting is central to the U.S. finance sector and incorporates several sub-markets, a few of which include loan underwriting, mortgage underwriting, and financial underwriting. Here’s a look at the market value and growth rate for each sub-market:

Loan Underwriting

Loan underwriting is one of the industries under the US finance and insurance sector. The size of this market as of 2024 is approximately $7 trillion, while the compound annual growth rate between 2019 and 2024 is 3.5%.

Mortgage Underwriting

The mortgage lender market in the United States has vastly grown in size. The size of the market in 2023 was estimated to be $1024.5 million, and it is set to enter into the year 2024 with a revaluation of $1158.58 million, showing a growth of CAGR 13.1%. All seemingly upward-downward trends lead the market to the amount of $1809.66 million by the year 2028, representing a CAGR of 11.8% during the forecast period. The professional mortgage underwriting field might grow from a 4% increase from 2018-2028, adding 12,600 jobs over the decade. Currently, an estimate puts over 123,503 mortgage underwriters working in the States.

Financial Underwriting

Financial underwriting is a part of the larger finance and insurance industry in the U.S., which has, once more, a market volume estimated at about $7.0 trillion by 2024. The industry managed to grow at about 3.5% CAGR from 2019 to 2024. The growth will most likely continue for another five years.

Market Dynamics

Following are the market dynamics in Europe and North America for loan, mortgage and financial underwriting services

Europe

In Q2 2024, loan volumes came to €21.5 billion 10% increase from the previous period to 82.83% of which Western European leverage loans represented: mostly accounted for by increasing volumes in distressed debt trading. Meanwhile, European mortgage origination is thoroughly undermined by soaring interest rates-greatly disappointing for the year, which was already projected to be stagnant, in sharp contrast to the 4.9% growth we saw in 2022, the slowest in over ten years. The financial underwriting market remains stable, with pricing adjustments in the range of -1%-+10%. Capacity is still decent, and the disturbed underwriting remains cautious with generally constant coverage terms.

North America

The loan underwriting market in North America is still on the growth track. It is projected that this market will range from $252.06 billion in 2023 to $287.26 billion in 2024, indicating a compound annual growth rate of 14%.

The continuing interest rates were in opposition to pleas for the mortgage underwriting industry. Lending slowed down both nationally and internationally, which led the insurers to revise their strategies by scaling back coverage of the most severely impacted states. In the meantime, financial underwriting is coming under heavy pressure from substantial losses that are born mostly of increased natural disasters and inflation. This is serving to drive premiums higher and render a more conservative approach to underwriting.

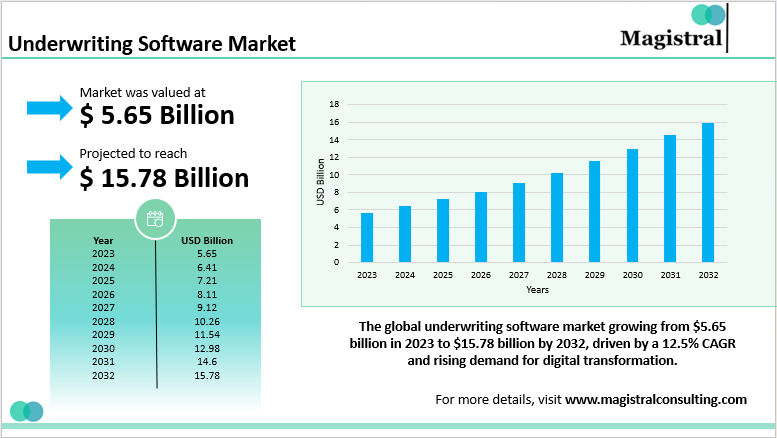

Underwriting Software Market

The worldwide marketplace for underwriting software was worth about $5.65 billion in 2023 and is expected to reach approximately $15.78 billion in value by 2032, growing at a CAGR of 12.5% from 2024 to 2032. The demand for digital transformation and data-based decision-making has provided great opportunities for market growth since business organizations have been working on innovative solutions to improve underwriting processes.

Underwriting Software Market

Market Segmentation

The underwriting software market segments by functionality, deployment mode, end user, and region. By deployment, it includes on-premises and cloud solutions. By functionality, it comprises automated underwriting systems (AUS), rating engines, and decision support systems. For end users, the market serves insurance companies, brokers and agencies, reinsurers, and managing general agents (MGAs). Regionally, it covers North America, Europe, Asia-Pacific, and LAMEA.

Magistral’s Services for Underwriting Outsourcing

At Magistral Consulting, we provide bespoke underwriting outsourcing solutions for financial institutions to augment their underwriting functions. We designed our services to offer increased efficiency, mitigate risk, and optimize costs. This allows our clients to focus on what matters most. We offer the following services to our clients:

Adaptable Capacity for Shifting Loan Demands

Our solutions empower lenders to deal with fluctuating loan volumes in a manner that decreases the burden on internal resources in times of peak demand. We offer a flexible approach that adjusts to the business’s requirements, ensuring uninterrupted service.

Comprehensive Risk Assessment

A team of talented specialists prepares credit reports and performs risk pricing analysis to offer a productive risk-aid strategy. Our specialized underwriting outsourcing practices will provide you with credible, quantifiable analyses. These will be used for sound decisions and decrease solutions in the default.

Operational Cost Reduction

By underwriting outsourcing functions to Magistral Consulting, clients save on recruitment, training, and operational overhead costs. We streamline processes and reduce the need for in-house underwriting teams, providing significant cost-saving opportunities.

Expedited Processing

We use automation and specialized human skills in underwriting outsourcing. It can accelerate processing, thus reducing the turnaround time for loan approval. The lender and the loan applicant gain more when they make a quick decision.

Accurate Assessments and Evaluations

We have sufficient reputable underwriters with enough expertise to conduct a reasonably sound property valuation. The underwriters guarantee they base decisions on effective qualitative analysis rather than guesswork, minimizing errors.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does outsourcing underwriting services improve operational efficiency?

Outsourcing underwriting services helps streamline processes through automation and the use of specialized technology. It allows institutions to manage fluctuating loan volumes more easily and reduces the burden on in-house staff. As a result, loan approval times are shortened, and operational bottlenecks are minimized.

What are the cost benefits of underwriting outsourcing?

By outsourcing underwriting functions, financial institutions can significantly cut costs related to recruitment, training, and maintaining an in-house underwriting team. Additionally, outsourcing can reduce overhead expenses, offering savings of up to 40% in operational costs while improving processing efficiency.

How does underwriting outsourcing affect risk management?

Outsourcing to specialized third-party underwriters enhances risk management by providing access to experts who perform thorough and consistent risk assessments. These professionals use advanced tools and methodologies to ensure that credit evaluations are accurate and risks are minimized, ultimately reducing the chance of defaults.

Can underwriting outsourcing speed up loan processing?

Yes, outsourcing underwriting services can dramatically reduce loan processing times. By leveraging advanced technology, such as AI and automation, third-party providers are able to assess applications more quickly, which leads to faster approvals and improved customer satisfaction.