Accuracy, speed, and timely availability of reliable information on which hedge funds operate are guiding principles. Such an environment requires Equity and Country Themed Reports as critical sources. These reports help hedge fund managers identify the trends, risk monitors, and profitable areas of investment-cum-opportunities spread across sectors and geographies.

This broad consultation is able to determine the value of Equity and Country Themed Reports, analyses their impact on the developed geographies such as the US, UK, Europe, and Middle East countries; tracks new trends, and balances niche-specific solutions toward solving hedge fund orders in general around the world.

Important Features of Equity Reports

Equity reports are the backbone of hedge fund strategies as they offer extremely detailed information on the performance of a company, its financial metrics, and sector dynamics. The reports are quite crucial for hedge funds to find high-potential investments and mitigate risks well.

Key Features of Equity and Country Themed Reports

Detailed Financial Measures

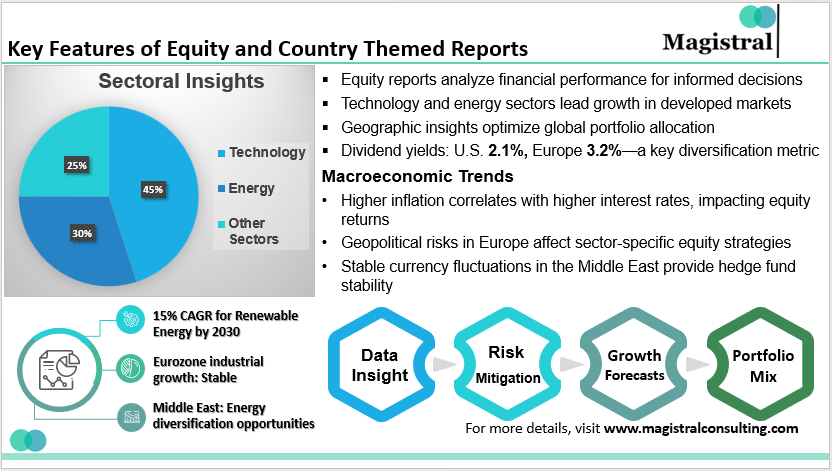

Equity reports provide some kind of summary concerning the financials in terms of, for example, EPS growth rate, P/E multiple, a dividend yield, and RoE. For instance, 2024 S&P 500 P/E has already hit an unbelievable high of 22x and add to that some facts regarding investors’ confidence-a bonanza for sectors especially those so-called high-growth sectors such as technology or energy. Considering this, hedge funds subsequently calculate the expected returns based on the outlook of the equity through analysis and Equity and Country themed reports.

Industry Analysis

The boom in the growing industries is the expectation of equity reports. The renewable energy sector can have up to a 15% compounded annual growth rate by 2030, thanks to the clean energy plans U.S. and Europe have planned. Similarly, the technology sector is exciting in using technological advancements through AI and cloud computing and hence calls for special attention.

Geographic Diversification

Equity reports of hedge funds produce opportunities geographically. The average yield of dividend in European stocks is 3.2% as compared to that of the U.S. stocks, which recorded an average of 2.1%. Gaining maximum profit, the geographical view helps optimize funds for portfolios.

Sectoral Opportunities

Technology

NVIDIA and Microsoft are applying AI innovations in order to offer hedge funds great growth opportunities.

Energy

The U.S. and Europe have invested a lot into the renewable energy sector, and is being steadily on the growth, thus proving to be long-term opportunities in the sector.

Financial Services

The U.S., the U.K. and European financial sectors remain very stable and good for risk-adjusted returns.

Macro View for Country-Themed Reports on Global Strategies

Whereas equity reports may only be provided as company-specific, Country-Themed Reports deliver a more balanced view according to the specific political, economic, and regulatory setting of the given country. It hence provides hedge funds with the best macro-driven strategy, that is, an investment properly diversified.

Global Impact of Equity and Country Themed Reports

Regional Insights in Country-Themed Reports

United States

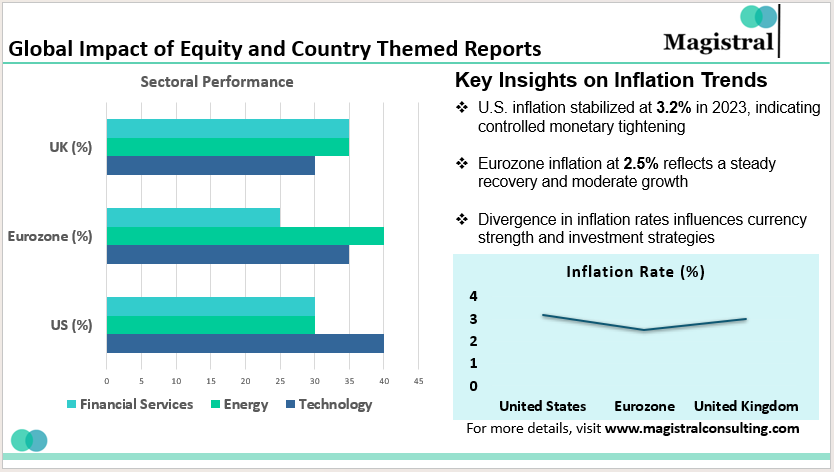

Since inflation also moved up to 3.2% in 2023, hedging funds should monitor the monetary policies that could be done in the United States Federal Reserve. Themed country reports present the impact of fluctuating interest rates on real estate, consumer goods, and the technology industry.

United Kingdom

Although economic growth in 2023 may rise modestly around the UK as the driver from financial services to renewable energy sources expands, country-specific information is certainly required. Any hedge fund contemplating direct investment into companies domiciled in the UK, for example, will without question rely on country reports regarding GDP, currency, or post-Brexit regulatory action.

Eurozone

Eurozone has an inflation rate of 2.5% in 2023, so stable and dynamic; it’s a good investment location. Industrials and clean energy have been the investment opportunities. Germany and France are the two biggest economies in the Eurozone.

Country-specific reports bear risks on geopolitical tensions and ECB monetary policies.

Middle East

It is an area of interest to hedge funds, wherein oil-exporting economies continue pushing investments in the energy sector. The country reports, reflecting Middle East and Central Asia oil price trends, have very detailed analysis of Saudi Arabia’s diversification agenda with Vision 2030 and geopolitics.

The two critical components that would be understood in relation to the risk of political instability, currency fluctuation, and regulatory change are Equity and Country Themed Reports. For example, the strength of the Euro against the U.S. dollar impacts international equity returns. Hence, it becomes a macroeconomic analysis and currency that is very important in country-specific reports.

Highly developed Equity and Country Themed Reports

One of the needs on the world financial front with vast growth has emerged. Hedge funds exploit all the modern technology to strategize further and stay ahead of the competition through Equity and Country Themed Reports.

Technological Revolution

AI and Predictive Analytics

Quite fundamentally, AI application in Equity and Country Themed Reports has brought a renovated hedge fund decision-making. For example, predictive modeling enables one to obtain opportunities for growth in sectors like renewable energy and technology where hedge funds can catch up with the current trends of the markets.

Big Data Integration

Big data analytics revolutionizes the depth and reliability of Equity and Country Themed Reports to provide hedge funds with actionable insights on the risk management and investment strategy through macroeconomic indicators, geopolitical events, and sectoral data.

Developed Markets Focus

The hedge funds have been shifting their attention towards developed markets like the U.S., the U.K., and Europe. Hedge fund firms are functioning with the existence of strong regulatory systems and financial systems. The country-specific reports in the three above-mentioned countries have real insights in terms of the market trends. There are also fiscal policies concerning interest rate movements, which in turn has been helpful in a hedge fund firm’s decision-making process. Equity and Country Themed Reports have played a big part in this as well.

Sectoral Innovations

Renewable Energy

Irrespective of whether it has happened or not, there have been significant investments in the United States and Europe regarding renewable energy. This is a great space for hedge funds to capitalize

Technology

Hedge funds will have to place equity in innovation that is led by AI solution, cloud computing and security solutions

Magistral Consulting’s custom Equity and Country-based Reports

In this complex global marketplace, hedge funds will have to fit into the unique contours of investment strategy. Magistral Consulting will be able to create tailor-made Equity and Country Themed Reports by which hedge funds can make insightful decisions with an actionable view through customized Equity reports.

Equity Analysis

Magistral provides equity analysis that goes granular on statistical data including EPS growth, P/E and dividend yield. All these reports are prepared for hedge funds in order to determine sector performers which include renewable energy equities as well as the technology stock. Hence, on data-driven basis, such a hedge fund, the equity fund can be built. Equity and Country Themed Reports are also a key feature of our services.

Country themed reports

Country-specific magistral reports will include more in-depth macroeconomic forecasts, political risk assessments, and currency analysis. From the reports, it is gathered that the Eurozone report would answer a couple of questions regarding the monetary policy effects of the ECB on the fixed-income market and equity opportunity in industrials and renewables and the like.

Sector-Specific Insights

Magistral is of the view that it needs to provide sector-specific projections of growth industries in line with hedge fund strategy. It covers clean energy, technology, and financial services. In such an eventuality, the company would be able to get properly calibrated and consistent results. It is done with the use of strong data models and Equity and Country Themed Reports.

International Risk Special Insights

Magistral has report analyses with great geopolitical risk analyses, interest rates, and volatility in currencies that allow for hedging capabilities and capitalizing on all the emerging opportunities in volatile markets.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com