In the dynamic world of finance, hedge funds stand out as a popular investment vehicle sought after by both institutional and individual investors. These investment funds, characterized by their flexibility and diverse strategies, have become integral components of many portfolios, offering opportunities for substantial returns and risk management. As investors seek to diversify their portfolios and capitalize on global opportunities, identifying the top geographies to invest in hedge funds becomes paramount. In this article, we delve into some of the most promising regions for investments, exploring their unique attributes, market dynamics, and investment potential.

United States: The Powerhouse of Hedge Funds

The United States reigns supreme as the epicenter of the hedge fund industry, boasting the largest and most developed market globally. With financial hubs like New York and Connecticut housing a plethora of hedge funds, the U.S. offers unparalleled access to diverse investment strategies, talented fund managers, and sophisticated infrastructure. The regulatory environment, although stringent, provides a stable and transparent framework conducive to investment growth and innovation. From equity long-short strategies to macroeconomic plays, hedge funds in the U.S. cater to a wide array of investment objectives, making it a perennial favorite among investors seeking alpha generation and portfolio diversification.

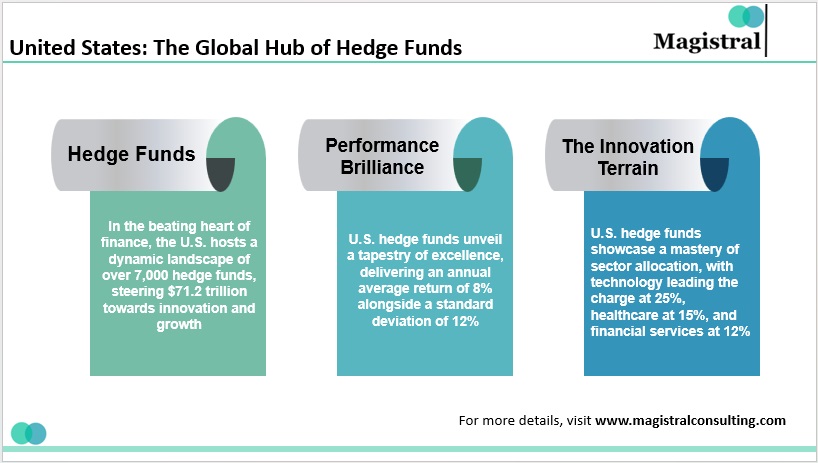

United States: The Global Hub of Hedge Funds

Hedge Funds: Driving Financial Innovation

At the heart of the financial world, the United States houses over 7,000 hedge funds as of 2024, managing $71.2 trillion in assets under management (AUM). With consistent growth over the past five years, the industry continues to thrive, attracting investors worldwide seeking alpha generation and portfolio diversification.

Performance Excellence: The U.S. Hedge Fund Advantage

Over the past decade, hedge funds in the United States have delivered impressive returns, averaging 8% annually with a standard deviation of 12%. This translates to a favorable Sharpe ratio of 0.67, signaling superior risk-adjusted returns compared to traditional asset classes.

Sector Allocation: Navigating Market Dynamics

Hedge funds in the United States demonstrate a keen focus on sectors driving innovation and growth. Technology reigns supreme, commanding a significant portion of hedge fund portfolios at 25%, closely followed by healthcare at 15% and financial services at 12%. This strategic sector allocation reflects the adaptability and agility of U.S. hedge funds in navigating market dynamics and seizing lucrative opportunities.

United Kingdom: Europe’s Financial Hub

As Europe’s leading financial center, the United Kingdom offers a compelling destination for investments. London, home to a vibrant ecosystem of financial institutions, asset managers, and hedge funds, serves as a gateway to European markets and beyond. The city’s cosmopolitan culture, coupled with its robust regulatory framework and investor-friendly policies, makes it an attractive hub for hedge fund managers looking to access capital, talent, and deal flow. Despite geopolitical uncertainties surrounding Brexit, the UK remains resilient, buoyed by its deep-rooted financial expertise and global connectivity.

Hedge Funds

Data sourced from the Financial Conduct Authority (FCA) reveals that over 1,000 hedge funds operate within the United Kingdom as of 2024, managing an estimated £500 billion in assets under management. Despite uncertainties revolving around Brexit, the industry has exhibited resilience, witnessing an annual growth rate of 8% in AUM over the last three years.

Asia-Pacific: Emerging Opportunities

The Asia-Pacific region emerges as a compelling frontier for investments, fueled by rapid economic growth, burgeoning middle-class wealth, and increasing investor sophistication. From financial hubs like Hong Kong and Singapore to emerging markets such as China and India, the region offers a diverse array of investment opportunities across equities, fixed income, currencies, and alternative assets. As institutional investors seek exposure to high-growth markets and unique alpha-generating strategies, hedge funds in Asia-Pacific play an instrumental role in capturing market inefficiencies and unlocking value across diverse geographies and sectors.

Hedge Funds

Within the Asia-Pacific region, more than 1,500 hedge funds operate as of 2024, collectively managing approximately $750 billion in assets under management, according to data compiled by AsiaHedge. The industry has experienced robust growth, witnessing a yearly increase of 15% in AUM over the past five years.

Investment Strategies

Hedge funds in the Asia-Pacific region predominantly employ long/short equity strategies, constituting approximately 40% of total assets under management. Macro strategies and event-driven strategies are also prevalent, comprising 20% and 15% of AUM, respectively.

India: Unlocking Growth Potential

India distinguishes itself with robust economic fundamentals, a burgeoning middle class, and a thriving entrepreneurial ecosystem, positioning it as an appealing destination for investments. As one of the fastest-growing major economies worldwide, India offers abundant investment opportunities across diverse sectors, including technology, healthcare, consumer goods, and financial services. With prominent financial hubs like Mumbai and Bangalore driving innovation and economic advancement, hedge funds in India play a vital role in identifying emerging trends, unlocking value, and delivering attractive risk-adjusted returns to investors.

Hedge Funds: Driving Investment Growth

The hedge fund industry in India is gaining traction, with an estimated 100 hedge funds managing a total AUM of $15 billion by 2024. This nascent yet burgeoning industry has exhibited consistent growth, with AUM witnessing an impressive annual increase of 20% over the past three years. Hedge funds in India play a crucial role in driving investment growth, identifying emerging trends, and delivering favorable risk-adjusted returns to investors.

Understanding Investor Demographics

Institutional investors dominate the investor landscape in Indian hedge funds, comprising pension funds, insurance companies, and sovereign wealth funds. This segment accounts for approximately 60% of the total AUM, reflecting the confidence of institutional players in the Indian market. High-net-worth individuals and family offices constitute the remaining 40% of investors, highlighting the diverse investor base driving growth in the Indian hedge fund industry.

Switzerland: The Epitome of Stability

Nestled in the heart of Europe, Switzerland stands out as a beacon of stability and financial sophistication, making it an attractive destination for investments. With cities like Zurich and Geneva serving as global financial centers, Switzerland offers a conducive environment for hedge fund managers seeking a balance between regulatory oversight and entrepreneurial freedom. The country’s political neutrality, robust legal framework, and investor-friendly tax regime make it a preferred domicile for hedge funds looking to attract global capital and establish a presence in the European market.

Hedge Funds

Switzerland boasts a flourishing hedge fund industry, with an estimated 500 hedge funds in operation as of 2024, managing over CHF 300 billion in assets under management, according to data provided by the Swiss Financial Market Supervisory Authority (FINMA). The industry has maintained steady growth, with AUM witnessing an annual increase of 12% over the past five years.

Investment Strategies

Hedge funds in Switzerland predominantly focus on global macro strategies, constituting approximately 30% of total assets under management. Fixed income arbitrage and equity long/short strategies are also prevalent, comprising 20% and 15% of AUM, respectively.

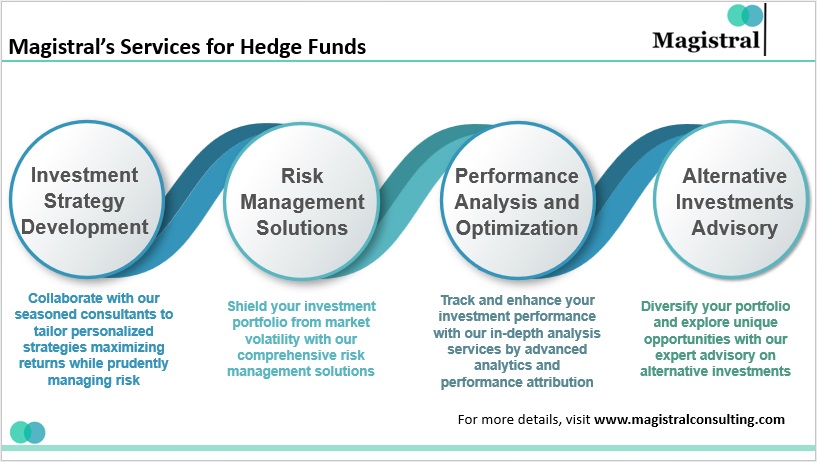

Magistral’s Services for Hedge Funds

Magistral Consulting is dedicated to offering tailored consulting services to meet each client’s distinct needs, ensuring they possess the knowledge and strategies essential for investment success. With expertise spanning various domains, we provide solutions precisely aligned with our clients’ goals. Below, we delineate four key sub-topics exemplifying the scope of Magistral Consulting’s services:

Magistral’s Services for Hedge Funds

Investment Strategy Development

Crafting a robust investment strategy is pivotal for navigating today’s dynamic market landscape effectively. Our seasoned consultants collaborate closely with clients to craft personalized investment strategies tailored to their financial objectives, risk tolerance, and investment horizon. Whether optimizing asset allocation, diversifying portfolios, or implementing tactical asset management approaches. We leverage our expertise to devise strategies to maximize returns while prudently managing risk.

Risk Management Solutions

Effective risk management is indispensable for shielding investment portfolios from market volatility and unforeseen events. Magistral Consulting provides comprehensive risk management solutions, identifying, assessing, and mitigating various risk factors encompassing market, credit, liquidity, and operational risks. Through robust risk management frameworks and advanced mitigation techniques, we aid clients in safeguarding their assets and preserving wealth over the long term.

Performance Analysis and Optimization

Continuous monitoring and evaluation of investment performance are imperative for pinpointing strengths, weaknesses, and opportunities for enhancement within a portfolio. Our team at Magistral Consulting furnishes in-depth performance analysis and optimization services, enabling clients to track investment performance, gauge key performance indicators, and identify avenues for improvement. Leveraging advanced analytics, performance attribution methodologies, and scenario analysis, we empower clients to refine their investment strategies and achieve superior outcomes.

Alternative Investments Advisory

In today’s fiercely competitive investment landscape, alternative investments present opportunities for portfolio diversification and augmented risk-adjusted returns. Magistral Consulting delivers expert advisory services on alternative investments encompassing hedge funds, private equity, real estate, and structured products. We conduct rigorous due diligence and evaluation of investment opportunities. Our team offers strategic guidance to help clients navigate the intricacies of alternative investments and capitalize on unique market opportunities.

At Magistral Consulting, our pledge is to deliver excellence in consulting services. Equipping our clients with the expertise, insights, and support requisite for attaining their investment objectives. Whether you’re a seasoned investor seeking to refine your strategy or a newcomer grappling with the nuances of finance, we are here to aid you in unlocking your full investment potential.

What are hedge funds, and how do they differ from traditional investment funds?

Hedge funds are investment funds that employ various strategies to generate returns for their investors. Unlike traditional investment funds, hedge funds often have more flexibility in their investment strategies, allowing them to profit in both rising and falling markets.

Why are the United States and the United Kingdom considered top destinations for investments?

The United States and the United Kingdom are considered top destinations due to their well-established financial infrastructure, diverse investment opportunities, and access to talented fund managers. Additionally, these countries offer favorable regulatory environments and investor-friendly policies that attract hedge fund managers and investors alike.

What factors contribute to the emergence of the Asia-Pacific region as a promising destination for investments?

The Asia-Pacific region's rapid economic growth, expanding middle class, and increasing investor sophistication make it an attractive destination for investments. Additionally, financial hubs like Hong Kong and Singapore provide access to diverse markets and investment opportunities across the region.

Why is India gaining attention as a lucrative destination for investments?

India's robust economic fundamentals, growing middle class, and thriving entrepreneurial ecosystem make it an attractive destination.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com