Introduction

Investment banks utilize pitchbooks, which are sales books, to pitch potential clients as well as sell goods and services. It gives a general picture of the company, including historical information, financial strength, and services offered to potential customers. The sales crew of a company will utilize a pitchbook as a form of field guide to remember key benefits and to make clear crucial points. A pitch book should contain the crucial information required to persuade a potential investor, client, or business partner. Therefore, avoid using too many words and focus on the most critical things.

Key topics covered in a typical pitch book include details on the investment highlights, significant financial data, the company’s core clients and customer base diversity, obstacles to entry for competitors, ability, and plan to meet future projections, future growth opportunities, management team strength, scalability of functions, prospects in the external market place, and known risks. The information provided in the pitchbook is used by an investment bank’s sales team to market its services to potential customers. Pitchbooks can be very helpful for companies, investment bankers, investors, and other stakeholders.

Types of Pitchbook

There are four different types of pitchbooks, which are explained below:

General Pitchbook

A general pitchbook offers a wide picture of the organization and includes significant details such as past profitable investments, present transactions, trends in the market, and profit metrics. Additionally, it includes details on the company such as its history, size, key executives, and global outreach.

It includes a client list broken down by various sectors, along with the relevant services offered to each client. Finally, the pitchbook might also include information on the firm’s rivals. It gives a general overview of the company’s top rivals, their performance, and the firm’s market position in relation to them.

Deal Pitchbook

For specific deals, the team creates a pitchbook that highlights how the investment business can deliver services to meet the client’s financial needs. They use graphs to display market rates, trends, and explain the firm’s valuation. The pitchbook also includes a list of potential buyers, financial institutions, acquisitions, and a brief summary. Additionally, the team provides a summary of advice and suggestions to help the client achieve their objectives.

Management Presentation

After the business finalizes an agreement with a client, the team conducts management presentations to pitch to potential investors. These presentations detail the client’s business, outline investment needs, present financial metrics, and provide information about the project requiring funding.

Sell-Side M&A Pitchbook

A sell-side M&A pitchbook’s principal goal is to persuade the customer to choose the investment bank to conduct the transaction. It includes a list of prospective purchasers for the client’s business, an overview of the valuation, suggestions, information on the bank’s profitable transactions in the client’s sector, etc.

Challenges faced by companies in the creation of a Pitchbook

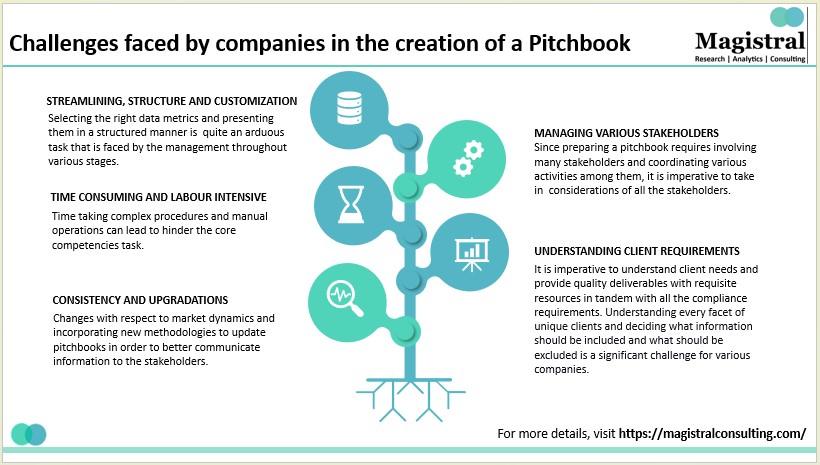

While creating the pitchbook, various challenges are faced by the companies as discussed below:

Streamlining, Structuring, and Customization

Often, companies face challenges in understanding their prospective clients/ customers, and hence collating, customizing, and structuring the Pitchbook is not efficient. Selecting the right data metrics and presenting them in a structured manner is quite an arduous task that is faced by the management throughout various stages.

Challenges faced by companies in the creation of a Pitchbook

Time-consuming and Labour-intensive

For firms, it is a challenge, as it takes a lot of time to build and finalize the framework and create a pitchbook in tandem with all the requisite information. A business team working on a Pitchbook devotes its bandwidth to requirement gathering and other tasks related to Pitchbook, eventually losing focus on other priority tasks and core competencies, which can be detrimental to the organization’s growth.

Consistency and Upgradations

Continuously upgrading pitchbooks with respect to changing market scenarios/customer requirements is a must. The companies shall incorporate new ways and develop new methodologies to work and update pitchbooks regularly to better transpire and communicate the information to its stakeholders.

Managing various Stakeholders

Many people, including the managing director, vice president, associates, and analysts, are involved in the pitchbook preparation. To outperform the competition and persuade the client that they are the greatest in the market, the company must ensure that they are utilizing the most recent industry facts. The areas that require successful management include collaboration and coordination.

Understanding Client Requirements

An effective pitchbook must be able to focus on the important details while also meeting the client’s requirements. Understanding each aspect of a unique client and deciding what information to include and exclude presents a significant challenge for businesses.

Benefits of Pitchbook Support

Below are some of the major benefits of pitchbook support:

Focus on core competency

Pitchbook assistance can allow businesses to focus on their core operations rather than devoting time to creating a Pitchbook in which they lack expertise. As a result, prioritizing the main job is critical.

Benefits of Pitchbook Support

Better Analysis and Structure

Pitchbook Support will better manage and coordinate various tasks while creating a Pitchbook. It will highlight the strengths, and showcase how the organization is different from its competitors in terms of experience, expertise, and modus operandi.

Cost and Expenditure control

You can convert fixed costs into variable prices with pitchbook support, meaning you only pay for the services you utilize. Consequently, adopting a support service can enable you to cut costs on a range of expenses, such as staffing, purchasing software, expertise, etc.

Better Branding and Messaging

Materials with inconsistent or poorly thought-out messaging could be detrimental to the brand’s reputation. Given the fierce competition in the market, having a brand and pitchbook approach that is compliance-focused is essential. Pitchbook support services help present your market position, strengths, and goodwill in a meaningful way.

Better Presentation

Pitchbook support services can help to exercise brevity and incorporate various Charts, and graphs which makes the data metrics easy to understand. Moreover, it may also take up various cases to explain various elements to its prospective clients/customers.

Magistral’s Services on Pitchbook Support

By having a Pitchbook support service, an organization can save both time and costs. It can also focus on its core competencies. It can provide a platform where it can understand the needs and requirements. Following which it can offer tailor-made support services as you deem appropriate. At Magistral, in addition to providing an extension to your employees to assist with your particular needs, we give the strategic knowledge you want to assess change. To provide the most effective and cutting-edge financial solution for every client requirement, we draw upon the multi-function knowledge base and experience of professionals in many market segments. Magistral can help in Pitchbook support in various ways such as:

Enhancing Service Requirements:

Provide tailor-made services as per the needs and requirements of the customer. Taking into consideration of various stakeholders and employing various recommendations provided by them.

Data Management:

Cleaning and filtering out the data and ensuring that significant information is showcased in tandem with the graphical representations. Employing various data metrics and collating information as per the client’s requirement

Compliance and Research Management:

By merging information from internal, external, and third parties, we have a strong knowledge of the opportunities and challenges facing your firm. We have carefully chosen insights on markets, categories, competitors, and consumers. It will help your commercial and marketing teams make better strategic decisions with respect to compliance requirements.

Analysis and Execution:

We have a dedicated team of experts for handling respective operations for creating a Pitchbook. Having exposure to diverse fields and expertise in handling various functions handling in an efficient manner.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is Authored by the Marketing Department of Magistral Consulting. For any business inquiries, you could reach out to prabhash.choudhary@magistralconsulting.com