Real estate financial modeling has progressed well beyond static spreadsheets and pro formas. In today’s higher capital cost environment, with tenant behavior constantly shifting and geopolitical challenges, modeling is not just about valuation; it is about making real-time decisions using a dynamic decision-making tool. Whether underwriting an acquisition, structuring a syndication, or forecasting ESG-linked outcomes, institutional investors and asset managers are now demanding models that are dynamic, data-integrated, and regionally nuanced. This article explores the advanced types, trends, and transformational drivers shaping real estate financial modeling in 2025 and beyond.

Types of Real Estate Financial Modeling

As real estate investments become more expensive and challenging, real estate financial modeling has developed into a discipline with numerous model types based on the strategy and assets life cycle stages.

Acquisition Model

The acquisition model assesses whether to buy a property by forecasting expected rental income, expected expenses, expected financing costs, and expected capital demands. It produces a set of return metrics, including IRR, debt service coverage ratios (DSCR), and equity multiples, and may include a sensitivity analysis exercise to test the various sensitivity variables such as exit cap rate or vacancy. Acquisition models are often used at the beginning of the underwriting process; now the goal is to establish whether the asset meets the investor’s return requirements.

Development Model

The development model simulates ground-up construction or a major redevelopment project. It incorporates land costs, staged construction projects, lease-up periods, and the phased drawdown of debt. The duration of these models is usually many years, and they test the IRR as well as yield-on-cost. Timeline-based logic is dependent on timelines to capture various risks related to delays, cost overruns, etc. Development models are often mandated by sponsors when they seek a capital or construction loan.

Rent Roll and Lease Model

This real estate financial modeling type details projected income by tenant, lease term, and rent escalation. It’s crucial for office, retail, and industrial assets with multiple leases. It also incorporates assumptions for renewals, downtime, and re-leasing costs. Highly granular, it feeds into larger acquisition or operating models. The structure helps assess tenant risk and income stability.

Operating Model (Stabilized Assets)

Used for income-producing properties, this model tracks actual revenues, expenses, and capital expenditures. It focuses on cash flow, NOI, and distributions. Asset managers use it for budgeting, performance benchmarking, and refinancing decisions. Often, it’s linked with BI dashboards for real-time insights. It’s vital for optimizing ongoing operations and reporting.

REIT or Portfolio-Level Model

This model consolidates multiple assets across property types and geographies. It includes fund-level income, cash flows, leverage, and investor returns. Metrics like NAV, FFO, and AFFO are core outputs. The model also allows sensitivity testing across economic variables. It supports institutional decision-making and dividend forecasting.

Syndication or Waterfall Model

Syndication models describe how profits are split among equity partners. They model cash flows based on ranges of scenarios under waterfall logic. Tiers include preferred returns, catch-up, and sponsor promotion. Syndication models provide transparency and alignment in joint ventures. They are the financial model used in private equity & fundraising presentations.

Mortgage or Debt Model

Debt models, in this case, refer to any analysis of financing structure, including interest rates, amortization, and prepayment terms. Debt models assess LTV, DSCR, and refinancing risk. Flows are usually modeled nested within an acquisition or development model and will detail cash flow under varying debt scenarios. Lenders use them to price risk; borrowers use them to optimize structure. Crucial in high-rate environments.

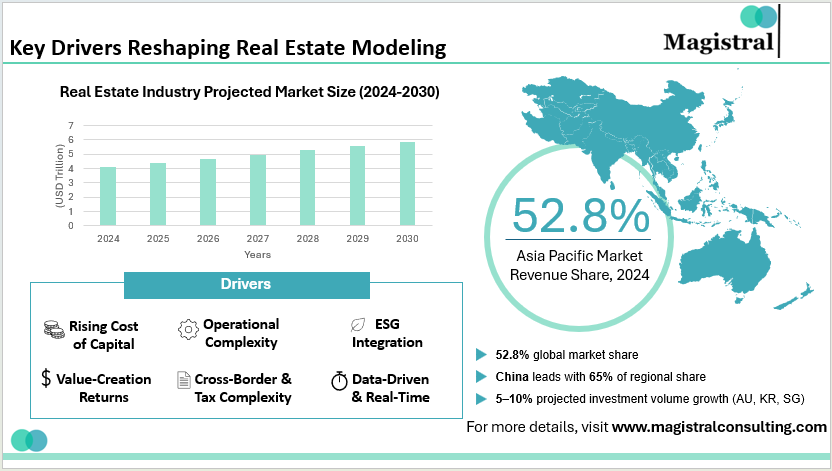

Key Drivers Reshaping Real Estate Modeling

The real estate industry and real estate financial modeling are undergoing fundamental changes. With an estimated USD 4.13 trillion in 2024 and projected growth to USD 5.85 trillion by 2030, the global sector is shifting and redefining how financial models are developed and utilized. With the industry growing at an estimated CAGR of 6.2% investors and asset managers need to operate and build models in a more data-driven, regionally sophisticated, and operationally complex environment. Below are six of the most important trends restructuring real estate financial modeling today:

Key Drivers Reshaping Real Estate Modeling

Rising Cost of Capital

Higher interest rates and lower credit availability are driving upwards the costs of capital. Models must explicitly include thoughtful debt structuring logic, triggers for refinancing, and coverage ratios that include stress testing, especially for development and value-add strategies.

Operational Complexity

Asset classes best exemplified by build-to-rent, logistics, and life sciences require thinking about new revenues and new operating expenses. Models must embrace forecasting lease churn, operating margins, and tenant-level performance for projects instead of relying on a static rent roll.

ESG Integration

Environmental sustainability is now tied to both valuation premiums and financing terms. Modern models account for green capex, projected energy savings, and compliance costs tied to global ESG regulations, especially relevant in European and urban Asian markets.

Shift from Market-Driven to Value-Creation Returns

As cap rate compression is slowing, investors are available for NOI growth, which can often only be achieved through operational improvements. Our models must incorporate value-creation growth strategies such as lease restructuring, repositioning, and controlling costs, rather than just market appreciation.

Cross-Border and Tax Complexity

Real estate capital is crossing borders, especially to high-growth countries like Asia Pacific, which had 52.8% of the global market share in 2024, and much of it is heading to countries like China, India, Vietnam, and the Philippines. These considerations require models that can account for:

• Currency Risk

• Country-Specific Tax Logic

• Transfer Pricing and Repatriation Constraints

For example, China alone had a little over 65% of the regional market share, while Southeast Asia has been growing on the back of tourism and foreign direct investment.

Data-Driven and Real-Time Decision-Making

Stakeholders now expect real estate financial modeling to dynamically incorporate market data, including changing construction costs, cap rates, and rent comparables, in real-time. Combining these elements into Business Intelligence (BI) dashboards allows for ongoing monitoring, sensitivity analysis, and much faster decision-making, which is increasingly expected.

>Markets in Australia, Singapore, and Korea are in a position to see investment volumes increase by 5–10% over the next year, based on macro stability and value-add. real estate financial modelling must reflect that momentum by incorporating appropriate regional risk-return-based assumptions and changing investor preferences.

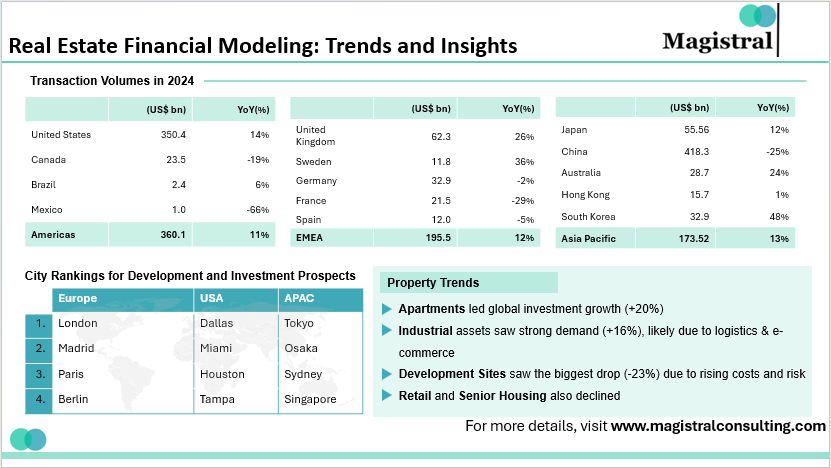

Real Estate Financial Modeling: Trends and Insights

The 2024 landscape reveals dynamic investment shifts that demand localized and responsive real estate financial modeling. Cities like Madrid (+1), Houston (+11), and Warsaw (+12) have seen dramatic uplifts in investor sentiment, indicating a shift in capital flows toward secondary and emerging markets.

Real Estate Financial Modeling: Trends and Insights

Investment location also differs regionally – Dallas, London, and Tokyo are top investment cities for the US, Europe, and Asia-Pacific communities, respectively, but with unique tax implications, rent growth potentials, and financing landscapes. These differences will necessitate regionally specific input assumptions in acquisition and portfolio models.

Transaction Volume Resurgence

Global real estate transaction volumes were $1.17 trillion in 2024, recovering in notable volume at:

• United States: $250.4B (+14%)

• South Korea: $32.9B (+48%)

• Australia: $28.7B (+24%)

This level of activity shows the need for models to consider exchange rate fluctuations, regional spread variances on cap rates, and local debt cost (for example, when doing portfolio or REIT-level analysis on a cross-border basis).

Capital Allocation by Property Type

Capital allocation focus is changing based on asset class:

• Apartments led the growth at $194.5B (+20%)

• Industrial was close behind at $190.7B (+16%)

• Office and Retail were flat or slightly negative</p>

Financial models will need to accommodate asset-specific assumptions (including items like office lease rollover risk, or operating margin sensitivity with logistics), further emphasizing the use of flexible, modular model templates.</p>

Magistral’s Services for Real Estate Financial Modeling

Magistral offers the following solutions for each stage of the real estate financial modeling process:

Acquisition and Underwriting Models

Custom models that enable the analysis of the purchase of an asset, taking into account cash flow, IRR, DSCR, sensitivities, etc.</p>

Development Feasibility Modelling

Real estate financial modeling, we offer full life-cycle models that analyze the development process through construction Timing, budgeting of costs, identifying financial sources, lease-up schedule, and exit strategy.</p>

Rent Roll and Lease Abstraction

Tenant-level modeling to input detail around escalations, rollover risk, and re-leasing assumptions, suited for office, retail, and mixed-use assets.

Value-Add and Repositioning Models

Capex-focused modeling to assess the impact on NOl, yield-on-cost, and total valuation uplift from value adds, across multifamily, hospitality, and industrial asset types.</p>

Waterfall and Syndication Structures

Modeling investor distributions, including promoted tiers, preferred returns, and IRR-based waterfalls for equity syndications and joint ventures.

REITs and Portfolio Consolidation Models

Multi-asset frameworks for tracking full fund performance against NAV, FFO/AFFO, and capital allocations by geography and use.

Debt Modelling and Refinancing Analysis

Structures and comparisons of mortgage options, including consideration of amortization, prepayment penalties, and refinancing perspectives.

ESG and Energy Modelling

Incorporation of ESG metrics and the financial consideration of green building into forecasts for evaluating sustainability and financing impacts long term in real estate financial modeling.</p>

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

Nitin is a Partner and Co-Founder at Magistral Consulting. He is a Stanford Seed MBA (Marketing) and electronics engineer with 19 + years at S&P Global and Evalueserve, leading research, analytics, and inside‑sales teams. An investment‑ and financial‑research specialist, he has delivered due‑diligence, fund‑administration, and market‑entry projects for clients worldwide. He now shapes Magistral Consulting’s strategic direction, oversees global operations, and drives business‑development support.

FAQs

What is real estate financial modeling used for?

What are the most common types of real estate financial models?

How has financial modeling evolved in 2025?

Why is ESG important in real estate modeling now?