Introduction

Private equity funds have gained significant prominence in the realm of finance and investment, playing a vital role in the broader private equity industry. These funds specialize in investing in privately held companies or acquiring substantial ownership in publicly traded companies.

Functioning as investment vehicles, they amass capital from diverse sources, including institutional investors, high-net-worth individuals, and pension funds. Skilled investment professionals known as fund managers or general partners are responsible for managing this capital.

The primary aim is to generate substantial returns for their investors. They achieve this objective through active management and strategic decision-making concerning their investments. Unlike public equity investments that involve trading shares on public exchanges, private equity funds take a longer-term approach and actively participate in nurturing the growth and development of the companies they invest in.

To summarize, private equity funds serve as investment vehicles that pool capital from various investors to invest in private companies or acquire significant ownership in public companies. Operating with a long-term perspective, these funds actively manage their portfolio companies and strive to generate attractive returns through strategic decision-making and value creation.

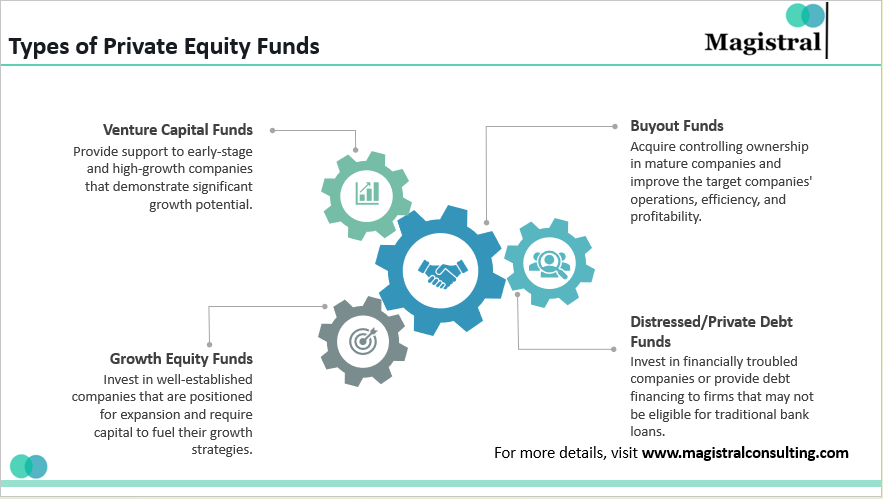

Types of Private Equity Funds

Private equity funds encompass a diverse range of investment strategies, each catering to specific market niches and objectives. Here are some common types:

Types of Private Equity Funds

Venture Capital Funds:

The primary goal is to promote high-growth, early-stage businesses with substantial room for expansion. They provide entrepreneurs with financial support, mentorship, and strategic advice in exchange for an equity stake. Typically, these funds focus on biotech, technology, and other innovative industries.

Growth Equity Funds:

Growth equity funds invest in well-established companies that are positioned for expansion and require capital to fuel their growth strategies. These funds seek out companies with proven business models, positive cash flow, and the potential for substantial value creation.

Buyout Funds:

Buyout funds specialize in acquiring controlling ownership in mature companies. Their objective is to improve the operations, efficiency, and profitability of the target companies to generate significant returns. Buyout funds can be further categorized based on the size of the companies they target, such as large-cap, mid-cap, and small-cap.

Distressed/Private Debt Funds:

Private or distressed debt funds make investments in financially distressed businesses or offer debt financing to businesses that might not be qualified for conventional bank loans. Usually, these funds buy distressed debt securities at a discount to restructure the business or make their investment back through asset sales or repayment.

Benefits of Investing in Private Equity Funds

Private equity funds offer a multitude of advantages to investors that surpass those of conventional investment channels. Among them are a few of them:

Portfolio diversification in Private Equity Funds:

Investment portfolios with a higher risk-return profile may benefit from using private equity funds. Private equity investments complement patient capital because of their extended investment horizon, which enables a long-term emphasis on value generation.

Access to high-growth companies:

Private equity funds make investments in businesses at all phases of development, from start-ups to well-established enterprises. Investors get exposed to high-growth, creative enterprises that would not be listed on open markets.

Active involvement:

Private equity funds actively participate in the management and decision-making of their portfolio companies. This hands-on approach allows for greater influence and potential for value creation.

Potential for higher returns:

Funds aim to generate above-average returns by identifying and nurturing promising companies. The illiquidity premium associated with private investments can lead to significant gains if successful exits are achieved.

Challenges of Private Equity Funds

Numerous challenges that private equity firms face might have an impact on their operations and investment results. The following are some major obstacles that they must overcome:

Deal Sourcing and Competition:

A persistent difficulty for private equity funds is locating appealing investment opportunities. The market becomes more saturated with funds, which increases competition and makes it harder to find good offers. Higher competition frequently leads to higher prices and possibly worse returns on investments.

Complexities of Due Diligence in Private Equity Funds:

Complete due diligence on possible portfolio companies is difficult and takes a lot of time. Evaluating private companies’ financial health, market potential, and management teams can be difficult due to the restricted availability of publicly available information. Accurately identifying possible dangers and development possibilities requires thorough due diligence.

Liquidity and Exit Strategies:

Generally speaking, private equity investments are illiquid, which means that money must be held for a long time before it can be realized. There is uncertainty associated with the timing and execution of exits because they are dependent on external factors such as market circumstances. Investors’ access to returns and the fund’s liquidity may be impacted by inadequate exit opportunities or departure delays.

Economic and Market Volatility:

The fluctuations in the economy and markets can affect private equity funds. The success of portfolio companies may be impacted by changes in the macroeconomic environment, difficulties unique to the sector, or unanticipated circumstances. Amidst uncertain times, it becomes imperative to adjust to evolving market dynamics and implement efficient risk mitigation strategies.

Through recognition and proactive resolution of these obstacles, private equity funds can endeavour to enhance their efficacy, produce appealing returns for stakeholders, and sustain their pivotal position in the worldwide investment terrain.

Magistral’s Services on Private Equity Funds

Our speciality lies in providing private equity firms with thorough advice and insights. Having extensive industry knowledge, our team consists of highly skilled people. Collectively, we provide a variety of tailored consulting services to address the unique requirements of investors and private equity fund managers. Our team’s offerings include the following services:

Magistral’s Services on Private Equity Funds

Fund Formation and Structure:

Among the services we offer to our clients are assistance with the formation and organization of funds, regulatory compliance monitoring, and optimizing the fund’s operational and legal framework.

Investment Strategy and Deal Sourcing of Private Equity Funds:

We create investment strategies in close collaboration with fund managers to meet their unique goals. We help with deal sourcing, finding good investment possibilities, and doing in-depth due research on potential companies.

Investment Execution and Portfolio Management:

Our team offers expert guidance on investment execution, negotiation, and deal structuring. We assist clients in implementing effective portfolio management practices, monitoring investments, and providing ongoing support to maximize value creation.

Risk Management and Compliance:

We help identify and mitigate potential risks for these funds, ensuring adherence to regulatory requirements and industry best practices. Our services include risk assessment, compliance reviews, and implementation of robust risk management frameworks.

Exit Strategies and Value Enhancement:

We provide strategic advice on exit strategies, optimizing the timing and execution of exit events. Additionally, we offer guidance on value enhancement initiatives to maximize investment returns.

At Magistral Consulting, we combine our deep industry knowledge, analytical expertise, and customized solutions to support fund managers and investors throughout the entire investment lifecycle. We aim to help clients achieve their investment objectives, navigate complexities, and maximize returns in the dynamic realm of private equity funds.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research.

For setting up an appointment with a Magistral representative:

visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com