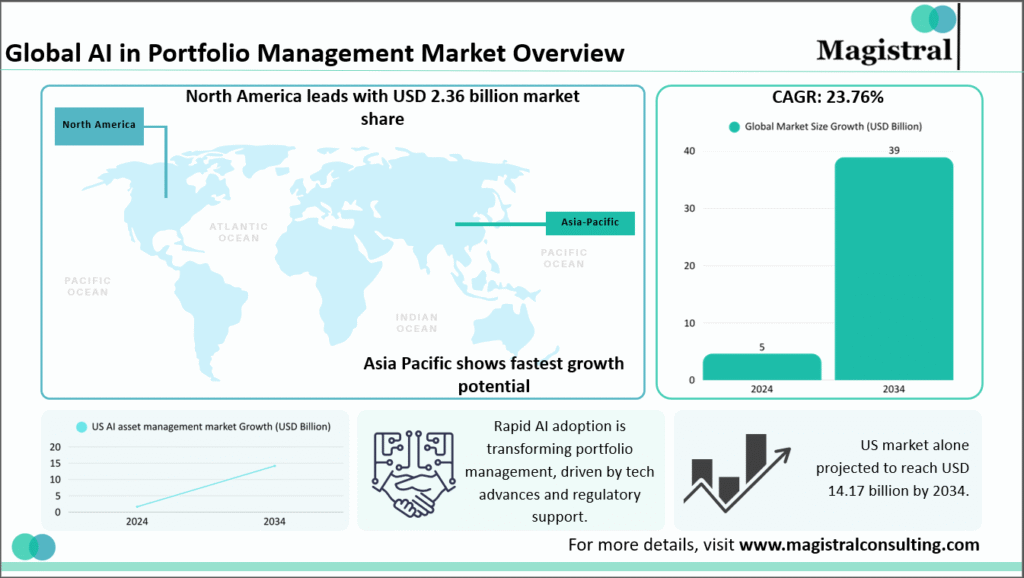

Artificial intelligence in portfolio management has empowered sophisticated algorithms. They can evaluate a very extensive dataset for significant market patterns and very accurate strategic investment decisions. The global AI in asset management market was USD 4.62 billion in 2024, forecasts a startling growth trajectory up to USD 38.94 billion by 2034, growing at a pace of 23.76% CAGR. This is not only exponential growth for the global AI industry. It also shows that the industry acknowledges that using various components of AI in portfolio management has real-world effectiveness with enhanced accuracy, lowered operational costs, and improved risk assessment measures.

Market Growth and Adoption Trends of AI in Portfolio Management

The rapid acceptance of AI in Portfolio management has transformed the industry. North America leading at USD 2.36 billion in 2024 and Asia Pacific becoming the fastest-growing region on account of fintech investments. Firms now use AI not only to automate processes but also to gather insights.

Global AI in Portfolio Management Market Overview

Current Market Dynamics and Investment Patterns

In 2024, the United States AI in the asset management market was worth USD 1.65 billion, and projects will grow to USD 14.17 billion by 2034. The growth pattern is indicative of the strong confidence that institutions have in AI-driven investment strategies and reflects technology’s proven capacity to deliver measurable results.

Regional Leadership and Innovation Centres

Advanced infrastructure in technologies, huge investments into AI research, and proximity to the leading financial institutions shift North America into the continuer of its lead. The region’s innovation-inspiring regulatory framework and improved data analytics principles enhance decision-making and operational efficiency. Major AI firms and startups in both the United States and Canada drive cutting-edge solutions that further cement North America’s stronghold in this sector.

Emerging Markets and Growth Opportunities

Asia Pacific has strong potential for AI in projects for managing portfolios, given the accelerating adoption of technology and higher investment in the fintech sector. The idea of technology startups in a dynamic and growing environment encourages the innovation and implementation of AI in such a region. Government initiatives that push for digital transformation catapult the growth of such markets and opportunities for international collaboration.

Operational Efficiency and Performance Enhancement Through AI in Portfolio Management

AI-enabled operations deliver transformational improvements in the operations of investment firms regarding data processing and decision-making. Particularly, a leading US investment firm collaborating with Gradient achieved a 30% improvement in accuracy, an 80% reduction in workload, and 30% cost savings, all made possible by AI in data transformation.

Data Processing and Analysis Capabilities

Investment firms handle massive volumes of unstructured data from portfolio companies, comprising qualitative insights, sales collateral, financial statements, and quarterly reports. AI systems are best suited to collect key entities, relationships, and themes and transform them into structured formats.

Automated Calculation and Risk Assessment

With fully automated AI techniques, most financial calculations are very complex and require extensive manual thinking to be done automatically. Such systems fill data gaps while furnishing consistent benchmarks and projections that are necessary for investment analysis and decision-making processes. Risk assessment capabilities allow portfolio managers to assess threats and opportunities faster than they otherwise would.

Resource Allocation and Strategic Focus

AI automation liberates investment professionals from laborious data processing tasks and directs their efforts toward activities that require human intelligence and judgment and more strategic use of the resources. Organizations can redirect human capital to higher-value activities.

Technology Solutions and Platform Integration

Leading platforms combine artificial intelligence with user-friendly interfaces, allowing a portfolio manager to apply advanced analytics without extensive technical background. They can range in solutions from full portfolio management systems to specialized tools addressing individual aspects of investment analysis and decision-making.

Integration with Existing Infrastructure

Modern AI solutions provide firms with flexible APIs and integration capabilities to embed advanced analytics into their current systems without needing a complete replacement of their platforms. This method minimizes the disruption an organization would undergo while maximizing the actual benefits of AI technology being introduced.

Data Extraction and Transformation Tools

Such tools will automatically identify relevant information while transforming it into actionable insights. Natural language processing capabilities allow a system to see in context and grasp the meaning within complex financial documents and communications.

Risk Management and Compliance Applications of AI in Portfolio Management

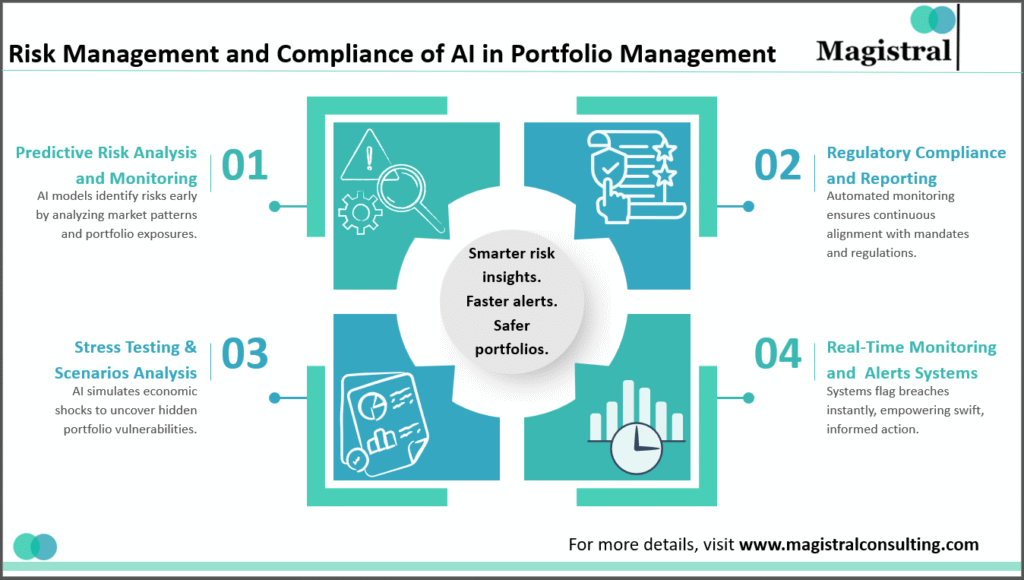

Advanced algorithms detect patterns of market volatility, compute portfolio concentration risks, and monitor compliance in real-time. This, in turn, allows investment firms to maintain sound risk management practices while keeping track of complicated regulatory requirements across several jurisdictions.

Risk Management and Compliance of AI in Portfolio Management

Predictive Risk Analysis and Monitoring

The machine learning algorithms feed on the whole historical market data to trace their pattern and current portfolio compositions. With their analytical power, these systems warn against concentration risks, market volatility concerns, and possible changes in correlations affecting portfolio performances up to the time of warning. Predictive analytics gives portfolio managers foresight before the realization of losses or the actual happenings of risks.

Regulatory Compliance and Reporting

AI systems automate compliance monitoring by evaluating portfolio positions continuously against regulations and investment mandates. It produces in-depth reports, demonstrating adherence to the different regulatory requirements. Also, flagging any potential compliance issues before they become a problem. Automatic compliance monitoring reduces the risk of a regulatory breach.

Stress Testing and Scenario Analysis

AI advanced platforms offer scenario-based stress tests on a variety of conditions to evaluate portfolio performance within the markets. Scenario analysis capabilities allow portfolio managers to ascertain risk exposures and determine response strategies for varying market conditions.

Real-Time Monitoring and Alert Systems

AI monitoring continues to oversee portfolio positions and market conditions while issuing near-instantaneous notifications once selected risks are surpassed. This real-time action is crucial to addressing new conditions within the market and helping nip small matters in the bud before growing into major concerns. Automated alert systems ensure information reaches the concerned portfolio managers on critical updates even while their attention is engaged across numerous portfolios.

AI in Portfolio Management: Future Developments and Innovation Trends

There is an enhanced evolution of AI in portfolio management with emerging new technologies and the sophistication of existing technologies. These developments are set to alter the practice of portfolio management further while opening avenue after avenue for competitive advantage.

Emerging Technologies and Applications

Quantum computing can be a change in paradigm. AI for portfolio management by providing unparalleled computational ability toward hard optimization calculations. Advanced NLP capabilities allow for a sophisticated analysis of unstructured data sources, from news articles to social media sentiment and earnings call transcripts.

Enhanced Personalization and Client Services

Future AI developments will bring highly personalized portfolio management services tailored to individual client preferences, risk tolerances, and investment objectives. Very advanced analytics will provide deep insights into client behaviour patterning while fostering effective communication and delivery. Personalization avenues will set apart investment firms while helping with client satisfaction and retention.

Collaborative AI and Human Expertise

The future of AI in portfolio management lies in the cooperative working relationships between artificial intelligence systems and human experts. Thus, obviating the need to replace human professionals. Advanced AI tools should enhance human decision-making abilities. Allowing portfolio managers to focus more on strategy and client relationship development. Hence, this synergy will maximize the advantages of artificial intelligence efficiency and human discretion in investment management.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

How does AI improve risk management in investment portfolios?

AI in portfolio management enhances risk management through predictive analytics that identify potential threats before they impact portfolio performance. These systems continuously monitor market conditions, analyse portfolio concentrations, and provide early warning signals for various risk factors while enabling proactive risk mitigation strategies.

What types of data can AI systems process for portfolio management?

Modern AI platforms process diverse data types including structured financial data, unstructured documents, market news, social media sentiment, and alternative data sources. These systems excel at extracting meaningful insights from various information sources while converting unstructured data into actionable intelligence.

How quickly can investment firms expect to see results from AI implementation?

Results from AI in portfolio management implementation typically become apparent within months of deployment, with firms often experiencing immediate improvements in data processing efficiency and accuracy. Comprehensive benefits, including cost reductions and enhanced performance metrics, usually materialize within the first year of implementation.

What challenges do firms face when implementing AI portfolio management solutions?

Common implementation challenges include data quality issues, integration with existing systems, staff training requirements, and regulatory compliance considerations.