The mortgage lending world is constantly changing sphere and demand for Mortgage Lending Process increases. Every advancement in technology, every regulatory reform, and every change in the economy will show how much this new age in Mortgage Lending Process is different from any that came before it in 2025. Therefore, the intention of this article is to examine the modern Mortgage Lending Process -in statistics, trends, and innovations which are shaping mortgage use today.

The Mortgage Lending Process

In general, the mortgage lending process has a few steps in it:

Pre-Approval

Borrower assesses their readiness for the loan and applies for a simple loan estimate.

Application

Applying for a specific loan with detailed financial information.

Processing

Documents verification, credit history, and property details.

Underwriting

Lenders evaluate risk and then decide whether to approve the loan.

Closing

Final contract provisions occur, at which time the ownership of the real property changes.

While this process has almost been accomplished within a year, digitized platforms during the year 2025 have further raised speed and efficiency levels for such transactions.

Global Mortgage Market Trends: A 2025 Perspective

The Mortgage Lending Process market in 2025 depicts an intricate mix of economic recovery, regulatory changes, and technology-led innovations. Across important regions of the world, such as the U.S., Australia, U.K., and India, the governments and lenders are striving towards borrower evolving expectations, inflationary pressures, and digital transformations. It shows how the world mortgage realm is being built up:

Mortgage Lending Process – Market Trends

United States: The Market Rebounds, Hopeful but Uneasy

- After a roller-coaster couple of years with high inflation factors and monetary tightening, U.S. housing and mortgage markets are stabilizing.

- Interest Rate Consideration: Mortgage rates have slightly improved throughout 2025, now averaging 6.62% for a 30-year fixed mortgage (down from 6.88% in 2024). While this is not a substantial decrease, it has nonetheless reinstated some measure of affordability for the middle-income sector.

- Mortgage Volume on the Rise: Total mortgage originations are estimated at $2.3 trillion, which is an impressive 28% increase over the previous year. A significant portion of this—$1.46 trillion—will come from purchase originations, indicating a resurgence in home-buying activity resulting from the pent-up demand and now-stabilized home prices.

Australia: Lending Criteria Are Adjusted in Favor of Borrowers

- Australia is addressing housing affordability by modifying lending policies for younger and lower-income buyers.

- Effective New Assessment of Student Loan Debts: The Commonwealth Bank has introduced new criteria to improve treatment of HECS debts for mortgage lending purposes. Liabilities due within the next 12 months have been excluded from debt servicing, while debts falling due over the medium term (2-5 years) have been allowed a more favorable buffer.

- Outcome: As a result of this move, many potential borrowers, especially recent graduates, will qualify for larger loans, easing their entry into homeownership amid high-price urban markets like Sydney and Melbourne.

The United Kingdom: Helping Tenants Cross the Deposit Barrier

- Lender innovation in the U.K. addresses one of the most significant hurdles to homeownership: the deposit.

- Zero Deposit Mortgages Are Here: Barclays introduced a zero-deposit mortgage product in 2025 for buyers participating in the Right to Buy scheme and allowing long-term tenants in government housing to purchase their homes without having to save for a deposit—utilizing that Right to Buy discount as equity.

- Strategic Intent: The initiative is focused on increasing homeownership among lower-income households and providing a much-needed springboard for renters seeking to break into the property market without having had the opportunity to accumulate any substantial savings upfront.

Key Takeaway

Despite the differing economic contexts around the world, countries have been working strategically to improve access to housing finance in their jurisdictions. With interest rate concessions, policy aids, and digital innovations, global Mortgage Lending Process markets in 2025 are becoming the most inclusive, vibrant, and adaptable than they have ever been.

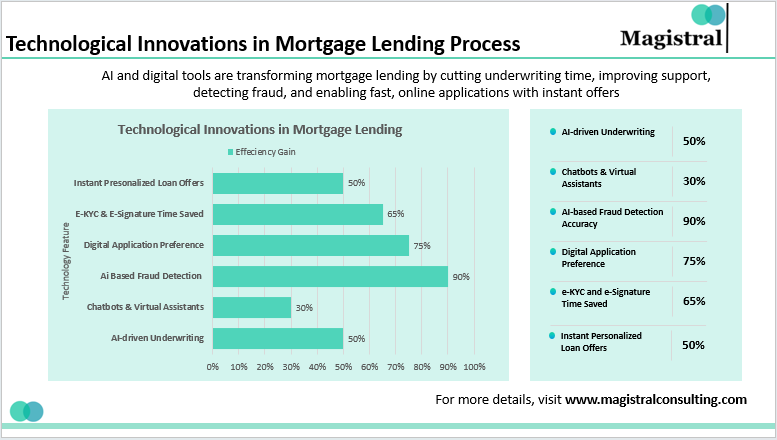

Technological Innovations in Mortgage Lending Process

The following Technological innovations have taken place in the Mortgage Lending Process:

Technological Innovations in Mortgage Lending Process

AI and Automation Technologies

The following points highlight how AI has transformed the Mortgage Lending Process:

- Accelerated Underwriting: AI-powered underwriting can cut in half the amount of time applicants spend in underwriting, which results in greater efficiency.

- Improved Customer Experience: Automated applications are filled out with the help of virtual assistant chatbots which provide immediate assistance for customers as they navigate the application process.

- Fraud Detection: Algorithms that are more sophisticated identify anomaly detection in applications in advance.

Digital Platforms

End-to-end digital solutions enable borrowers to:

- Complete applications online.

- Utilize e-KYC and e-signatures for verification.

- Receive instant eligibility assessments and personalized loan offers.

Flexible Repayment Options

Flexible repayment structures have gained further importance, bringing added popularity with respect to individual career pathways and financial circumstances in the year 2025.

Step-Up Loans

Especially suitable for young professionals or the early-career segment with low initial incomes but a bright future in earning potential, the loan commences with lower EMI payments, which increase in relation to expected income growth and allow for smooth home acquisition without immediate pressure on finances.

Flexi-EMI Plans

These plans offer borrowers the flexibility to change their monthly repayments based on prevailing financial conditions, for example, temporary loss of income or surge in family expenses. Flexi-EMIs provides much-needed breathing space to homeowners so they can honor their loan obligations without defaulting or refinancing during a period of short-term disruption.

The mortgage lending process in 2025 reflects a dynamic interplay of technological innovation, policy reforms, and market adaptations. As digital platforms and AI continue to streamline operations, borrowers benefit from enhanced accessibility and tailored loan products. However, ongoing regulatory vigilance is essential to ensure equitable access and mitigate emerging risks in this evolving landscape.

Magistral Consulting: Services for the Mortgage Lending Process

Magistral Consulting offers tailored solutions for mortgage lenders, helping them enhance efficiency, improve compliance, and delivering better borrower experiences across the loan

Market Research & Benchmarking

We furnish insight into mortgage market trends, customer behavior, and shifts in regulations. Competitive benchmarking allows lenders to sharpen pricing and product design, and digital strategies.

Financial Analysis & Risk Assessment

We build credit risk models, portfolio health assessment, and risk-based pricing strategies to strike the right balance between profitability and borrower access for lenders.

Process Automation & Digital Support

We assist lenders in streamlining operations by mapping the current processes, suggesting automation tools, and lending a hand during the implementation of the digital lending platform.

Data Management & Analytics

We assist in cleaning and structuring working mortgage data, building dashboards, and leveraging analytics for customer segmentation, approval optimization, and tracking loans.

Regulatory & Compliance Support

Magistral makes sure underwriting processes comply with CFPB, RBI, and ASIC regulations. We assist with documentation, AML checks, and fraud workflow.

Strategic Advisory

We also offer strategic advice to lenders on product launches (e.g., green loans, step-up EMIs), market entry, and establishing partnerships with fintech or real estate portals.

We deliver insights on mortgage market trends, customer behavior, and regulatory shifts. Competitive benchmarking helps lenders refine pricing, product design, and digital strategies.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

What are the trendy hot global mortgage lending trends this year?

What is trending now are rate changes, the rollouts of digital infrastructures such as the U.K. and India, and products like zero-deposit and green mortgages.

Flexible repayment options now available?

Yes. Nowadays, lenders provide flexible repayment options such as step-up loans and Flexi-EMI plans that suit the needs of different income groups and life stages, especially to younger borrowers.

What are the major global drivers of mortgage product innovation?

The three drivers are technology innovations; increasing demands from customers for personalization in their borrowing; and competition on both financial and environmental inclusiveness.

Which are the most advanced countries in 2025 regarding mortgage innovation?

The U.S., U.K., Australia, and India see significant traction-the U.S. sees climbing volumes of loan disbursement, the U.K. has removed bottlenecks to deposits, and India has better enhanced its digital systems for better access to rural areas.