Commercial loan underwriting is at the heart of business financial decision-making. It provides the basis for evaluating the creditworthiness of borrowers and the stability of financial institutions. It is also done for spurring economic growth. In the recent past, the underwriting process has seen a significant transformation in light of technological advances, regulatory changes, and market dynamics.

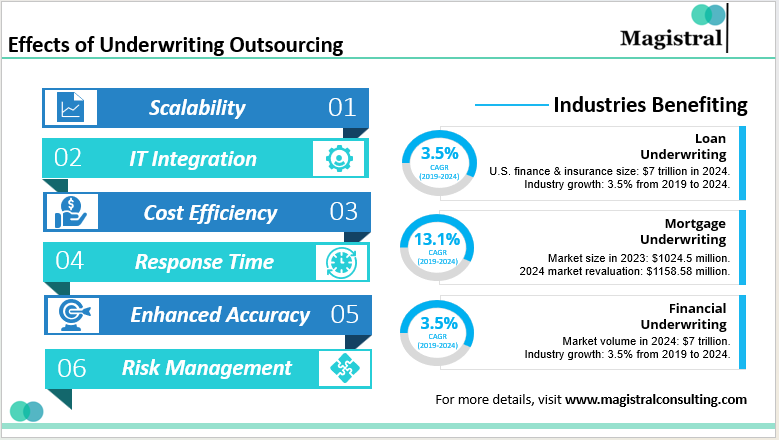

Effects of Commercial Loan Underwriting Outsourcing

Advanced technology, expert rating, and scalability in outsourcing may facilitate the process of transformation for commercial loan underwriting. This process will be a benefit for both lenders and borrowers. The subsequent section explains the process of how outsourcing works with commercial loan underwriting and the role of such outsourcing in the modernization of lending trends:

Risk Mitigation

It limits the loan risk by checking every borrower for full creditworthiness, hence limiting the issuance of loans to less creditworthy clients and applicants.

High accuracy

Applying special expertise along with advanced technology in commercial loan underwriting would bring more precise appraisals and risk estimation. This makes the understanding of true financial implications, on both lenders’ and borrowers’ sides, accurate.

Cost Efficiency

Outsourcing commercial loan underwriting can save a financial institution a lot of overhead costs that are incurred in recruiting, training, and maintaining an in-house underwriting team. It helps to use resources more efficiently.

Scalability

The flow of loan applications is highly volatile and can change without notice at the period of the year and is majorly volatile with the peak flows. Outsourcing underwriting would also help lenders gain scalability in managing operations up to scale or any significant downsizing when it does without impacting the internal space.

Faster Turnaround Times

Processes and know-how usually lead to timely approval of a loan, which in turn offers quick access for customers to funds to run their respective businesses.

Improved Compliance

A professional underwriting service would have all regulatory compliances and other industry standards and thus decrease chances of facing some legal issue which in turn can enhance the credibility in general.

IT Integration

Commercial loan underwriting will become more efficient and effective as it would take into consideration artificial intelligence and data analytics, taking huge amounts of data to help make better decisions.

Expert Evaluation

Access to experienced underwriters means using their experience and judgment to arrive at better loan decisions that balance risk and return.

Focus on Core Business

Outsourcing underwriting allows financial institutions to focus on their core business activities, such as customer relationship management and strategic growth initiatives, without getting bogged down by the complexities of underwriting processes.

Risk Management

Standardized and comprehensive appraisals reduce the rate of defaults, contributing to the overall health and stability of the financial institution.

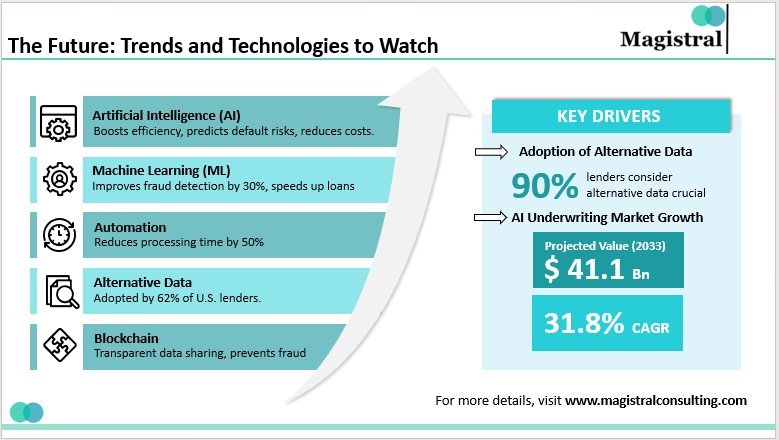

The Future: Trends and Technologies to Watch

The landscape of credit underwriting in the United States is rapidly changing. This paper takes a closer look at how technologies are driving change in the credit market.

The Future: Trends and Technologies to Watch in Commercial Lending Underwriting Outsourcing

Artificial Intelligence

Credit underwriting is not possible without AI. The efficiency and accuracy achieved are unparalleled. AI helps hasten loan approvals, thus allowing lenders to process applications faster, predict default risks with great precision, minimize bad debts, and automate decisions to reduce operational costs.

Machine Learning

Machine Learning enables lenders to be smarter through data-driven decisions. US lenders utilizing ML have realized a 30% fraud detection rate improvement accompanied by faster loan processing. The tools also help institutions adhere to regulatory requirements by identifying potential risks in areas of compliance early on.

Automation

Automation reduces tedious, manual underwriting steps. This decreases processing time and helps lenders achieve up to 50% faster loan approvals. Documentation errors are reduced through automation.

Alternative Data

The use of alternative data such as rent payments, utility bills, and even social media behavior allows lenders to make more comprehensive assessments of creditworthiness. Research shows that 62% of U.S. financial institutions currently include alternative data in their underwriting, and the trend is going to grow exponentially in the coming years.

Blockchain

With decentralized data storage, it enhances stakeholder trust and tamper-proof audit trails. It automatically disburses loans once predefined criteria are met and protects confidentiality, reducing fraud and transparent records easing audits and legal compliance.

Key Drivers

AI Underwriting Market Growth

The AI underwriting market is projected to grow to USD 41.1 billion by 2033, with a CAGR of 31.8%.

Adoption of Alternative Data

Over 90% of lenders consider alternative data crucial, yet only 43% have integrated it, highlighting a significant growth opportunity.

5 Key Ratios for Commercial Loan Underwriting

Understanding key financial ratios is essential in commercial loan underwriting, as they provide valuable insights into a borrower’s financial health, risk profile, and repayment capacity.

Profit Margin Ratio

This is a widely used profitability ratio, and it indicates the amount of profit generated over sales. This ratio measures the company’s ability to earn enough profit to sustain its business. Profit margins often vary from industry to industry, so, a prudent banker should always compare it with close competition and with the average industry standard.

Debt Ratio

This is a solvency ratio, which indicates the debt level of the borrower as a percentage of total assets. A lower debt ratio suggests a more stable business and a higher is the reverse. Experts consider a ratio of 0.5 or less healthy, as it means the company has twice as many assets as liabilities. They carefully examine anything above 0.5 before making a decision.

Loan to Value (LTV) Ratio

This is a risk assessment coverage ratio that is very critical for mortgage underwriting. The LTV ratio ensures that the collateral is worth more than the size of the loan. The higher the LTV ratio, the more risk involved.

Debt Service Coverage Ratio (DSCR)

This is a liquidity ratio, which indicates the amount of cash generated by the business to service its debts (principal, interest, and leases). DSCR validates the borrower’s capacity to pay back the debt and keep running the business. DSCR between 1.25-1.5 is a relatively safe number to consider. However, it differs from business to business and depends on the risk aversion policies of the bank.

Net Worth to Loan Size Ratio

This ratio is used to compare the borrower’s net worth to the size of the requested loan. A high net worth indicates stable financial health, ultimately ensuring the repayment of the loan.

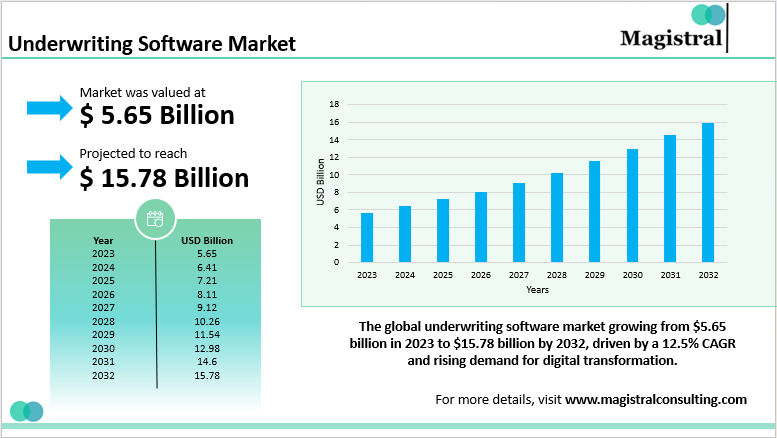

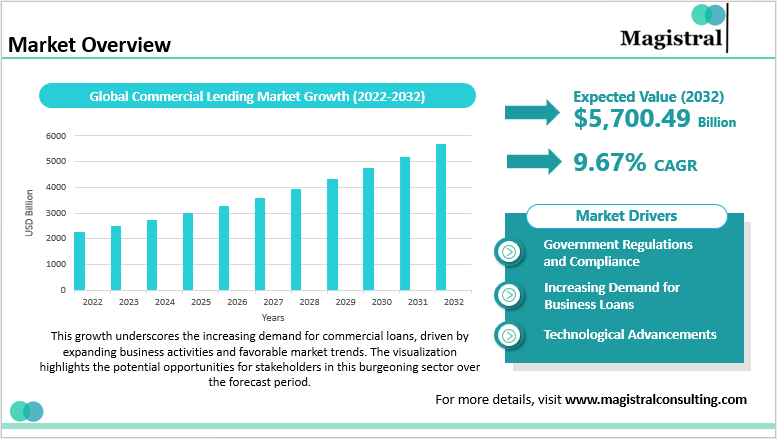

Market Overview

The commercial lending market was at USD 2264.82 billion in the year 2022. The commercial lending market size was estimated at USD 2483.83 billion in the year 2023 and it is projected to grow at 5700.0 billion (USD Billion) in 2032. The growth trend is expected to provide good news with respect to the market trends in the coming years, claiming the growth rate to be a CAGR of around 9.67% for the forecast period, i.e., ending 2032.

Market Overview of Commercial Lending Underwriting Outsourcing

Commercial Lending Market Drivers

Increasing Demand for Business Loans

The growing demand for business loans among small and big companies fuels this market with the help of online lenders offering prompt approvals and government initiatives supporting small businesses.

Government Regulations and Compliance

Strict government regulations, combining stability with business operations costs related to compliance in financial institutions, guarantee stability in financial operations and loan borrowers, in compliance with relevant policy guidelines set by the government.

Technological Advancements

AI, machine learning, and mobile banking have helped tremendously in shaping instant lending situations in easy credit checks, prompt loan approvals, and good customer satisfaction.

Magistral’s Services for Commercial Loan Underwriting

Magistral Consulting provides expert services to enhance the efficiency, accuracy, and compliance of commercial loan underwriting processes. It thereby directs financial institutions in making informed lending decisions and mitigating risks.

Risk Assessment and Creditworthiness Evaluation

Magistral provides a comprehensive analysis of financial data, market trends, and borrower profiles to assess the credit risk and creditworthiness of applicants, ensuring well-informed lending decisions in commercial loan underwriting.

Loan Application Processing and Verification

We conveniently process all commercial loan applications, including verifying all financial documents, collateral, and borrower information to ensure accuracy and compliance with regulatory standards.

Financial Modeling and Risk Analysis

We employ state-of-the-art financial modeling and risk analysis tools to assess the potential for defaults on loans by looking at the ability of the borrower to repay through cash flow, debt service, coverage ratios, and other metrics central to the financial facets of the facility in commercial loan underwriting.

Regulatory Compliance and Due Diligence

Magistral provides that the local and federal laws guide every step of the underwriting process, maintaining the legal risks to a minimum. We rigorously assess and ensure the proper execution of all documentation and legal obligations.

Technology-Driven Solutions

We enable an improved commercial loan underwriting process through the incorporation of leading-edge technologies. It involved such as artificial intelligence, machine learning, and data analytics. It is assuring thereby that the institutions adopt more rapid yet credible decisions.

Portfolio Risk Management and Monitoring

To continue evaluating and analyzing loan performance with the aim of risk identification and mitigation support. We provide post-approval monitoring to assist institutions in maintaining a healthy loan portfolio.

Tailored Underwriting Strategies

Depending on the needs of a client, for commercial loan underwriting, whether they be small loans, corporate loans, or specialized financing, we develop custom underwriting solutions aimed at making the underwriting process work far more effectively.

About Magistral Consulting

Magistral Consulting has helped multiple funds and companies in outsourcing operations activities. It has service offerings for Private Equity, Venture Capital, Family Offices, Investment Banks, Asset Managers, Hedge Funds, Financial Consultants, Real Estate, REITs, RE funds, Corporates, and Portfolio companies. Its functional expertise is around Deal origination, Deal Execution, Due Diligence, Financial Modelling, Portfolio Management, and Equity Research

For setting up an appointment with a Magistral representative visit www.magistralconsulting.com/contact

About the Author

The article is authored by the Marketing Department of Magistral Consulting. For any business inquiries, you can reach out to prabhash.choudhary@magistralconsulting.com

Why do lenders choose to outsource commercial loan underwriting?

Lenders outsource commercial loan underwriting to enhance efficiency, reduce costs, access expert knowledge, and leverage advanced technologies like AI and machine learning. Outsourcing also helps manage fluctuating loan application volumes, ensuring scalability and faster turnaround times.

How does outsourcing improve risk management in loan underwriting?

Outsourcing providers employ experienced professionals and advanced risk assessment tools to evaluate borrowers comprehensively. This reduces default risks by ensuring loans are extended to creditworthy applicants. Providers also ensure adherence to regulatory standards, mitigating legal risks.

What role does technology play in outsourced underwriting?

Technology plays a pivotal role in outsourced underwriting. Tools like AI, machine learning, and automation streamline processes, improve credit risk analysis, and reduce errors. Data analytics enables providers to make accurate predictions about borrower behavior and repayment capacity.